Credit Suisse, plus S&P 500 support, interest rate volatility, Fed decision, VIX, and oil crashes

The Sandbox Daily (3.15.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Credit Suisse takes center stage

S&P 500 struggling to find support

interest rate volatility exploding

all eyes on the Fed

VIX emerging from winter hibernation

crude oil crashes

But for now, a brief headache:

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.42% | S&P 500 -0.70% | Dow -0.87% | Russell 2000 -1.74%

FIXED INCOME: Barclays Agg Bond +1.00% | High Yield -0.33% | 2yr UST 3.896% | 10yr UST 3.459%

COMMODITIES: Brent Crude -3.93% to $74.41/barrel. Gold +0.63% to $1,922.9/oz.

BITCOIN: -1.01% to $24,502

US DOLLAR INDEX: +1.13% to 104.765

CBOE EQUITY PUT/CALL RATIO: 0.75

VIX: +10.16% to 26.14

Quote of the day

The difference between sounding smart and being smart is "I don't know."

-Naval Ravikant, AngelList

Credit Suisse takes center stage

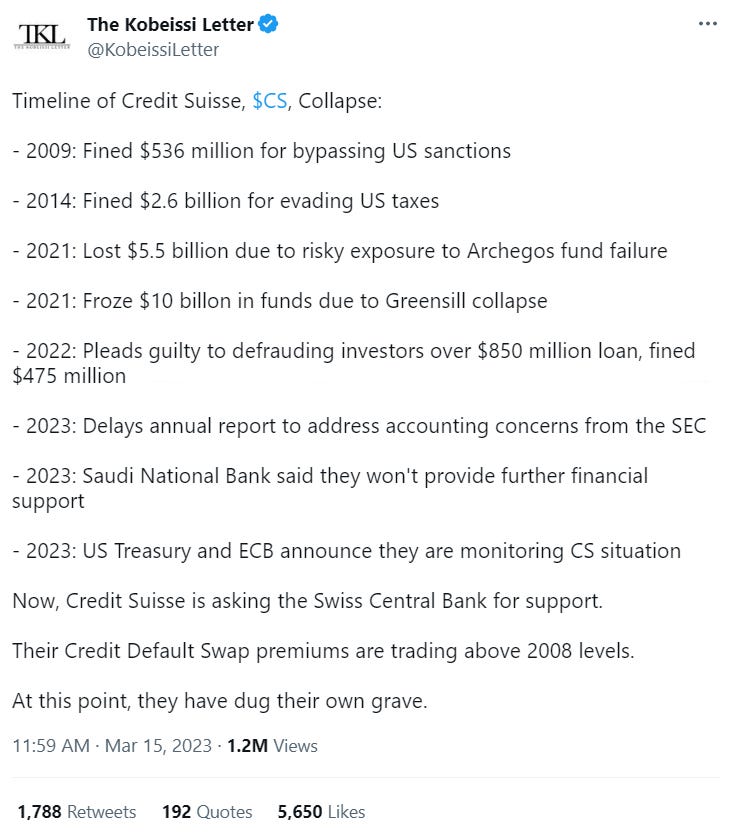

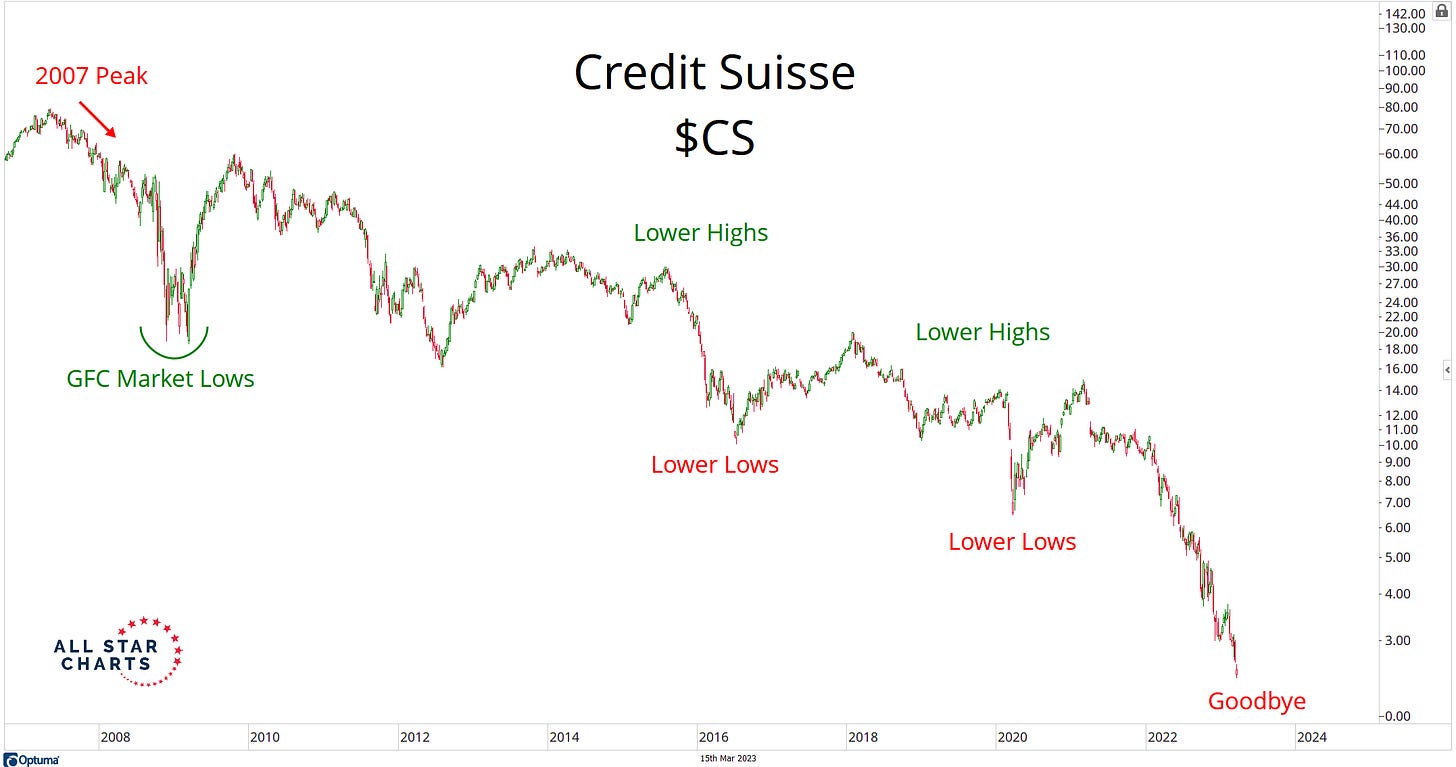

Switzerland’s 2nd largest asset manager, Credit Suisse, has been pummeled over the last decade by scandals, leadership changes, and legal issues. Here’s a brief stroll down memory lane to catch you up on the bank’s troubles:

Just yesterday, Chief Executive Officer Ulrich Koerner was pleading for patience as he pushes through a radical overhaul of the battered bank. But today, its stock was hammered after its biggest shareholder – the Saudi National Bank – ruled out increasing its stake because of regulatory constraints.

Now banks that trade with Credit Suisse are moving to safeguard their counterparty exposure, snapping up credit-default swaps (remember those nightmares ??!?) that will compensate them if Credit Suisse’s fortunes darken further.

So frantic was the demand for these insurance contracts that they spiked to levels unseen at a major global bank since—you guessed it—the financial crisis. At least one bank, BNP Paribas, informed clients it will no longer accept requests to take over their derivatives contracts when Credit Suisse is the counterparty.

