Emergency Fund: the lifeboat for your finances and sanity, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (1.31.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the lifeboat for your finances and sanity

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.14% | S&P 500 -0.50% | Dow -0.75% | Russell 2000 -0.86%

FIXED INCOME: Barclays Agg Bond -0.20% | High Yield -0.20% | 2yr UST 4.207% | 10yr UST 4.543%

COMMODITIES: Brent Crude -0.14% to $76.78/barrel. Gold -0.49% to $2,809.3/oz.

BITCOIN: -2.98% to $101,960

US DOLLAR INDEX: +0.65% to 108.501

CBOE TOTAL PUT/CALL RATIO: 0.69

VIX: +3.72% to 16.43

Quote of the day

“The world has enough for everyone's need, but not enough for everyone's greed.”

- Mahatma Gandhi

Cash reserves: the lifeboat for your finances and sanity

Life is unpredictable.

Financial setbacks can will pop up without notice, often at the worst possible time.

Job loss. Medical bills. A fender bender. The HVAC that suddenly goes kaput. You get the picture.

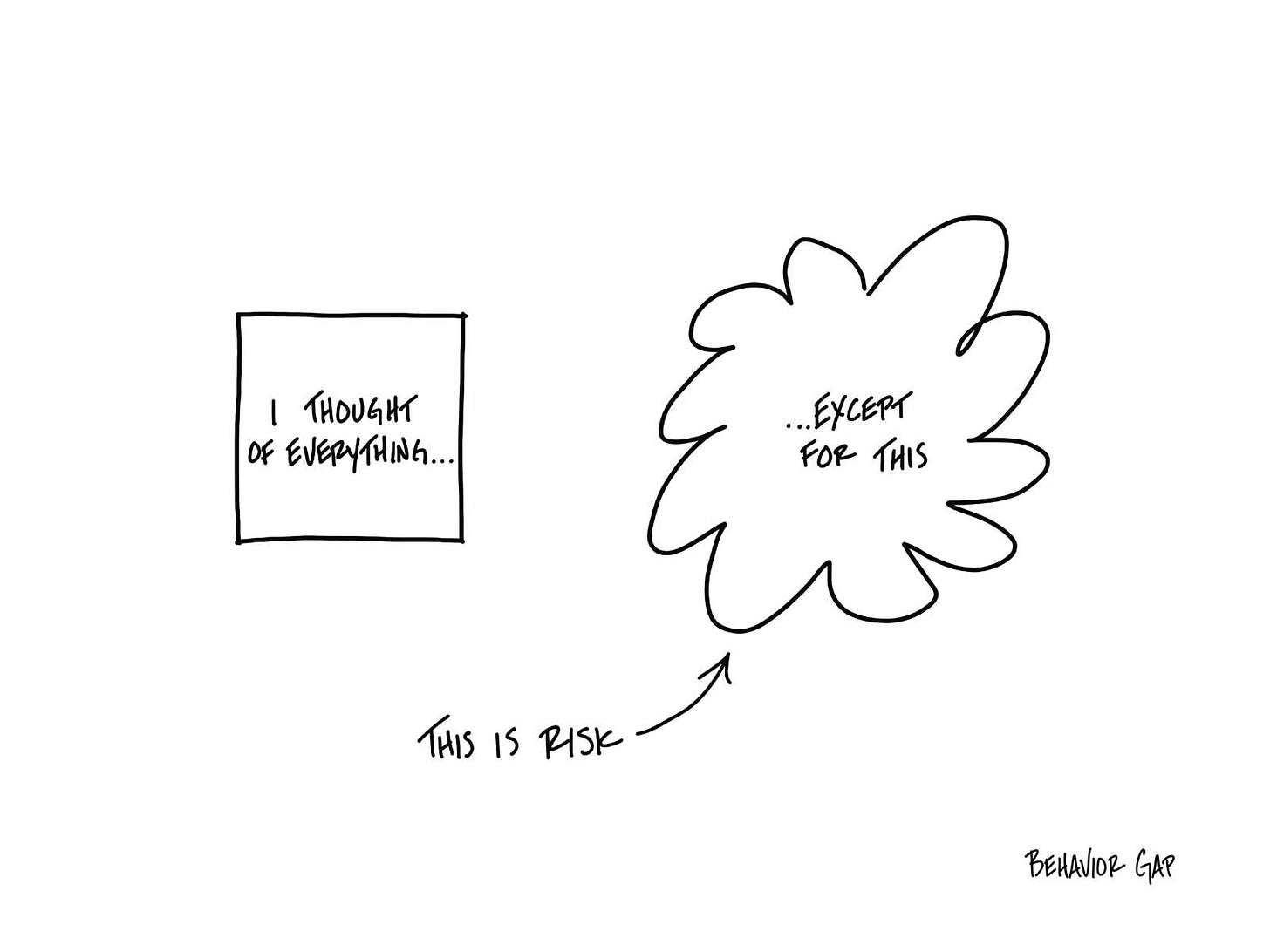

People manage risk by looking backwards and preparing their families to handle adverse scenarios they’ve previously experienced or been taught by others. But, what about these unforeseen things still to come?

