Commercial bankruptcies, plus Bitcoin inflows surge, manufacturing, and the unemployment rate

The Sandbox Daily (1.16.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

commercial bankruptcies have risen but remain below pre-pandemic levels

Bitcoin ETFs spark huge crypto inflows

New York manufacturing off to dismal start

lingering headwind for labor market

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.01% | S&P 500 -0.37% | Dow -0.62% | Russell 2000 -1.21%

FIXED INCOME: Barclays Agg Bond -0.75% | High Yield -0.63% | 2yr UST 4.224% | 10yr UST 4.056%

COMMODITIES: Brent Crude -0.52% to $77.74/barrel. Gold -0.97% to $2,031.8/oz.

BITCOIN: +1.22% to $43,158

US DOLLAR INDEX: +0.92% to 103.348

CBOE EQUITY PUT/CALL RATIO: 0.83

VIX: +4.45% to 13.84

Quote of the day

“Investors love to fight trends. We see that quite often. In bear markets they're always looking to pick a bottom. In bull markets they're always trying to pick a top.”

- J.C. Parets, Founder of All Star Charts in QQQ New All-Time High vs. Bonds

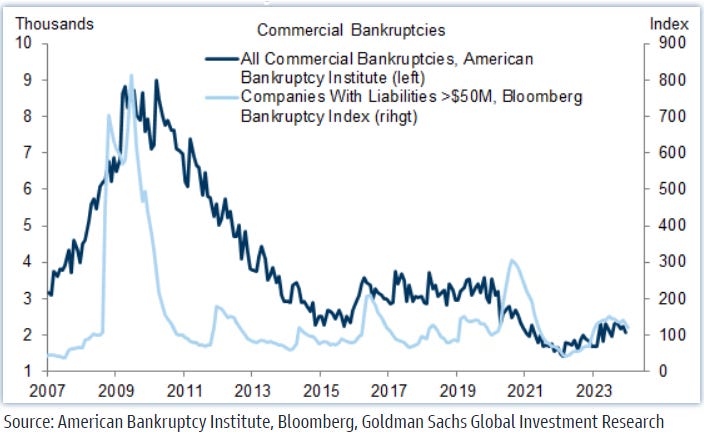

Commercial bankruptcies have risen but remain below pre-pandemic levels

Media reporting will sometimes highlight the rise in commercial bankruptcies since 2022, but zoom out a bit and it looks far less ominous.

The current level is still well below the pre-pandemic level. While large company bankruptcies are somewhat higher, they have only returned to their 2019 levels.

Source: Goldman Sachs Global Investment Research

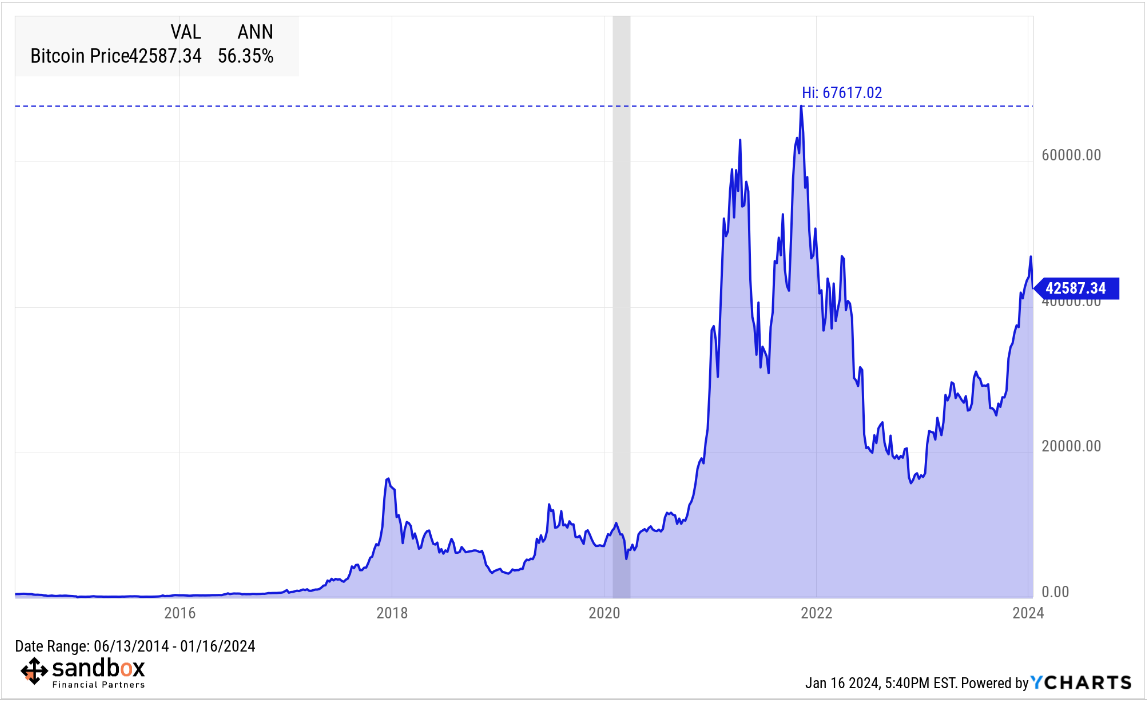

Bitcoin ETFs spark $1.18B in crypto inflows last week

Bitcoin hit a significant milestone last week as the U.S. Securities and Exchange Commission (SEC) approved the registration applications of eleven spot bitcoin exchange-traded funds (ETFs). The launch of these funds underscores bitcoin’s remarkable journey from a niche and nascent digital currency to a regulated new asset class.

Per CoinShares reporting, last week’s launch of the spot bitcoin ETFs cumulatively attracted $1.18 billion of investor net inflows in their 1st week of trading – in fact, just two days of trading given Thursday’s 1/11 launch date – underscoring strong investor demand across both institutional and retail verticals.

After months of hype and uncertainty surrounding the SEC's approval of spot bitcoin via traditional Wall Street exchanges, crypto investors' hopes appear to have been vindicated.

The early leader out of the gate for inflows is BlackRock’s iShares Bitcoin Trust (IBIT) with $497.9M, followed by Fidelity Wise Origin Bitcoin Fund (FBTC) at $422.3M and the Bitwise Bitcoin ETF (BITB) at $237.9M.

Meanwhile, the Grayscale Bitcoin Trust (GBTC) experienced an outflow of $579M during the same period. GBTC is one of the largest and oldest holders of bitcoin, but with Grayscale charging 1.50% while other fund managers charge just a fraction of that, many GBTC holders are switching to lower-fee options.

Source: CoinShares, Wall Street Journal, The Block, Eric Balchunas

New York manufacturing off to dismal start

Manufacturing activity in New York State collapsed further in January.

The Federal Reserve Bank of New York reported the Empire State Manufacturing Index fell much more than expected, dropping from -14.5 to -43.7 in December 2023 – a truly staggering decline. The consensus estimate had expected activity to remain in contraction but improve to -5.0. This is the worst reading since May 2020 (when it was -48.5) and the 3rd-worst reading on record.

The New York manufacturing data is the 1st of the regional Fed reports to come out for the month and can provide an early indication of manufacturing activity for other regions; we get Philly regional data next on Thursday. The latest reading points to continued weakness.

Source: Dwyer Strategy, New Davis Research

Lingering headwind for labor market

If the U.S. economy is approaching recession, the labor market doesn’t know it yet.

Approaching two years into an aggressive Federal Reserve tightening cycle, many continue to remain puzzled over the lack of uptick in the unemployment rate – the current 3.7% is up only slightly from 2023’s low of 3.4% but still near the lowest levels on record.

One simple explanation?

The transmission mechanism from Fed tightening to a lift in the unemployment rate, as measured by the troughs in each data series, takes 23 months on average – so the current delay is perfectly normal.

As such, February 2024 will mark the beginning of the time frame when joblessness “should” start climbing – 23 months after the lows in the Fed Funds Rate in March 2022.

Source: Piper Sandler

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.