Central banks are cutting rates. History says that’s good for investors.

The Sandbox Daily (9.30.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

most central banks are easing = bullish for equities

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 +0.41% | Nasdaq 100 +0.28% | Dow +0.18% | Russell 2000 +0.05%

FIXED INCOME: Barclays Agg Bond -0.01% | High Yield -0.04% | 2yr UST 3.617% | 10yr UST 4.158%

COMMODITIES: Brent Crude -1.40% to $67.06/barrel. Gold +0.64% to $3,881.1/oz.

BITCOIN: +0.06% to $114,489

US DOLLAR INDEX: -0.38% to 97.826

CBOE TOTAL PUT/CALL RATIO: 0.78

VIX: +0.99% to 16.28

Quote of the day

“Whenever the mind wanders, restless and diffuse in its search for satisfaction without, lead it within; train it to rest in the self. Abiding joy comes to those who still the mind.”

- Bhagavad Gita

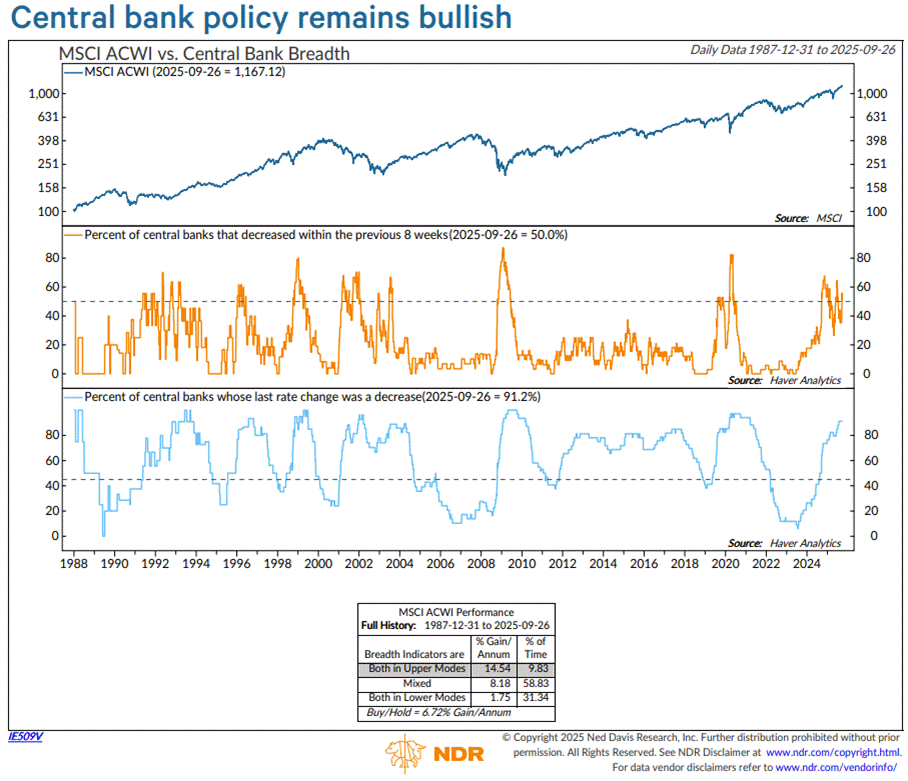

Most central banks are in easing mode

The fastest tightening cycle in decades has given way to something very different: global, synchronized rate cuts.

The Fed’s September rate cut, followed by the prospect of one or two more reductions this year and further easing across 2026, should provide support to the domestic economy.

Around the globe, central banks are easing in unison, a rare alignment that carries important consequences for investors. The outlook remains sanguine as growth skews positive following several years of tepid expansion, showing surprising resilience in the face of heightened risks around inflation and interest rates.

With over 90% of the world’s central banks now in easing cycles, monetary policy should help further the economic expansion into 2026.

Why does monetary easing matter for stocks?

Easier monetary policy ripples through markets in three important ways:

Lower discount rates: Equity valuations benefit when future earnings are discounted at lower rates.

Liquidity support: Lower policy rates reduce the cost of capital for banks and corporations, which encourages lending and investment. At the same time, savers earn less on cash, which nudges capital toward higher-yielding assets like equities.

Confidence: When policy shifts from restraint to support, businesses and households unlock deferred spending and investment.

Already, we’re seeing the thaw: housing, autos, and manufacturing are shaking off localized comas. C-Suites, after preparing for Jamie Dimon’s “economic hurricane,” are dusting off CapEx plans.

History supports the bull case.

Since 1980, the first Fed cut has usually been followed by equity gains over the next 12 months, though the key distinction is the reason why easing occurs.

Mid-cycle “insurance cuts” (think 1995 or 2019) tend to fuel rallies. Recession-driven cuts (2001, 2008) can coincide with equity drawdowns, as falling earnings outweigh easier policy.

And yet we must remember: easing is a tailwind, not a guarantee.

No central bank cycle is without risk.

If cuts come because growth is about to crater, equities may still struggle. In the current cycle, inflation remains a wild card; premature easing could reignite price pressures, forcing policymakers back into a whiplash tightening cycle.

Also consider markets may have already priced in a good portion of the easing narrative, limiting upside surprise.

Bottom line, the pivot away from aggressive tightening is unmistakable, and history suggests that shift is generally bullish for equities.

Rate-sensitive sectors – technology, housing, biotechs, banks – stand to benefit the most. Bonds enjoy the cushion of lower yields, though credit spreads will bear watching if growth falters.

Central banks are stepping off the brake pedal. Generally speaking, that’s an invitation to press on the gas.

Source: Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)