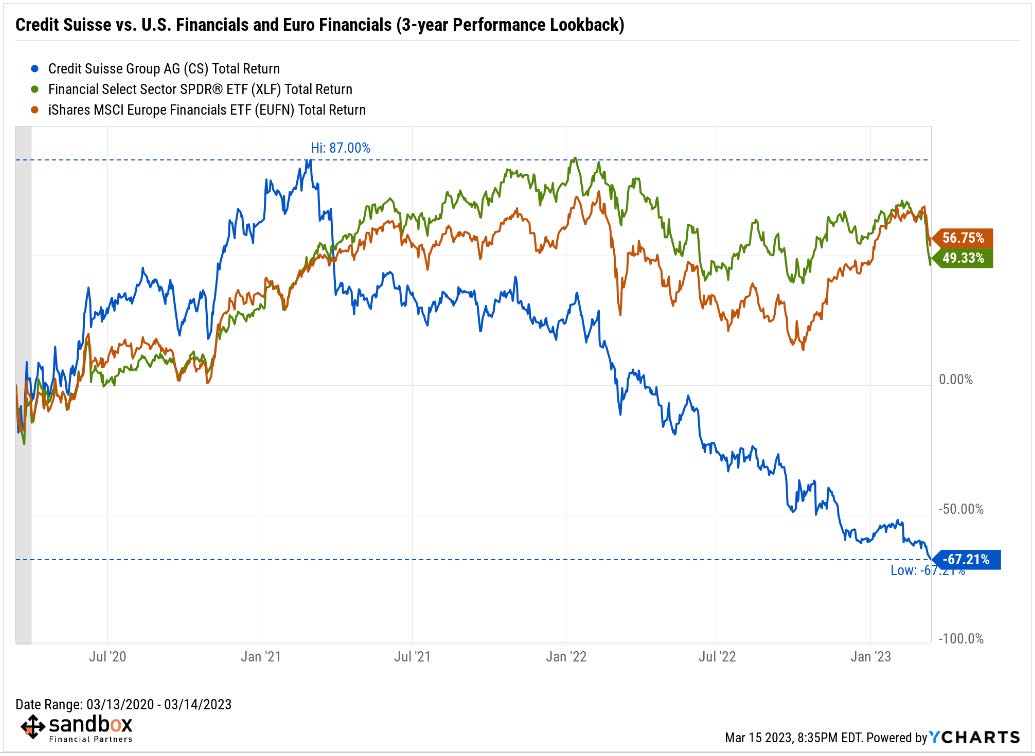

From a technical perspective, this stock has been in a well-defined downtrend since the Global Financial Crisis – making lower highs and lower lows spanning a decade. Is it time to finally say “goodbye?”

And just hours ago, the Swiss National Bank announced that CS is a systemically important bank and that it would provide liquidity if necessary. For now, this hasn’t done much to stop the bank’s stock price from falling.

Source: ZeroHedge, Bloomberg, All Star Charts, The Kobeissi Letter

S&P 500 struggling to find support

3,900 continues to be a significant area of congestion for both bulls and bears since last May.

Will the bulls find support at this level, or will the bears overload the market with more supply and take the index down to the next support level around 3,750-3,800.

The S&P 500 is currently below its 50-day moving average and 200-day moving average, and tracking lower which could potentially wipe out its entire 2023 gains thus far.

