Earnings season reactions, plus housing market strength, oil markets, pandemic population shifts, and job openings

The Sandbox Daily (5.1.2024)

Welcome, Sandbox friends.

This afternoon, the Federal Reserve wrapped up its two-day policy meeting and the central bank unanimously announced to leave the target range unchanged for the benchmark Federal Funds Rate at 5.25% to 5.50% — where it’s been since July 2023. Didn’t have 45 minutes to catch the all-important Q&A press conference with Fed Chair Jerome Powell? Here is the wonderful Callie Cox to break down the key points:

Source: Twitter

Today’s Daily discusses:

earnings season reactions

resilient U.S. housing market

oil volatility subdued despite elevated geopolitical risks

pandemic population shifts

job openings fall to 3-year low

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.32% | Dow +0.23% | S&P 500 -0.34% | Nasdaq 100 -0.70%

FIXED INCOME: Barclays Agg Bond +0.35% | High Yield +0.53% | 2yr UST 4.966% | 10yr UST 4.634%

COMMODITIES: Brent Crude -3.20% to $83.57/barrel. Gold +1.01% to $2,326.9/oz.

BITCOIN: -3.71% to $58,019

US DOLLAR INDEX: -0.28% to 105.927

CBOE EQUITY PUT/CALL RATIO: 0.60

VIX: -1.66% to 15.39

Quote of the day

“I don’t feel that Wimbledon has changed me. I feel, in fact, as if I’ve been let in on a dirty little secret: winning changes nothing. Now that I’ve won a slam, I know something that very few people on earth are permitted to know. A win doesn’t feel as good as a loss feels bad, and the good feeling doesn’t last as long as the bad. Not even close.”

- Andre Agassi in Open: An Autobiography

Earnings season reactions

Given the global stock rally leading up to the earnings season and the already stretched positioning, stock reactions to earnings season results will continue to be underwhelming, with beats rewarded less (black bars below), and misses penalized by more than usual (blue bars).

In Europe, the sales beats are anemic relative to the history at 43%, and the reaction function for EPS misses is dramatically worse than we’ve seen in years – same story we’re seeing in the U.S. (above).

Source: J.P. Morgan Markets

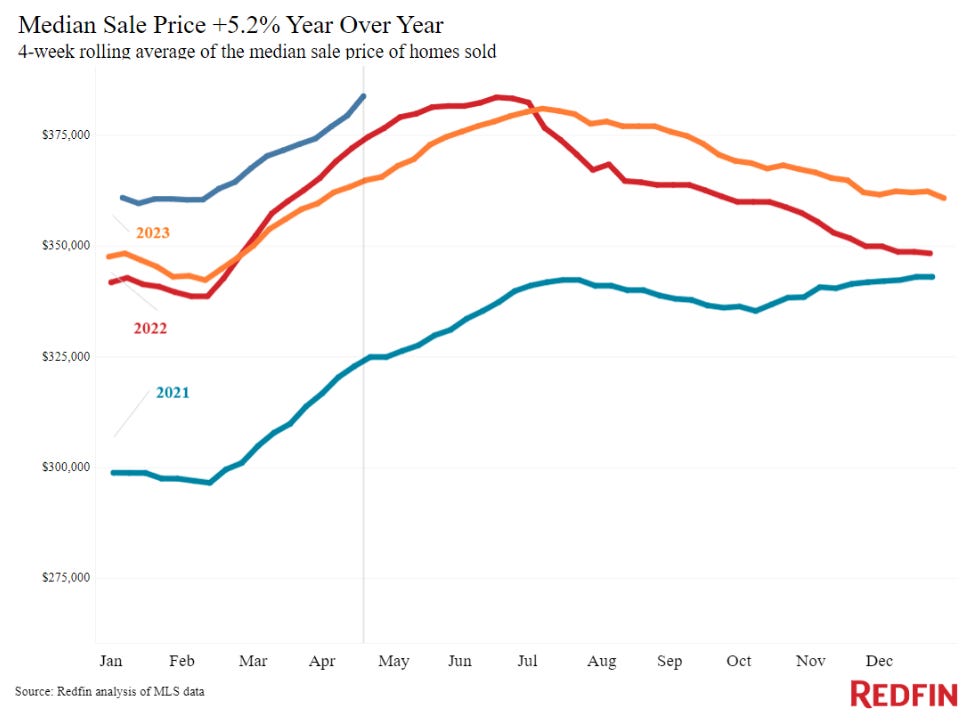

Resilient U.S. housing market

The median U.S. home sales price hit a record $383,725 during the four weeks ending April 21, up +5.2% from a year earlier – one of the biggest jumps since October 2022.

Unfortunately, housing affordability is worse than ever.

The combination of record high home prices and elevated mortgage rates (average hit 7.39% last week) have driven the median monthly mortgage payment to a record $2,843, up +12.6% versus this time last year.

Source: Redfin

Oil volatility subdued despite elevated geopolitical risks

Low realized volatility for a commodity can be interpreted as a market in equilibrium with future expected supply roughly in-line with future expected demand, or at least one with an absence of supply or demand shocks.

Given heightened tensions in the Middle East following Hamas’ attack of Israel and Houthi attacks of cargo ships in the Red Sea, 20-day realized volatility for crude oil sitting near the lowest levels of the last five years continues to surprise investors.

During that 5-year period, low realized volatility has also meant below average to negative forward returns as well.

Source: Ned Davis Research

Pandemic population shifts

The Midwest, along with the Northeast and Far West, lost population to the South and Mountain West, due to pandemic-era migration.

Drivers underpinning these population shifts include lower state tax rates, more affordable housing, a rise in energy infrastructure spend, and the manufacturing renaissance.

Source: Piper Sandler

Job openings fall to 3-year low

Each month, we turn to the Labor Department's Job Openings and Labor Turnover Survey (JOLTS) to understand the ebbs and flows of what's really happening among businesses and their workers.

Job openings across America continued its gradual 2-year descent lower, falling -3.7% in March from the prior month to 8.5 million and down -11.8% from one year ago.

This measure has steadily declined since hitting the cyclical peak of 12.0 million in March 2022 when the Federal Reserve initiated its tightening cycle, but the number of job openings still remains ~27% higher than 3-year period pre-COVID. The report illustrates the kind of cooling that the Federal Reserve would like to see, with demand for workers slowing through fewer openings rather than outright job losses.

The report showed that the ratio of job openings/unemployed Americans edged down to 1.32 from 1.36 in the prior month – well below the cycle peak of 2.1 but still a touch higher than the general pre-pandemic levels and the 1.23 level in February 2020.

Elsewhere, Quits also fell in March, bringing the Quit Rate down to 2.1% – its lowest level since August 2020 and below the pre-pandemic rate of 2.3%. The peak of this cycle topped at 3.0%. See chart below.

This reflects reduced labor turnover and less worker confidence in their job prospects. It also implies a continued squeeze of the pay premium of job switchers over job stayers, which should contribute to overall wage growth moderation in the near-term.

The Fed is closely watching the progress of labor demand/supply rebalancing. The labor market has certainly moved toward better balance, but overall conditions continue to be tight.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Bloomberg, Advisor Perspectives

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.