Despite pessimism June looking positive, plus life remains in this bull, bank balance sheet losses, and job openings slip again

The Sandbox Daily (6.4.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

despite pessimism, high probability June a positive month

still some fight left for this bull

big unrealized losses remain in banks’ Treasury securities portfolio

job openings fall to 3.5-year low

Let’s dig in.

Markets in review

EQUITIES: Dow +0.36% | Nasdaq 100 +0.29% | S&P 500 +0.15% | Russell 2000 -1.25%

FIXED INCOME: Barclays Agg Bond +0.36% | High Yield -0.05% | 2yr UST 4.772% | 10yr UST 4.332%

COMMODITIES: Brent Crude -1.00% to $77.58/barrel. Gold -0.97% to $2,346.3/oz.

BITCOIN: +2.67% to $70,626

US DOLLAR INDEX: +0.02% to 104.144

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +0.38% to 13.16

Quote of the day

“Life is nothing more than a series of stages, one after another. Our problem is that we often enjoy a particular stage so much that we’re hesitant to move to the next one. Each chapter should be enjoyable, yes, but each chapter should also prepare you for a new chapter that you could only reach by experiencing your current one.”

- Jack Raines, Sherwood Media in Adios, Business School

Despite pessimism, high probability June a positive month

A few tailwinds to remain constructive on markets over the coming weeks and months include seasonality, favorable inflation data points, low levels of leverage as measured by NYSE Margin Debt, high (and still rising) levels of cash on the sidelines (“buy-the-dip mentality”), persistent pessimism on market and the U.S. consumer, and a stronger-than-expected earnings season. Let’s touch on a few below.

