Deep Risk vs. Shallow Risk

The Sandbox Daily (3.13.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Deep Risk vs. Shallow Risk

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -1.30% | S&P 500 -1.39% | Russell 2000 -1.62% | Nasdaq 100 -1.89%

FIXED INCOME: Barclays Agg Bond +0.31% | High Yield -0.56% | 2yr UST 3.957% | 10yr UST 4.271%

COMMODITIES: Brent Crude -1.10% to $70.17/barrel. Gold +1.85% to $3,001.3/oz.

BITCOIN: -3.17% to $80,531

US DOLLAR INDEX: +0.23% to 103.849

CBOE TOTAL PUT/CALL RATIO: 0.91

VIX: +1.77% to 24.66

Quote of the day

Deep Risk vs. Shallow Risk

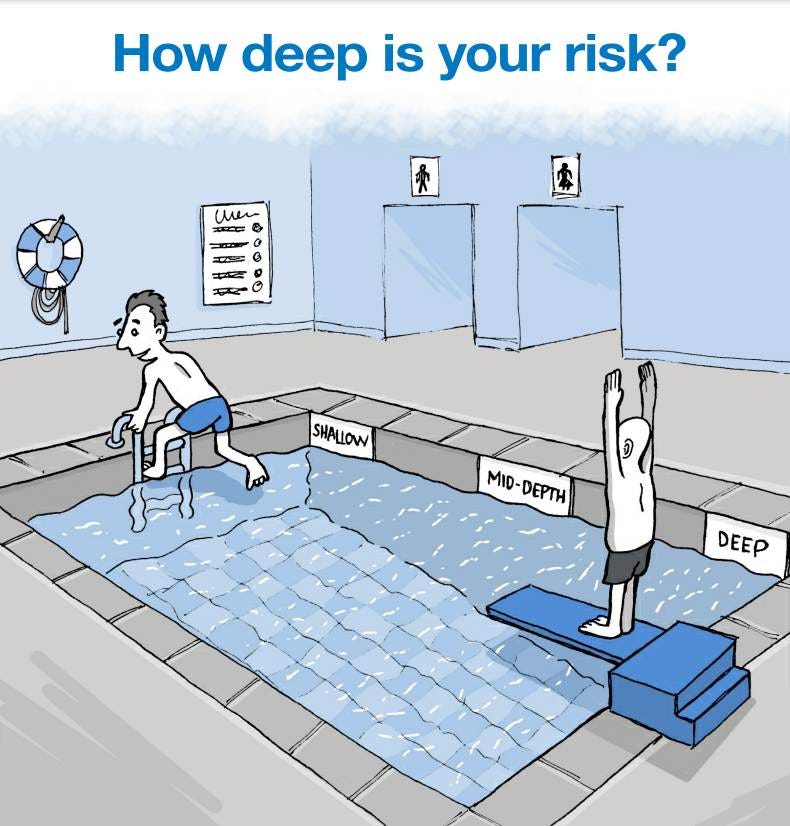

In William Bernstein’s book Deep Risk, he draws an important distinction for investors between "Deep Risk" and "Shallow Risk."

Deep Risk is Bernstein's term for permanent loss of capital. Risks like hyperinflation, confiscation, and severe economic collapse can erode wealth over long periods and are quite difficult to recover from – making them particularly dangerous for long-term investors.

Shallow Risk involves the more rudimentary declines in asset prices from day-to-day volatility, short-term economic disruptions, and episodic market dislocations. Shallow Risk is what most investors are accustomed to: market downturns that last a few weeks or months, perhaps a couple years at worst, but they eventually come and go. While unsettling, these risks tend to reverse over time, meaning investors who stay patient and diversified usually recover their losses.

In simple terms, the mathematical catch-up game to recover from losses becomes more problematic as you shift from “Shallow Risk” into more “Deep Risk.”

Bernstein wrote this book because he saw a gap in investors' thinking.

When we think about risk, most of us focus almost exclusively on Shallow Risk – periodic losses that are transitory.

But Deep Risk – the risk of permanent impairment – is often overlooked when we think about the range of possible outcomes. This shortfall in thinking is intuitive: gaming out the worst possible scenarios for every decision we make is no way to live.

So, Bernstein’s message is straightforward: pay attention to both.

And don't minimize the probability of Deep Risk, even if they're the types of events that we haven't seen recently.

William Bernstein himself writes, “Put into different words, Shallow Risk, if handled properly, deprives you only of sleep for a while; Deep Risk deprives you of sustenance.”

Bottom line: a smart approach is to maintain a diversified portfolio, stay invested through volatility, and hedge against Deep Risks with assets like U.S. Treasuries or gold.

Source: Deep Risk: How History Informs Portfolio Design

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: