Earnings season, plus high yield credit, Millennials, Fed's emergency lending, and consumer spending

The Sandbox Daily (4.17.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

corporate earnings this week

using high yield as a barometer for recession

Millennials retirement planning

Fed’s emergency loans to banks fall for 4th straight week

consumers pull back on spending

After a much-needed Spring Break to decompress and soak up the sun, it’s time to roll up the sleeves and get back into the charts.

But first, here are the little rugrats – full of smiles !!

Now, let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.22% | S&P 500 +0.33% | Dow +0.30% | Nasdaq 100 +0.06%

FIXED INCOME: Barclays Agg Bond -0.50% | High Yield -0.27% | 2yr UST 4.205% | 10yr UST 3.606%

COMMODITIES: Brent Crude -1.63% to $84.89/barrel. Gold -0.41% to $2,007.5/oz.

BITCOIN: -2.94% to $29,496

US DOLLAR INDEX: +0.54% to 102.101

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: -0.70% to 16.95

Quote of the day

“Studying history makes you feel like you understand something. But until you’ve lived through it and personally felt its consequences, you may not understand it enough to change your behavior. We all think we know how the world works. But we’ve all only experienced a tiny sliver of it. As investor Michael Batnick says, ‘some lessons have to be experienced before they can be understood’.”

-Morgan Housel, The Psychology of Money

Corporate earnings this week

U.S. quarterly earnings season is in full swing.

Among big, notable names to watch this week alone include Charles Schwab, Bank of America, Johnson & Johnson, Goldman Sachs, Netflix, Taiwan Semiconductor Manufacturing, Tesla, American Express, CSX, and Proctor & Gamble.

With 60 S&P 500 constituent companies reporting this week, investors will get a clearer picture whether the economy is heading for a soft landing, hard landing, or perhaps no landing at all.

Interesting to note the S&P 500 has witnessed the biggest pre-earnings one-month rally since early 2009, as the index jumped nearly +6% in the month leading up to the belly of earnings season. Despite many expecting an earnings recession (remember 4Q22 was negative -2.4% EPS growth), the market has rallied strongly into this critical earnings cycle amidst terrible sentiment and positioning as well as a legitimate banking crisis – so many are naturally concerned with Corporate America’s ability to deliver on earnings.

Source: Earnings Whispers, Bloomberg

Using high yield as a barometer for recession

U.S. High Yield corporate credit spreads have retraced roughly half of their March widening from the regional banking crisis, but nonetheless remain at elevated levels compared to six weeks ago.

This chart from Goldman Sachs shows that current spreads are not assigning a high probability weight to a recessionary outcome as spreads are 30% tighter now than their median level during the 2001 run-of-the-mill recession, the mildest one from a spread widening perspective. These comparisons are relative to medians to moderate the outsized effect outliers can have on the average level. When comparing 2023 to more pronounced recessions like 1990-1991 and 2007-2009, the current spread levels across the credit spectrum are nowhere close to pricing in a major growth scare.

Looking at this in a slightly different way and putting valuations into a longer-term perspective, this next chart shows that, using B-rated bonds to control for similar credit quality through time (even excluding recessions) spreads are still only at their median levels vs. their history since 1987. In other words, valuations aren’t signaling either an extremely bearish (or bullish) outcome.

