Earnings season is here !!!, plus bitcoin halving and central bank historical precedence

The Sandbox Daily (4.11.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

1st quarter earnings season is here

bitcoin halving event fast approaching

follow the (central bank) leader

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.65% | S&P 500 +0.74% | Russell 2000 +0.70% | Dow -0.01%

FIXED INCOME: Barclays Agg Bond +0.02% | High Yield -0.09% | 2yr UST 4.948% | 10yr UST 4.576%

COMMODITIES: Brent Crude-0.24% to $90.26/barrel. Gold +1.85% to $2,391.7/oz.

BITCOIN: +0.96% to $70,634

US DOLLAR INDEX: +0.02% to 105.268

CBOE EQUITY PUT/CALL RATIO: 0.72

VIX: -5.63% to 14.91

Quote of the day

“Success is not final, failure is not fatal. It is the courage to continue that counts.”

- Winston Churchill

1st quarter earnings season is here

1st quarter reporting season from corporate America begins tomorrow (Friday, April 12) with the money center banks.

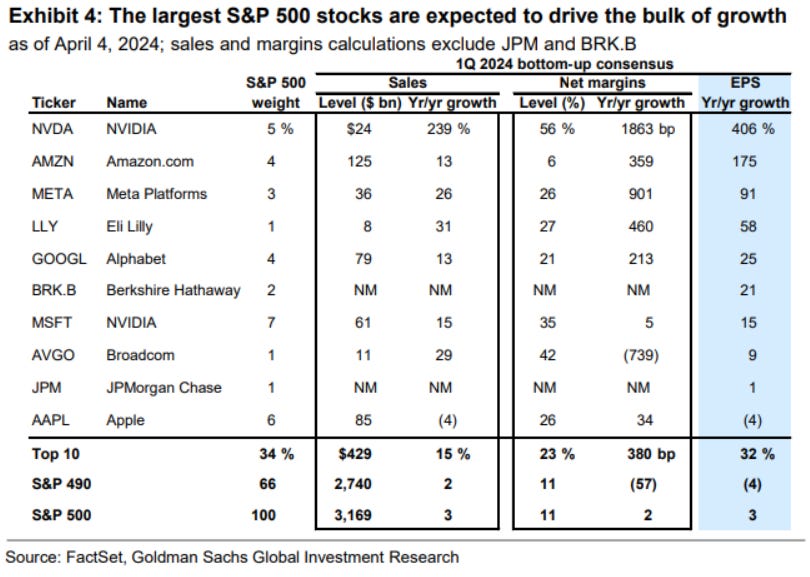

Market consensus expects 3% YoY earnings growth for the S&P 500, a deceleration from the 8% growth posted during 4Q24 earnings season. This upcoming quarter’s expected EPS growth rate is the highest pre-season bar set by consensus since 2Q22.

The big question on every investor’s mind: will the largest stocks in the index exceed lofty consensus expectations?

After all, the top 10 names (listed below) account for 34% of the index and essentially all of the EPS growth; the remaining 490 names in the S&P 500 are projected to report lower YoY EPS growth.

Make no mistake: Q1 is a “show me” quarter.

At the index level, the potential for further valuation expansion will be limited by already elevated multiples and high interest rates. Earnings need to be the primary driver of forward S&P 500 returns this year.

Source: Goldman Sachs Global Investment Research

Bitcoin halving event fast approaching

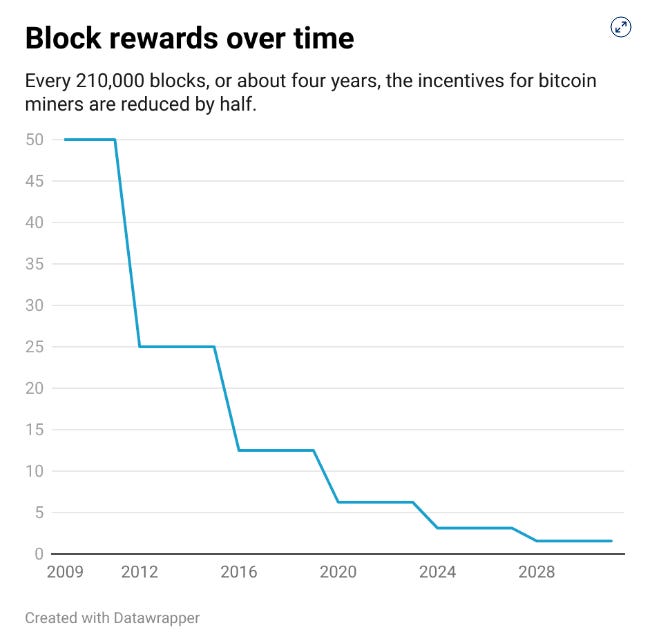

The bitcoin halving cycle – a technical event that occurs on the bitcoin network roughly every four years and reduces bitcoin’s mining reward by half – is fast approaching, with the latest estimates targeting between April 18 and April 21.

