Earnings at center stage, plus quiet market strength, China, gasoline prices, and Roaring Kitty

The Sandbox Daily (5.13.2024)

Welcome, Sandbox friends.

Here we go again: for the first time since 2021, “Roaring Kitty” is back posting on social media. Shares of meme-stock darling GameStop ($GME) surged – and at one point doubled – while trading was halted numerous times after volatility screens were breached throughout the frenetic day. Other worthless meme stocks caught a sympathy bid as the retail trader vibes returned Monday. Where does this go next !?!

Today’s Daily discusses:

how earnings can guide investors through difficult markets

stocks push higher on “quiet strength”

better China trading could have more room to run

gasoline prices weigh on inflation expectations

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.21% | S&P 500 -0.02% | Russell 2000 -0.03% | Dow -0.21%

FIXED INCOME: Barclays Agg Bond +0.05% | High Yield -0.03% | 2yr UST 4.865% | 10yr UST 4.488%

COMMODITIES: Brent Crude +0.76% to $83.42/barrel. Gold -1.39% to $2,342.1/oz.

BITCOIN: +2.79% to $63,078

US DOLLAR INDEX: -0.08% to 105.221

CBOE EQUITY PUT/CALL RATIO: 0.60

VIX: +8.37% to 13.60

Quote of the day

“Don't wait. The time will never be just right. Start where you stand, and work whatever tools you may have at your command and better tools will be found as you go along.”

- Napoleon Hill, Author

How earnings can guide investors through difficult markets

With markets nervous about stubborn inflation, a gradually slowing labor market, and the timing of the 1st Fed rate cut, investors are more focused on this corporate earnings season than usual.

