Energy rips, plus cheap fixed-rate debt, Q2 earnings, and the Fed's preferred inflation guage

The Sandbox Daily (7.31.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Energy’s fierce rally

cheap fixed-rate debt puts borrowers in better financial position

Q2 earnings season hits full stride

PCE inflation shows further evidence of cooling

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.09% | Dow +0.28% | S&P 500 +0.15% | Nasdaq 100 +0.04%

FIXED INCOME: Barclays Agg Bond +0.12% | High Yield +0.24% | 2yr UST 4.885% | 10yr UST 3.967%

COMMODITIES: Brent Crude +0.67% to $85.23/barrel. Gold +0.19% to $2,003.7/oz.

BITCOIN: -0.65% to $29,232

US DOLLAR INDEX: +0.26% to 101.883

CBOE EQUITY PUT/CALL RATIO: 0.71

VIX: +2.25% to 13.63

Quote of the day

“What we experience is change, not time. Aristotle observed that time does not exist without change, because what we call time is simply our measurement of the difference between 'before' and 'after'.”

- Scott Galloway, Post Corona: From Crisis to Opportunity

Energy’s fierce rally

Crude oil just finished its biggest monthly gain since January 2022, with the price of Brent Crude rising 14% in July.

The continued strong lift in the underlying commodity is evident in rising Energy prices as the sector quietly takes over as the best performer of the last month. The sector rotation that’s taken place this summer should be respected, despite mainstream media continuing to flag the 2023 bull market as narrow in breadth.

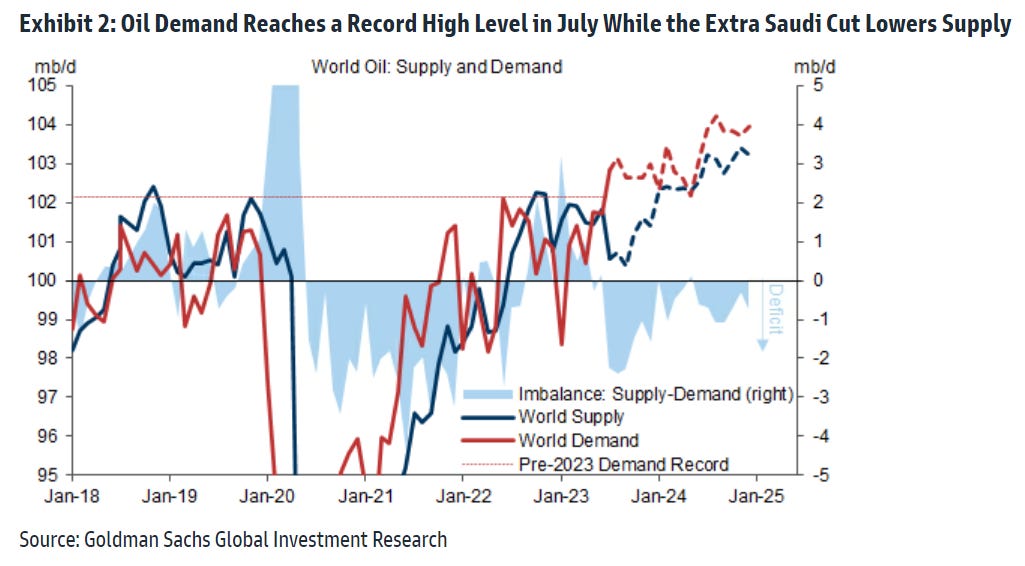

Per a recent Goldman Sachs note, this rally has been spurred by investors growing more constructive on their outlook for the global economy as well as a swing in positioning. Demand is soaring while Saudi supply cuts have brought back deficits, just as the market has abandoned its growth pessimism. The reduction in U.S. recession risk – following firmer economic activity but softer inflation data – has supported investor sentiment. A weaker dollar has also helped.

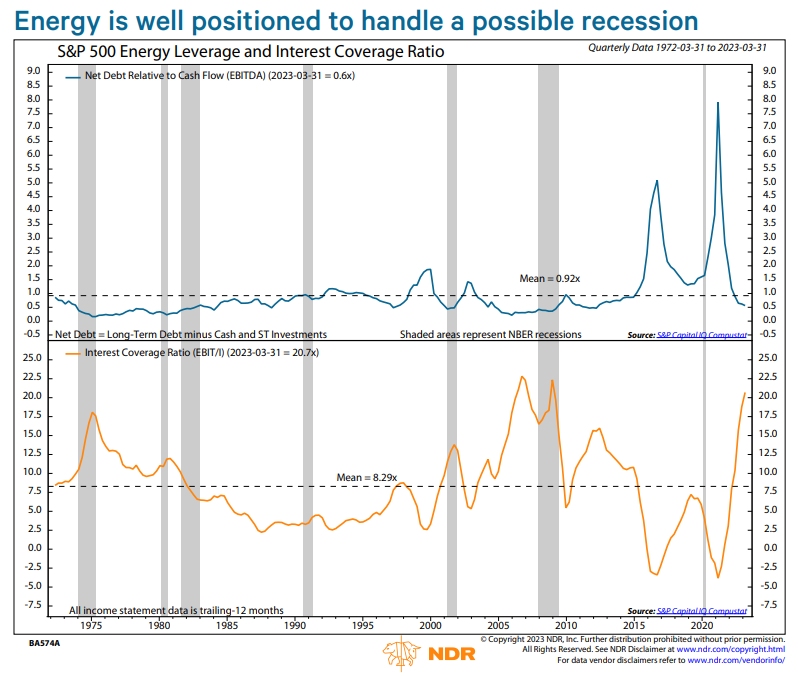

It also helps that Energy companies have become more investor friendly with their capital decisions since COVID-19. This cycle has seen dividend payouts, net repurchases, and net debt reduction all reach record highs for the sector.

Since late June, oil prices have run up without abandon – and on heavy volume. But when you zoom out, oil has been trading sideways for the last year as you can see in the chart below. Brent Crude now seems to be approaching its first logical area of possible resistance to this rally as it challenges the January and April 2023 highs.

The larger relative breakout in Energy vs. the S&P 500 index could mean that the sector remains a 2nd half outperformer.

Source: Goldman Sachs Global Investment Research, Ned Davis Research

Cheap fixed-rate debt puts borrowers in better financial position

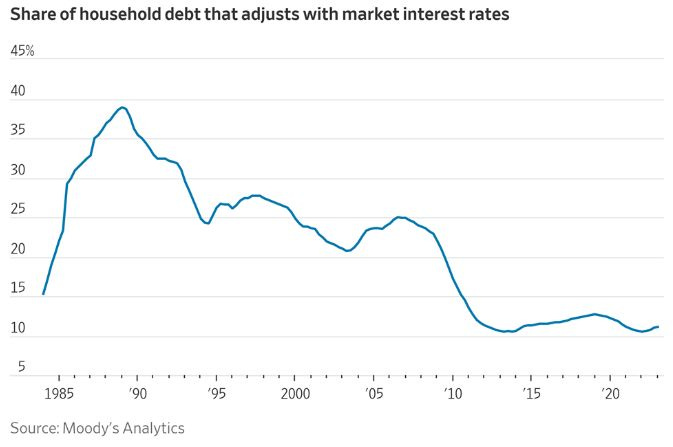

Only 11% of U.S. household debt has an adjustable interest rate.

That means the vast majority of Americans with existing fixed rate mortgages, auto loans, or student loans have not been impacted by the Federal Reserve’s 11 interest rate hikes since March 2022.

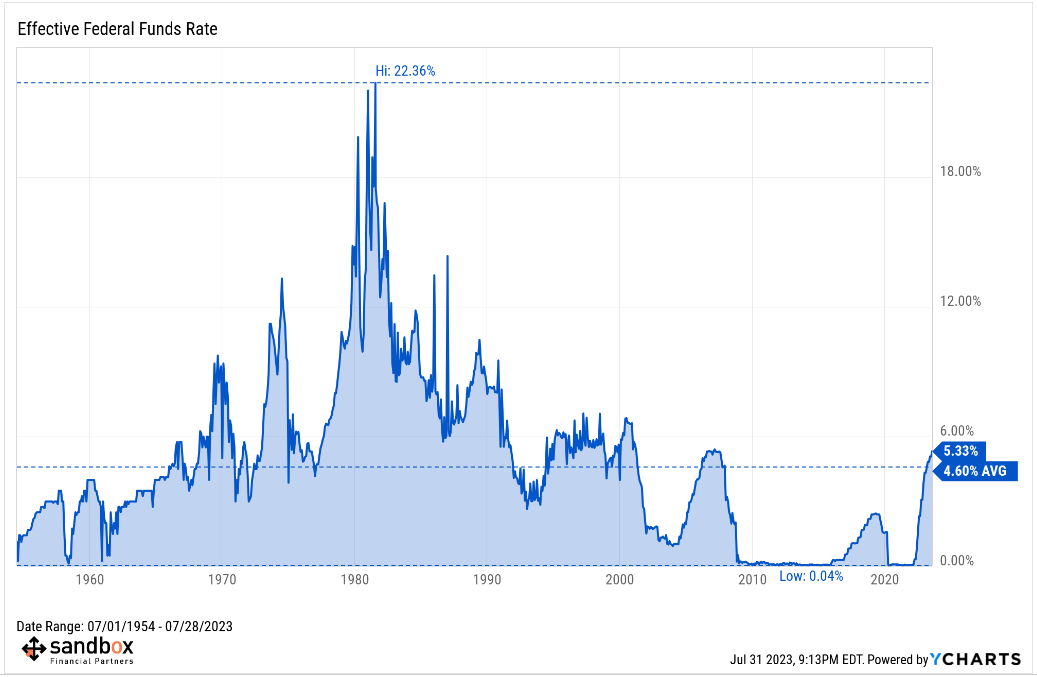

That metric has been consistent for the last 10 years around these historically low levels but has only recently gained attention as the Fed lifted the benchmark lending rate to the highest level since 2007.

Source: Wall Street Journal

Q2 earnings season hits full stride

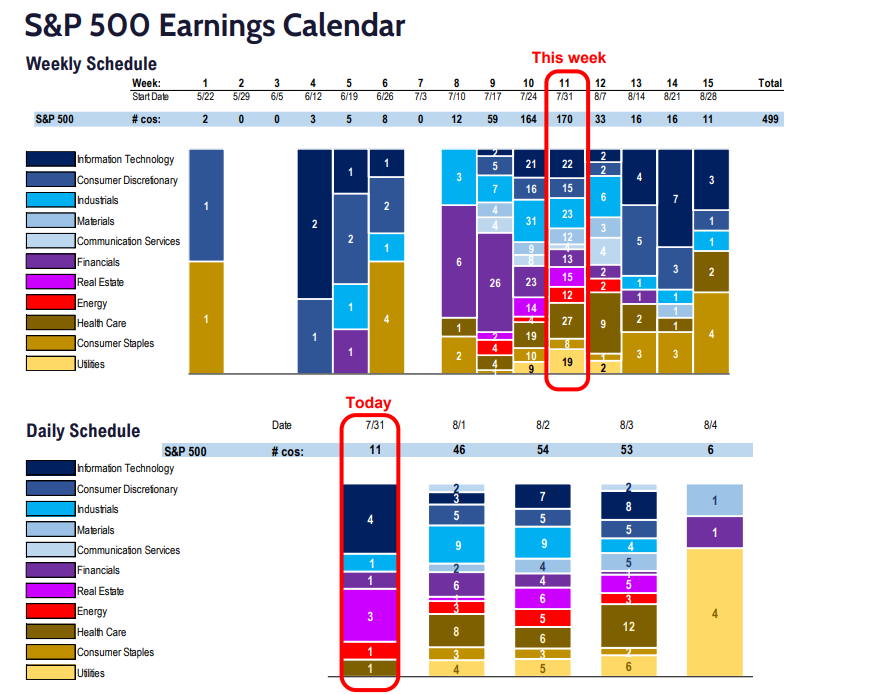

The S&P 500 will have 170 companies report earnings this week.

Marquee names are reporting results every day. SoFi, AMD, Caterpillar, Uber, Pfizer, CVS, ABInBev, Amazon, and Apple are notable reporters.

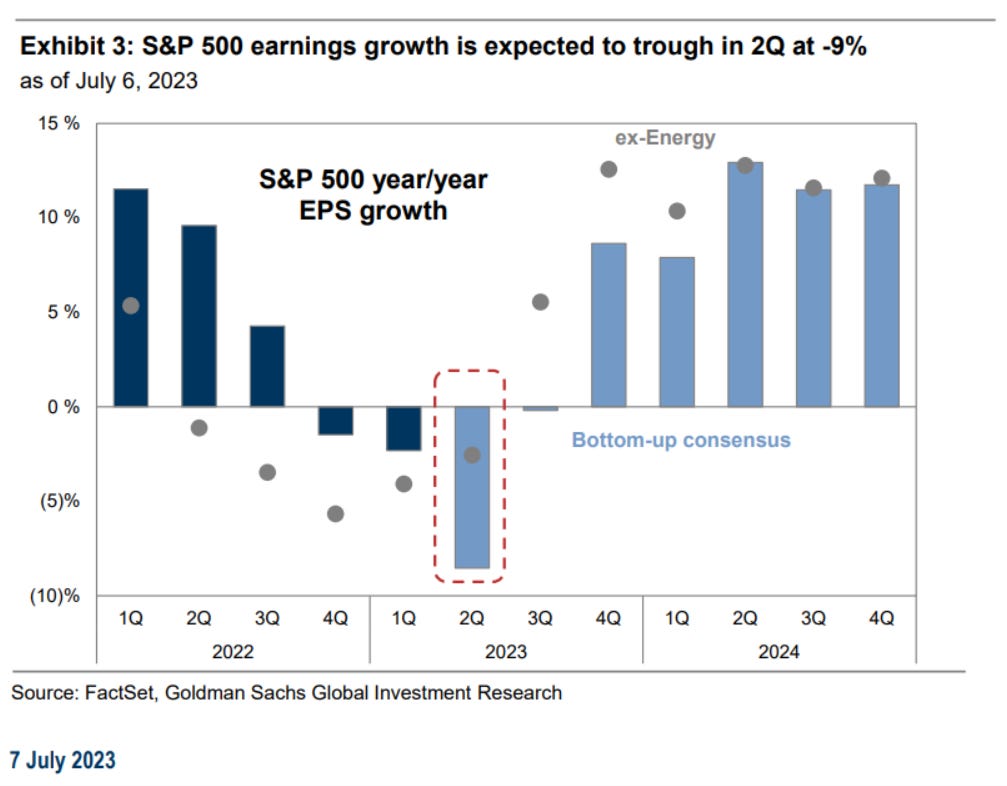

Consensus expects 2Q profits for the aggregate S&P 500 index to fall by -9% YoY, however, EPS growth estimates for the median S&P 500 stock are more optimistic (+1%). Many expect this reporting season to be the trough in the earnings cycle, yet S&P 500 ex-Energy EPS already troughed in Q4 of 2022, coinciding with the market bottom (October 2022).

We are in the heart of earnings season with a combined 336 index companies reporting from last week to this one.

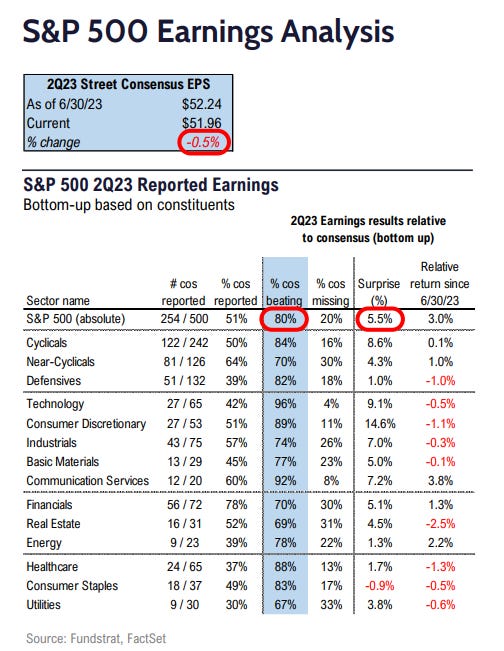

Of the 254 companies in the S&P 500 (51%) that have reported, 80% have reported actual EPS above their estimates, which is above both the 5-year average of 77% and 10-year average of 73%.

In aggregate, companies are reporting earnings that are +5.5% above estimates, which is below both the 5-year average of +8.4% and 10-year average of +6.4%.

This means more companies are beating estimates but by smaller amounts.

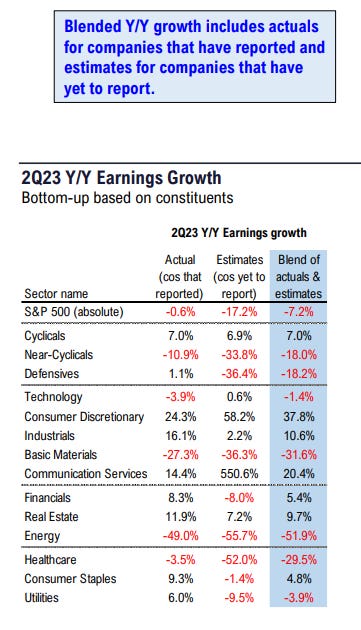

The blended earnings decline (blended combines actual results for companies that have reported and estimated results for companies that have yet to report) for the 2nd quarter is -7.2% today, which would mark the 3rd consecutive quarter in which the index has reported a year-over-year decline in earnings – so the earnings valley/recession is here, as expected.

Source: Goldman Sachs Global Investment Research, Earnings Whispers, Fundstrat, FactSet

PCE inflation shows further cooling

Inflation pressures continued to moderate in June, confirming the Fed’s shift to a slower pace of tightening this year.

The Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, showed core inflation increased +0.2% MoM, in line with estimates and lower than the previous month’s +0.3% rise. As for the YoY change, core PCE inflation rose by +4.1%, the lowest level since September 2021.

Most of the slowdown in inflation has come from the goods side, but core inflation continues to run above the Fed’s target of 2%. As favorable base effects diminish in the 2nd half of this year, further progress on inflation will prove more difficult, especially if the labor market remains tight and consumer demand holds up.

This latest PCE report suggests that while the Fed should be nearing the end of its tightening cycle, it may keep rates higher for longer than markets currently anticipate.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.