December is here!, plus equity flow, volatility on stock returns, bank losses, and bearish sentiment collapses

The Sandbox Daily (11.30.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

seasonal trends favor year-end push higher

equity flows depriving markets of liquidity

low volatility is constructive

banks' unrealized losses grew in Q3

bearish sentiment collapses

Let’s dig in.

Markets in review

EQUITIES: Dow +1.47% | S&P 500 +0.38% | Russell 2000 +0.29% | Nasdaq 100 -0.25%

FIXED INCOME: Barclays Agg Bond -0.33% | High Yield -0.18% | 2yr UST 4.677% | 10yr UST 4.331%

COMMODITIES: Brent Crude -2.77% to $80.60/barrel. Gold +0.24% to $2,061.9/oz.

BITCOIN: +0.48% to $37,944

US DOLLAR INDEX: -0.21% to 103.285

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: -0.46% to 12.92

Quote of the day

“Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

- Jason Zweig

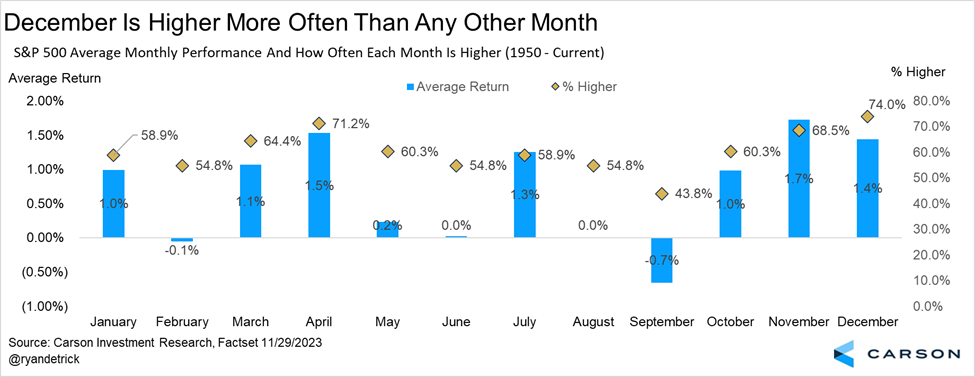

Seasonal trends favor year-end push higher

The S&P 500 just snapped a 3-month losing streak in style, posting its best month since July 2022 and one of its strongest November monthly gains on record.

After returning 8.9% in November and sitting just ~5% away from all-time highs, the S&P 500 heads into December with seasonal winds at its back – looking to add further gains to a surprisingly strong year, up +19% year-to-date.

Since 1950, the S&P 500 in December has been higher 74% of the time, with an average monthly return of +1.4%.

Generally speaking, most time frames you choose – past 20, ~75 years, and all pre-election years (like 2023) – December is a fairly strong month historically for equities.

The green bar – “past 10 years” – comes in a touch negative, skewed from the 9.2% December drop in 2018.

Source: Liz Ann Sonders, Ryan Detrick, CMT

Equity flows depriving markets of liquidity

After experiencing the biggest 2-week inflow to equity funds since February 2022, perhaps the improving macro backdrop is bringing cash off the sidelines back into equities. Finally.

After all, net flows for stock mutual fund and ETFs is negative -$240 billion year-to-date. That’s in a year when the S&P 500 is up nearly 20%.

This should support the FOMO trade into year-end, as well as provide a meaningful tailwind for stocks in 2024 when (not if) flows finally flip positive.

Source: FS Insight

Low volatility is constructive

This next chart sure grabs your attention.

Historically, when the CBOE Market Volatility Index (VIX) is low, the S&P 500 produces its strongest forward returns.

Daily sub-13 VIX closes – such as those over the last week – produce annualized returns of +47%, markedly higher than any other volatility environment.

Who would’ve thought when volatility was low – i.e. greater certainty around price – that market’s perform constructively on a go forward basis.