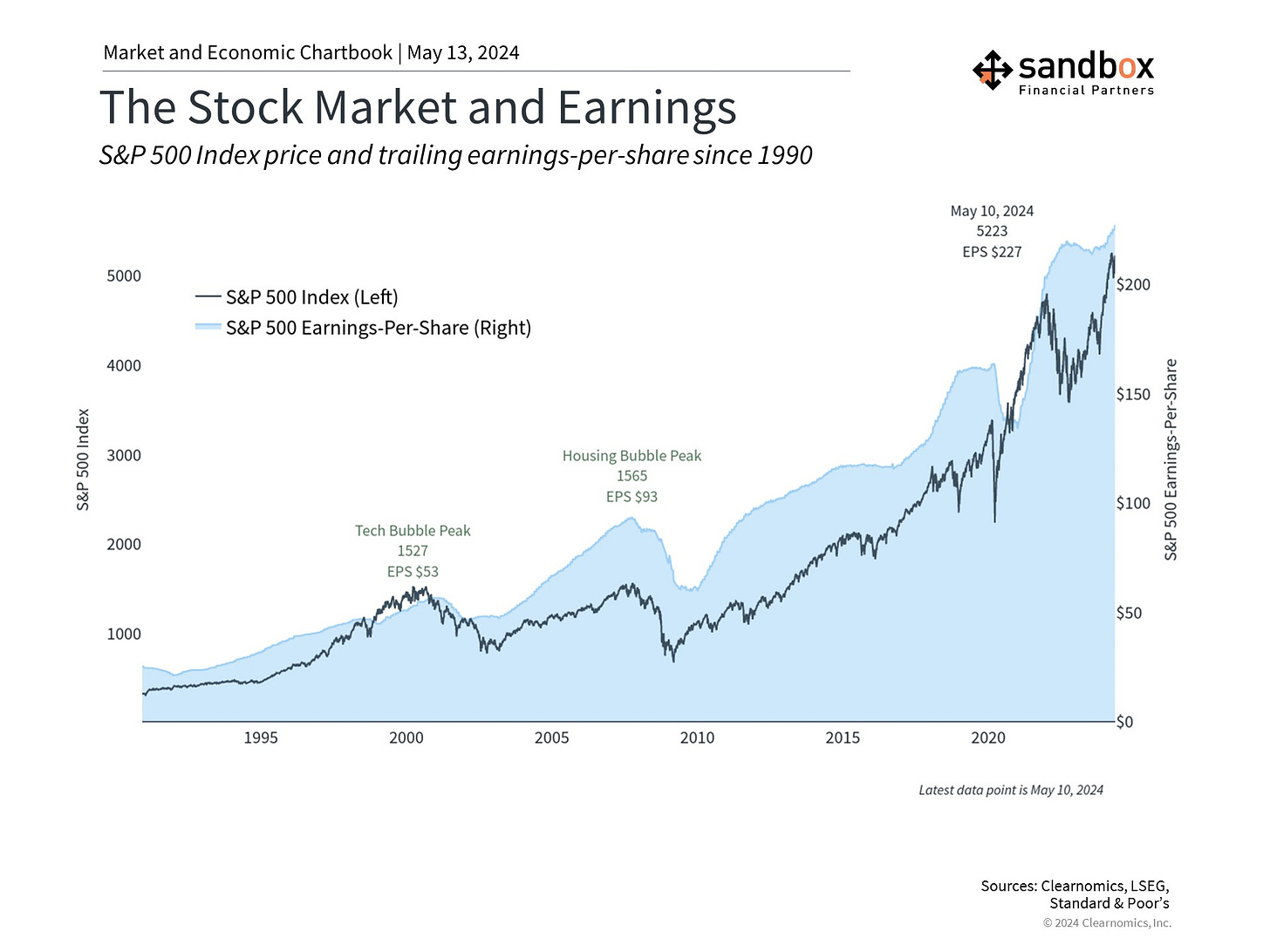

This is because while the economy has avoided a “hard landing,” corporate earnings only began to rebound in the second half of 2023. Since the stock market tends to follow the trajectory of earnings in the long run, many investors are hoping for signs that corporate profits will grow sustainably in the coming quarters.

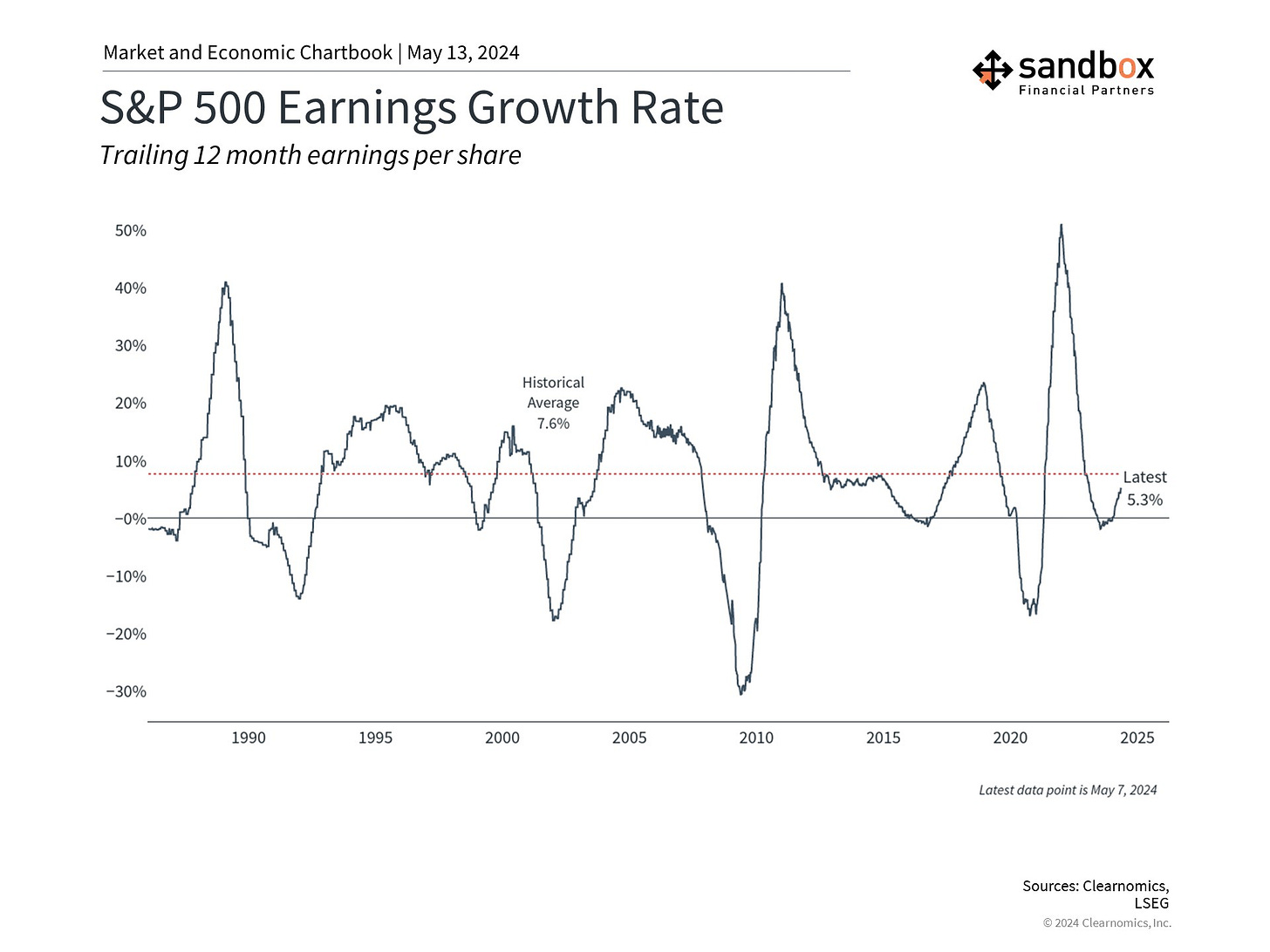

With 92% of S&P 500 companies having reported their 1st quarter earnings results, the trends are generally positive. According to FactSet, 78% of large cap companies had positive EPS surprises last quarter which is better than the 10-year average (73%). The blended earnings growth is coming in around 5.4% year-over-year, the highest in almost two years, making this the 3rd straight quarter of earnings growth.

On a full-year basis, the consensus estimate for S&P 500 earnings in 2024 is now $239 per share, according to LSEG data. If this is achieved, it would represent a +10.2% increase from last year. Wall Street analysts also expect continued growth of +14.0% and +11.7% in 2025 and 2026, respectively. The hope of an earnings rebound is one reason the stock market has rallied over the past year, driving up valuations.

Thanks in part to steady earnings growth, the S&P 500 is now within 1% of its all-time high.

I could stop here, but there’s one important point to note for long-term investors.

While investors focus a great deal on topics such as inflation, the job market, and GDP, investors do not directly invest in the economy. Issues such as the impact of higher interest rates, a slowdown in the labor market, or a “hard landing” affect investors through the financial performance of companies. In turn, this affects stock prices which then impact the overall market and investor portfolios.

The chart below shows that while they do not mirror each other exactly, there is a strong relationship between corporate earnings and the stock market. The stock market tends to follow the trajectory of earnings, with differences between the two lines the result of changes in stock market valuations, investor sentiment, and most importantly, positioning. But, make no mistake, this long-term relationship is the reason investors focus so much on the path of earnings.

This is why economic cycles matter for long-term investing: when the economy is growing and consumers are strong, company sales tend to improve. Conversely, spending tends to slow during economic downturns, hurting corporate profits. For investors, focusing on these longer-run trends is far more important than trying to guess what the market might do over a day, a week, or a month.

These dynamics can also impact how markets behave during pullbacks. If the market does experience a decline when the economy is otherwise strong, valuations will grow more and more attractive. Eventually, investors will find it appropriate to add to their portfolios, helping to stabilize the market. In contrast, market pullbacks are much more challenging when they are the result of economic challenges such as recessions. This is why bear markets have typically only occurred when there has been a significant recession or economic shock.

Bottom line?

The latest earnings figures show that companies are performing well which is a positive sign in this uncertain market environment. In the long run, investors should focus more on trends around economic fundamentals such as earnings than on day-to-day stock moves.

