Contrarian red flags heading into year-end

The Sandbox Daily (12.16.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

contrarian red flags

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.26% | S&P 500 -0.24% | Russell 2000 -0.45% | Dow -0.62%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.06% | 2yr UST 3.487% | 10yr UST 4.147%

COMMODITIES: Brent Crude -2.82% to $58.84/barrel. Gold -0.08% to $4,331.7/oz.

BITCOIN: +2.02% to $87,773

US DOLLAR INDEX: -0.09% to 98.224

CBOE TOTAL PUT/CALL RATIO: 0.92

VIX: -0.12% to 16.48

Quote of the day

“An idiot admires complexity, a genius admires simplicity.”

- Terry Davis

Contrarian red flags

According to data from both J.P. Morgan and Bank of America, positioning and sentiment by asset managers towards U.S. equities is tilting excessively bullish – a cautionary yellow flag.

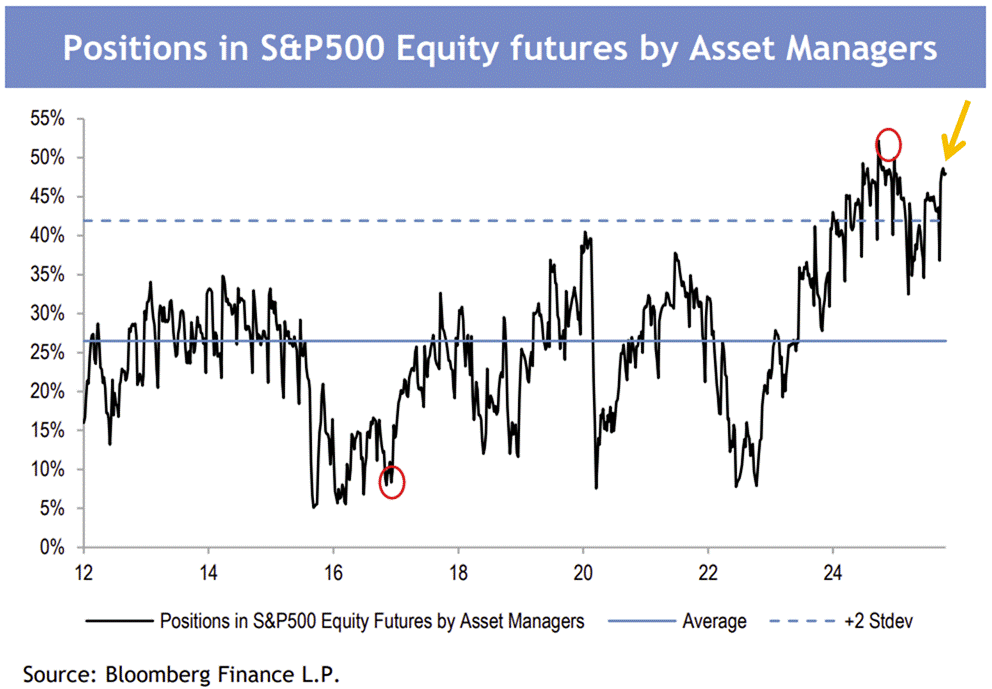

Per JPM, net long positioning in S&P 500 futures is close to 50% and approaching the highest level on record, sitting over two standards deviations (the dashed line in the graphic below) above its historical average (the solid blue line).

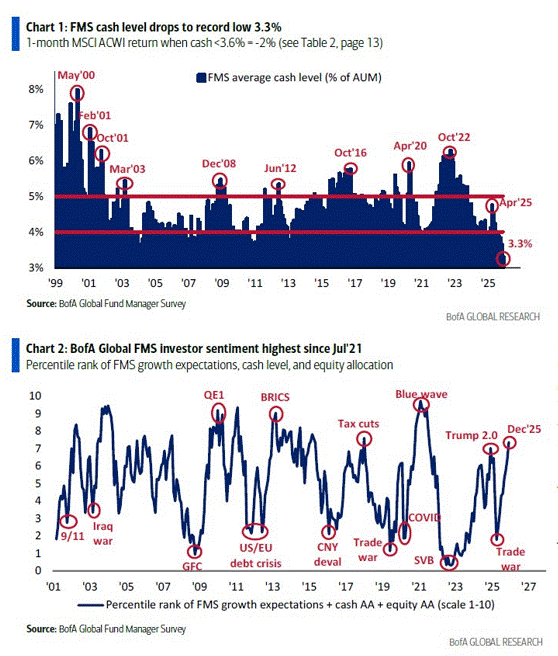

Meanwhile, per BofA’s Fund Manager Survey, investors hold the lowest cash allocation in history at the same time we are hitting the highest sentiment levels since July 2021.

Crowded long positioning and excessive sentiment by themselves don’t need to mark a local top, but it does compress near-term upside.

The big pools of money are max long, and in the context of high valuations, the risk arises from an increasingly smaller pool of marginal buyers.

Often times, this bulled-up backdrop creates an environment where the possibility of a pullback is elevated because the stock market becomes far more sensitive to negative surprises. When everyone’s positioned and feeling a similar way, the opportunity rises to clear consensus and the pockets of excess.

Taken together, the near-term downside risks are growing as there’s less firepower to support the next leg higher, especially if economic or market conditions suddenly weaken.

As we get closer to year-end, investors may feel tempted to lock in gains rather than add further directional exposure to the long side.

Sources: J.P. Morgan, Bank of America

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)