Deep Risk vs. Shallow Risk, plus hikes-to-cuts, housing affordability crisis, and bond yields

The Sandbox Daily (9.28.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Deep Risk vs. Shallow Risk

from hikes to cuts

housing affordability crisis

bonds normalizing after a decade+ of ZIRP

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.87% | Nasdaq 100 +0.84% | S&P 500 +0.59% | Dow +0.35%

FIXED INCOME: Barclays Agg Bond +0.30% | High Yield +0.48% | 2yr UST 5.062% | 10yr UST 4.577%

COMMODITIES: Brent Crude -1.46% to $95.14/barrel. Gold -0.47% to $1,882.1/oz.

BITCOIN: +3.38% to $27,066

US DOLLAR INDEX: -0.51% to 106.128

CBOE EQUITY PUT/CALL RATIO: 0.94

VIX: -4.83% to 17.34

Quote of the day

“Maintain a margin of safety. If your life is designed only to handle the expected challenges, then it will fall apart as soon as something unexpected happens to you. Always be stronger than you need to be. Leave room for the unexpected.”

- James Clear, Atomic Habits

Deep Risk vs. Shallow Risk

In William Bernstein’s Deep Risk, he draws a distinction between "deep risk" and "shallow risk." While Bernstein writes about these risks under specific environments like hyperinflation, deflation, confiscation, and devastation, my analysis is much more rudimentary but hopefully helpful nonetheless.

Deep risk is Bernstein's term for a permanent loss.

Shallow risk is what most investors are accustomed to: market downturns that last a few months or a couple years but eventually come and go. The drops can feel sudden, if not terrifying at times, but a part of the process when putting your capital at risk.

In other words, the mathematical catch-up game to recover from losses becomes more problematic as you shift from “shallow risk” into more “deep risk.”

Bernstein wrote this book because he saw a gap in investors' thinking: when we think about risk, most of us focus almost exclusively on shallow risk – periodic losses that are transitory. But deep risk – the risk of permanent loss – is often overlooked when we think about the range of things that could go wrong. So his message is straightforward: pay attention to both. And don't minimize the probability of deep risk, even if they're the types of events that we haven't seen recently.

William Bernstein himself writes, “Put into different words, shallow risk, if handled properly, deprives you only of sleep for a while; deep risk deprives you of sustenance.”

Source: Deep Risk: How History Informs Portfolio Design

From hikes to cuts

Since 1950, the average length of time from the final rate hike of a tightening cycle to the first rate cut of an easing cycle is 8 months.

If July was indeed the last rate hike of this cycle from the Federal Reserve, then the Fed should start cutting rate around March 2024 based on historical averages and precedent.

However, the variability (3 months to 18 months) and small sample size (13 instances) suggests weak predictive power and falls short of explaining the macro backdrop accompanying each cycle.

Source: Torsten Slok

Housing affordability crisis

The monthly mortgage payment for purchasers of existing homes, using the 30-year average mortgage rate, stands at $2,351 – a substantial increase from $977 back in March 2020.

The lack of supply and the post-Covid environment favoring work-from-home flexible arrangements have created a housing affordability crisis.

This comes as the average 30-year mortgage rate hit 7.31% this week, the highest level since 2000.

Source: Michael McDonough, Freddie Mac, Bloomberg

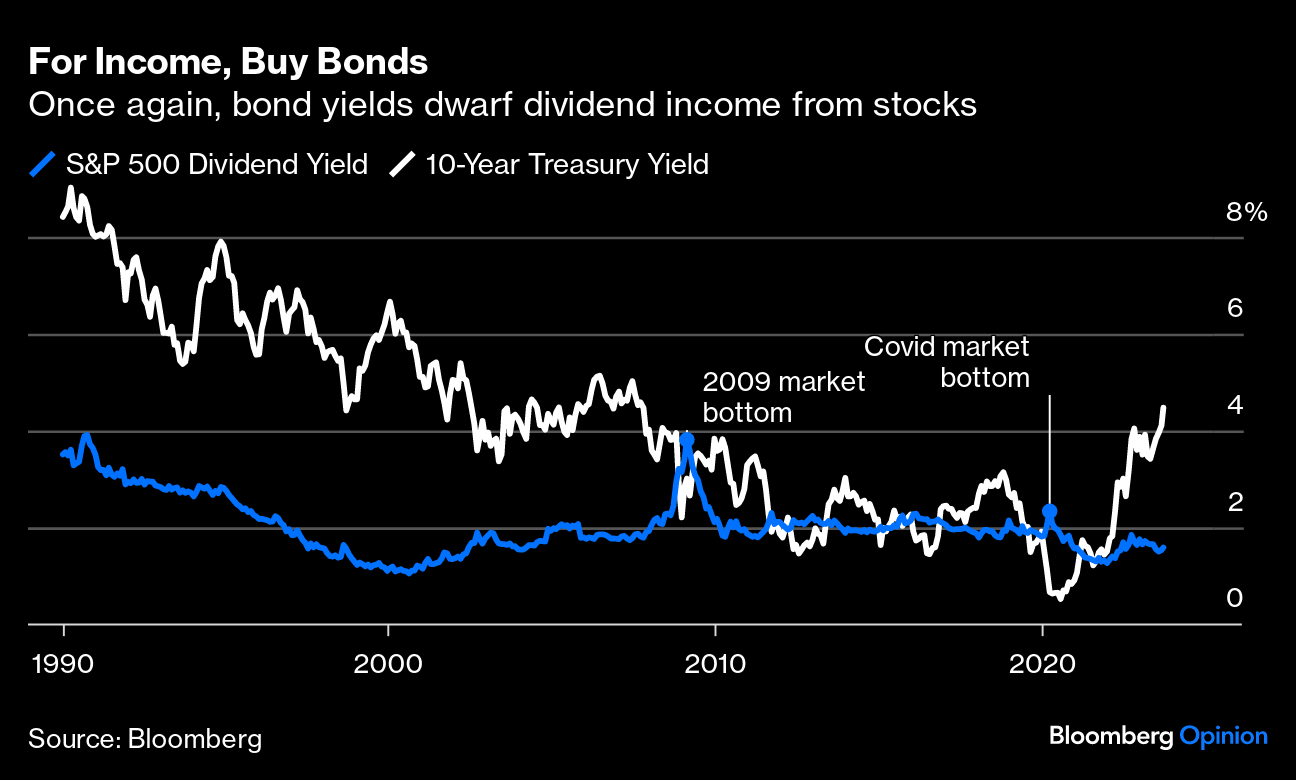

Bonds normalizing after a decade+ of ZIRP

Risk-free yields have mean reverted back to their VERY long-term average.

Near term, higher bond yields are pressuring equities by becoming a greater source of return competition relative to stocks, as well as lowering the present value of future earnings due to discounting them back at a higher rate.

Source: John Authers

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.