Chair Powell comments, plus % central banks hiking, Tesla earnings, leading indicators, and a visit from JPM

The Sandbox Daily (10.19.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

just 23.5% of central banks remain in rate hiking mode

Tesla reporting results down, yet investor interest remains up

leading economic indicators continue to show weakness ahead

J.P. Morgan brass visits Annapolis

Let’s dig in.

Markets in review

EQUITIES: Dow -0.75% | Nasdaq 100 -0.85% | S&P 500 -0.85% | Russell 2000 -1.51%

FIXED INCOME: Barclays Agg Bond -0.38% | High Yield -0.36% | 2yr UST 5.163% | 10yr UST 4.988%

COMMODITIES: Brent Crude +1.92% to $93.26/barrel. Gold +1.15% to $1,977.7/oz.

BITCOIN: +0.72% to $28,602

US DOLLAR INDEX: -0.35% to 106.196

CBOE EQUITY PUT/CALL RATIO: 0.68

VIX: +11.34% to 21.40

Quote of the day

“There’s no precision in our understanding of how long [monetary policy] lags are. One thing that has changed in the modern era is that, over the course of the last 30 years, central banks have decided that instead of being secretive to be very transparent. What that has meant is market’s move well in anticipation of policy moves. So the transmission from policy moves to financial conditions actually happens before the move now, where that was not the case 50 years ago when Milton Friedman coined the phrase ‘long and variable’ lags.”

- Federal Reserve Chairman Jerome Powell, Speech from the New York Economic Club

Just 23.5% of central banks remain in rate hiking mode

After one of the fastest and most aggressive monetary policy tightening cycles in history, most central banks have paused – with inflation lower and having avoided a severe global recession.

Just 23.5% of central banks have raised rates at their last meeting over the previous 8 weeks, which is down from the peak of 85.3% in September 2022.

Although most Developed Market central banks (33.3%) have taken a break from tightening policy, the central banks that paused first were Emerging Markets (just 10.0% still hiking), many of which were also the first to raise rates in this global tightening cycle.

Some of these early tighteners have seen their economies achieve soft landings, providing some hope that it’s possible in other parts of the world.

Source: Ned Davis Research

Tesla reporting results down, yet investor interest remains up

Tesla reported 3rd quarter earnings on Wednesday that fell far below consensus expectations, missing both revenue (top line) and earnings (bottom line) estimates – the 1st time since 2019 that they have missed on both metrics.

During the company’s quarterly call with investors, CEO Elon Musk shared his pessimistic view regarding the state of the global economy.

The headlines weren’t kind.

One issue: Tesla's year-over-year growth rate in vehicle deliveries slowed from 57% growth in the first half of the year to 27% growth in Q3.

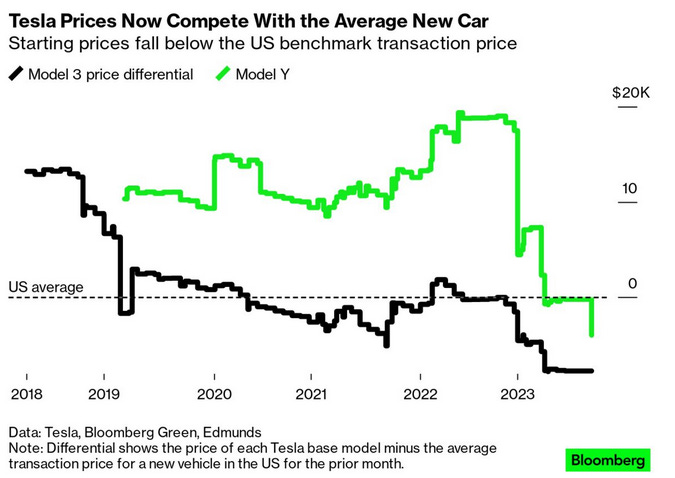

Another issue: price cuts – lots of them. The goal to boost demand hasn’t worked as planned. Tesla’s Model 3 and Model Y are now cheaper than the average vehicle.

Yet, Tesla’s product lineup, supply chain management, and its competitive EV pricing model has helped the company maintain its strong position in the EV market and take share of the auto market overall – see below.

One major announcement stated the plan is to begin deliveries on the Cybertruck later this year, though the company warned that it won't be profitable for another 18 months.

One bright spot is Tesla’s impressive cash generating abilities and cash position itself, which currently stands at a whopping $26.1 billion and provides a lot of optionality for future opportunities.

Love or hate Elon, Tesla is a stock that gains the investing public’s interest as the daily trading volume in its shares exceeds that of any other U.S. stock on most days.

Shares of TSLA finished down -9.30% on the day, yet remains up +97.01% in 2023.

Source: Goldman Sachs Global Investment Research, J.P. Morgan Markets, Wall Street Journal, Tech Crunch, ML Truck

Leading economic indicators continue to show weakness ahead

While a number of recent economic indicators show a diminishing risk of recession in the near-term, the Conference Board’s Leading Economic Index (LEI) suggests the sky is not all clear.

The leading indicators sank -0.7% in September, and the decline marked the 18th contraction in a row. Declines of this magnitude have always been associated with recession.

The Conference Board publishes leading, coincident, and lagging indexes designed to signal peaks and troughs in the business cycle for major global economies. Many economists and investors track this measure closely.

The majority of LEI components have deteriorated over the past six months, pointing to persistent weakness in activity.

As shown below, such a streak of consecutive monthly declines has led to recessions each time; the only instances we’ve had more consecutive declines were the recessions that started in 1973 and 2007.

The LEI has been signaling recession for some time but one hasn’t materialized. The Conference Board still expects a mild recession in 1H 2024.

It’s possible that the LEI components – which favor manufacturing, credit, and consumer sentiment – could be underestimating the strength of economy in light of excess savings and government stimulus.

While no forecasting system is perfect, this one has a pretty good track record.

Source: The Conference Board, Ned Davis Research, Liz Ann Sonders

J.P. Morgan brass visits Annapolis

Not often do we welcome big visitors into Annapolis, MD.

Yesterday, I shared this chart below to demonstrate how different sectors across fixed income would perform assuming a parallel 1% move in interest rates higher and lower from current rates.

It’s incredibly informative, especially with how much rates are moving in this environment.

Today, I met the exceptionally brilliant gentleman who makes that chart, among many other fixed income related graphics in the deck of all market decks, the J.P. Morgan Guide to the Markets.

On the right is Jordan Jackson, Global Market Strategist and a member of Dr. David Kelly’s team; on the left is the best representation of JPM, Derek Allen.

We crushed breakfast at Iron Rooster and devoured a week’s worth of calories in one sitting.

Source: J.P. Morgan Guide to the Markets

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.