Elections don't dictate market performance, plus the Millennium Fund and Chinese consumer confidence

The Sandbox Daily (10.1.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

it’s the economy, stupid

Millennium – “don’t lose money”

Chinese consumer confidence

Let’s dig in.

Markets in review

EQUITIES: Dow -0.41% | S&P 500 -0.93% | Nasdaq 100 -1.43% | Russell 2000 -1.48%

FIXED INCOME: Barclays Agg Bond +0.26% | High Yield -0.05% | 2yr UST 3.609% | 10yr UST 3.732%

COMMODITIES: Brent Crude +2.56% to $74.47/barrel. Gold -0.32% to $2,681.8/oz.

BITCOIN: -3.86% to $60,843

US DOLLAR INDEX: +0.07% to 101.261

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: +15.12% to 19.26

Quote of the day

“As fiduciaries, we have an obligation to our clients that we show up as the best version of our Selves.”

- Justin Castelli in Our Obligation

It’s the economy, stupid

As we begin the final quarter of the year, financial markets and the economy have defied the expectations of many investors.

Rather than falling into recession, the economy has grown steadily while inflation rates have fallen back toward the Fed’s 2% mandated target. As a result, the macroeconomic environment has shifted to a monetary easing cycle, propelling the S&P 500 to 43 new all-time highs in 2024. The 1st three quarters of the year are a reminder that it’s often best to focus on the longer-term trends rather than events in the rearview mirror.

Of course, there are still many roadblocks in the months ahead. There always are.

The path of Fed policy is on everyone’s mind, while the conflict in the Middle East continues to deteriorate in front of our very eyes.

However, as Tom Lee of Fundstrat noted on the most recent The Compound and Friends podcast, investors are waiting for the U.S. election result before deploying fresh powder from the sidelines.

The wide-ranging implications for tax policy, regulation, trade, and more have investors nervous about the potential impact of the presidential election on the economy. As the race intensifies over the next 35 days, it’s crucial to remember that while elections are important for the country and its citizens, it is also important not to vote with our portfolios and our hard-earned savings.

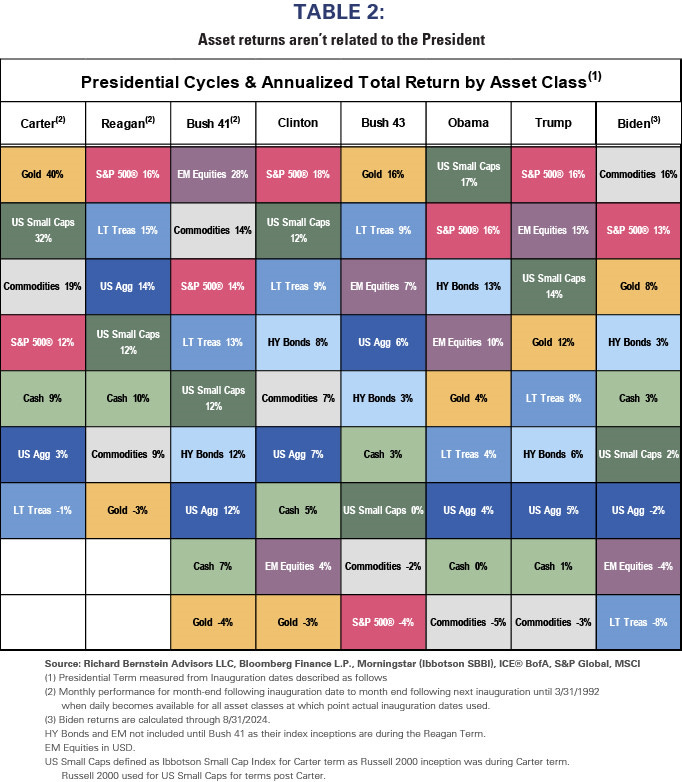

History shows that the stock market has experienced long-term growth under both major political parties. It is not the case that the market or economy crashes when one political party is in office. This is because the underlying drivers of market performance – economic cycles, earnings, valuations, etc. – are far more important than the person or party who occupies the White House.

In fact, when drilling down into asset class returns, the results are quite literally a random walk down Wall Street.

The reality we must all come to terms with is that facing risks is unavoidable when it comes to investing and planning for the future. How investors choose to react to those risks is ultimately what determines investment and financial success.

Rather than trying to time the market to avoid these risks, it’s far better to hold a well-constructed portfolio that can weather different market environments.

Source: Clearnomics, RBA Advisors

“Don’t lose money”

A pitch, if you allow me.

What if I offered you the chance to invest in something that has achieved an average annualized return of +13.9% net of fees since 1990?

What if that same asset produced positive returns in 87% of all months and its worst drawdown ever was a paltry -7.06% (July-December 2008)?

It’s worst – and only – negative calendar year performance was -3.50% in 2008.**

Finally, what if I told you this wasn’t a small-cap emerging market play or niche beta fund that was exploiting some market dislocation – rather, it was a $68.25 billion dollar juggernaut multi-strat hedge fund?!?

The response from most people would be: “bullshit.”

Or, “I’ve seen this story before.”

Well, thanks to some fantastic reporting from the Wall Street Journal, one reason for the Millennium Fund’s impressive performance is its acute risk management practices.

To wit:

When a PM’s losses approach 5%, their capital allocation is reduced. When losses eclipse 7.5%, they’re given U-Haul moving box.

By employing a low volatility investment approach with capital allocated across 250+ underlying portfolio management/trading teams, Millennium’s sterling history and reputation has presented a unique risk-adjusted opportunity for its investors.

** The -3.50% return in 2008 is inclusive of a -2.51% write-down of all the Fund’s exposure to Lehman Brothers. In the absence of the Lehman Brothers write-down, the return would have been -0.99% in 2008.

Source: Wall Street Journal

After collapsing in early 2022 on lock downs, Chinese consumer confidence remains low

While it remains to be seen if the Chinese bazooka of policy measures will be followed up by realized structural reforms and a reorientation towards domestic consumption as a growth driver, it’s clear that last week’s announcements are a powerful cyclical stimulus.

Outside of Chinese equities, one could argue that the global market response was rather tepid – at least relative to the importance of the Chinese economy and the size of the policy measures.

Investors are aware that policy can only do so much, and that Chinese consumer and investor confidence has been rattled by 1) the sharp decline in property prices, 2) a population in decline for two consecutive years, 3) record low birth rates, 4) autocratic regime decisions, and 5) geopolitical tensions.

Certainly, the Chinese equity rally does help to restore consumer and investor confidence at the margin. However, unlike in the United States, Chinese households do not hold large equity holdings where the wealth effect from rising share prices can play a key role in boosting confidence and spending.

Further, investment is predominantly driven by bank loans as opposed to capital markets, and simply cutting rates and increasing money supply doesn’t increase lending.

For now, not many are tactically bullish on China. China is under-owned by institutional investors, while valuations have another 10-15% upside before closing the discount to historical median.

This gives room for the current move to run higher, albeit most likely after some period of backing and filling to digest the recent gains.

Last week’s announcements from the PBOC and the Politburo may be just the first of many that will be aimed at shoring up confidence. The fact that the country has avoided a recession is remarkable, which may help to provide a better base for a recovery if this policy initiative succeeds.

Source: The Economist, T. Rowe Price

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: