CPI day (!!!), plus confidence wanes for Powell, financials, passive flows, and the best time to invest

The Sandbox Daily (5.10.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

CPI continues disinflation trend

confidence dips to all-time low for a Federal Reserve Chairman

financials hold the line

passive flows creating distortions?

the best time to invest

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.11% | Russell 2000 +0.56% | S&P 500 +0.45% | Dow -0.09%

FIXED INCOME: Barclays Agg Bond +0.65% | High Yield +0.61% | 2yr UST 3.908% | 10yr UST 3.441%

COMMODITIES: Brent Crude -1.03% to $76.64/barrel. Gold -0.26% to $2,037.6/oz.

BITCOIN: +0.81% to $27,889

US DOLLAR INDEX: -0.16% to 101.447

CBOE EQUITY PUT/CALL RATIO: 0.67

VIX: -4.35% to 16.94

Quote of the day

“For your performance to diverge from the norm, your expectations – and thus your portfolio – have to diverge from the norm, and you have to be more right than consensus. Different and better: that's a pretty good description of second-level thinking.”

- Howard Marks

CPI continues disinflation trend

This morning, the U.S. Bureau of Labor Statistics released their Consumer Price Index (CPI) report for April. U.S. consumer prices held steady in April and came in line with market expectations.

Headline Inflation

CPI: +0.4% MoM, versus +0.4% estimate and prior month of +0.1%

CPI: +4.9% YoY, versus +5.0% estimate and prior month of +5.0%

Core Inflation

CPI ex-food and inflation: +0.4% MoM, versus +0.4% estimate and prior month of +0.4%

CPI ex-food and inflation: +5.5% YoY, versus +5.5% estimate and prior month of +5.6%

Headline CPI (+4.93%) moved down for 10th consecutive month in YoY rate of inflation and printed the slowest annualized increase since April 2021 (+4.16%).

Core CPI (ex-food & energy) moved down a tick to +5.54%. The lagging shelter category continues to be an issue and one of great contention; many Fed watchers would like to see other reputable, more high-frequency data – like the Zillow or Redfin data series – incorporated into the FOMC’s analysis.

While prices are coming down, the rate at which its decreasing is slowing. The focus continues to be Core Services inflation (blue bar charts below).

Slower overall consumer price growth, but sticky core pressures, confirm that the path down to the Fed’s 2.0% inflation target will be bumpy.

Continued inflation cooling, particularly in the super-core element that has the Fed’s attention, supports a Fed pause in rate hikes. But since inflation is still too high for the Fed’s comfort, it does not suggest imminent rate cuts.

Source: Bureau of Labor Statistics, Ned Davis Research, Bloomberg

Confidence dips to all-time low for a Federal Reserve Chairman

Jerome Powell, Chairman of the Federal Reserve, faces the lowest public confidence for a Fed Chairman on record.

This poll shows waning public support for Jerome Powell as the Federal Reserve tries to engineer a soft landing via restrictive monetary policy in their fight against multi-decade high inflation. As we tip-toe towards the national election on November 5, 2024, political pressure will further mount on the Biden Administration and the Federal Reserve.

Something to keep a close eye on.

Source: Gallup

Financials hold the line

When it comes to the financial sector, volatility continues to expand as regional bank stocks remain vulnerable.

More importantly to the technical charts, the pre-financial crisis highs in the large-cap SPDR Financial ETF (XLF) remain intact. This chart below shows where financials peaked during previous cycles in 2007, 2018, and 2020, making it a critical level of interest:

Price has been holding above this polarity level of around 30.50 for some time now. As long financials hold support at this level, broader markets should remain healthy.

Source: All Star Charts

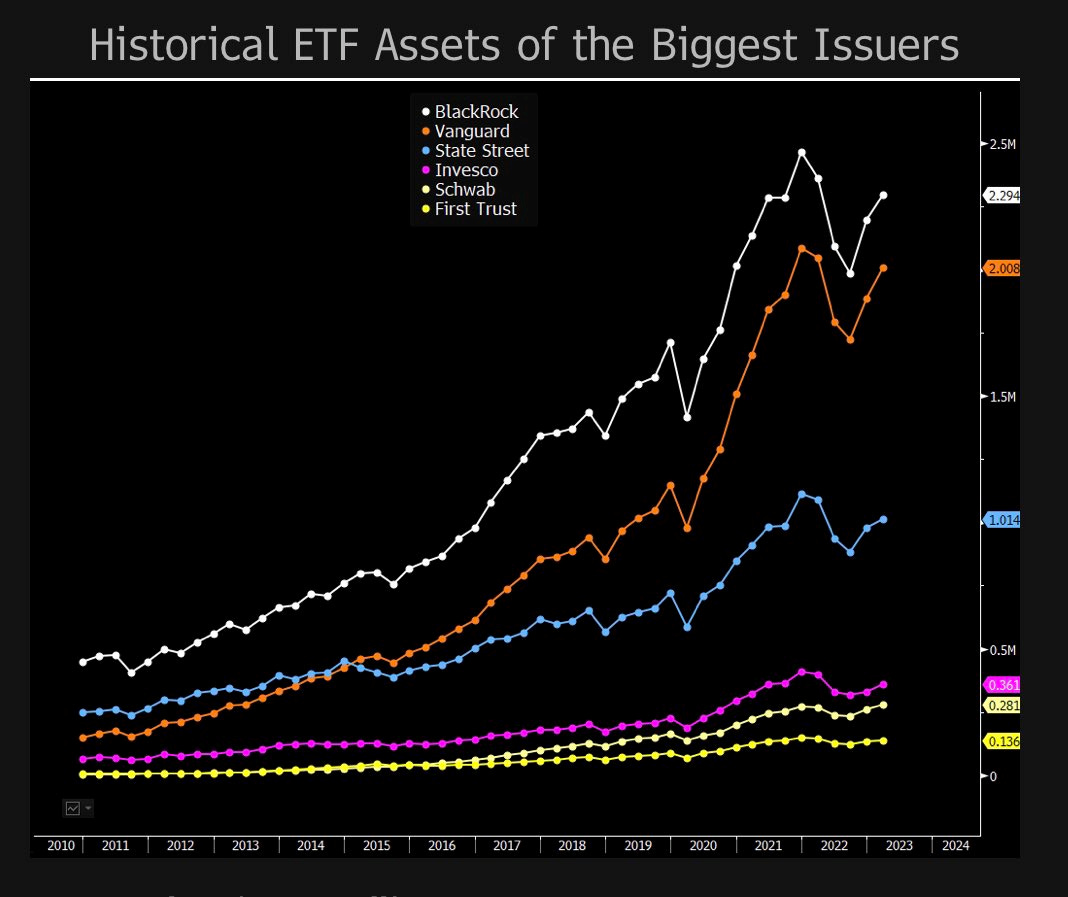

Passive flows creating distortions?

In 2021, passive fund ownership of U.S. stocks overtook active fund ownership for the first time – per a report from the Investment Company Institute, an industry body.

The chart below shows the steady progression of passively managed funds versus actively managed.

Passive investors tend to "buy the market" – meaning they are price-takers. These investors often focus on the largest passive ETFs, buying the well-known index ETFs and calling it a day. Other passive investors shift between stock factors like value or growth ETFs or funds focused on the market cap size, for example.

Within certain categories, distortions have evolved as the funds and strategies grow in size. For example, as popular value ETFs grow, the stocks they prefer in their respective categories grow even more prominent and further inflate their valuations, because there is always a buyer irrespective of the stock’s fundamental value or technical basis.

Asset growth over the last 15-20 years at the major ETF providers is astounding. As Eric Balchunas of Bloomberg notes, it’s likely that “only regulation can stop them.”

Source: Financial Times, Eric Balchunas

The best time to invest

Wealth building take time, patience, and a commitment to the plan.

The path forward is not an easy, uninterrupted one. In fact, it is full of fits and starts.

Investing during difficult markets is even harder and can bring about a range of unwelcome emotions, but that is precisely the time to be a buyer – not a seller – when markets go on sale. There is never a moment in time where the stock market referee calls time and runs over to you saying “now is the right time to start.”

As Mark Yusko of Morgan Creek Capital said: “Investing is the only business I know that when things go on sale, people run out of the store.”

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.