Source: Clearnomics

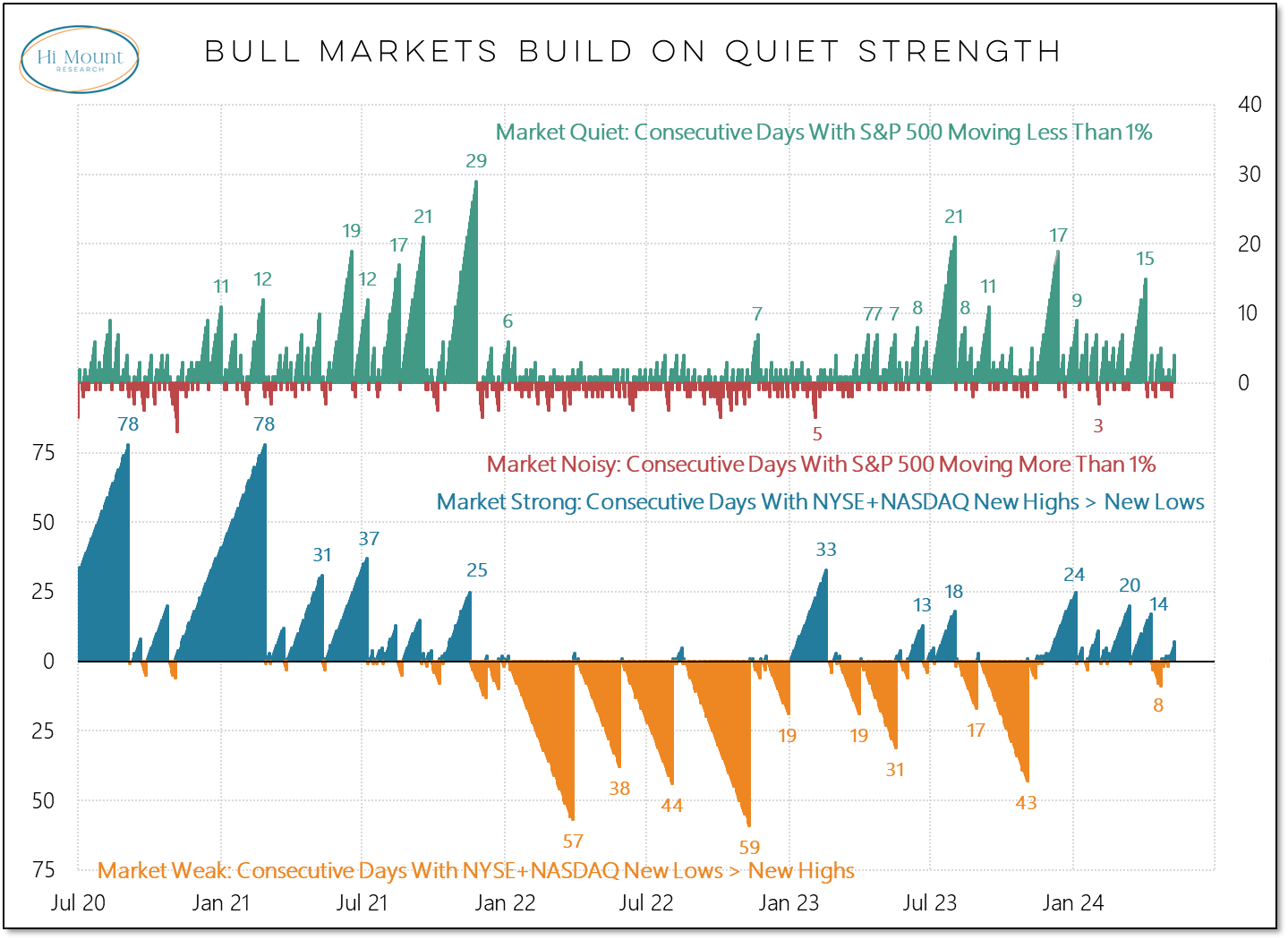

Stocks push higher on “quiet strength”

“We are at seven days in a row of more new highs than new lows and four days in row without a 1% swing in the S&P 500. While it may be boring for headline writers, quiet strength is the normal condition during bull markets.”

A quiet macro week was perhaps much-needed ahead of the all-important CPI inflation print on Wednesday. Stocks followed suit.

Source: Hi Mount Research

Better China trading could have more room to run

While it’s unlikely the longer-term structural concerns* are over, the more positive China trading of late could last through summer on increasing market hopes that the worst of the macro overhang may be behind us and equities have appropriately de-risked, and until the U.S. elections heat up (tariff/trade policy headwinds).

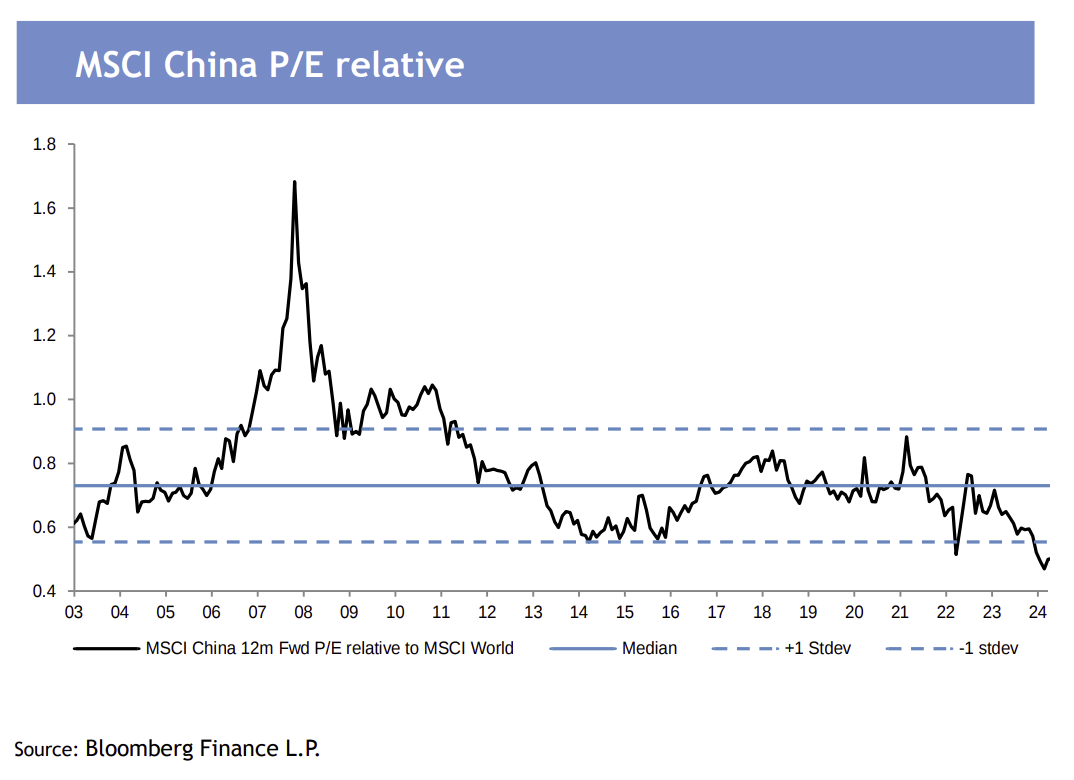

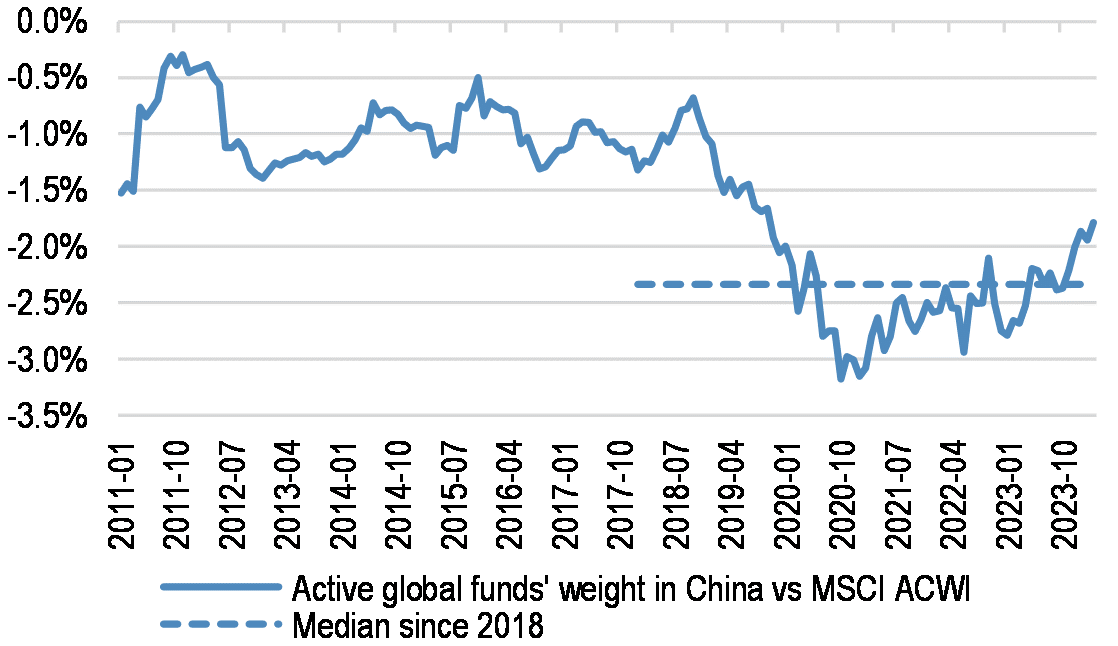

Some continue to be tactically bullish on China, despite many caveats. China is under-owned by institutional investors, sentiment towards Chinese policy is about as bearish as I can recall, and valuations have another 10-15% upside before closing the discount to historical median. Chinese equities’ rally has continued over the last few weeks on favorable and increasingly more aggressive policy actions.