Source: Goldman Sachs Global Investment Research

Millennials retirement planning

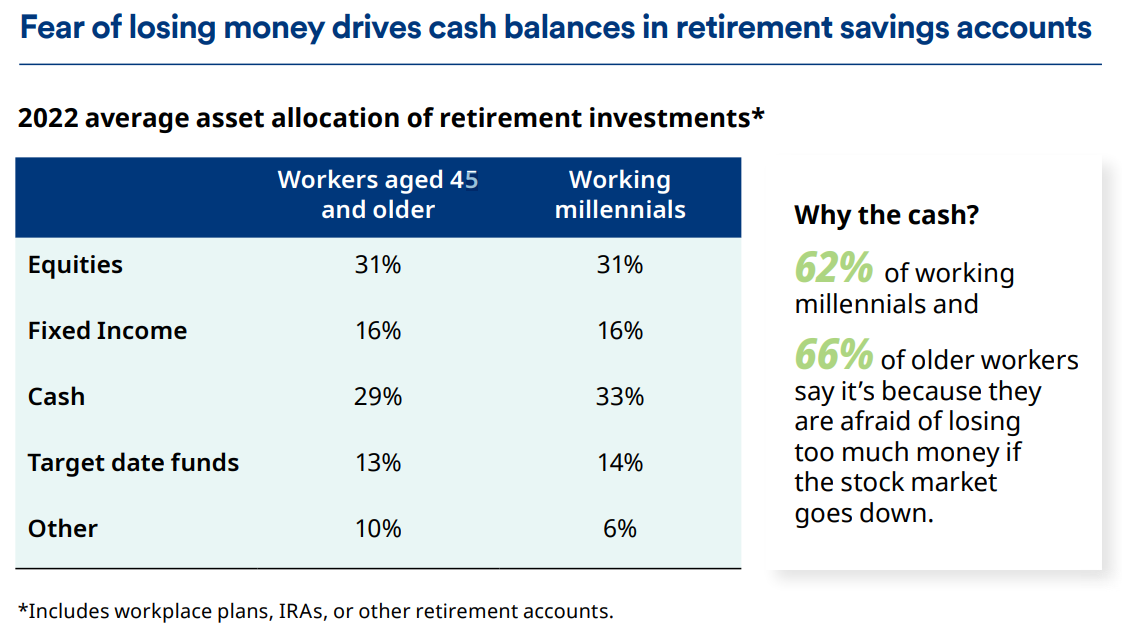

Millennials expect they will need $1.3 million to retire, and only 29% believe they will be able to save $1 million.

Working Millennials have more of their retirement savings allocated to cash (33%) than any other asset class (equities are the high at 31%).

If you're a Millennial, the percentage of your retirement investments allocated to cash should be ZERO.

Deb Boyden, Head of U.S. Defined Contribution at Schroders, had this to say: “There are profound gaps between what American workers say they need for a comfortable retirement and what they expect to have. This could be from a lack of planning, or for many it might just be too hard to save and invest enough to reach their retirement goals. The fact that, once again, so few Americans nearing retirement are confident they have enough money speaks volumes about the work we still need to do.”

Source: Schroders U.S. Retirement Survey 2023

Fed’s emergency loans to banks fall for 4th straight week

U.S. banks reduced their borrowings from federal regulators and their key backstop lending facilities, as Federal Reserve emergency lending has fallen for a 4th straight week.

For the 1st week since it was established, small- and mid-sized banks decreased their use of the emergency Bank Term Funding Program (BTFP), as balances dropped -9.1% to $71.8 billion. Borrowing from the Discount Window fell -3.0% to $67.6 billion.

The Federal Reserve provided $343.7 billion in liquidity to stressed banks, immediately after the problems at Silicon Valley Bank and New York Signature Bank, with some lending facilities overtaking 2008 financial crisis levels. But after its sharp peak, the banks have decreased their reliance on emergency federal lending.

The continued easing in financial institutions’ demand for liquidity from the Fed suggests stress in the banking sector is abating. Said Minneapolis Fed President Neel Kashkari, “I’m not ready to declare all clear but there are hopeful signs that these risks are now better understood and calm is being restored.”

Source: Bloomberg

Consumers pull back on spending

Retail sales fell -1.0% MoM in March, a deeper drop than the consensus estimate of -0.4%. Sales were down in 4 of the past 5 months, making the surge in January look more as an aberration, driven by seasonality. While the three-month average still came in at 0.6%, the consecutive declines in February and March (and a larger drop in March) show that consumers pulled back on spending as Q1 progressed.

On a YoY trend basis, retail sales moderated to +5.5%, the slowest pace since December 2020, although still higher than the rate of growth in the run-up to the last recession. Nevertheless, the decline in monthly sales and the slower YoY growth rate show that consumers have pulled back on spending, supporting the widely-held assessment that economic growth is on a slowing trajectory to… we will find out.

Source: Ned Davis Research, Zero Hedge

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.

ADORABLE children! Thanks for sharing the pic.