Source: Seth Golden

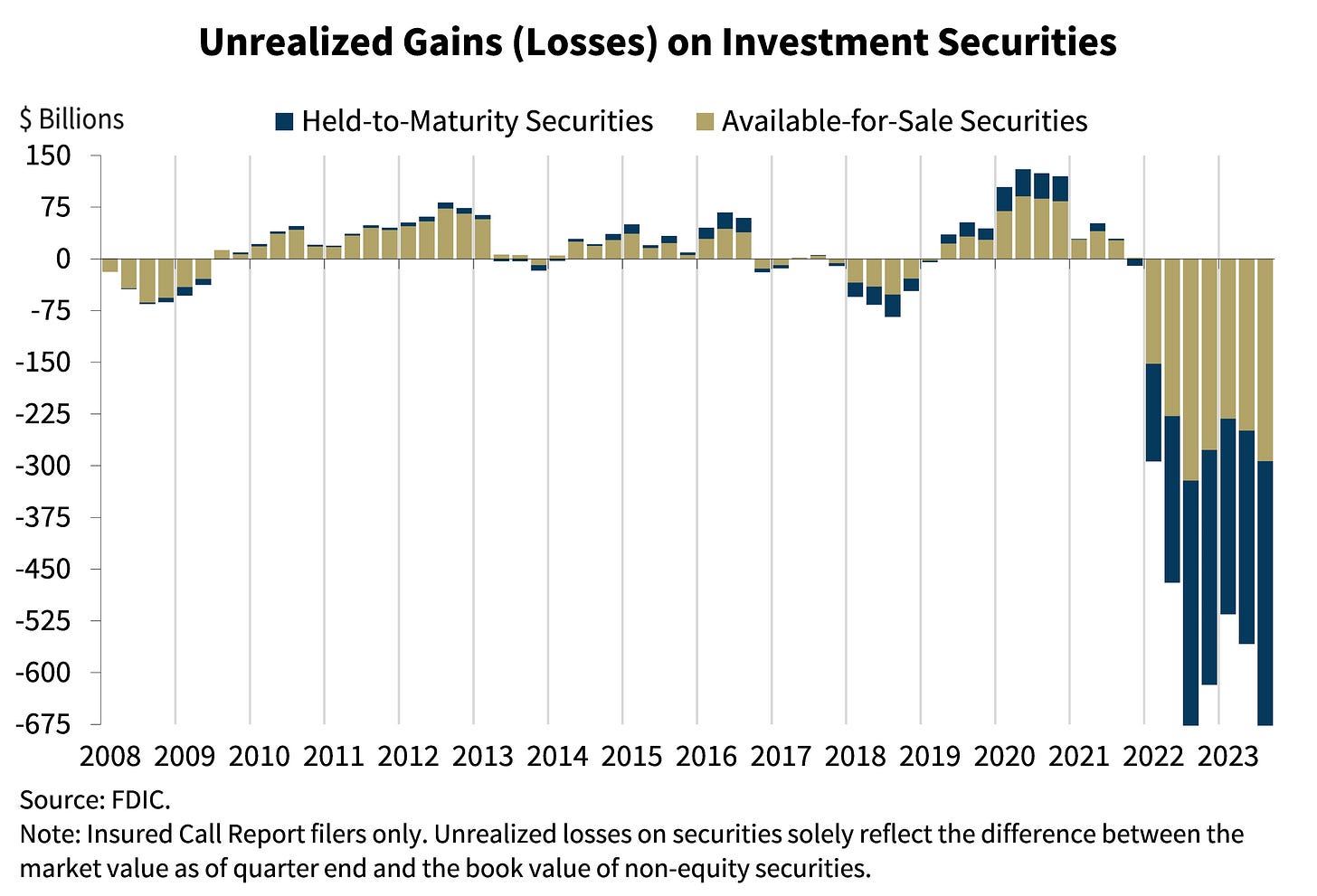

Banks' unrealized losses grew in Q3

Yesterday, the Federal Deposit Insurance Corporation (FDIC) released its 3rd-quarter update on the health of the nation's banks.

Big picture? The banking system is sound, with high and stable profits and solid scores on the performance of most loans.

Zoom in, however, and you’ll find the 3rd quarter surge in interest rates — which pushes down the value of fixed-income securities — inflicted material (unrealized) losses on their balance sheets.

FDIC-insured banks reported unrealized losses — essentially the difference between the price they paid for bonds in their investment portfolio and the current market price for those securities — of $684 billion in the third quarter. Remember, banks don't have to actually realize the losses on their balance sheets unless they sell the bonds.

Source: FDIC

Bearish sentiment collapses

The bears are back in hibernation as the American Association of Individual Investors’ (AAII) stock sentiment survey showed bearish sentiment dropped below 20% for the 1st time in 2.5 years (January 2018).

Source: American Association of Individual Investors, Hi Mount Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.