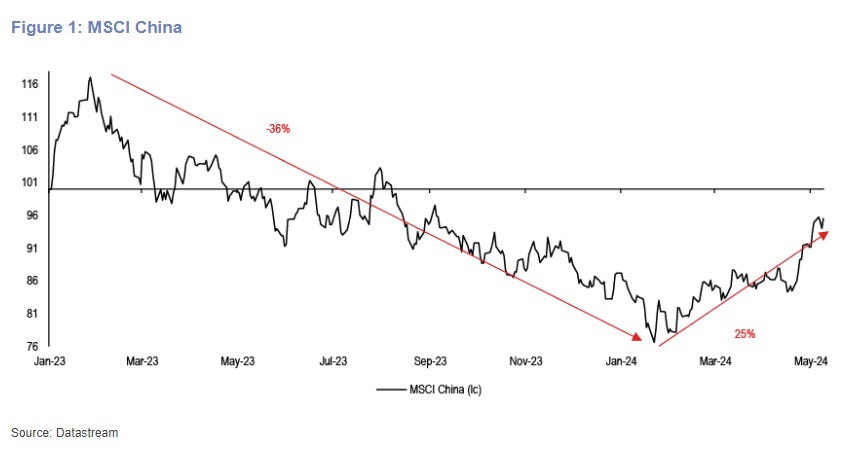

China stocks were down almost 40% from January 2023 to the recent lows in January 2024, although an aggressive bounce has witnessed large-cap stocks recover 25% or more.

The underweight positioning of managers is most obvious for global equity funds tracking the All Country World Index (ACWI) and Asia Ex-Japan, not so for EM broadly, and the recent rally has prompted a partial catchup towards pre-GFC levels.