As Carl Richards once said: “Risk is what’s left over after you think you’ve thought of everything.”

A solid Emergency Fund, or Cash Reserve, is a crucial element to any financial plan.

In fact, if you drew up a financial order of operations as the instructional manual for managing your household finances, establishing a healthy Cash Reserve should be right at the top. One could argue paying off high-interest debt is the only rung higher on the ladder.

A Cash Reserve keeps your financial life out of the ditch. If someone doesn’t have a safety net in place, many turn to high-interest debt or family to step in. Not good.

Ultimately, your Emergency Fund will protect you from two different types of emergencies: income shocks (inflows) and spending shocks (outflows).

The general rule of thumb states your Emergency Fund – money set aside exclusively for unexpected financial hiccups – should cover between three and six months of expenses.

How much you save should be specifically tailored to your household, monthly income and expenses, debt management, risk tolerance, and lifestyle needs.

Personally, three months feels light. Six months seems like the sweet spot, while nine or twelve months is appropriate for the conservative folks.

Start with three months if the following apply:

steady job in a stable industry

young and/or healthy

dual income household

nobody relies on your income

low debt loads

industry with high job turnover

Bump up to six months if the following apply:

unpredictable income

highly cyclical/unstable industry

self-employed

recurring health issues

dependents rely on your income

high debt loads

industry with low job turnover

Consider how the number you land on makes you feel. If your situation points to a small reserve, but in doing so causes anxiety, then build a larger cushion. Each situation is highly personal and specific.

These savings’ goals may seem lofty considering one recent Suze Orman study showed two in three Americans would struggle to cough up $400 in an emergency scenario. Or, this Bankrate survey that revealed just 41% of Americans could handle a common unexpected expense ($1000) from their savings.

While these polls are somewhat misleading and don’t factor important considerations like net worth quartiles or regional differences, the point remains: many Americans cannot overcome a fairly routine expense coming from left field.

Once you determine the general amount of your Emergency Fund, then you must find a home for it.

With thousands of dollars at play, you’ll need to ensure these funds are safe, liquid, accessible, and earning a rate of return.

Here are a few different accounts to consider:

High-Yield savings account that’s FDIC insured

Money Markets

A ladder of U.S. Treasury bills

A ladder of Certificates of Deposit (CDs) – slight catch here since most institutions penalize you for selling prior to maturity

Protip: To avoid tapping into your emergency savings, separate this pool of money from your everyday cash account(s) and create a separate account specific to your Cash Reserve.

Everyone needs an Emergency Fund – no matter how old or your income level. Planning ahead is key. If you’re diligent about saving for emergencies, you’ll be more prepared to handle whatever comes your way – reducing unnecessary strain and preventing bad decision making down the road.

Financial stability is best for your family and brings peace of mind.

Source: Carl Richards, Ramsey Solutions, CNBC, Bankrate, Bloomberg, Vanguard

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

All Star Charts – Do You Have Balance? (Louis Sykes)

The Art of Alchemy – Taylor Sheridan’s Lightbulb Moment (Frederik Gieschen)

No Mercy/No Malice – After the Fires (Scott Galloway)

Yahoo Finance – Chartbook: 44 Charts That Tell the Story of Markets and the Economy to Start 2025 (Josh Schafer and Brent Sanchez)

Pearl’s Prime Cuts – Stupid Simplicity Doctrine (Phil Pearlman)

The Root of All – Why You Should Pursue the “Unnecessary” Things in Life (Jacob Schroeder)

The Irrelevant Investor – How Hard is it to Pick Stocks? (Michael Batnick)

Podcasts

Andrew Yang Podcast feat. Gunjan Banerji of WSJ – When INVESTING Becomes GAMBLING: The Rise of Risky Bets (YouTube, Spotify, Apple Podcasts)

Master’s in Business with Barry Ritholtz and special guest Jonathan Clements (Spotify, Apple Podcasts)

To Live and Die in L.A. by Tenderfoot TV (Spotify, Apple Podcasts)

Movies/TV Shows

The Order – Jude Law, Tye Sheridan (IMDB, YouTube)

Music

Snow Patrol – But I’ll Keep Trying (Spotify, Apple Music, YouTube)

Travis Scott – 4X4 (Spotify, Apple Music, YouTube)

Books

Matthew McConaughey - Greenlights (Amazon)

Tweet

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: