DeepSeek rattles Wall Street

The Sandbox Daily (1.27.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

DeepSeek rattles Wall Street

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.65% | Russell 2000 -1.03% | S&P 500 -1.46% | Nasdaq 100 -2.97%

FIXED INCOME: Barclays Agg Bond +0.56% | High Yield +0.08% | 2yr UST 4.199% | 10yr UST 4.534%

COMMODITIES: Brent Crude -1.72% to $77.15/barrel. Gold +0.17% to $2,743.1/oz.

BITCOIN: -2.79% to $101,246

US DOLLAR INDEX: -0.11% to 107.327

CBOE TOTAL PUT/CALL RATIO: 0.76

VIX: +20.54% to 17.90

Quote of the day

“Whatever you feel certain about today may seem incredibly foolish tomorrow.”

- Josh Brown, LinkedIn

Death knell for AI?

So, this happened over the weekend:

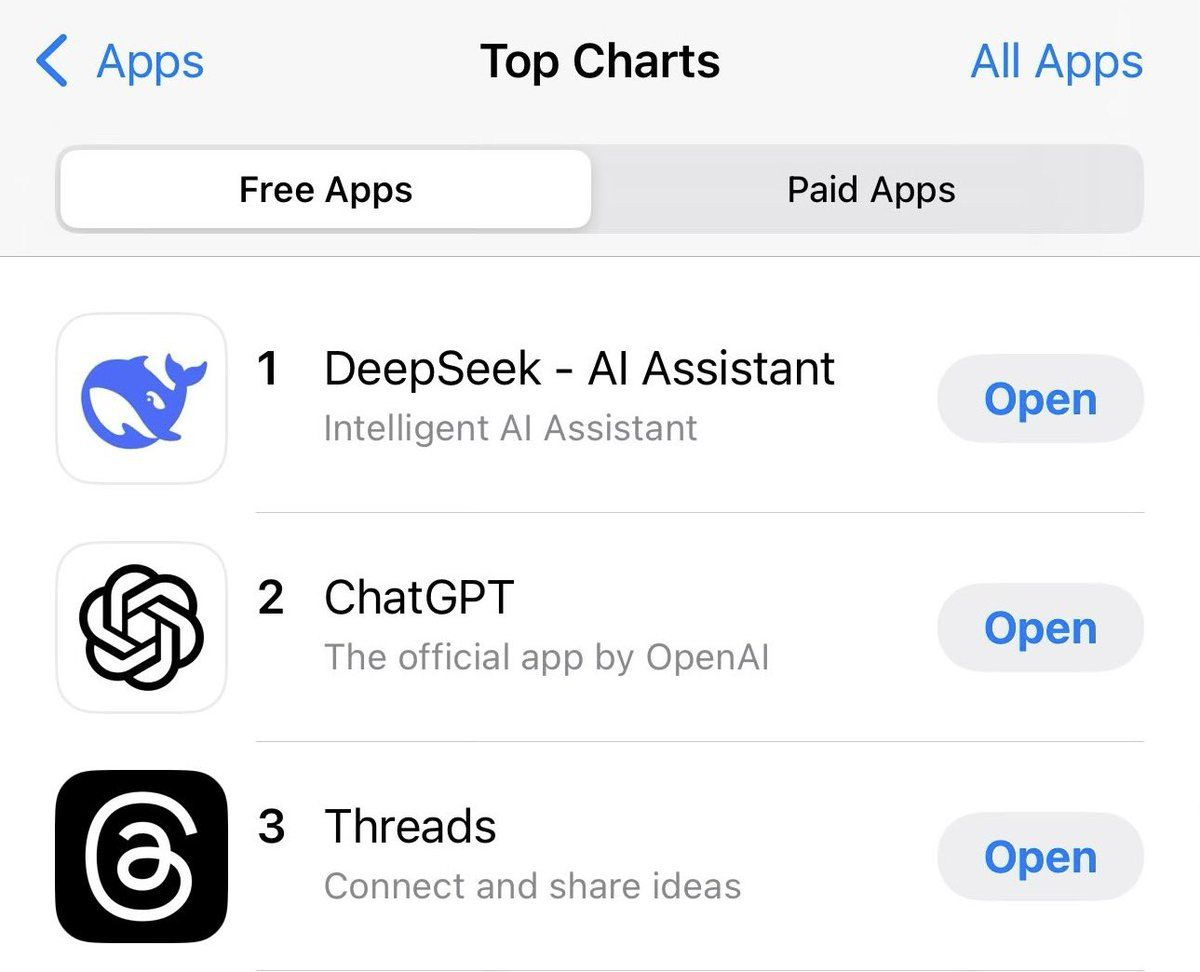

You are looking at a one-year-old Chinese artificial intelligence startup, DeepSeek, ascend the ranks to the #1 most downloaded app within Apple’s App Store over the weekend just days after releasing its R1 flagship model to the world.

The question on everybody’s mind today is: “how real is DeepSeek?”

The emergence of DeepSeek, led by Chinese quant hedge fund manager Liang Wenfeng, caught Silicon Valley and the rest of the AI world by surprise because its LLM could match or surpass many of the capabilities of rival models built by OpenAI, Anthropic, Google, Meta, and the rest – and here’s the qualifying kicker – using far less manpower and lower quality Nvidia H800 chips. Maybe, just maybe, U.S. Big Tech won’t be the only provider of cutting-edge AI capabilities.

This caused a steep sell-off across many stocks related to the artificial intelligence theme.

As the famed investor Benjamin Graham once quipped: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

In layman’s terms, stock prices – over the short term – are heavily influenced by investor sentiment, emotions, and positioning (akin to voting), whereas stock prices – over the long term – align with fundamental factors like cash flows and earnings to represent its true intrinsic value (the weighing machine). In today’s market action, that meant sell now and ask questions later.

AI darlings chipmakers Nvidia (NVDA) and Broadcom (AVGO) were taken behind the woodshed trading lower by 17%, last heard echoing Kevin Bacon’s famous line from Animal House: “thank you, sir, may I have another.”

