Fed adds liquidity, plus hikes-to-cuts, corporate borrowing, and the week in review

The Sandbox Daily (3.24.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed provides massive liquidity to the banks

From hikes to cuts

Corporate borrowing stable, for now

a brief recap to snapshot the week in markets

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.85% | S&P 500 +0.56% | Dow +0.41% | Nasdaq 100 +0.30%

FIXED INCOME: Barclays Agg Bond +0.17% | High Yield -0.20% | 2yr UST 3.783% | 10yr UST 3.378%

COMMODITIES: Brent Crude -1.30% to $74.92/barrel. Gold -0.72% to $1,998.9/oz.

BITCOIN: -2.21% to $27,612

US DOLLAR INDEX: +0.57% to 103.117

CBOE EQUITY PUT/CALL RATIO: 0.77

VIX: -3.85% to 21.74

Quote of the day

“An investment in knowledge pays the best interest.”

-Benjamin Franklin

Fed provides massive liquidity – aka the plumbing – to the banks

Banks borrowed a record amount from the Federal Reserve’s Discount Window over the last week, racing to secure sufficient liquidity to offset flighty deposits wreaking havoc on the banking system.

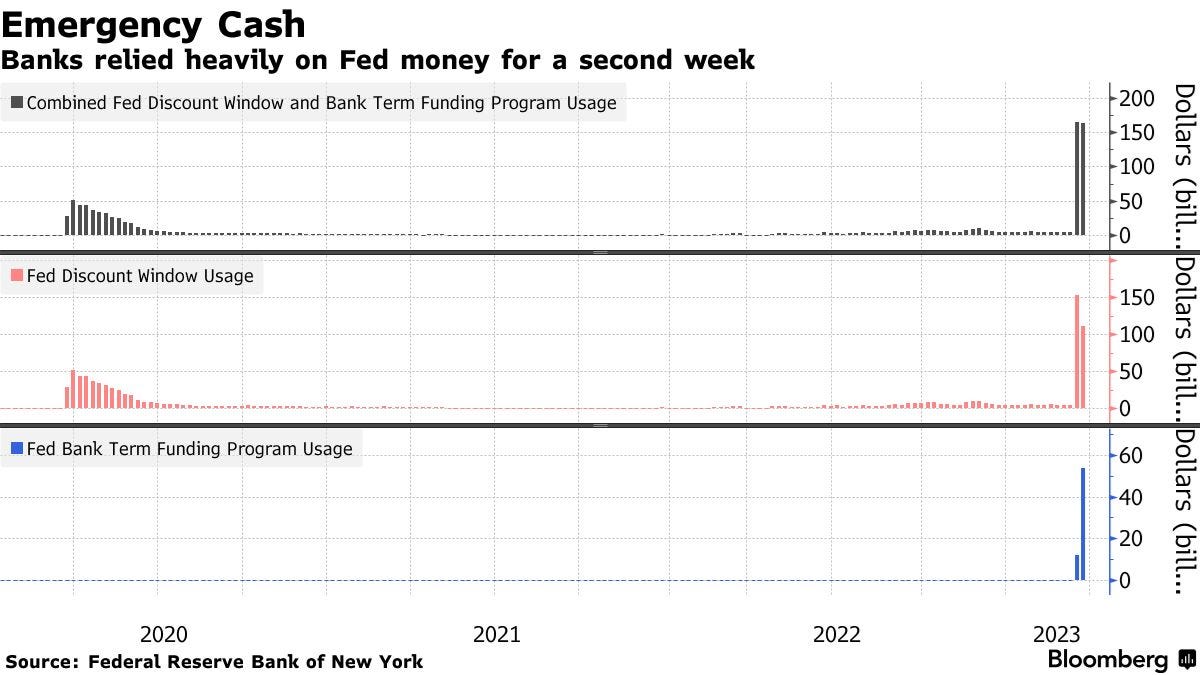

U.S. banking institutions are holding a combined $163.9 billion dollars in outstanding borrowings (1st panel in chart below) from the Fed this week, down slightly from $164.8bn the previous week.

$110.2bn is being borrowed from the Fed’s traditional backstop lending facility called the Discount Window (2nd panel in chart below). The other $53.7bn in borrowings come courtesy of the newly-launched Bank Term Funding Program (3rd panel in chart below), which opened on March 12th following the state of emergency which stemmed from the collapses of both Silicon Valley Bank and New York Signature Bank.

The Discount Window – which is catching headlines this week – is the main direct lending facility provided by the Fed to support stability and provide liquidity to the U.S. banking system. It enables the central bank to lend banks money for up to 90 days. While the service is always available to banking institutions, it’s particularly popular at moments of market or institutional stress when getting funds from elsewhere proves difficult. The banks get cash in return for providing collateral — securities like government bonds — that the Federal Reserve can keep if the loan isn’t repaid.

Funding markets had been showing signs of slowing/stress, though pressures have subsided with the take-up of emergency measures. Prior examples of tapping the Discount Window have included 9/11, the Global Financial Crisis, and the onset of COVID-19. The current levels of borrowing from the Discount Window far exceed any prior period in history – though, to be clear, we must keep in mind that asset values and the money supply are much higher in 2023.

The massive extension of credit to U.S. banks has caused temporarily caused the Fed’s balance sheet to balloon again, effectively reversing much of the Quantitative Tightening (QT) achieved this cycle.

These policies are aimed to provide ample liquidity in credit markets to keep the plumbing across the system fluid, however many investors are upset that these Federal credit programs are Quantitative Easing (QE) in disguise.

For those interested in a deeper dive on whether this is QE or not – as well as how these Federal credit facilities work – I encourage you to read Ayesha Tariq’s The Fed’s Super Discount Window is not QE.

Source: Federal Reserve, Bloomberg, Bianco Research

From hikes to cuts

Rate cuts will be a key theme and driver for markets in the second half of 2023.

It’s important to remember that the Fed never leaves it long between hiking and cutting rates. Historically, it has been just six months between the last hike and the first rate cut.

Source: ING

Corporate borrowing stable, for now

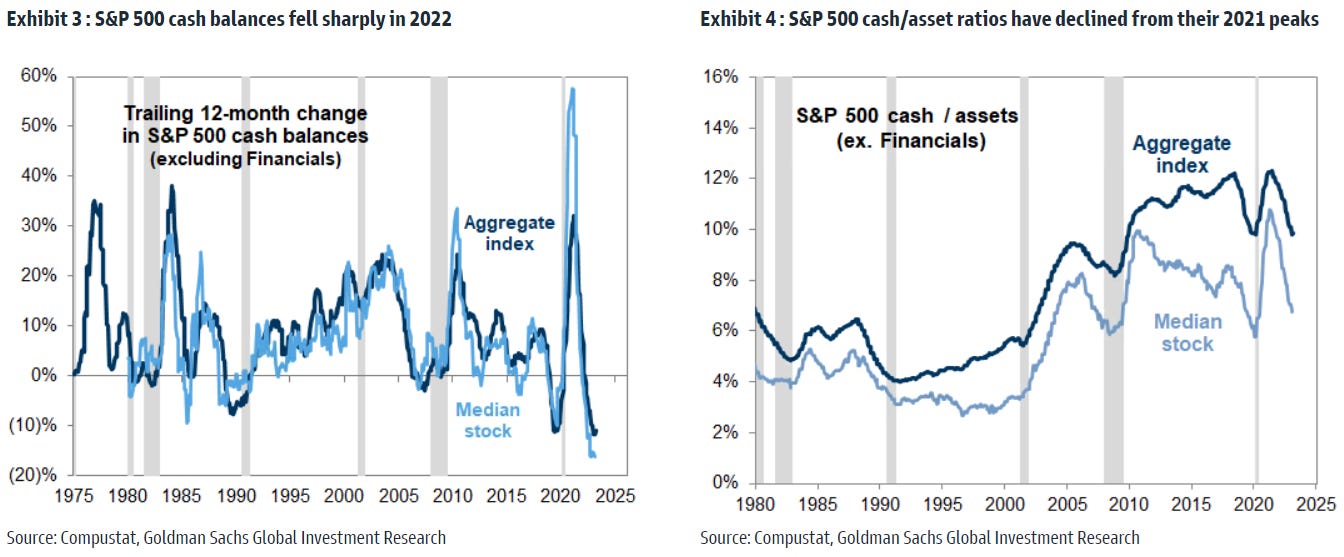

Long maturity, fixed rate debt has helped S&P 500 companies keep interest expenses near record lows despite the sharp increase in interest rates during the past two years.

In 2022, S&P 500 non-Financial borrow costs (interest expense/debt) registered just 3%, roughly in line with the average 10-year Treasury yield during the year, while extended debt maturities that were refinanced during the pandemic will help keep these costs low for many years to come.

However, the desire to protect profit margins from rising interest expenses and maintain necessary corporate spending programs has led to a rapid erosion of cash balances. S&P 500 cash fell by 12% in 2022, the largest annual decline on record, and cash/assets has dropped from a record high in 2021 to now the lowest level since 2010.

As companies cut expenses and hoard cash during this difficult environment, expect falling buybacks and muted CapEx growth in 2023.

Source: Goldman Sachs Global Investment Research

The week in review

Talk of the tape: Banks remain the headline this week with concerns about safety of deposits, liquidity in the system, credit availability, and further interest rate hikes.

Recent (negative) areas of focus in the press have revolved around the central bank balancing act between inflation and financial stability risks, lackluster investor sentiment, heightened concerns about Commercial Real Estate, broadening of layoffs beyond the technology sector, and additional signs of stabilization in housing.

More upshot dialogues emphasize soft/no landing scenarios, a broader (albeit choppy) disinflation trend, corporate cost-cutting efforts, elevated cash levels and still below average positioning, recent technicals holding, and the China reopening story.

Stocks: Stocks ended the week higher amid a volatile week of trading, with tech-focused segments showing relative strength. Bank balance sheets continue to be a concern for investors, in addition to hawkish global central banks’ response to persistent inflation pressures. The most recent bank challenges has market participants concerned over more banking woes as some investors believe the economy may be on the brink of recession.

Bonds: The Bloomberg Aggregate Bond Index finished the second straight week higher as yields declined, reversing a pattern of lower bond prices and higher yields. Given the concerns over the banking landscape, bond investors believe the Fed will eventually reverse course on monetary policy and the “higher-for-longer” theme.

Investment grade corporate new issuance may decelerate for a third consecutive year in 2023, even after an aggressive pace in the primary market over the past several weeks. Increased volatility and funding costs that remain higher across the curve have started to temper volume, with the year-to-date calendar about 5% behind the 2022 pace as of mid-March. Decreased new issuance could be a tailwind for corporate bond prices. We prefer shorter maturity high quality corporates at this point.

Commodities: Energy prices finished mixed even as traders remain concerned over the present banking climate and its potential effect on the economy. Crude oil rallied after reaching a 15-month low two weeks ago. Natural gas prices declined for the second straight week as winter makes an exit in the United States. The major metals, gold, silver, and copper, ended the week mixed as some investors sought refuge in precious metals given the prior week’s banking news. In addition, Chinese central bank buying of gold has also helped the recent return dynamics of this precious metal.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.