Bitcoin miners have two incentives to mine: 1) transaction fees that are paid voluntarily by senders (for faster settlement) and 2) mining rewards — 6.25 newly created bitcoins, or about $437,500 as of today’s price. In the next week or so, the mining reward will shrink to 3.125 bitcoins. The incentive was initially 50 bitcoins, but that was reduced to 6.25 in 2020.

Why does all this matter?

The market impact on bitcoin’s price is material.

After the 2012, 2016 and 2020 halvings, bitcoin’s price ran up 943%, 36%, and 83%, respectively, over the following six months.

Of course, past performance isn’t indicative of future returns – but the historical precedence of this small sample size is compelling.

Source: Seth Golden

Follow the leader

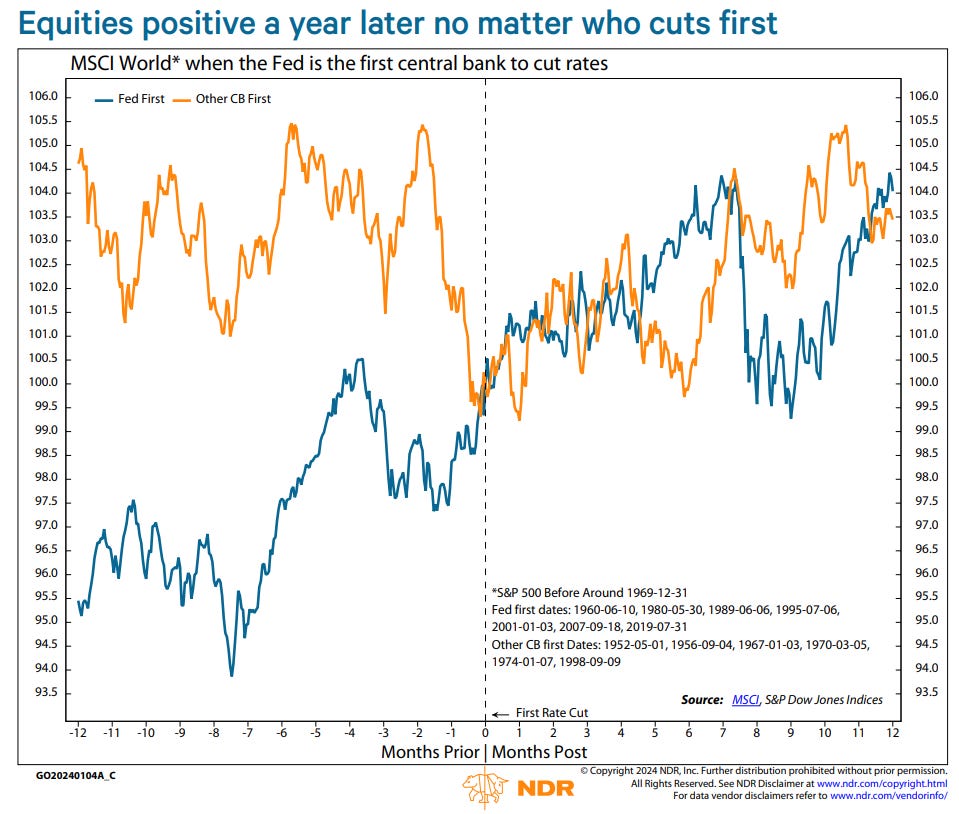

At the beginning of the year, the Fed appeared to be on a clear path to easing policy. Inflation data had been coming in less than anticipated, with markets pricing in around 150 bps of rate cuts – the equivalent of six 25 bps cuts throughout 2024. But a few ugly inflation reports since then, including this latest one for March, coupled with a stronger-than-expected labor market, has reduced some clarity on the Fed’s path.

Meanwhile, in many other parts of the developed world – such as the eurozone, Canada, and Australia – inflation has been surprising to the downside.

While I still expect the Fed to ease policy this year, the other major developed market central banks may do so before the Fed.

History suggests that despite working as independent entities, central banks tend to follow each other closely, reflecting the strong interrelationship of the global economy. To the contrary, recent history finds that the Fed has typically started cutting rates first.

As shown in the chart below, since the 1980s the Fed has initiated almost every easing cycle among major central banks (as shown by the vertical dashed black lines). Prior to the 1980s, the leading central bank varied but more than half the time it was the BoE that began rate cut cycles.

The table below shows the instances where the Fed initiated rate cut cycles first among major central banks. This has happened in every easing cycle since the 1980s except for 1998, when the Bank of Japan (BoJ) cut rates less than a month before the Fed.

On average, the ECB and BoJ have reduced rates roughly eight months after the Fed’s first cut. The BoE has been much quicker, cutting rates an average of almost five months later.

And what of the implications for stocks?

On average, the S&P 500 index tends to be up by around the same amount a year after rate cut cycles have begun, both when the cycle was started by the Fed or another major central bank.

Please keep in mind that the range of outcomes is quite varied and the sample size is rather small.

A more worrisome development would be if the Fed increases rates while other parts of the world are easing policy. This is even a more unusual circumstance. However, we did see this happen in 2015. In that case, we saw the dollar strengthen and equity markets down a year later.

Source: Ned Davis Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.