CPI data and a rate hike this week, plus consumer sentiment, U.S. dollar, bonds stall, and TikTok's year in review

The Sandbox Daily (12.12.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the important week for markets to close out 2022, consumer sentiment remains washed out, dollar tailwinds, the bond rally pauses at a logical level, and TikTok’s year in review.

Let’s dig in.

Markets in review

EQUITIES: Dow +1.58% | S&P 500 +1.43% | Nasdaq 100 +1.24% | Russell 2000 +1.22%

FIXED INCOME: Barclays Agg Bond +0.02% | High Yield +0.39% | 2yr UST 4.373% | 10yr UST 3.602%

COMMODITIES: Brent Crude +2.67% to $78.13/barrel. Gold -0.98% to $1,792.9/oz.

BITCOIN: +0.42% to $17,191

US DOLLAR INDEX: +0.20% to 105.016

CBOE EQUITY PUT/CALL RATIO: 0.95

VIX: +9.51% to 25.00

Important week for markets to close out 2022

It’s the week everyone’s been waiting for. Tuesday brings us the Consumer Price Index (CPI) report for November, while Wednesday brings another Federal Reserve interest-rate decision and a Q&A media session from Fed Chair Jerome Powell, and Thursday brings a critical read on the consumer via the Retail Sales report. These important macro and monetary policy announcements will help shape investor’s view of what’s ahead for a beaten-down stock market and economy heading in 2023.

Over the past six months, the S&P 500 has seen an average move of ~3% in either direction on the day that the CPI report is released, the highest since 2009. The S&P 500 index has fallen on 7 of the 11 CPI reporting days this year.

The market is expecting +0.3% month-over-month consumer price growth, which would equate to an annualized year-over-year growth of ~7.5% CPI growth. Here is a recap of the possible headline CPI YoY figures based on various MoM readings we could see:

One thing that is certain heading into this week is investor’s desire for seeking protection ahead of these major announcements, as evidenced by a surge in put option buying activity. The demand for hedges pushed the CBOE Equity Put-to-Call ratio to 1.46 last week – the highest level since 2001 and more than double this year’s average of 0.66.

Source: Bloomberg, Bespoke Investment Group

Consumer sentiment remains washed out

Bears have outnumbered the Bulls in the American Association of Individual Investors (AAII) sentiment poll for 37 consecutive weeks (since April 7). With the data series going back to 1987, the current stretch is the longest streak of negativity that we've ever seen.

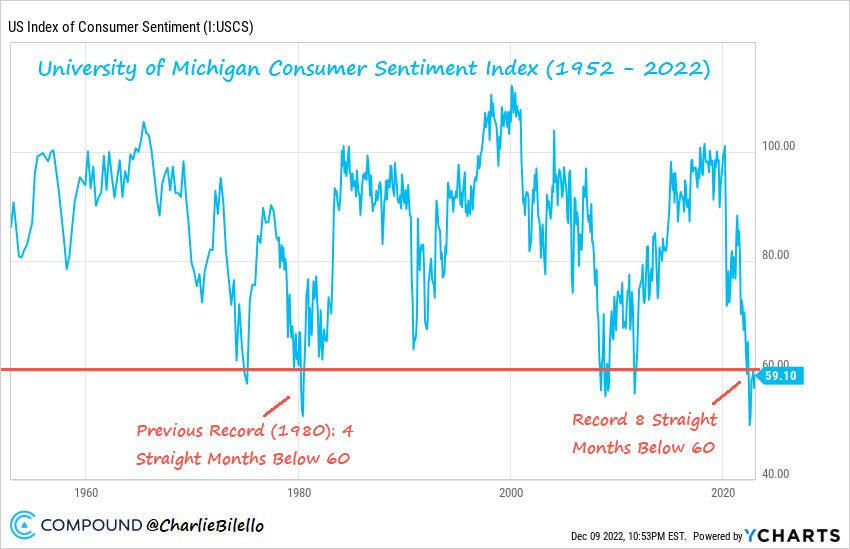

Confirming this survey data is The University of Michigan's Consumer Sentiment Index, which has been below 60 for 8 consecutive months – the longest run of extreme negative sentiment that we've seen with data going back to 1952. The prior record was 4 straight months during the 1980 recession.

When reviewing the gamut of asset class performance this year, it’s no surprise to see sentiment totally washed out.

Source: American Association of Individual Investors, Charlie Bilello

Dollar tailwinds

Since the U.S. dollar peaked in late September, commodities and international equities have stood out as leadership groups among all asset classes.

The iShares Silver Trust (SLV) and the iShares MSCI EAFE Index (EFA) have risen 23% and 19%, respectively.

When the dollar depreciates, dollar-denominated assets become cheaper, spurring economic activity and investment. A falling dollar is also synonymous with increased risk-seeking behavior among investors. This is exactly what we’ve been observing since the U.S. Dollar Index (DXY) peaked in late September.

Even some of the most beaten-down groups, such as international stocks and precious metals, have rallied significantly. We could expect these dollar tailwinds to persist and drive risk assets higher into 2023.

Source: All Star Charts

Bond rally pauses at a logical level

Bonds ended a four-week winning last week, dropping -0.5%. This occurred at a logical level, as the iShares Core U.S. Aggregate Bond ETF (AGG) printed a potential doji reversal candle on the weekly chart right at the summer lows. If bonds are lower this week, it would confirm the candle and suggest a resumption of the downtrend in core fixed income (yields higher, 3.4-3.5% remains key support for the U.S. 10-year Treausry).

Source: Beat the Bench

TikTok’s year in review

TikTok’s Year on TikTok 2022 is basically the dictionary definition of “trending.”

The company published its fifth annual report with lists of its buzziest clip, song, people, and food trends of the year – providing an overview of all the creators, moments, and trends that resonated the most in the app throughout the past 12 months.

TikTok’s “Year in Review” is separated into ten categories:

FYFaves – The most popular video clips of the year overall

TikTok Taught Me – Which highlights educational lessons, life hacks, and how-to’s people have learned from the TikTok community

The Playlist – The most popular songs on the app in 2022

Breakthrough Stars – The rising creators and celebrities who had big moments on TikTok this year

Only on TikTok – Key TikTok trends, powered by creative effects, sounds and other product features

The Hitmakers – The most popular artists in the app

Uncovered Communities – A celebration of subcultures and niche communities that are thriving on TikTok

Eats on Repeat – Key food and recipe trends

Loved by TikTok – Some of the most popular products and SMBs presented in the app

Emerging Artists – The TikTok stars of tomorrow

The top performer, with more than 300 million views, was this clip from chocolatier @amauryguichon on the creation of a chocolate giraffe.

Source: TikTok

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.