Excess savings wind down, plus investor time horizons, bonds on the move, and U.S. municipality tax concerns

The Sandbox Daily (8.21.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

are household savings still supporting the economy?

time horizons matter

investors reposition as rates retest highs of the cycle

U.S. municipalities to survive the office exodus

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.65% | S&P 500 +0.69% | Dow -0.11% | Russell 2000 -0.18%

FIXED INCOME: Barclays Agg Bond -0.50% | High Yield -0.03% | 2yr UST 5.007% | 10yr UST 4.342%

COMMODITIES: Brent Crude -0.33% to $84.52/barrel. Gold +0.38% to $1,923.7/oz.

BITCOIN: -0.29% to $26,103

US DOLLAR INDEX: -0.03% to 103.346

CBOE EQUITY PUT/CALL RATIO: 0.76

VIX: -0.98% to 17.13

Quote of the day

“There is a corollary to the premise that prices move in trends – a trend in motion is more likely to continue than to reverse.”

- John J. Murphy, Technical Analysis of the Financial Markets

Are household savings still supporting the economy?

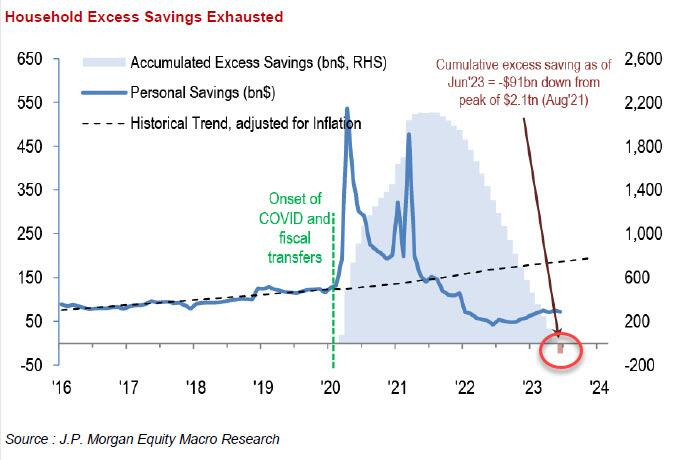

Since 2020, corporations and individuals were provided significant funds from the federal government to combat the pandemic-related economic shutdown and unknown commerce effects throughout the reopening process. Initially, this led to households “rapidly accumulating unprecedented levels of excess savings – defined as the difference between actual savings and the pre-recession trend.”

Many measures had cumulative excess savings peaking around $2.1 trillion dollars back in the summer of 2021.

As the economy reopened, the excess of household savings was spent slowly at first and then at a more noticeable and higher clip later on. Fast forward to today, high interest rates have not slowed the economy in part because consumers were/are still spending down these excess household savings.

The question now is how much money from prior stimulus remains as household savings and how it will continue to generate above-average spending from consumers.

Well, for starters, a troubling trend is emerging in that the amount households save on a monthly basis is now less than pre-pandemic.

And with higher prices across the economy, revenge travel and spending, things like concerts and games back to normal, lower savings rates, and the rest, one would expect excess savings to have drawn down. The San Francisco Fed published a report last week to approximate by just how much – they estimate the cumulative drawdowns have reached roughly $1.9 trillion dollars as of June 2023.

This implies that less than $200 billion of excess savings remains across the aggregate economy.

The rapid accumulation and subsequent depletion of excess savings during the current cycle moved at a much quicker pace than prior period.

With excess savings nearly exhausted, one key tailwind for consumer spending that boosted the U.S. economy over the last year or two seems to be fading away.

Source: J.P. Morgan, Federal Reserve Bank of San Francisco, RIA Advice

Time horizons matter

In the stock market, time pays.

Since 1928, the S&P 500 has generated a positive total return more than 89% of the time over all 5-year periods. Those are really good odds, if you buy and hold.

In fact, there’s never been a period where the S&P 500 didn’t generate a positive return for all 16+ year time frames.

It’s only when you review time periods fewer than 2-3 years do the odds of the S&P 500 index being positive go down by a measurable amount.

Source: Bespoke Investment Group

Investors reposition as rates retest highs of the cycle

Bond yields have come a long way in a short period of time.

30-year Treasury yields have backed up 95 bps from their April lows. Most of the rise has been due to higher real yields (see chart below); changes in growth expectations from strong macroeconomic data will do that. An increase in Treasury issuance – much larger than the market expected – also contributed. Japan’s attempt at policy normalization yet another driver that boosted yields.

With rates on the move, the market is adjusting.

The iShares 20+ Year Treasury Bond ETF (TLT) just experienced $1.8 billion in outflows in the past week. This is a staggering 5% of assets of TLT – a massive liquidation event.

The only time TLT underwent a larger outflow was March 20, 2020 when there was a massive -$3.9 billion in outflows – exactly 1 trading session prior to the COVID-19 market bottom.

Source: Ned Davis Research, FS Insight

U.S. municipalities to survive the office exodus

Declining office occupancy rates have municipal bond investors concerned, but a recent report from Alliance Bernstein suggests that U.S. cities aren’t nearly as dependent on commercial and office taxes as many believe.

It’s true that, outside of federal government transfers, property taxes are typically the largest source of tax revenue for large cities, but they account for only 30% of total revenue, on average, according to the Urban Institute – with office contributing just a portion of that.

In fact, of the largest U.S. cities by debt outstanding, commercial or office property taxes account for just 6.8% of total revenues, on average.

Cities have other important sources of revenue they can tap. These include income taxes, sales and use taxes, user charges (such as sewerage and parking meter payments), and intergovernmental transfers.

Source: Urban Institute, Alliance Bernstein

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.