Source: Capp Thesis

Interest rate volatility exploding

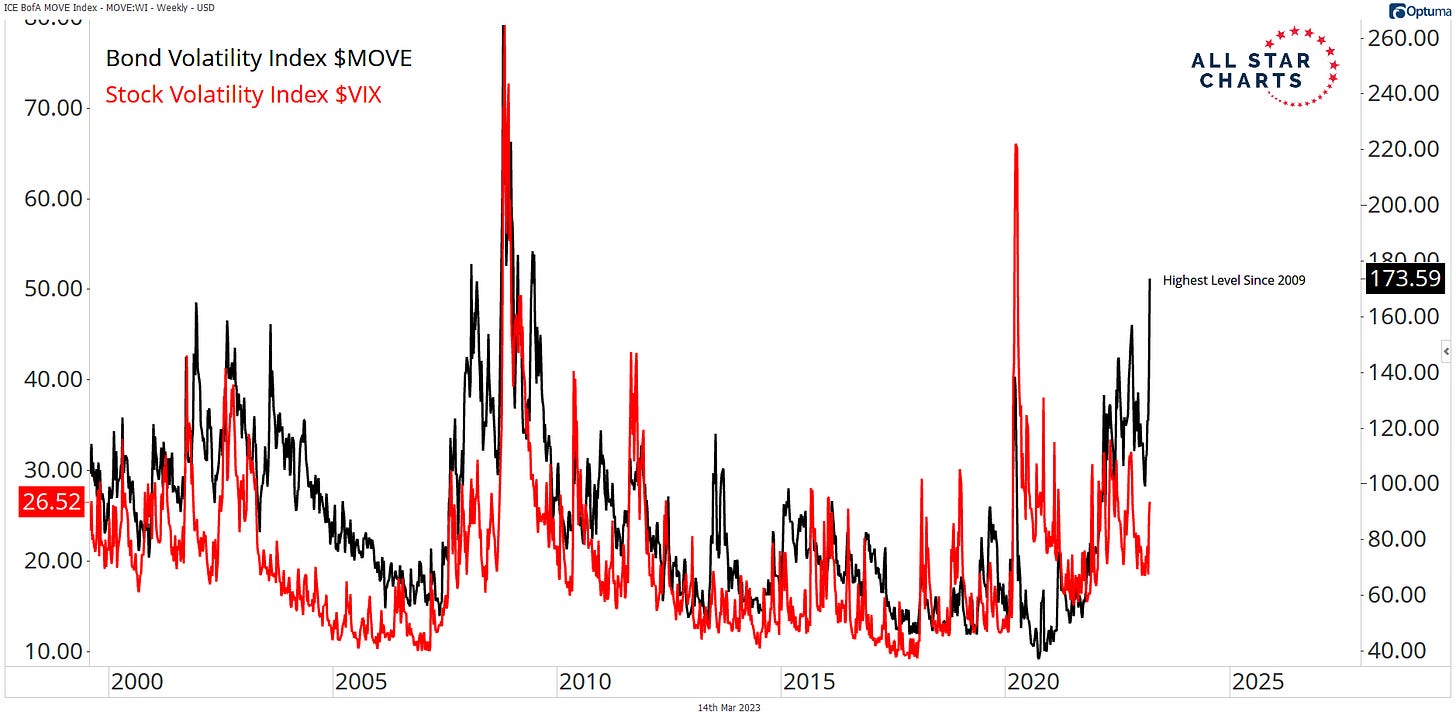

The volatility of price action in the rates market on a day-to-day basis is troubling.

The ICE BofAML MOVE Index, the "VIX” of the bond market, closed at the highest level since 2009. Here is a chart of the MOVE Index overlaid with the CBOE Volatility Index (VIX) to illustrate the positive relationship between these two measures.

When the MOVE Index gets to these elevated levels, the Fed historically is working on some policy easing measure (rate cuts, stimulus package, etc.).

Elevated bond market volatility does not bode well for equities as it signifies potential risks for other risk assets.

