CPI day (!!!), plus hedge funds, Twitter, bankruptcies rising, IMF growth outlook, and the case for indexing

The Sandbox Daily (4.12.2023)

👋 Happy Wednesday everyone, a quick message before today’s newsletter:

You are reading The Sandbox Daily. If you’d like to join our growing community to learn more about financial markets while cutting out the noise and bias, then please subscribe below. You can check out our previous Substack articles and follow me on Twitter too.

If you enjoy today’s post, feel free to share it with like-minded individuals – it helps us A LOT !! and serves our purest form of subscriber growth. The Sandbox Daily is a reader-supported site. We don't have any outside writers or investors, nor do we accept any advertising. So we rely purely on the support from readers like you to make this research endeavor possible.

For those readers already subscribed, I just wanted to take a moment to thank you for your attention and support. Time is the most valuable resource we have — even more than money. I appreciate you spending 5 minutes Monday through Friday engaging our content. 🙏 Thank you. 🙏

Now, onto today’s post!

Welcome, Sandbox friends.

Today’s Daily discusses:

CPI continues disinflation trend

Hedge Funds holding large bearish SPX bets

Twitter advertisers, cost cuts bring platform near breakeven

U.S. bankruptcies are increasing sharply this year

IMF lowers world growth outlook

the case for indexing

IMPORTANT PUBLISHER’S NOTE: The Sandbox Daily will be off for much-needed R&R over 🌴 Spring Break 🏖️ and will return to your inbox on Monday, April 17th. Hence a longer than normal newsletter to hold you over.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.11% | S&P 500 -0.41% | Russell 2000 -0.72% | Nasdaq 100 -0.89%

FIXED INCOME: Barclays Agg Bond +0.12% | High Yield -0.03% | 2yr UST 3.968% | 10yr UST 3.402%

COMMODITIES: Brent Crude +1.88% to $87.22/barrel. Gold +0.79% to $2,029.3/oz.

BITCOIN: -0.92% to $29,892

US DOLLAR INDEX: -0.64% to 101.551

CBOE EQUITY PUT/CALL RATIO: 0.56

VIX: -0.05% to 19.09

Quote of the day

“The key to money management: it’s making a lot of money when you’re right and minimizing it when you’re wrong.”

-Stanley Druckenmiller

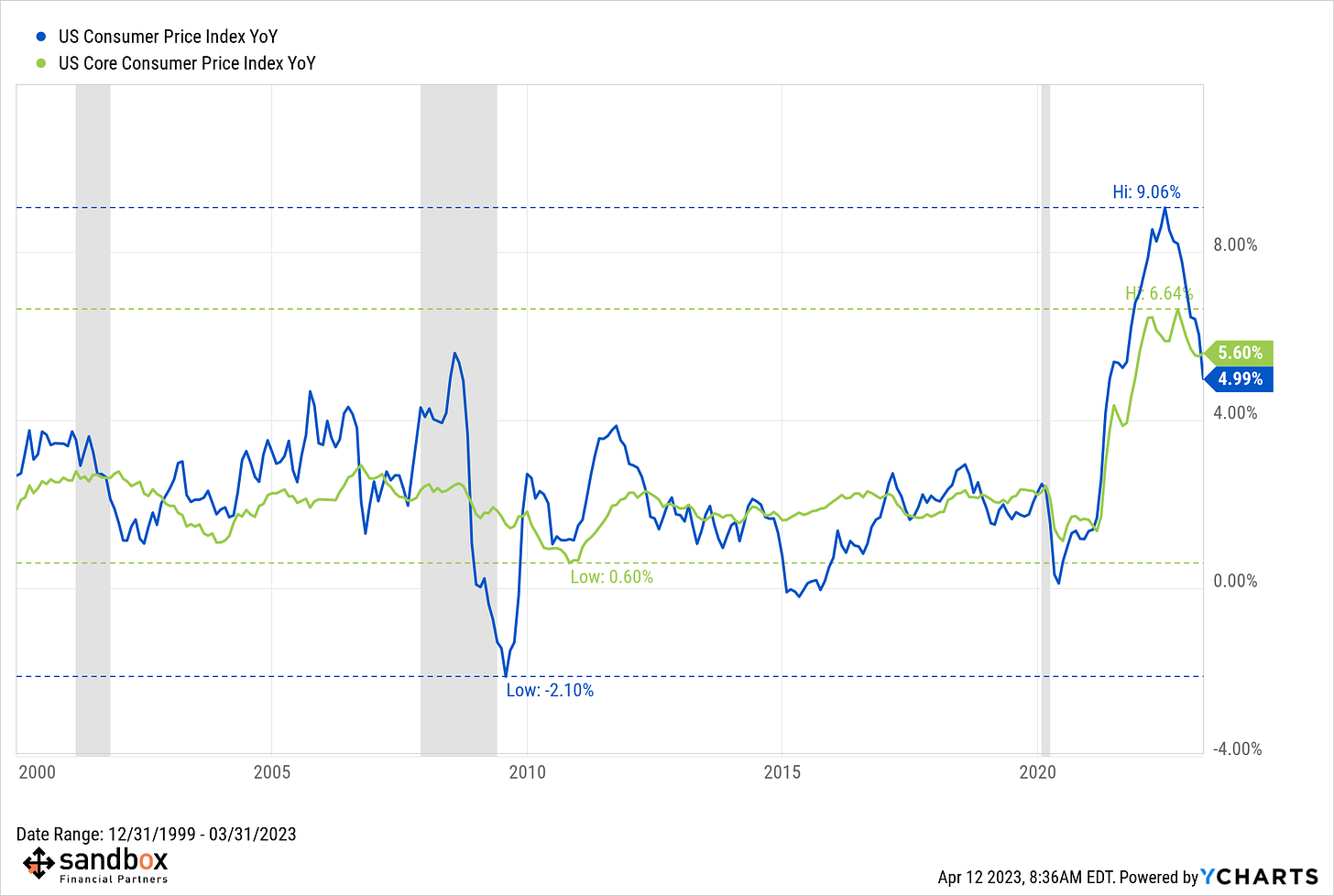

Consumer prices continue disinflation trend

This morning, the U.S. Bureau of Labor Statistics released their Consumer Price Index (CPI) report for March. U.S. consumer prices rose in March mostly in line with market expectations.

Headline Inflation

CPI: +0.1% MoM, versus +0.2% estimate and prior month of +0.4%

CPI: +5.0%: YoY, versus +5.1% estimate and prior month of +6.0%

Core Inflation

CPI ex-food and inflation: +0.4% MoM, versus +0.4% estimate and prior month of +0.5%

CPI ex-food and inflation: +5.6% YoY, versus +5.6% estimate and prior month of +5.5%

Headline CPI (+4.98%) moved down for 9th consecutive month in YoY rate of inflation and printed the slowest annualized increase since April 2021 (+4.16%).

Core CPI (ex-food & energy) moved up a tick to +5.60%, reversing 5 consecutive prints in the YoY rate. The lagging shelter category continues to be an issue and one of great contention; many Fed watchers would like to see other reputable, more high-frequency data – like the Zillow or Redfin data series – incorporated into the FOMC’s analysis.

While prices are coming down, the rate at which its decreasing is slowing. The focus continues to be Core Services inflation (blue bar charts below).

Slower overall consumer price growth, but sticky core pressures, confirm that the path down to the Fed’s 2.0% inflation target will be bumpy. Core goods inflation reaccelerated, but shelter showed early signs of easing. Services ex-energy and shelter, or “super-core inflation,” moderated somewhat.

Progress on core price growth, combined with the recent challenges in banking, give the Fed a green light to end the tightening cycle. Expect the Fed to pause after one more 0.25% rate hike in May – which the market has priced in and provides the Fed room to do so – before it assesses the cumulative impact of policy tightening on inflation, the economy, and financial stability.

Source: Bureau of Labor Statistics, Ned Davis Research, Bloomberg

Hedge Funds holding large bearish SPX bets

Hedge Funds collectively have their largest net short position in S&P 500 mini futures contracts since late 2011.

The broad takeaway from most analysts is bullish. They presume hedge funds and CTAs will cover their positions resulting in a short squeeze higher. While there is logic to their forecast, they fail to consider that banks and brokers are, by default, carrying equally aggressive long positions.

Source: Liz Ann Sonders

Twitter advertisers, cost cuts bring the platform near breakeven

In an unstructured Twitter Spaces interview with the BBC, Twitter owner and CEO Elon Musk reaffirmed the platform is “roughly breaking even” and could become cash-flow positive as soon as this quarter.

Musk declared that most of its advertisers who abandoned the social media platform after his $44 billion acquisition have returned.

The company’s aggressive cost-cutting efforts have started to bear fruit after massive layoffs, taking down the employee count to ~1,500 employees after inheriting “just under 8,000 staff members” before the go-private transaction was completed in October 2022.

Separately, Twitter has ceased to be an independent company after merging with a newly formed shell firm called X Corp, according to an April 4 document submitted in a California court.

Musk also noted he has no one in mind to succeed him as chief executive, despite many different media reports suggesting confidants of his inner circle – David Sacks of Craft Ventures and Steve Davis of The Boring Company – were next in line to inherit the torch.

Source: Reuters

U.S. bankruptcies are increasing sharply this year

U.S. corporate bankruptcy filings spiked in March, pushing the first-quarter tally to the highest level for the first three months of the year since 2010.

S&P Global Market Intelligence recorded 71 corporate bankruptcy petitions in March, the fourth straight month of increases and the highest monthly total since July 2020. The recent filings brought the year-to-date total to 183 as of March 31, more than any comparable period in the past 12 years.

The most noteworthy filing in March came from the banking sector, with SVB Financial Group filing for Chapter 11 bankruptcy on March 17th, although it was just one of several major bank failures in the month, placing heightened scrutiny on the sector.

While the consumer discretionary sector still accounts for the highest number of bankruptcy filings year to date, the financials sector experienced a windfall of filings in March and is now tied for second place with the healthcare sector's 14 filings.

Source: S&P Global Market Intelligence

IMF lowers world growth outlook

The International Monetary Fund (IMF) cut its global GDP forecasts to 2.8% for this year and 3.0% in 2024. The IMF also said it expects growth five years from now to be around 3% — the lowest medium-term forecast in over 30 years.

The IMF is warning of a hard landing for the global economy if persistently high inflation keeps interest rates high and amplifies financial risk.

The IMF headline says it all:

Source: International Monetary Fund, Bloomberg, CNBC

Should we just index?

If investing is stressful, boring, myopic, or straight-up unhealthy for you, perhaps the easiest and simplest form of investing is to dollar cost average into index funds every week or every month over a period of many years.

Indexing is not for everybody.

It won’t be sexy (who talks about indexing at cocktail hours with friends?). You won’t always hit homeruns (you’ll perform in line with whatever the basket’s index does). It will still include drawdowns (you are still married to market cycles and swings in momentum/sentiment/positioning).

But you will capture the two most important aspects to building durable wealth over the long haul: time and compounding. Oh yeah, it’s also the cheapest form of investing because, after all, costs do matter.

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.