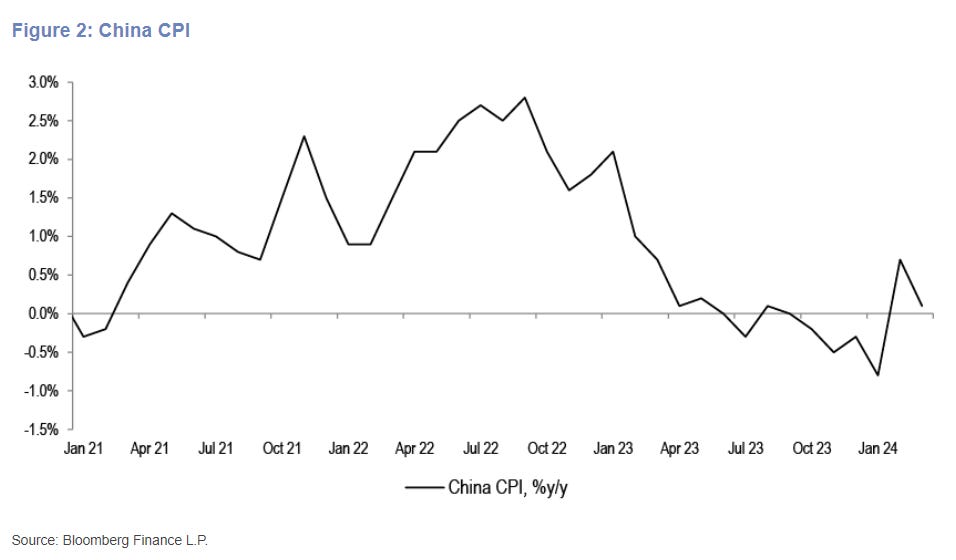

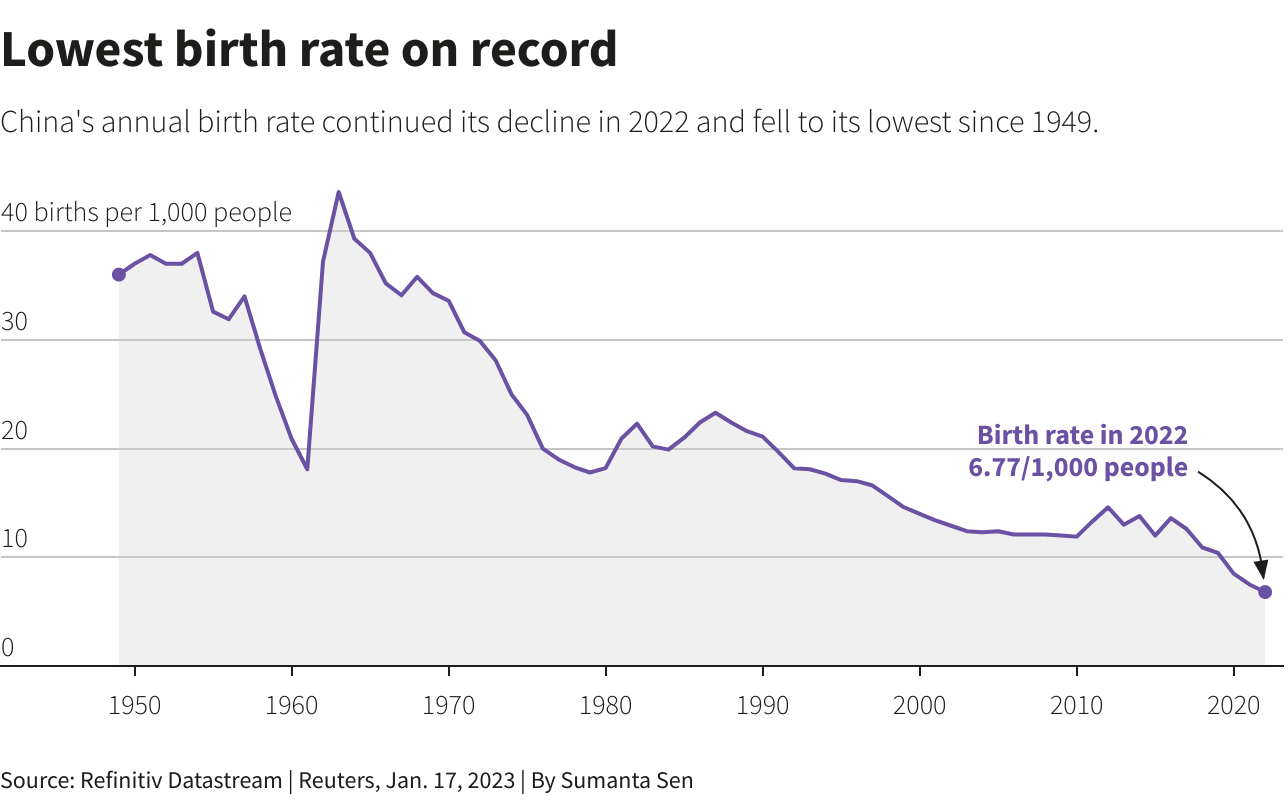

* Long-term structural challenges include China’s deflation pressure on corporate earnings, a troubled real estate market that accounts for an estimated 25-30% of the country’s GDP, a population in decline for two consecutive years, record low birth rates, and geopolitical tensions. See key charts below.

