Cash on the sidelines, plus zombies, Apple's rough day, and homeowners insurance

The Sandbox Daily (9.6.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

is cash on the sidelines still bullish?

no scaries from these Zombies

rough day for Apple

homeowners increasingly forgoing insurance

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 -0.33% | Dow -0.57% | S&P 500 -0.70% | Nasdaq 100 -0.88%

FIXED INCOME: Barclays Agg Bond -0.09% | High Yield -0.24% | 2yr UST 5.029% | 10yr UST 4.301%

COMMODITIES: Brent Crude +0.70% to $90.67/barrel. Gold -0.55% to $1,941.9/oz.

BITCOIN: -0.28% to $25,639

US DOLLAR INDEX: +0.05% to 104.856

CBOE EQUITY PUT/CALL RATIO: 0.74

VIX: +3.14% to 14.45

Quote of the day

“Patience and discipline can make you look foolishly out of touch until they make you look prudent and even prescient.”

- Seth Klarman, The Baupost Group

Is cash on the sidelines still bullish?

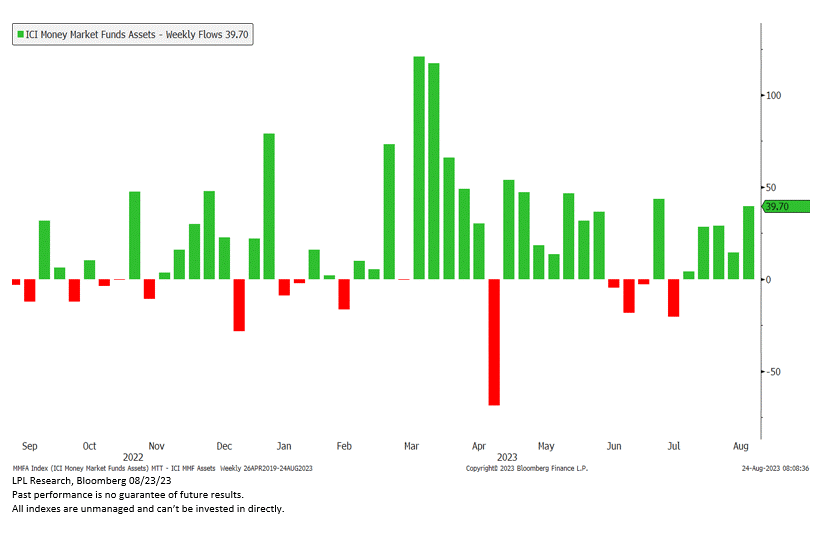

There is an existing narrative among some circles equating the sharp increase in money market assets with cash on the sidelines waiting to be redeployed into the stock market.

After the difficult year for stocks and bonds in 2022, along with endless calls for recession, a regional banking scare, and the debt ceiling standoff (remember that one from May/June??!?), it isn’t that surprising to see continued flows week after week into money markets lifting the outstanding stock of money funds into record territory.

Analysts imply the extra cash sitting in money market funds is fodder for the next leg higher in the stock rally.

During the 2008/2009 market swoon, money market assets rose sharply, peaked, and subsequently fell as stocks were troughing. Similarly, cash in money markets spiked at the pandemic's start in 2020 and then eased commensurate with stocks surging in value. If the recent surge of cash into money market assets is a placeholder for investors to buy stocks, we may have more room to run in equities.

However, monetary policy and the future course of interest rates as well as credit risk must all be considered under this new environment.

For starters, collecting ~5% on your money market creates a much higher threshold for rotating virtually risk-free capital into risk assets. Certain investors are satisfied chasing higher yields that are finally available through safe and daily liquid money market funds.

More important, though, is how long rates remain at these elevated levels. An initial rate cut or two would create a headwind for money market flows, however the Fed seems committed to higher-for-longer – so any interest rate cut and subsequent outflows from money markets seem like a 2024 issue, perhaps even 2025.

And as LPL Research notes, the “initial cuts to the federal funds target rate have not historically marked a peak in money market fund assets.” The high watermark and shift in flows only occurred after the Fed meaningfully cut interest rates.

Something else to consider in light of the regional banking mess from the spring: perhaps a large number of savers/non-investing depositors are simply avoiding credit risks associated with smaller banks and their deposits. The money shifted from the left pocket to the right, without any intention of ever moving the money into the stock market.

Source: St. Louis Fed, LPL Research

No scaries from these Zombies

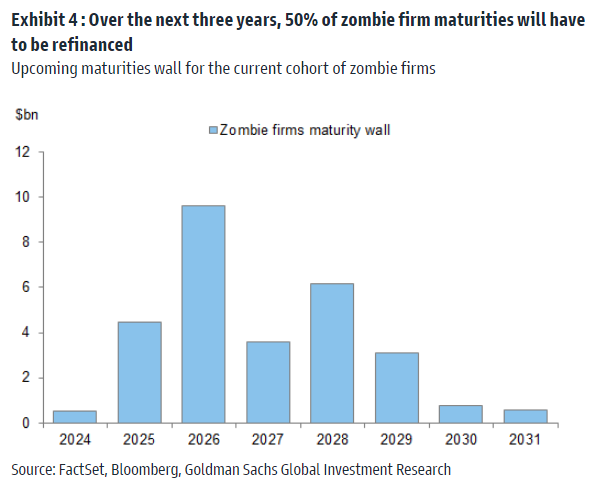

Over the past decade, low borrowing costs have allowed so-called “zombie” firms, those firms with weak balance sheets and de minimis growth prospects, to refinance their liabilities in public credit markets at historically cheap rates – thereby crowding out capital formation for more productive firms and allowing unhealthy businesses to remain solvent.

With High Yield funding costs at their highest levels in over ten years, the concerns over these zombies have picked up. Fortunately for credit markets, the universe of zombie companies is small at $36 billion, representing just a 2% share of U.S. bond issuers.

While zombie firms aren’t of 1st order importance when it comes to overall financial distress within HY – on account of their small share and size – the next several quarters will nonetheless be difficult for these issuers, with almost 50% of their notional outstanding debt set to mature within the next 3 years.

Source: Goldman Sachs Global Investment Research

Rough day for Apple

China has directed all government officials to no longer use iPhones at/for work as the country prioritizes state security measures and shifts away from the reliance on foreign technology. China accounts for ~19% of Apple’s overall revenue.

This latest development hit Apple shares hard in today’s session, causing the stock to drop -3.58% on the news – good for its 3rd worst day of the year (see “ROC” rate of change panel below).

Apple is a critical component for the major indexes – 11.4% of the Nasdaq 100, 7.5% of the S&P 500, and 3.6% of the Dow Jones Industrial Average – as well as a key holding in most people’s retirement accounts (via mutual funds and ETFs).

Source: Wall Street Journal, Mike Zaccardi CMT

Homeowners increasingly forgoing insurance

American homeowners are increasingly forgoing home insurance, gambling that the likelihood of a disaster isn’t high enough to justify the cost of a policy and leaving them at considerable risk of financial loss should disaster strike.

The national average for home insurance based on $250,000 in coverage increased this year to $1,428 annually, up 3.2% from 2022.

The Wall Street Journal estimates 12% of homeowners don’t purchase homeowners’ insurance. Some skipping insurance say they are doing so because they can no longer afford the rising premiums due to a range of factors including inflation and climate change.

Ditching home insurance might save cash in the short-term, but it’s also a major gamble. By taking this risk, homeowners are essentially betting they have enough money saved to buffer any need to draw against the policy.

Source: Bankrate

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Love your post Blake. My opinions on your recent post: Interest rates will not be cut over the next decade. Based on China events, Apple is now a screaming buy. Homeowners will do well to self insure more than ever by either raising their deductibles or going bare if they are mortgage free.