Closing out Future Proof, plus the 4 technical gaps, short-dated options, and Retail Sales

The Sandbox Daily (9.14.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Future Proof – thank you

4 types of gaps, simplified

share of short-dated options approaching 50%

retail sales show a resilient consumer

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.40% | Dow +0.96% | S&P 500 +0.84% | Nasdaq 100 +0.82%

FIXED INCOME: Barclays Agg Bond -0.14% | High Yield +0.12% | 2yr UST 5.014% | 10yr UST 4.288%

COMMODITIES: Brent Crude +2.32% to $94.01/barrel. Gold -0.05% to $1,931.6/oz.

BITCOIN: +1.55% to $26,601

US DOLLAR INDEX: +0.54% to 105.327

CBOE EQUITY PUT/CALL RATIO: 1.14

VIX: -4.90% to 12.82

Quote of the day

“Return of capital is more important than return on capital.”

- Rich Saperstein, Treasury Partners

Future Proof – wow!

Future Proof is an immersive professional, lifestyle, and networking event best experienced through audio/visual format.

Please enjoy this brief wrap-up video, courtesy of my iPhone.

Source: Blake Millard, Instagram

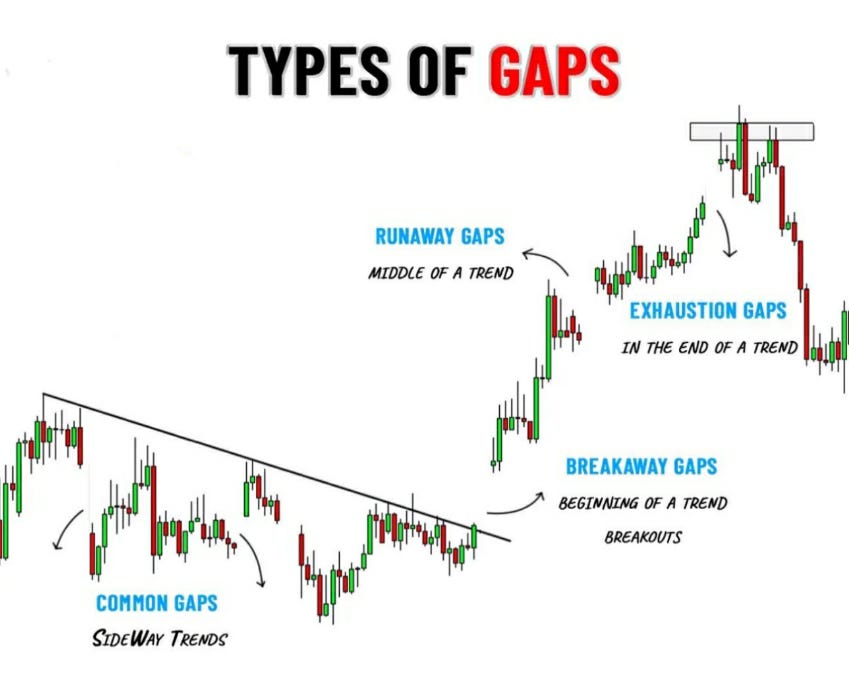

4 types of gaps, simplified

A gap is an area on a chart where the price of a security moves sharply up or down, with little or no trading in between.

Why are gaps important? They create opportunities and whether you have your trader hat or investors hat on, we are always looking for opportunities.

Market technicians have identified 4 types of market gaps:

Common gaps: This is the most frequent type and often occur when price is range-bound. These types of gaps are not big in size and get filled relatively quickly. These gaps do not provide much of a signal.

Breakaway gaps: Created as price breaks away from a consolidation phase, often gapping over a support/resistance level and typically signals a direction.

Runaway gaps: Gaps that occur in the middle of uptrends, showing a trend continuation signal and can suggest momentum is building. Preferably, these gaps are not too large in size to confirm sustainability. These represent buyers who did not get in during the beginning of the uptrend.

Exhaustion gaps: Gaps that happen at the end of a trend and can signal a reversal, showing the trend has changed. Price makes one final gap in the direction of the underlying trend on momentum exhaustion and then rollover.

Here is a chart of DraftKings Inc. ($DKNG) that demonstrates examples of each type of gap:

Gaps are used in concert with other tools to help investors and traders alike understand the market behavior of buyers and sellers.