Source: J.P. Morgan Markets, Reuters, Bloomberg

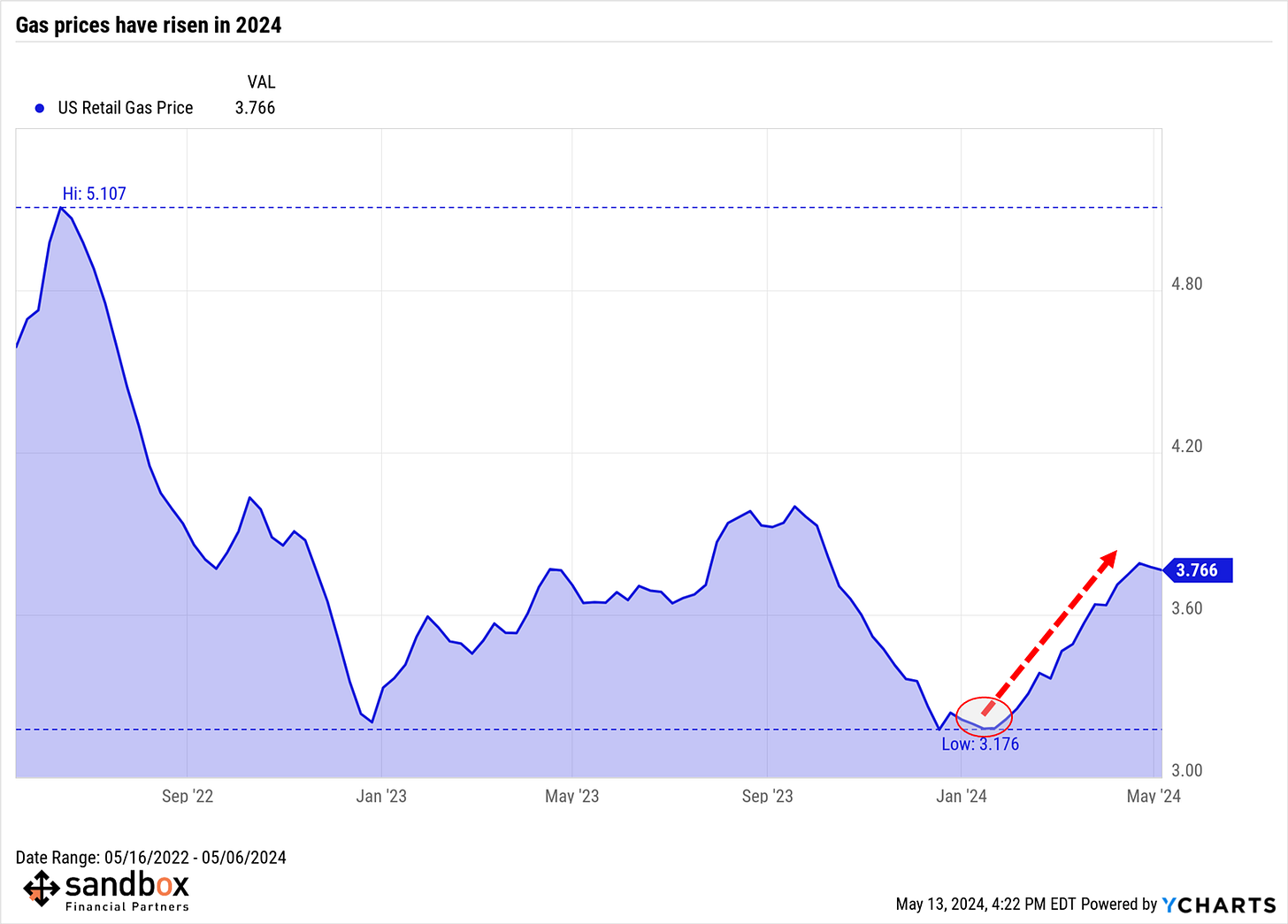

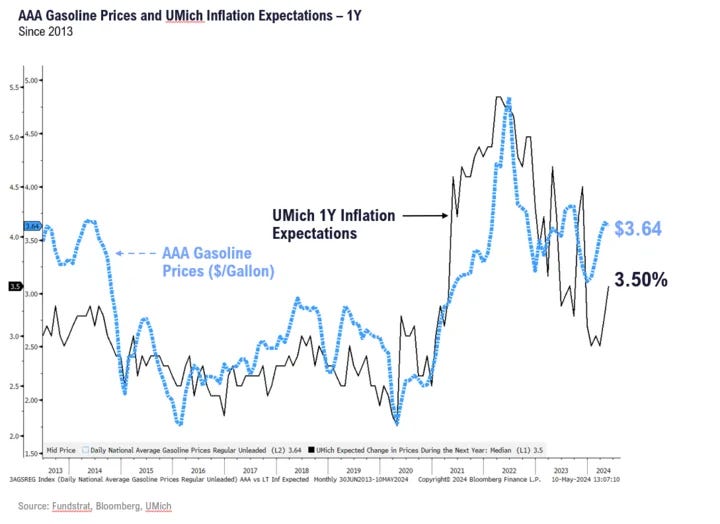

Gasoline prices weigh on inflation expectations

One reason for the inflection higher in 1-year forward inflation expectations?

Gasoline, which has reversed higher in 2024.

Most people drive by gas stations daily. It's impossible to miss the prices. If gas prices are trending higher, it's quite likely your perception of broader inflation is also moving higher.

We learned last week from the University of Michigan survey that the one-year outlook for inflation jumped to 3.50%, the highest level since November.

When people expect higher inflation, it can be a self-fulfilling prophecy — and if this reversal of progress in inflationary psychology continues, it will make the Federal Reserve policymakers warier of cutting interest rates.

"Because expectations are a key determinant of current behavior, they influence actual inflation and its evolution, and are high on my 'watchlist,'" Boston Fed president Susan Collins said last week.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.