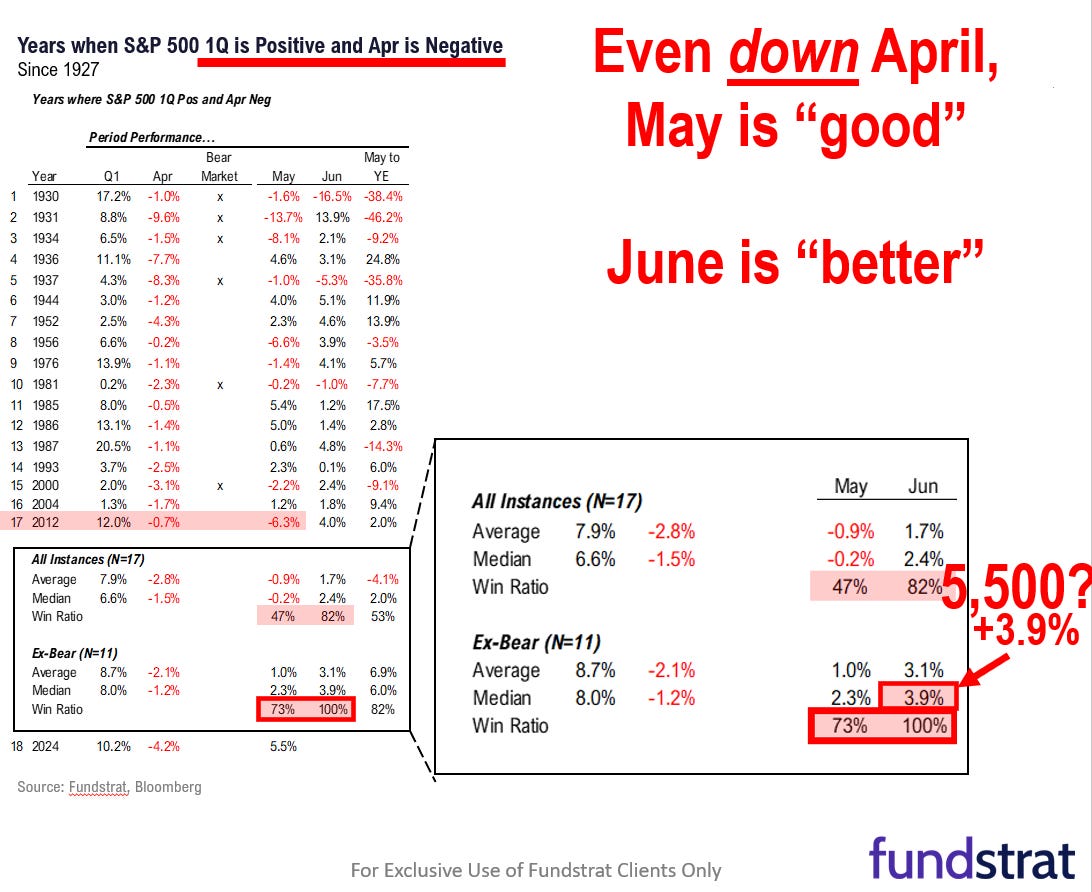

Historically, when stocks have seen a positive 1st quarter and a down April while the economy was not in a recession, June has turned out to be a positive month for equities 11 out of 11 times, with a median gain of +3.4%.

Tom Lee of Fundstrat notes that “seasonality alone implies that the S&P 500 could end June near 5,500, or >200 points higher.” Tom’s counterpart, Mark Newton, who heads Technical Strategy at Fundstrat, chimed in by highlighting another aspect of seasonality. “June is a much stronger month in an election year than really any other month outside of November.”

While we don’t have May numbers yet, we do know that investors de-risked in April after adding leverage in February and March. Moderate levels of leverage, as measured by NYSE margin debt, imply a local top is likely not around the corner.

With markets facing near-term fragility tests (this week’s jobs report on Friday 6/7 and next week’s CPI report on Wednesday 6/12), equities should bounce unless ecodata comes in red hot.

Finally, we know that $6 trillion dollars remains on the sidelines.

Following tax season, we’ve seen 5-6 straight weeks of growing money market balances from both retail and institutional pools. While a majority of this cash remains sticky, some cash does support the “buy-the-dip” mentality should equities face short-term turbulence.

Source: Fundstrat

Still some fight left for this bull

The current bull market cycle is 20 months old and has produced a 53% gain.

It’s a relatively modest result by historical standards – we’re still stuck in the lower left quadrant, see chart below – but in line with previous soft landings. The simple explanation is that soft landings produce smaller declines and therefore more muted recoveries (because stocks were less oversold).

Given the median bull market is 30 months long and produced 90% gains over the past 100 years or so, there is still likely some fight left for this bull.

Source: Jurrien Timmer

Big unrealized losses remain in banks’ Treasury securities portfolio

Last week, the Federal Deposit Insurance Corporation (FDIC) released its 1st-quarter update on the health of the nation's banks.

Big picture? The banking system is sound and resilient, with high and stable profits and solid scores on the performance of most loans.

Zoom in, however, and you’ll find the surge in interest rates from 2022 and 2023 — which pushes down the value of fixed-income securities — inflicted material (unrealized) losses on their balance sheets.

Unrealized losses on securities holdings are a direct consequence of the Federal Reserve tightening monetary policy. Losses increased $38.9 billion to $516.5 billion, as yields rose and prices fell.

Higher unrealized losses on residential mortgage-backed securities, resulting from higher mortgage rates in the 1st quarter, drove the overall increase.

This is the 9th straight quarter (!!!) of unusually high unrealized losses, just one of many signs showing how restrictive monetary policy is.

Source: Federal Deposit Insurance Corporation (FDIC)

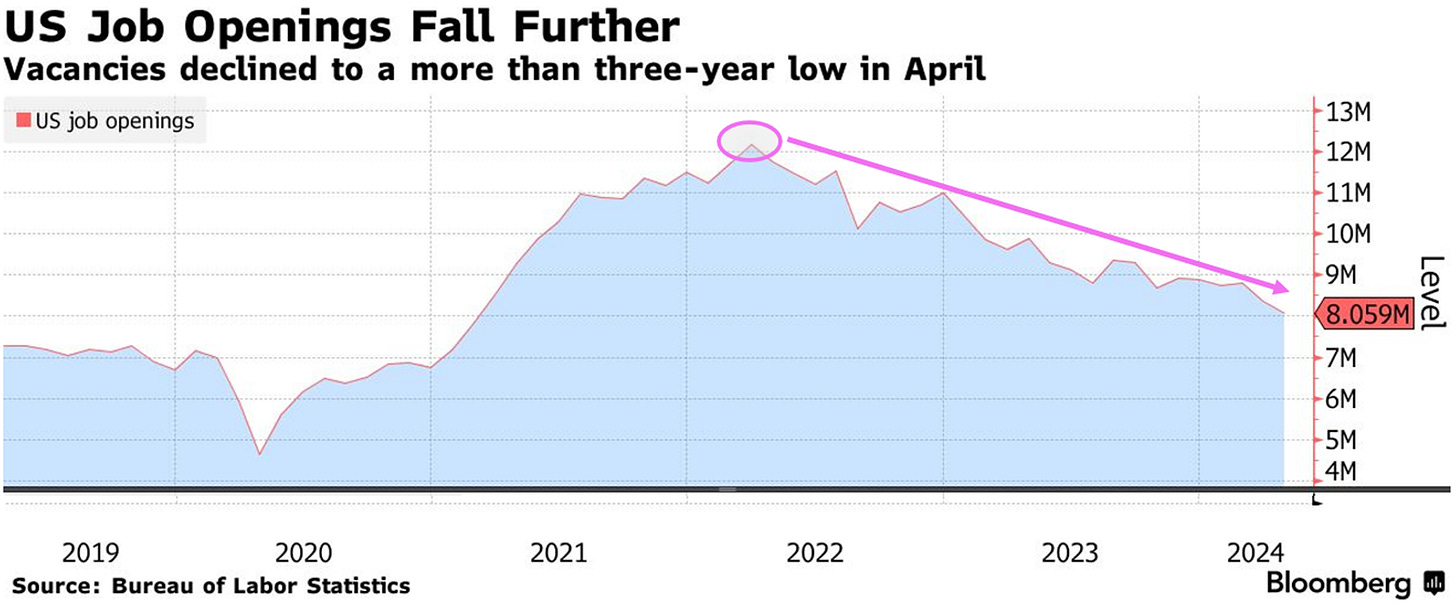

Job openings fall to 3.5-year low

Each month, we turn to the Labor Department's Job Openings and Labor Turnover Survey (JOLTS) to understand the ebbs and flows of what's really happening among businesses and their workers.

Job openings across America continued its gradual 2-year descent lower, falling -3.5% in April from the prior month to 8.06 million vacancies. Job openings are down -18.6% from one year ago and down -33.8% from the peak level in March 2022.

This measure has steadily declined since hitting the cyclical peak of 12.0 million vacancies in March 2022 when the Federal Reserve initiated its tightening cycle, but the number of job openings still remains ~26% higher than 5-year period average pre-COVID. The report illustrates the kind of cooling that the Federal Reserve would like to see, with demand for workers slowing through fewer openings rather than outright job losses.

The report showed that the ratio of job-openings-to-unemployed-Americans edged down to 1.24 from 1.32 in the prior month – well below the cycle peak of 2.03 and more or less in line with the general pre-pandemic levels and the 1.23 level in February 2020.

Elsewhere, the Quits Rate was unchanged in April at 2.2% – where it has been for the past 6 months and basically in line with its pre-pandemic level. The peak of this cycle topped at 3.0%. See chart below.

This reflects reduced labor turnover and less worker confidence in their job prospects. It also implies a continued squeeze of the pay premium of job switchers over job stayers, which should contribute to overall wage growth moderation in the near-term.

The Fed is closely watching the progress of labor demand/supply rebalancing, and today’s report shows the labor market has certainly continued to move toward better balance.

It also suggests that the Fed can hold monetary policy steady for now, allowing higher-for-longer interest rates to squeeze inflation without causing a recession.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Bloomberg, Advisor Perspectives

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.