Source: Trading View, Sunil Gurjar CFTe

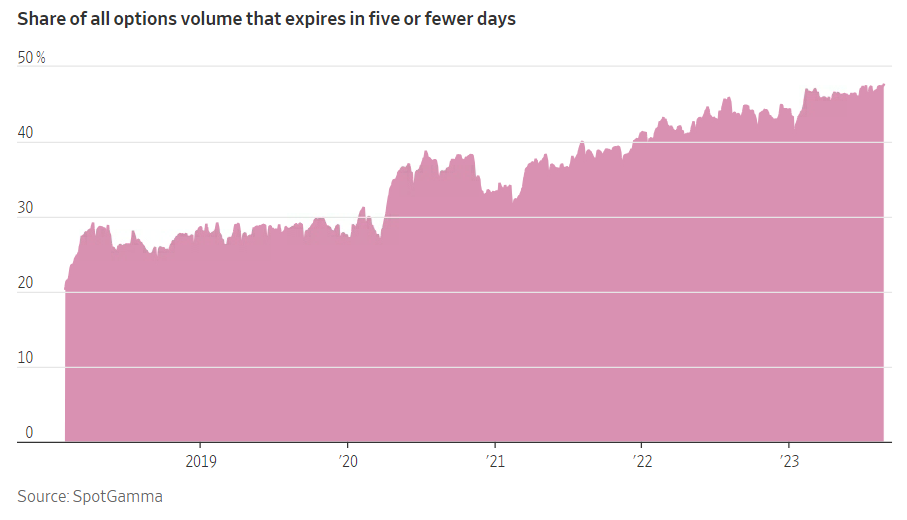

Share of short-dated options approaching 50%

Trading using short-dated options has been going bananas for the last few years. For a small upfront fee, investors get the chance for a big payout almost immediately.

The share of shorter-dated options (5 days or less) versus the overall pool continues to tick higher, accounting for nearly half of all options-market activity. Individual investors make up ~30% of that.

Not long ago, options trading was best left to professionals with access to sophisticated trading tools, data, and support systems. Now, a new generation of speculators are swinging for the fences using short-term options.

Source: Wall Street Journal

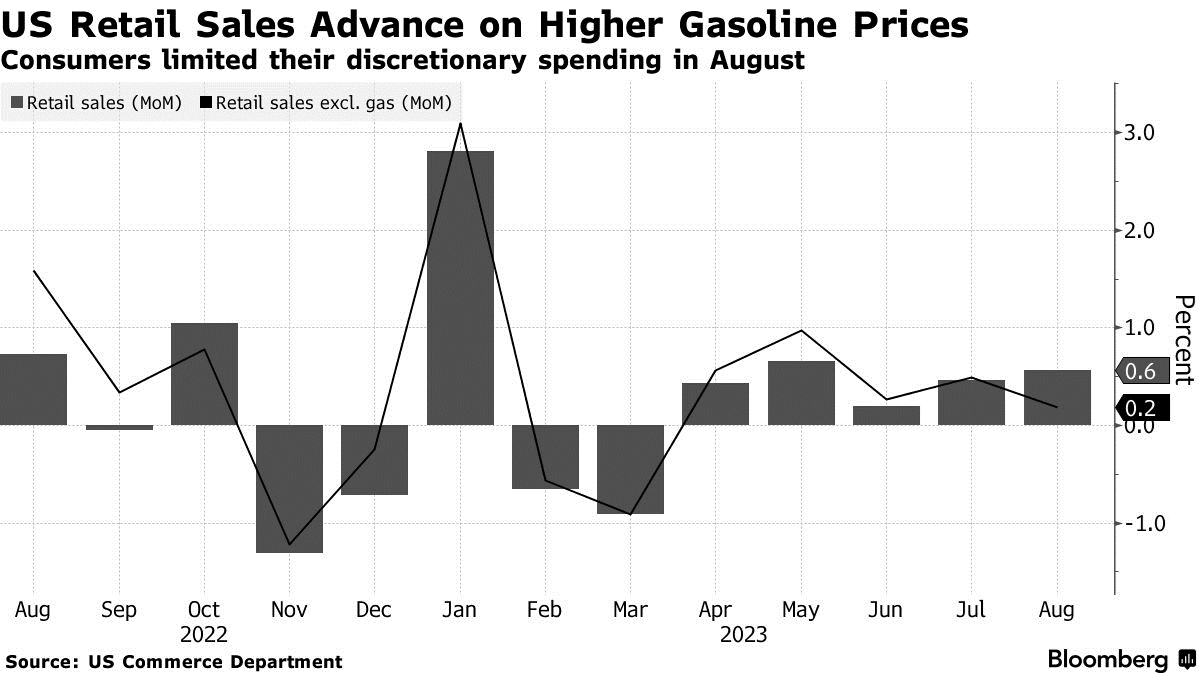

Retail Sales show a resilient consumer

Retail Sales – an economic metric that tracks consumer demand for goods – jumped well above expectations, climbing +0.6% in August and blowing away the consensus of +0.1%.

August marked the 5th straight monthly gain in sales, the longest winning streak since September 2020 and indicating that consumer spending power remains intact despite a choppy 1st quarter.

The biggest driver was a 5.2% surge in gas station sales, the most since March 2022 and reflecting higher gasoline prices at the pump. This caused consumers to pull back on other spending categories.

Source: Ned Davis Research, Bloomberg, YCharts

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.