🪨 December’s rocky start 🪨

The Sandbox Daily (12.10.2024)

Welcome, Sandbox friends.

A brief note today as the year-end workload for the wealth management space ratchets significantly higher this time of year. Investors are checking their lists, and checking them twice, confirming their naughty I-meant-to-do-this-in-April-but-holy-moly-its-almost-December-31st blind spots and nice financial plans are in good order.

Today’s Daily discusses:

December’s rocky start

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 -0.30% | Nasdaq 100 -0.34% | Dow -0.35% | Russell 2000 -0.42%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield +0.05% | 2yr UST 4.147% | 10yr UST 4.228%

COMMODITIES: Brent Crude -0.06% to $72.10/barrel. Gold +1.33% to $2,721.5/oz.

BITCOIN: -1.67% to $96,283

US DOLLAR INDEX: +0.24% to 106.403

CBOE TOTAL PUT/CALL RATIO: 0.79

VIX: -0.07% to 14.18

Quote of the day

“Therefore do not worry about tomorrow, for tomorrow will worry about itself. Each day has enough trouble of its own.”

- Matthew 6:34 (NIV)

December’s rocky start

U.S. markets have been churning in December as key economic releases – including last Friday’s November nonfarm payrolls report and this week’s CPI inflation report due Wednesday 12/11 – keep a lid on the year-end rally. Both the jobs and inflation data points will be significant inputs for the Fed’s decision on interest rates next week on December 18, which is the final Federal Open Markets Committee meeting of 2024.

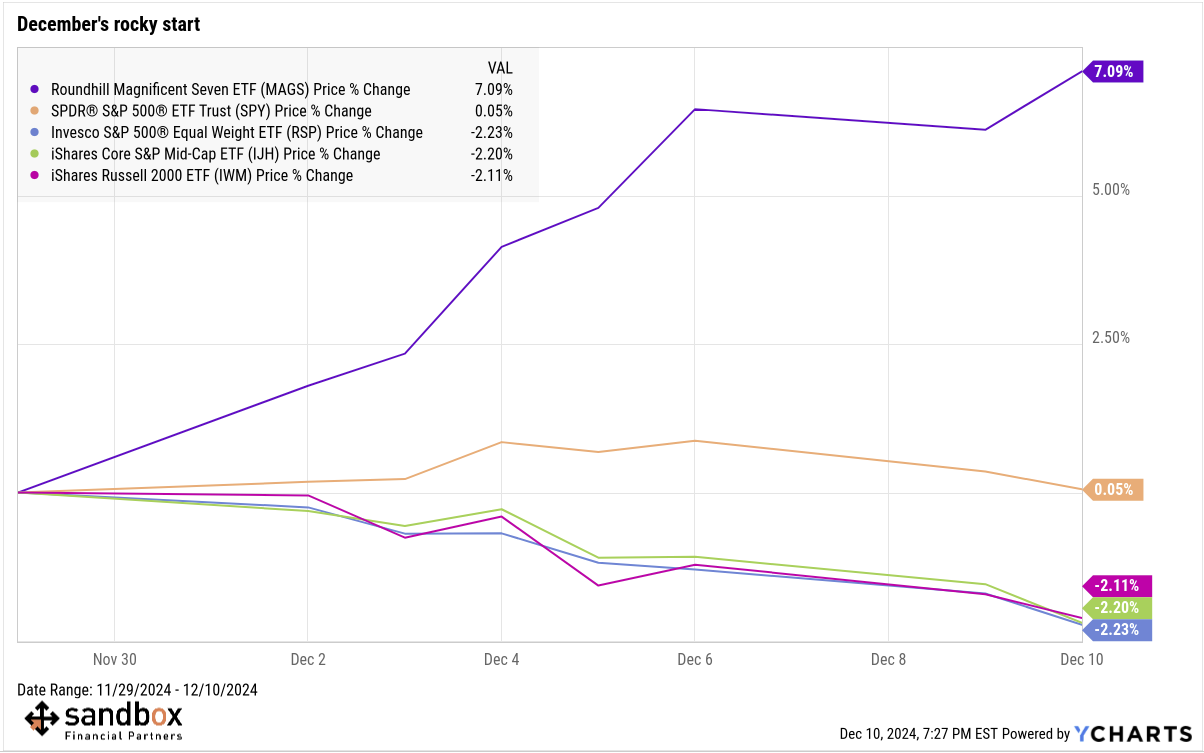

Here is the Mag 7 (MAGS) running laps around the S&P 500 (SPY), the equal-weight index (RSP), and both mid- (IJH) and small-caps (IWM) since the calendar turned:

Tom Lee of Fundstrat has flagged this “zone of hesitation” a near-term headwind before the end of the year in which markets want some clarity on macro data before embracing a “risk on” mentality.

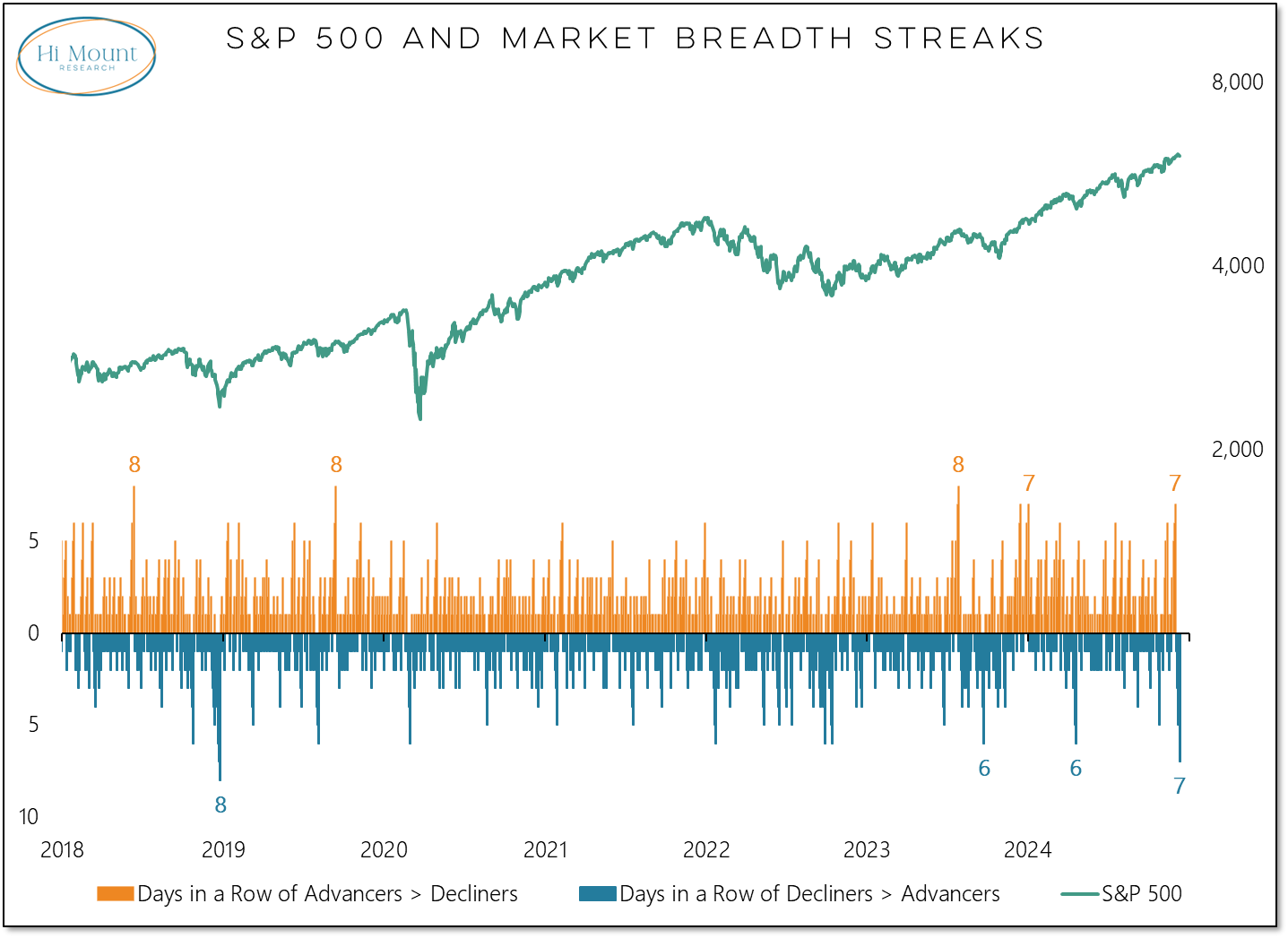

Inside this macro zone of hesitation, much is being made of deteriorating breadth conditions amidst markets pushing all-time highs (57 new all-time highs and counting for the S&P 500).

Exhibit A: the S&P 500 index has undergone seven consecutive days in which more stocks have been going down than going up, matching the high-end of prior negative breadth streaks observed over recent years.

In other words, we have experienced weaker breadth each trading day of December.

Upward momentum has waned as investors trim some profits during key economic data and earnings reports.

And yet, the vast majority of primary underlying uptrends remain intact.

While participation had broadened out over recent weeks and months as large-cap growth stalled, we are seeing rotation back into and leadership from other areas of the market right now.

Once the market clears this macro data overhang, expect typical seasonal tailwinds and the Santa Claus rally to support stocks into year-end as investors view pullbacks – confirmed by support levels – as buying opportunities.

Source: Hi Mount Research, Grant Hawkridge

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: