Diversification opportunities (it's been a minute)

The Sandbox Daily (5.27.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

diversification (it’s been a minute)

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +2.48% | Nasdaq 100 +2.39% | S&P 500 +2.05% | Dow +1.78%

FIXED INCOME: Barclays Agg Bond +0.45% | High Yield +0.61% | 2yr UST 3.977% | 10yr UST 4.444%

COMMODITIES: Brent Crude -0.71% to $64.28/barrel. Gold -1.86% to $3,303.2/oz.

BITCOIN: +0.42% to $109,891

US DOLLAR INDEX: +0.50% to 99.603

CBOE TOTAL PUT/CALL RATIO: 0.95

VIX: -7.83% to 18.96

Quote of the day

“At the end of the day, your integrity is all you have. Guard it carefully.”

- Jerome Powell, Chairman of the Federal Reserve

Diversification (it’s been a minute)

It’s common knowledge that stocks are the most important foundation for investors with long-term portfolios. When included as part of a comprehensive financial plan, stocks have historically created wealth and helped investors achieve their financial goals.

However, a natural question is: what type of stocks?

While investors and the media tend to focus on stocks of the largest companies (and those usually within their own country, also known as “home bias”), there are many other categories that can play important roles in diversified portfolios.

The stock market is often seen as synonymous with the S&P 500 or Dow Jones Industrial Average.

The S&P 500 is an index that tracks the performance of the 500 largest publicly traded companies in the United States, weighted by market capitalization, a measure of company size. The Dow is one of the oldest indexes that includes only 30 large, blue-chip companies, again only U.S.-domiciled companies.

As such, these indexes are helpful when trying to understand the overall stock market and economy in the United States, since the largest companies are what drive those trends.

However, when building portfolios, narrowing your investment choices to just domestic companies overlooks other areas of opportunity. This is especially relevant when a handful of stocks, such as the Magnificent 7, have been the primary drivers of both positive and negative returns.

Since 2000, diversification has frustrated many investors as U.S. tech has been the biggest and most consistent game in town.

2025 is a different environment and requires a different playbook.

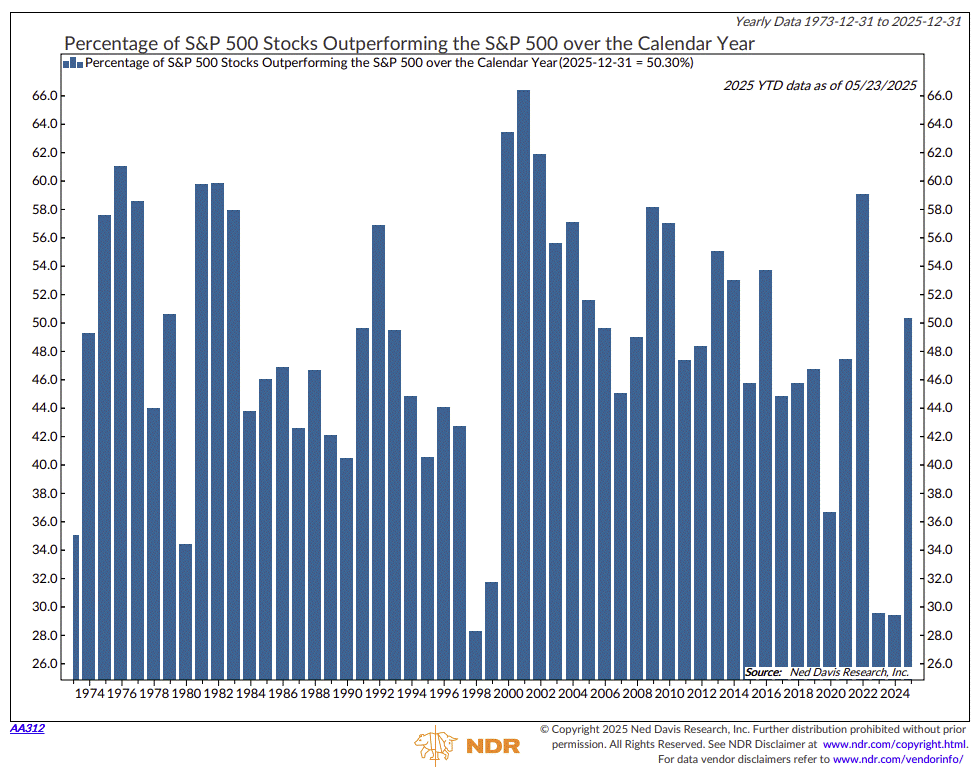

A broader market – and one in which the biggest winners are NOT the Mag 7 – illustrate the opportunities that exist for diversification. Over half the companies in the S&P 500 are outperforming the index itself in 2025, a stark contrast from both 2023 and 2024.

International markets and small-caps are two examples that can provide opportunities and diversification.

Each offers distinct characteristics and potential benefits that can enhance portfolio diversification, especially during times of market volatility and economic uncertainty.

What has worked

It’s no secret international stocks are clicking in 2025.

This area is typically categorized into two main segments: Developed Markets (think Europe, Japan, and Australia) and Emerging Markets (such as China, India, and Brazil). These classifications reflect differences in economic maturity, market infrastructure, regulatory frameworks, and much more.

Although U.S. stocks have led global markets for years, international stocks are enjoying their moment in the sun.

Specifically, the MSCI EAFE index, which tracks 21 key Developed Market countries, has gained ~17% year-to-date. The MSCI EM index, which tracks Emerging Markets, has risen ~10%. This has occurred despite global uncertainty due to trade.

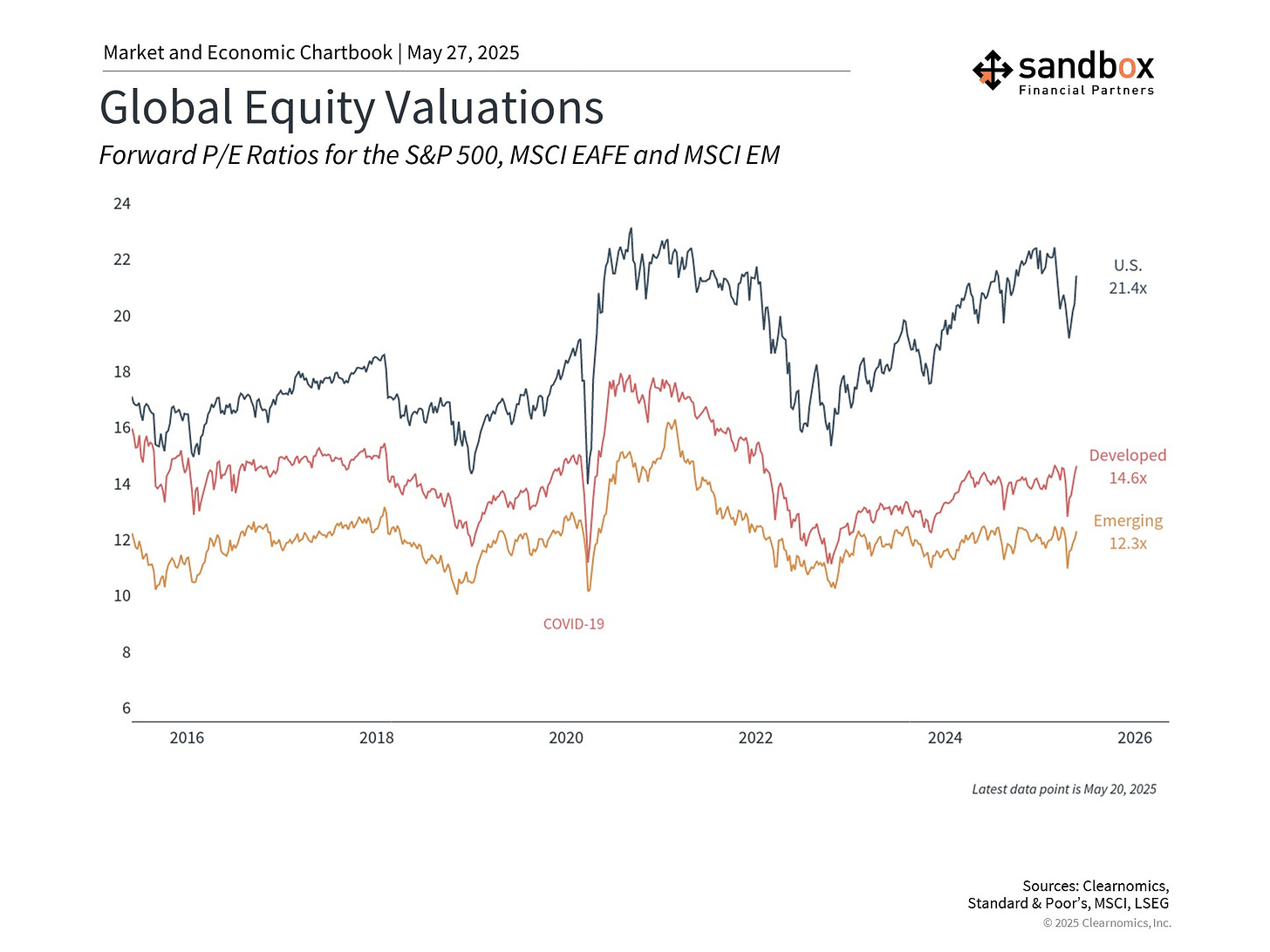

Not only have these markets performed better this year, but valuation differences remain substantial. While the S&P 500 trades at elevated price-to-earnings ratios, international markets offer more attractive valuations, as shown in the chart below. This is partly due to political and economic challenges in many of these regions over the past ten years, some of which have begun to turn around.

One key difference between investing in the United States and internationally is that currency fluctuations affect returns. In particular, the weaker dollar has created favorable conditions for international markets. This is because foreign assets increase in value when the currencies they are denominated in strengthen, allowing them to be converted back to more dollars.

This currency tailwind has been a meaningful contributor to the strong performance of international stocks this year, providing an additional boost beyond the underlying performance of foreign companies.

What has not worked

Small-cap stocks represent companies with market capitalizations typically ranging from a few hundred million to a few billion. This contrasts with large- and mid-cap companies that range from tens to hundreds of billions, and mega caps which are now valued in trillions of dollars.

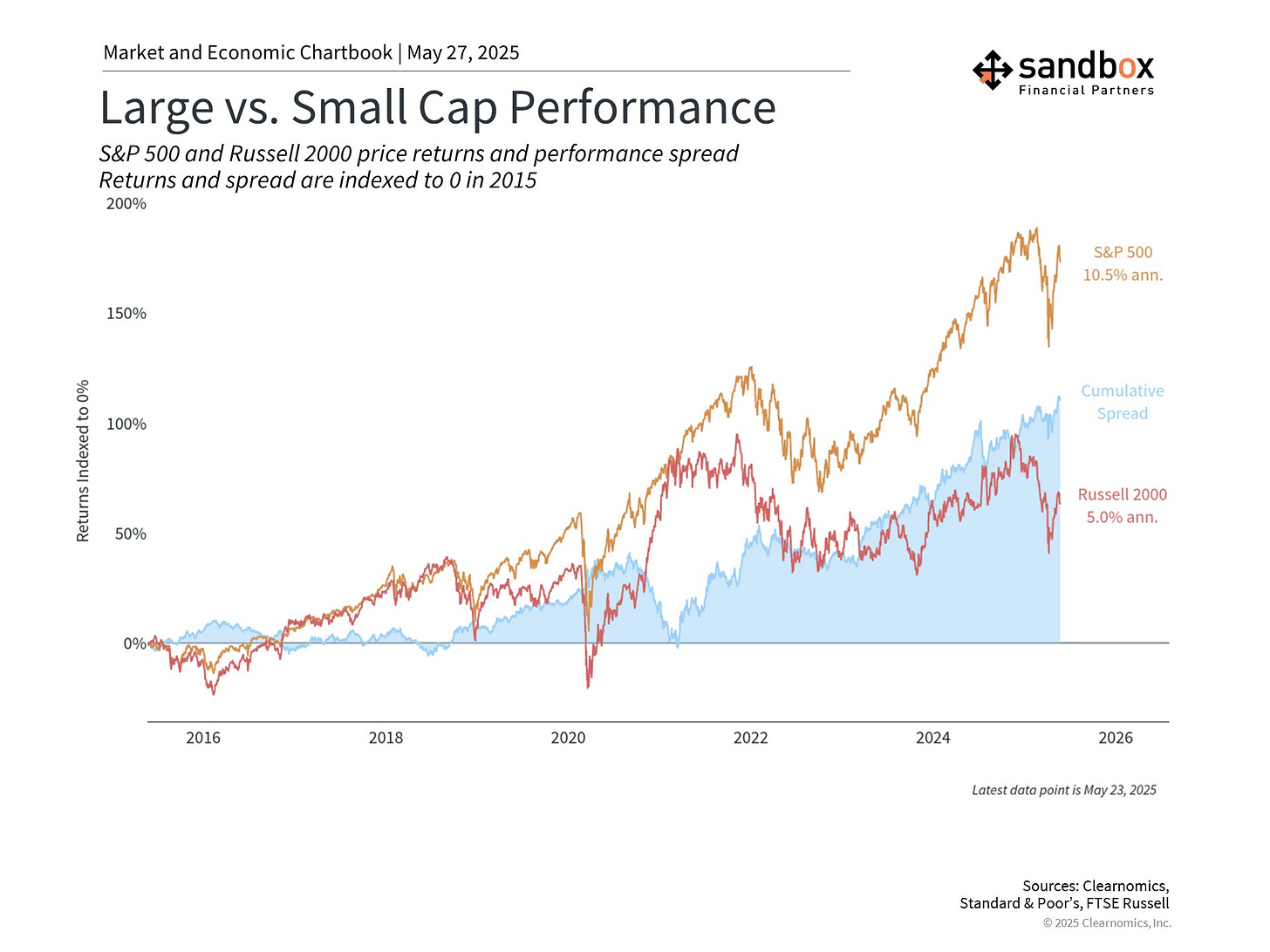

The Russell 2000 index, which tracks small-cap performance, has generated ~5% annualized returns over the past decade compared to ~10% for the S&P 500, as shown in the chart below.

This performance gap has been particularly pronounced in recent years as the market concentration from large- and mega-cap companies has increased, especially in technology and artificial intelligence-driven sectors.

Small-cap companies typically have less exposure to the technology sector and derive more of their revenue from domestic operations, making them sensitive to changes in U.S. economic policy and trade conditions.

Notably, small caps have struggled so far this year due to ongoing uncertainty around tariffs and economic growth.

And yet, this has created potentially attractive valuations. Small-cap stocks are currently trading at more reasonable price-to-earnings ratios compared to large-cap stocks.

The Russell 2000 currently has a PE ratio well below its 10-year average. More striking is the price-to-book value of 0.8x, considerably lower than the historical average of 1.2x. In comparison, many of the S&P 500’s valuation metrics are well above average, if not near all-time highs.

The interest rate environment is another important difference between large and small-cap companies.

Small caps often rely more heavily on financing from floating rate debt than their large-cap counterparts, making them more sensitive to interest rate fluctuations. While this created challenges when interest rates rose rapidly beginning in 2022, the more stable environment since then could help. This is especially true if the Fed continues to cut rates later this year.

It's important to diversify across regions and market capitalizations

For long-term investors, maintaining exposure to different factors – such as small-cap and international stocks, to name just two – can help create more balanced portfolios.

This is especially true after the significant performance of large-cap stocks which have been driven by just a handful of the largest companies.

This is not to say that U.S. large caps will become less important. This is also not an argument for making significant changes to well-constructed portfolios.

Instead, maintaining long-term portfolios is all about holding the right asset allocation across different types of investments because different themes and factors come in and out of favor over time.

While any single asset class may underperform during certain periods, their different characteristics and return sequencing can provide valuable diversification benefits over time.

By including more attractively valued parts of the market – such as small-caps and international markets – we can potentially strengthen long run risk-adjusted outcomes and take advantage of market opportunities.

Sources: Ned Davis Research, Clearnomics, J.P. Morgan Guide to the Markets

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)