Dollar at key support, plus jobless claims, housing data, I-bonds, and a look at 4/20

The Sandbox Daily (4.20.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Dollar index sits on key support

recurring jobless claims jump to highest since November 2021

existing home sales, prices continue slide

I-bonds looking less attractive at upcoming reset

the cannabis industry soars high on revenues

Let’s dig in.

Markets in review

EQUITIES: Dow -0.33% | Russell 2000 -0.54% | S&P 500 -0.60% | Nasdaq 100 -0.78%

FIXED INCOME: Barclays Agg Bond +0.46% | High Yield -0.09% | 2yr UST 4.149% | 10yr UST 3.534%

COMMODITIES: Brent Crude -2.78% to $80.81/barrel. Gold +0.48% to $2,017.0/oz.

BITCOIN: -3.35% to $28,302

US DOLLAR INDEX: -0.15% to 101.949

CBOE EQUITY PUT/CALL RATIO: 0.80

VIX: +4.31% to 17.17

Quote of the day

“Living with uncertainty becomes easier once we accept that the magic certainty button doesn’t exist. It’s not real, so don’t bother looking or hoping for it.”

- Carl Richards, The Behavior Gap

Dollar index sits on key support

After falling ~15% from its September 2022 peak to late January 2023, the Dollar index bounced by ~5% but has since given that up and sits on what is becoming critical support.

While many view this as a critical period for the future direction of the Dollar index, its relationship to other assets is equally important.

For example, the S&P 500 and the Dollar have been mirror images of each other over the past couple years. The circles in the chart below highlight that the S&P 500 (orange line) is bumping up against its Resistance as the Dollar (blue line) falls to its Support.

The Dollar has held its tight range for the past 4-5 months, with the February pivot lows at approximately 101 marking the lower boundary of the year-to-date range and current value of the Dollar index.

It's quite likely the fate of the Dollar index and the S&P 500 are in the same hands, depending on how it resolves from this range. If the Dollar index undercuts these levels, a weaker Dollar will be a key ingredient for a broader risk-on rally.

Source: All Star Charts

Recurring jobless claims jump to highest since November 2021

Continuing jobless claims, which reflect the number of people seeking ongoing unemployment benefits, increased to 1.865 million in the week ended April 7, the highest level since November 2021.

This level is now in-line with pre-pandemic levels and where they were before the Fed retired the word “transitory” in November 2021.

The pickup in continuing claims adds to signs that the labor market is beginning to lose momentum.

The labor market remains on solid footing more than a year after the Federal Reserve began aggressively raising interest rates to tame high inflation. Job gains, though, are less broad-based than during the height of the pandemic rebound in 2021 and 2022. More workers have filed for unemployment benefits this year, likely a reflection of layoffs in technology, finance and real estate.

Existing home sales, prices continue slide

U.S. existing home sales (aka previously owned homes), which make up most of the housing market, fell -2.4% in March from the prior month, marking the 13th time in the previous 14 months that sales have slowed. Existing home sales fell -22% from a year earlier, the 19th consecutive YoY decline – the longest streak since 2009.

Now, the housing market’s slowdown is starting to weigh on prices, which have fallen on an annual basis for 2 consecutive months for the first time in 11 years. The national median existing-home price decline of -0.9% in March from a year earlier to $375,700 was the biggest year-over-year price drop since January 2012.

The U.S. housing market has slowed dramatically in the past year as rising mortgage rates, skyrocketing home prices from the pandemic, and persistently low inventory have frustrated buyers. A cooling economy and the prospect of recession in the next 12 months have brought transaction activity to a standstill.

"Home sales are trying to recover and are highly sensitive to changes in mortgage rates," said NAR Chief Economist Lawrence Yun.

Source: National Association of Realtors, Bloomberg, Calculated Risk, Charlie Bilello

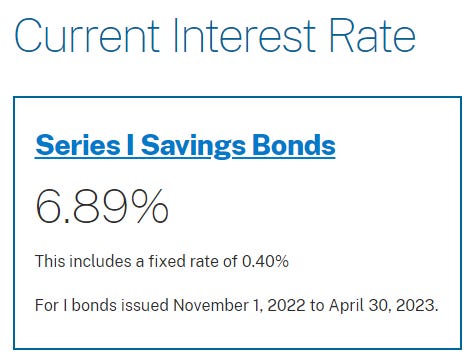

I-bonds looking less attractive at upcoming reset

Just six months ago, investors were plowing billions of dollars into I-bonds. Now investors are wondering if I-bonds are still an attractive investment.

The yield on these inflation-protected government bonds is expected to fall again to roughly 3.8% in May, down from the current rate of 6.89% and the historic 9.62% rate last year.

The bonds’ yield is tied to inflation, which is showing signs of easing from both the consumer side (output) and the producer side (input).

Other investing options have finally caught up to these higher yields and offer competitive market rates, such as high-yield savings accounts, money market funds, certificates of deposits, and short-term Treasury bills – effectively making I-bonds look less attractive in comparison.

Source: TreasuryDirect, Bloomberg

The cannabis industry soars high on revenues (hello 4/20)

A new report shows that legal marijuana sales brought in an estimated $30 billion in 2022.

This is more than the sales of chocolate and craft beer combined — they generated $20 billion and $7.9 billion, respectively. However, in the U.S., tobacco products still reigned supreme, bringing in $52.7 billion last year.

It doesn’t feel like long ago that there was a controversy surrounding Colorado and Washington state legalizing recreational marijuana in 2012. However, since then, many other states have been quick to follow suit and legalize the drug – in fact, 21 states have legalized recreational marijuana, while another 37 allow medical use.

Despite soaring revenues, the cannabis industry still faces its fair share of struggles. Most notably, there are major regulatory challenges which make it hard for marijuana businesses to raise funding, legally navigate the market, and stay in business.

Source: MJBizDaily, Statista

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.