Source: All Star Charts

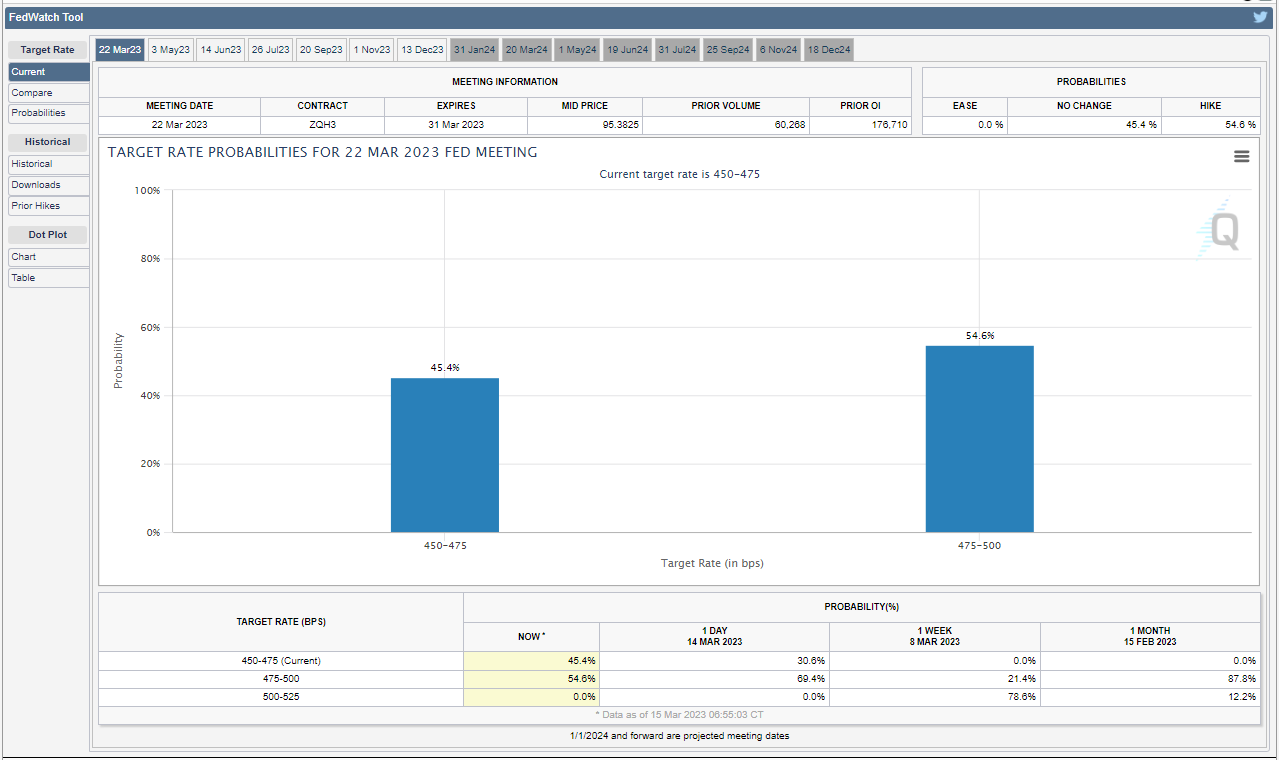

All eyes on the Fed

The Federal Reserve’s upcoming policy meeting is next week, March 21-22. All eyes are on the Fed.

After taking interest rates from 0–0.25% to 4.50–4.75% in 12 months, the outlook from here is incredibly unclear.

Fed Funds Futures show the market is nearly split 50-50 between no hike (4.50–4.75%) and 25 bps (4.75–5.00%). This time last week, the market had nearly priced in (~80%) a 50 bps hike that would have taken Fed Funds to 5.00–5.25%. Clearly, the market’s expectations have shifted materially lower.

What has also changed is where rates land in roughly 9 months from today. After expecting rates to peak out around 5.4% in January, the market has now priced out 175 basis points to ~3.7% – which is 0.90% lower than the current Fed Funds Rate.

Translation: the bond market is moving quickly to suggest only one or two more 0.25% hikes this tightening cycle, then cuts later in 2023.

Less than a week after Jerome Powell was pounding the table on Capitol Hill, arguing the Fed must stay aggressive in its inflation fight, the market thinks the Fed is about to make an abrupt pivot and drop the Fed Funds Rate rapidly. In the balance hangs financial stability risks.

Source: CME FedWatch Tool, Bespoke Investment Group

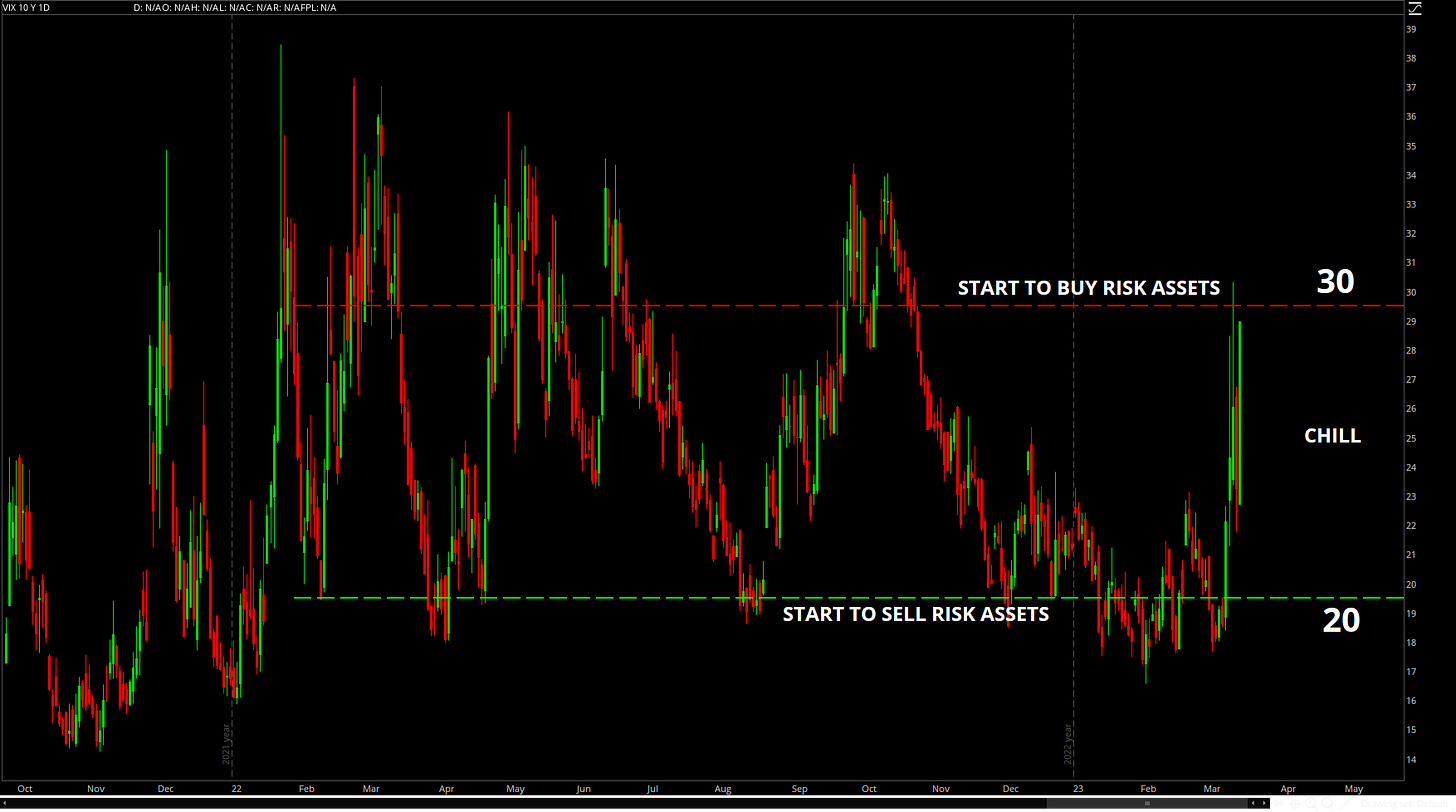

VIX emerging from winter hibernation

Despite the major market disruptions over the last 1-2 weeks, the CBOE Market Volatility Index (VIX) cannot get above 30.

Part of the reason why VIX can’t get going to washout levels is because the longer-dated 3-month VIX measure is rising just as much, which is not typical for a correction-only move in the S&P 500.

It’s always important to understand what kind of market environment you are in before deciding what strategies to employ. For now, this is a macro, event-driven market so invest accordingly.

Source: Cubic Analytics

Crude oil crashes

Crude oil traded below $70/barrel this morning for the 1st time since December 2021.

The commodity is now down 47% from last year’s peak of $130/barrel.

Crude is now trading at 52-week lows after resolving lower from a coiling consolidation range since the end of last year.

Source: Charlie Bilello

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.