Nuclear power plays Vistra (VST) and Constellation Energy (CEG), which have run up in the last year amid surging electricity demand for AI data centers, got clobbered as each lost over 20%.

Cloud hyperscalers Microsoft and Alphabet – if they are to represent the high-flying growth trade – show the rotation that underpinned today’s action as Value stocks posted their best day relative to Growth stocks since October 2008.

One final chart, if you’ll indulge me.

Should your portfolio be overexposed to the names on this list below – the 32 stocks in the Russell 1000 universe of U.S. large-cap stocks that sold off by greater than 10% – then perhaps it’s time to rethink strategy and your concentration risk.

And yet, despite the headlines and selling carnage, 70% of S&P 500 index constituents finished higher today and 82% of stocks performed better than the index.

Just look at all that green!

So, is the panic selling justified or not?

Tom Lee said today was the worst market overreaction since the 2020 pandemic outbreak.

Maybe, maybe not. Only time will tell.

Today is one of those days that happen every so often for long-term investors. Out of seemingly nowhere, the market got spooked by a headline and stocks responded in a very visceral way.

Mr. Market does not like unannounced surprises like this. And by this, I mean American companies being horribly inefficient and perhaps overspending by billions of dollars on AI.

Today reminded me of July 19, 2024 when a seemingly routine day was upended by a CrowdStrike software update that led to a massive IT outage, crashing millions of Windows systems around the globe and paralyzing governments, banks, airlines, and everyone in between. The reaction was widespread, the magnifying glass intense, and the selling pressure palpable. Was that the death knell for CrowdStrike?

The point is today is not the day to abandon ship and draw up a new playbook.

Markets don’t move higher in a straight line. Two steps forward, one step back, and the occasional black eye.

When disaster strikes your portfolio, keep a cool head and stay on target. Perhaps draw up your own blueprint with tips to navigate volatile markets so you are ready for the next disaster.

Sources: Apple, Bloomberg, Enrique Abeyta, Mike Zaccardi, Bespoke Investment Group, FinViz, StockTwits, CNBC

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: