December jobs report, plus Venture Capital and 4th quarter earnings preview

The Sandbox Daily (1.5.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

solid job growth, but with less rosy details

Venture Capital market still in retreat

4th quarter earnings preview

Let’s dig in.

Markets in review

EQUITIES: S&P 500 +0.18% | Nasdaq 100 +0.15% | Dow +0.07% | Russell 2000 -0.34%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield +0.08% | 2yr UST 4.393% | 10yr UST 4.051%

COMMODITIES: Brent Crude +1.60% to $78.83/barrel. Gold +0.08% to $2,051.7/oz.

BITCOIN: -1.25% to $43,791

US DOLLAR INDEX: +0.04% to 102.461

CBOE EQUITY PUT/CALL RATIO: 0.69

VIX: -5.52% to 13.35

Quote of the day

“In bull markets, resistance levels breakout. In bear markets, support levels breakdown.”

- Caleb Franzen, Cubic Analytics

Solid job growth, but with less rosy details

Today was the first major economic report of 2024.

At first blush, this morning’s December jobs report from the Bureau of Labor Statistics showed a resilient labor market that continues to hang tough despite every effort from the Fed to slow down the economy.

But, there is much more under the hood worth visiting.

Let’s start with the good.

The labor market ended 2023 on solid ground, with nonfarm payrolls expanding by 216K in December which was above consensus of 170K and the highest print in 3 months. The U.S. economy has now added jobs for 36 consecutive months.

Average hourly earnings jumped +0.4% MoM, pushing the YoY change up to +4.1%. This is good news from the perspective of the consumer who are now making gains in real terms as inflationary pressures continue to subside. However, higher wages also increase the prospects of more inflation in the future which puts more pressure on the Fed to maintain their higher-for-longer message – not good for stocks that are expecting cuts as early as this spring.

The unemployment rate remains at 3.7%, below consensus expectations of 3.8%. This is just a touch higher than the 3.4% cycle lows we saw in 2023. The economy remains at/above full employment.

However, some flags are starting to emerge – yellow ones for now, not red just yet.

Jobs data for the prior two months (Oct & Nov) were revised down by 71K. In fact, in 10 of the previous 11 months, payrolls have been revised lower from the initial print to the second revision by a cumulative 427K. As such, it’s estimated ~25% of the job gains made in 2023 have ultimately been revised away.

This month, government payrolls rose by a solid 52K (24% of headline print). In fact, government has been providing an offset to slower job growth or job cuts in cyclical sectors like manufacturing, trade, and transportation.

The labor force participation rate – the share of the population that is working or actively seeking work – slumped from 62.8% to 62.5%. 676K people left the labor force – the largest monthly drop in nearly 3 years.

The household survey within the report showed that 683K fewer people were employed, the biggest drop since April 2020.

Job growth averaged 165K in the fourth quarter, the weakest quarter of the expansion (though still above what’s required to meet the growth in the population).

On balance, a March rate cut seems premature, although the market is still assigning at least a 60% probability of that happening.

With the unemployment rate near its lowest level on record and the U.S. economy continuing to add more jobs than expected, perhaps the market’s expectations for a full Fed pivot are a bit premature at the moment and should dial down expectations of a Fed rate cut in Q1.

Source: Ned Davis Research, J.P. Morgan Markets, ZeroHedge, Bloomberg, CME FedWatch Tool

Venture Capital market still in retreat

Venture Capital investments globally fell to the lowest levels since 2019, reaching $346B and down -54% since the peak in 2021.

Fundraising activity is down, invested capital is down, the number of deals is down, exits are down – everything remains well off the fervor and peaks of the prior cycle.

Though dry powder remains high, investors have become much more cautious when deploying capital to new portfolio companies.

Source: VentureBeat, Financial Times

4th quarter earnings preview

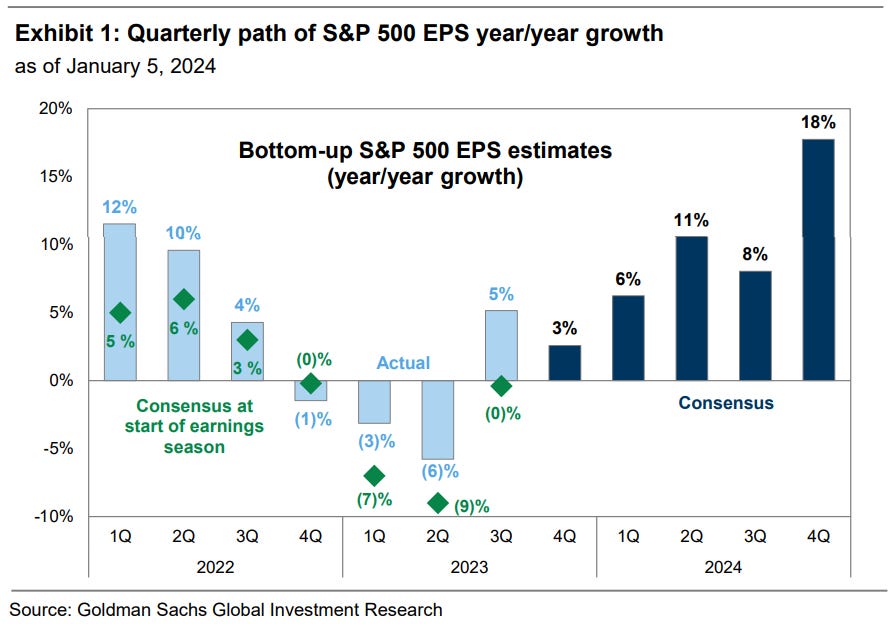

Reporting season for 4th quarter corporate earnings begins next week.

Consensus expects 4Q23 profits for the S&P 500 index will grow by 3% YoY. Analysts have not entered a quarterly reporting season with positive S&P 500 EPS growth expectations since the 3rd quarter of 2022.

At the sector level, Utilities (+47%) is expected to post the strongest YoY EPS growth, while Energy (-28%) is expected to post the largest decline. Consensus is also optimistic on “mega-cap tech” sectors Communication Services (+36%), Consumer Discretionary (+22%), and Info Tech (+16%).

Looking ahead, S&P 500 EPS revisions for 2024 are tracking better than 2023 and the historical average. Since the start of start of 4Q 2023, the full-year 2024 EPS estimate has been trimmed by just -1%. This time last year, 2023 EPS was lowered by -4%, and the historical negative revision has averaged -2%.

Information Technology is the only sector with positive 2024 EPS revisions since the start of 4Q 2023 (+2%).

Source: Goldman Sachs Global Investment Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.