Copper rally reflects economic growth, tariffs, and technical breakouts

The Sandbox Daily (7.15.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the copper rally reflects growth trends and tariffs

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.13% | S&P 500 -0.40% | Dow -0.98% | Russell 2000 -1.99%

FIXED INCOME: Barclays Agg Bond -0.30% | High Yield -0.30% | 2yr UST 3.952% | 10yr UST 4.491%

COMMODITIES: Brent Crude -0.53% to $68.84/barrel. Gold -0.71% to $3,335.3/oz.

BITCOIN: -3.01% to $116,572

US DOLLAR INDEX: +0.57% to 98.637

CBOE TOTAL PUT/CALL RATIO: 0.85

VIX: +1.05% to 17.38

Quote of the day

A wise man once said: “Don't be afraid to start over again. This time you're not starting from scratch, you're starting from experience.”

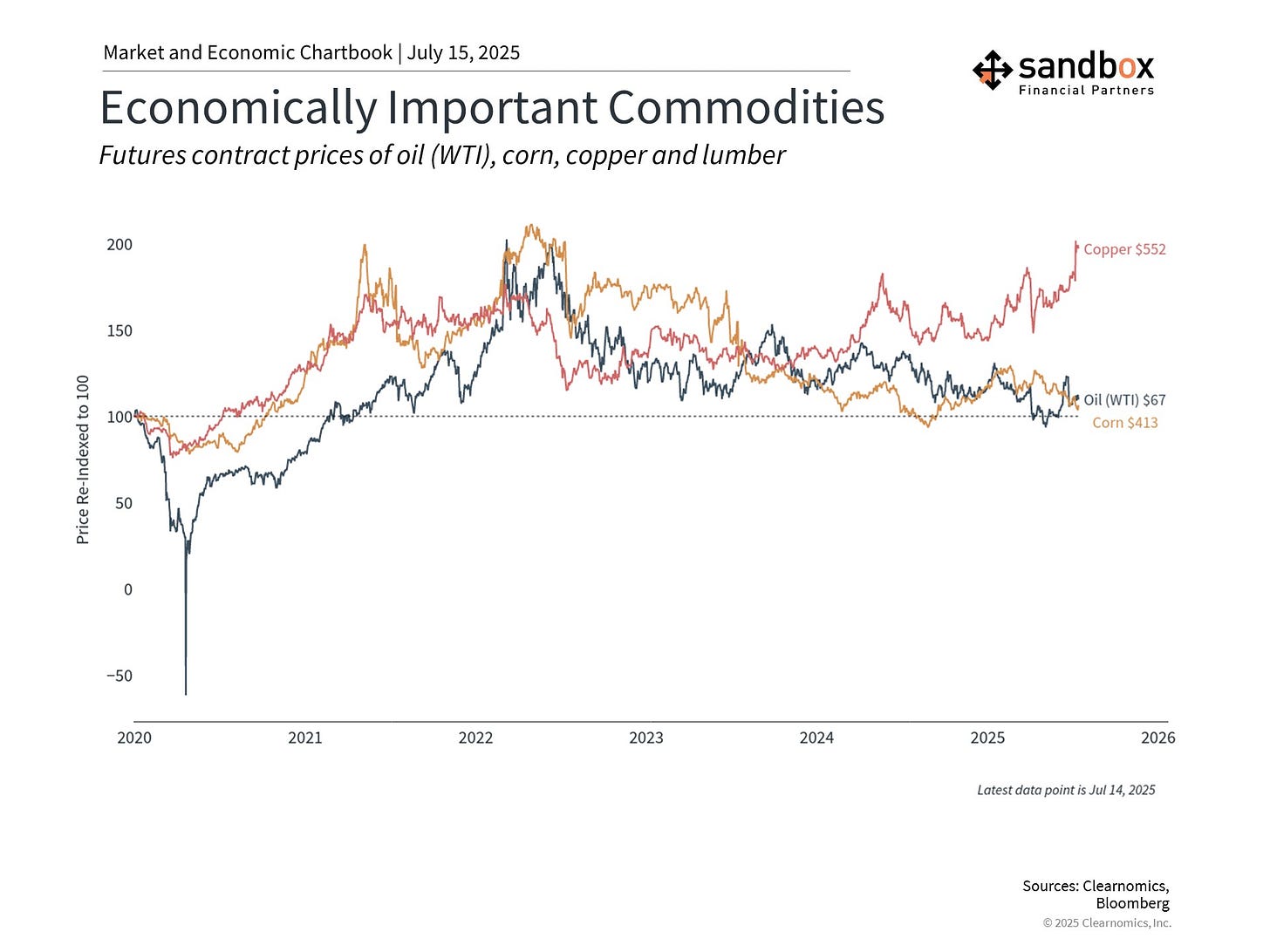

The copper rally reflects growth trends and tariffs

Last week, copper surged to record highs after the White House announced 50% tariffs on copper imports – double what was previously floated for the valuable commodity and bringing its tariff rate in line with other industrial metals like steel and aluminum.

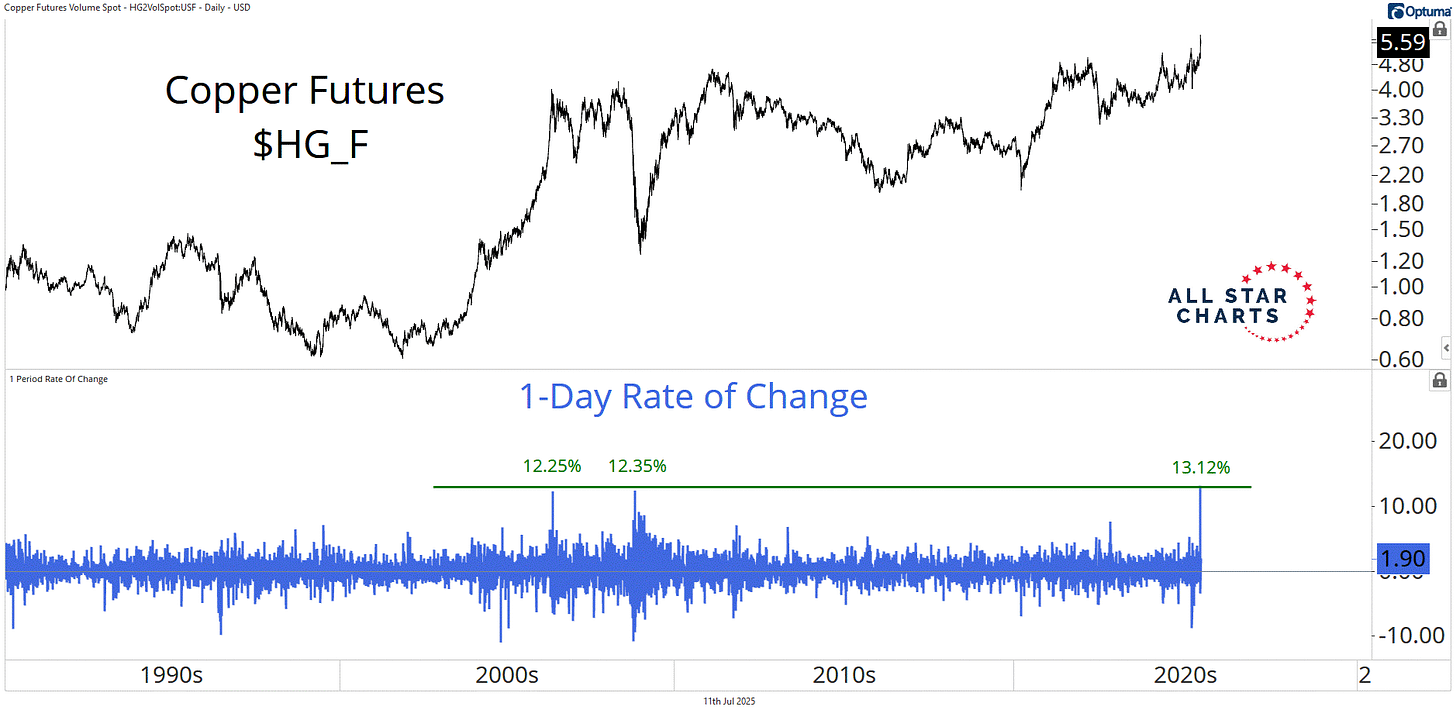

President Trump’s announcement sent copper prices soaring, scoring its best single-day gain ever. Just another chart pattern breaking out…

Copper is extremely vital to the real economy, as an industrial metal needed in construction, electrical infrastructure, electronics, and renewable energy projects.

For this reason, copper is often used as an economic indicator – sometimes known as "Dr. Copper" – since its price movements are sometimes used to predict or confirm economic trends.

The idea that a tariff on copper imports will encourage U.S. production is a complex one.

Currently, the United States is already the world’s 6th largest producer of copper with roughly 1.1 million tons produced last year, which is actually down about 10% from its peak level back in 2022.

The United States then relies on imports for 45% of its copper consumption, primarily from Chile, Canada, Mexico, and Peru.

Tariff policies may help to spur domestic production in the long-run, but will also impact pricing and supply chains in the short-run.

Additionally, China's substantial copper use makes the metal sensitive to global economic conditions and trade relationships.

How does this copper tariff announcement affect investors?

Like Bitcoin and small-caps and other volatile assets, it’s important to distinguish between sharp price movements and whether an asset fits well within a portfolio.

And, as Tony Pasquariello of Goldman Sachs wrote in a note to clients over the weekend, it’s hard to separate “the noise factor around the sector variables – namely copper and pharma” under this administration, their policy goals, and the ever-evolving rhetoric.

Trying to predict the next move for copper is akin to predicting the exact path of the economy and trade policy. A fool’s errand for most.

Instead, investors should focus on whether copper and other assets help to improve the characteristics of their portfolios, alongside other economically-sensitive asset classes, including stocks.

If copper is your prerogative, then one way to position for a continued bullish advance would be to go long the United States Copper Index Fund (CPER), which seeks to track the daily investment results of the SummerHaven Copper Index, which is constructed to reflect the daily performance of a portfolio of copper futures contracts on the COMEX exchange.

Source: All Star Charts, Clearnomics, Goldman Sachs Global Investment Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)