College education, plus the Magnificent 7 and the bond maturity wall

The Sandbox Daily (4.29.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

college education, by the numbers

earnings with and without the Magnificent 7

bond maturity schedule

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.70% | Dow +0.38% | Nasdaq 100 +0.36% | S&P 500 +0.32%

FIXED INCOME: Barclays Agg Bond +0.30% | High Yield +0.30% | 2yr UST 4.975% | 10yr UST 4.609%

COMMODITIES: Brent Crude -1.12% to $88.51/barrel. Gold +0.03% to $2,347.8/oz.

BITCOIN: -1.24% to $62,876

US DOLLAR INDEX: -0.31% to 105.618

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: -2.40% to 14.67

Quote of the day

“Most of us spend too much time on what is urgent and not enough time on what is important.”

- Stephen Covey, Author of The 7 Habits of Highly Effective People

College education, by the numbers

For many households, college decisions are a cause for celebration. However, college also represents one of the largest expenses and sources of financial stress in our lives, on par with retirement or buying a home. These feelings are only worsened by the current market environment as investors adjust to higher interest rates, a less certain path of Fed policy, and more stubborn inflation.

It’s well known that the cost of college has risen far faster than inflation over the past 40 years. The chart below shows the average level of tuition and fees after adjusting for inflation – i.e., increases shown on the chart are above and beyond inflation – according to the National Center for Education Statistics. For example, the average cost of tuition and fees alone for the 2022-2023 school year was $35,248 for private 4-year institutions and $9,750 for public universities.

Students and their families can also expect other expenses beyond tuition and fees such as the cost of room and board, which average $10,000+ per year. Add food, beverage, and entertainment costs – and the bill keeps climbing higher.

At the most expensive colleges, the total cost of attendance can be around $85,000/year for a total 4-year cost of $340,000 or more. The cost of 2-year colleges has not risen as much but has still outpaced inflation. These ever-rising costs are one reason many have grown disenchanted with higher education.

And yet, despite rising costs, there is clear evidence that, on average, college graduates earn more and are more likely to be employed than those with lower levels of education.

According to the Bureau of Labor Statistics, the unemployment rate for those with a college degree was just 2.2% in 2023 compared with 3.9% for those with a high school diploma alone. The median annual earnings of college graduates was $74,650, significantly higher than the $44,950 median for those with a high school diploma alone. This pattern continues for increasing levels of education including master’s, professional, and doctoral degrees.

It should come as no surprise that science, engineering, and business degrees have generally resulted in the highest annual earnings, compared to degrees in arts, education and humanities fields.

These figures are the primary reason college is still seen by many as the best path to financial success.

Source: Clearnomics

Earnings with and without the Magnificent 7

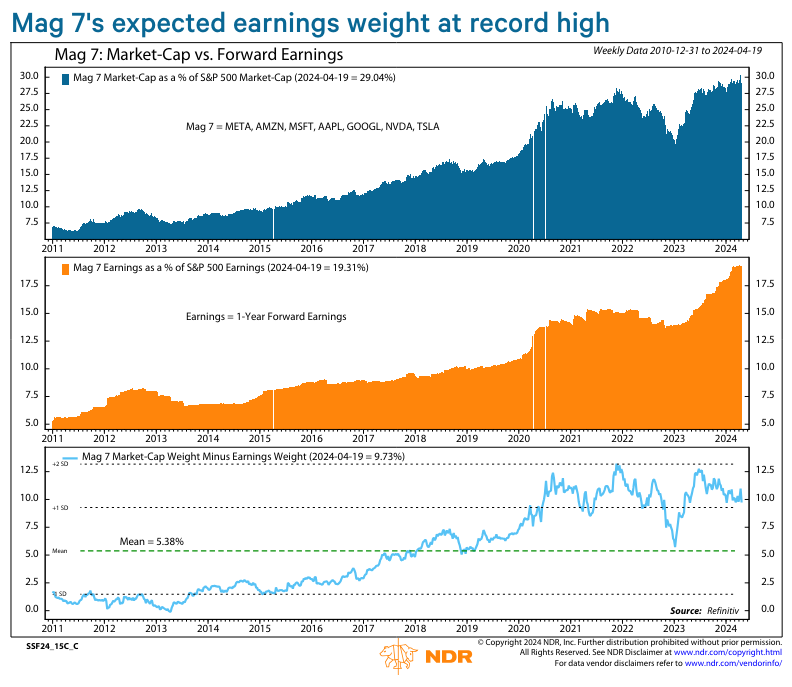

The Magnificent 7 have garnered a lot of attention for their dominance of earnings and returns, and rightfully so.

This handful of mega-cap tech stocks have accounted for most of the S&P 500’s recent gains, and yet, their outperformance has been supported by fundamentals. Mag 7 earnings rose +11.8% in the four quarters through Q4 2023, while earnings for the rest of the S&P 500 index constituents fell -3.2%.

Analysts expect the gap to widen in the next four quarters. Consensus estimates are calling for the Mag 7’s earnings to soar 36.9% in 2024 versus 1.0% for the other 493 companies.

Key questions for the rest of 2024 are whether high Mag 7 expectations will be met, if earnings outside the Mag 7 can accelerate, and how much is reflected in valuations.

Source: Ned Davis Research

Bond maturity schedule

One reason for the tightening delay in the monetary policy transmission mechanism coming from the Federal Reserve this cycle is the corporate debt refinancing that occurred during the pandemic, with one corporate treasury after another terming their debt out into the future at generationally low interest rates.

Limited refinancing needs thus far meant that, at an aggregate level, companies have been shielded from the higher borrowing costs in today’s marketplace.

But this is starting to change – a growing volume of debt will need to be refinanced over the next few years, culminating in 2028-2029 which represents the peak of the maturity wall for both large-caps and small-caps.

Most impacted by higher interest rate environments are the lowest rated issuers often referred to as High Yield, or Junk. Similar maturity profile here, peaking 2027 and 2028.

And when looking at the S&P 500 index, 9 of the 11 sectors have 20% or more of their debt maturing in the next 3 years.

Source: J.P. Morgan Markets, Goldman Sachs Global Investment Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.