Fast food inflation, plus residential mortgages, tax refunds, and investor sentiment

The Sandbox Daily (4.18.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

fast food affordability

solid fundamentals for residential mortgages

tax refunds are bigger but fewer of them

sentiment sinks following recent market chop

Editor’s note: The Sandbox Daily will be off Friday, April 19. Expect your next market update to arrive in your inbox on Monday next week. Enjoy your weekend!

And now, let’s dig in.

Markets in review

EQUITIES: Dow +0.06% | S&P 500 -0.22% | Russell 2000 -0.26% | Nasdaq 100 -0.57%

FIXED INCOME: Barclays Agg Bond -0.28% | High Yield +0.08% | 2yr UST 4.992% | 10yr UST 4.637%

COMMODITIES: Brent Crude -0.55% to $86.81/barrel. Gold -0.15% to $2,394.4/oz.

BITCOIN: +3.76% to $63,632

US DOLLAR INDEX: +0.20% to 106.158

CBOE EQUITY PUT/CALL RATIO: 1.13

VIX: -1.15% to 18.00

Quote of the day

“I can’t change the direction of the wind, but I can adjust my sails to always reach my destination.”

- Jimmy Dean

Fast food affordability

Americans love fast food – that’s no secret. What don’t they love? Paying more for fast food.

For the 10-year period from 2014 to 2024, average menu prices have risen between 39% and 100% — all increases that outpace inflation during the given time period (31%).

The golden arches was the biggest offender of the group, effectively doubling their prices over this time frame.

The dramatic price increases at McDonald’s – a chain recently in the headlines for $18 Big Mac meals – are pronounced across the entire menu, so it’s not specific to any one food group. Food prices are just unilaterally higher across the board – similar to anecdotal experiences that Americans are enduring at the supermarket.

The major appeal of fast food is that its fast and at a cheap price – but these days fast food is weighing heavy on consumer wallets.

Source: Finance Buzz

Solid fundamentals for residential mortgages

Residential mortgage performance has been a bright spot in the U.S. housing market over the past three years.

While other measures of health for the housing market, such as affordability and home sales, remain challenged by the high rate environment, credit stress across the US mortgage market has stayed benign. Less than 0.5% of outstanding mortgages are in foreclosure, representing near record lows, and new delinquency rates remain contained, albeit slightly higher over the past two quarters.

Through the back-up in mortgage rates so far, three key macroeconomic factors have supported loan performance.

1st, U.S. homeowners are sitting on roughly $32 trillion in total equity. This buffer for investors has expanded over recent years as home prices have appreciated by 45% nationwide over the past three years and high funding costs disincentivized mortgage borrowers from cashing out home equity.

2nd, alternative housing options are particularly unappealing in the current housing market, with a stark gap between new and existing mortgage rates and limited inventory of single-family housing.

Last, the labor market remains on a solid footing at 3.8% unemployment.

Source: Goldman Sachs Global Investment Research

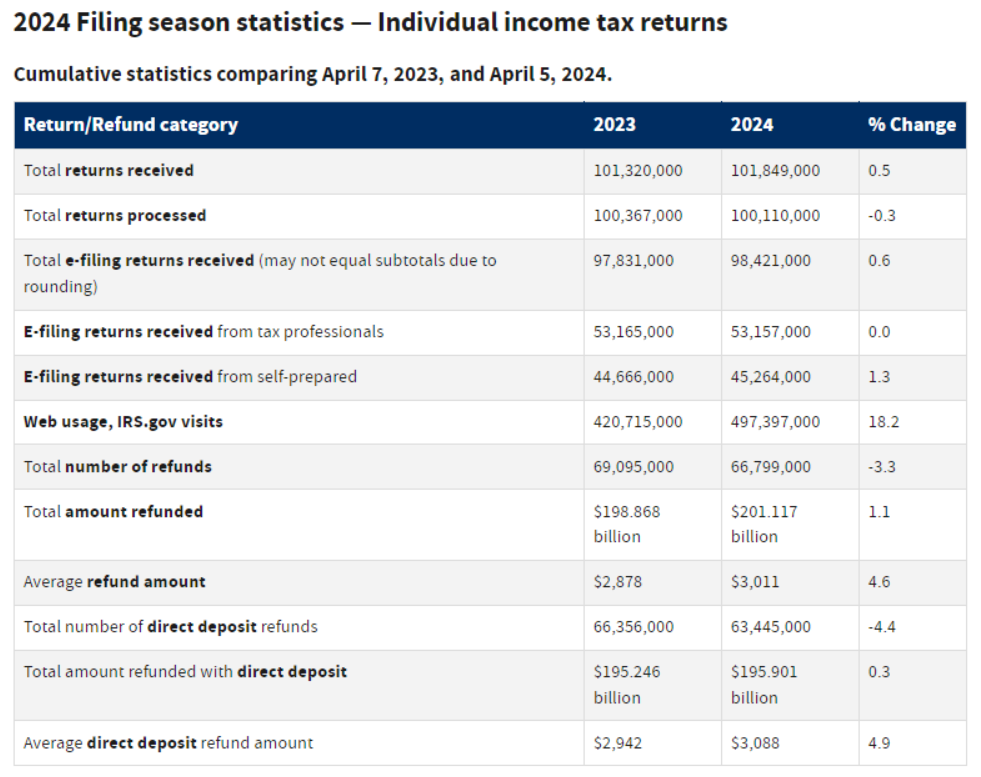

Tax refunds are bigger but fewer of them

Tax Day 2024 is officially behind us. For many Americans, this means refund checks are on the way — but not as many as in previous years.

IRS data shows that while this year’s average tax refund check is bigger than last year’s, fewer taxpayers expect to receive them. Here’s why.

In the first week of April, the average tax refund was more than $3,000, up from just under $2,900 the year before – a roughly 5% increase year-over-year. This increase is likely due to recent updates to the tax code.

For example, the IRS introduced a higher standard deduction for single filers – $13,850, up from $12,950 in 2022. The IRS also increased contribution limits for retirement plans. Both of these updates make it easier for taxpayers to reduce their taxable income and liability, which can lead to receiving a higher refund.

However, the total number of refunds issued was down 3.3% from last year.

That’s becoming something of a trend: the number of refunds has fallen in the two previous years as well. This may be related to the rise of the gig economy and independent contract work. Without traditional employers to withhold taxable income or file on their behalf, contract employees may be paying less in taxes throughout the year, and consequently receiving smaller refunds or even owing money.

Some see this trend as a positive development, since refunds aren’t really free money, but rather money you’ve already spent in overpaid taxes – almost akin to a savings stash that isn’t collecting interest.

Source: Internal Revenue Service, Axios, AP News

Sentiment sinks following recent market chop

After a week of steady declines for the market, the American Association of Individual Investor’s bull/bear investor sentiment spread – or the number of bulls minus the number of bears – has quickly moved back down near the flat-line.

At 38%, Bullishness sentiment has reached its lowest levels of the year.

At 34%, Bearishness is higher than at any point in 2024, increasing 10 points this week – the largest week-over-week increase since November 2022. In fact, the level of bears hasn’t reached this magnitude since equities bottomed last fall, specifically late October/early November.

Source: American Association of Individual Investors, Dwyer Strategy, Bespoke Investment Group

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.