Consumer prices update, plus 2023 expectations, reviewing 2022, FTX CEO arrested, and Christmas classics

The Sandbox Daily (12.13.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the Consumer Price Index (CPI) report from November, industry analysts predict a ~12% price increase for the S&P 500 in 2023, the dreadful year for stocks and bonds, Sam Bankman-Fried arrested (finally), and the season of Christmas classics.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.09% | Russell 2000 +0.76% | S&P 500 +0.73% | Dow +0.30%

FIXED INCOME: Barclays Agg Bond +0.67% | High Yield +1.04% | 2yr UST 4.218% | 10yr UST 3.503%

COMMODITIES: Brent Crude +3.24% to $80.52/barrel. Gold +1.64% to $1,821.7/oz.

BITCOIN: +3.46% to $17,748

US DOLLAR INDEX: -1.03 % to 104.050

CBOE EQUITY PUT/CALL RATIO: 0.64

VIX: -9.80% to 22.55

CPI inflation cooling

Inflation took another important downward step in November – affirming the market’s assessment that it has peaked in this cycle – as the November Consumer Price Index (CPI) data came in softer than expected, sending risk assets firmly higher.

The Consumer Price Index (CPI) ticked up +0.1% MoM in November – the smallest gain in four months – and below the consensus of +0.3%. Core CPI, which excludes the more volatile food and energy components, rose +0.2% MoM, the smallest advance in 15 months (August 2021), and also below the consensus of +0.3%.

On a YoY basis, the headline CPI print eased to +7.1% from +7.7% in the prior month; this is the fifth straight monthly decline, the lowest headline level since December 2021, and a reading firmly off the peak rate of 9.1% back in June. Meanwhile, Core CPI inflation came down to +6.0% from a cycle peak of +6.7% in September.

Categories like used cars and trucks, airline tickets, and medical expenses are trending lower. However, shelter costs rose +0.6% and food costs were up +0.5% – both way too hot.

Both the headline and core inflation rates continue to run much higher than pre-pandemic times, but are showing noteworthy signs of cooling – perhaps indicating the worst of the inflationary pressures has likely passed and validating an anticipated slowing in the pace of Federal Reserve interest-rate hikes.

Source: Ned Davis Research, Bloomberg

Industry analysts predict a ~12% price increase for S&P 500 in 2023

With 2022 coming to a close, analysts are making predictions for the closing price of the S&P 500 for next year. These predictions vary widely, as market strategists are divided as to whether believe the S&P 500 will close above or below 4,000 at the end of 2023.

Industry analysts in aggregate predict the S&P 500 will close December 2023 at 4,493.50. This bottom-up target price for the index is calculated by aggregating the median target price estimates (based on the company-level target prices submitted by industry analysts) for all the companies in the index. With the S&P 500 trading at 4,020 as of December 13th market close, the bottom-up target price of 4,493 is +11.8% above current levels.

However, it is important to note that industry analysts have historically overestimated the closing price of the index at the start of the year. For example, at the end of last year (December 31, 2021), the bottom-up target price for the S&P 500 was 5,264.51. Based on today’s closing price (4,019.65), analysts overestimated the price of the index by 31% at the start of CY 2022. In fact, over the previous 20 years, industry analysts have overestimated the calendar year’s final price of the index by ~8.3% on average.

Source: FactSet

A dreadful year for the average stock-bond portfolio

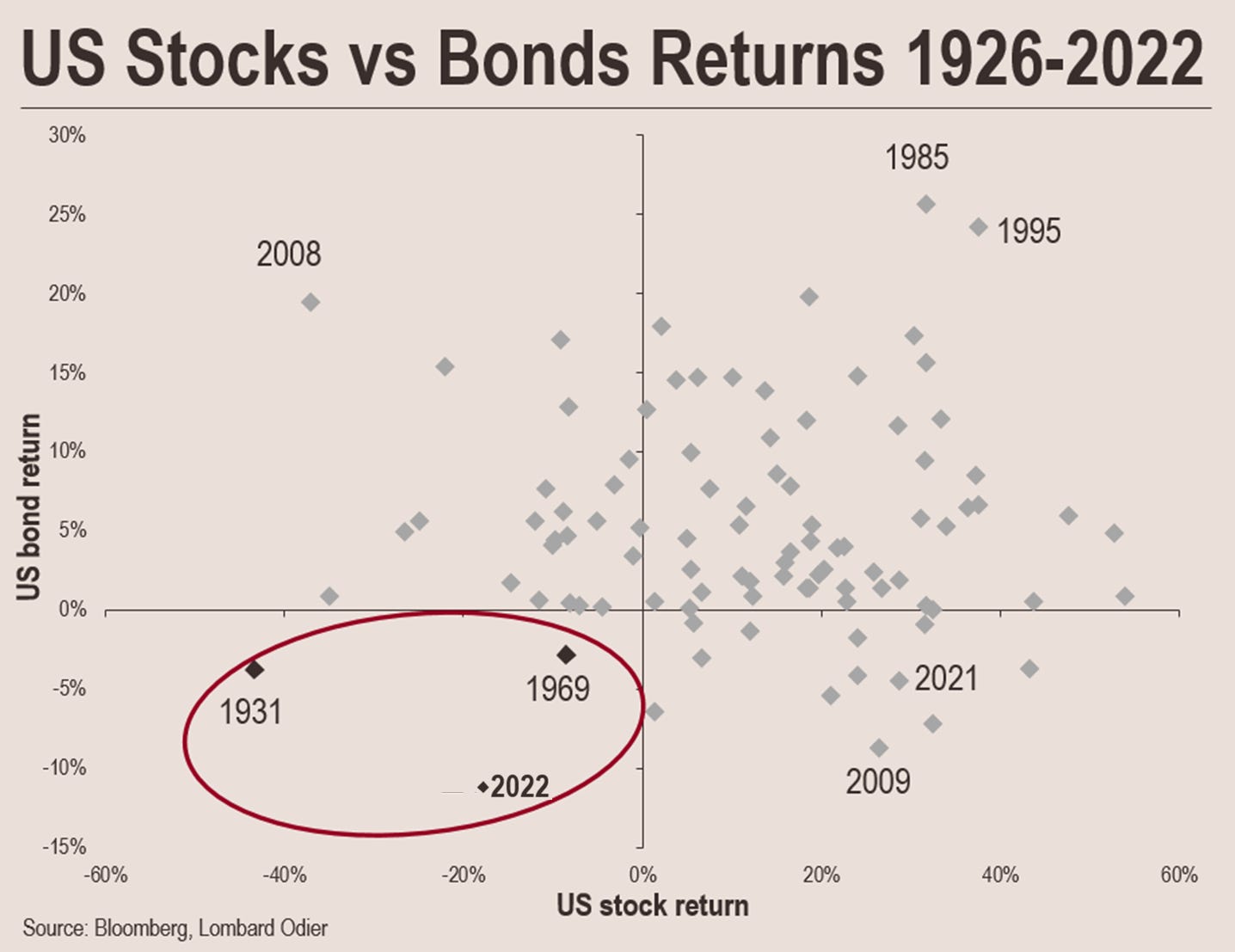

2022 has been an outlier year for investment returns, especially the high correlation between stocks and bonds.

Since 1926, stocks and bonds only had 3 years (1931, 1969 and 2022) of combined negative returns. History says this trend won't continue into 2023, but sentiment is very negative while positioning is weak, so we'll see if the crowd or the contrarian wins out next year.

Source: Lombard Odier

Sam Bankman-Fried arrested, finally

The attorney general for the Bahamian government announced last night that the former CEO and co-founder of FTX Trading Ltd., Sam Bankman-Fried, had been arrested at the request of American authorities. FTX, the cryptocurrency exchange once valued at $32 billion dollars, filed for Chapter 11 bankruptcy protection in November.

This morning, the Securities and Exchange Commission (SEC) charged Samuel Bankman-Fried with orchestrating a scheme to defraud equity investors, while roughly at the same time federal prosecutors in the southern District of New York unsealed an indictment with criminal charges of conspiracy to commit wire fraud and securities fraud, standalone charges of securities fraud and wire fraud, money laundering, and conspiracy to defraud the United States and campaign finance regulations.

Source: Securities and Exchange Commission, Dr. Parik Patel

Christmas classics

Every year, debates break out around when it’s acceptable to give in to the holiday season and let the tidal wave of Christmas wash over you.

Listeners don't seem afraid to dig out Mariah Carey’s Christmas cracker early, with All I Want for Christmas is You breaking into Spotify's top 200 early in November — routinely racking up 2, 3 or 4 million streams before we even turned our calendars. The only Christmas song in the Spotify ‘one billion’ club, AIWFCIY is likely raking in $25,000+ per day in Spotify royalty fees — though Carey will have to split those with publishers, labels and other rights-holders.

Other hits like Rockin’ Around the Christmas Tree and Wham’s Last Christmas aren’t too far behind either with 5.9mm and 6.1mm daily streams, respectively, for the most recent data point. Some non-festive favorites like Harry Styles’s As it Was and Sam Smith's Unholy are still lingering in the top 10, but non-seasonal songs are quickly becoming the minority — 6 of the top 10 spots are already occupied by Christmas classics.

Source: Chartr

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.