Fed announces a pause on interest rate hikes (finally)

The Sandbox Daily (6.14.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed pauses/skips after 10 consecutive hikes, signals very hawkish outlook

don’t just do something, sit there

wholesale prices (PPI) for May point to further easing of inflation pressures

stock and bond volatility saying different things

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.70% | S&P 500 +0.08% | Dow -0.68% | Russell 2000 -1.17%

FIXED INCOME: Barclays Agg Bond +0.09% | High Yield +0.04% | 2yr UST 4.696% | 10yr UST 3.792%

COMMODITIES: Brent Crude -0.86% to $73.65/barrel. Gold -0.14% to $1,955.8/oz.

BITCOIN: -2.79% to $25,182

US DOLLAR INDEX: -0.32% to 103.011

CBOE EQUITY PUT/CALL RATIO: 0.56

VIX: -5.00% to 13.88

Quote of the day

“There's a lot of blood, sweat, and guts between dreams and success.”

- Bear Bryant, Head Football Coach, University of Alabama

Fed pauses/skips after 10 hikes, signals very hawkish outlook

After 10 straight rate hikes that began on March 16th, 2022, the Federal Reserve left interest rates unchanged for the 1st time since its January 2022 FOMC meeting. Today's Fed decision to pause was supposedly a unanimous 11-0 decision.

The target range on the Fed Funds Rate remains at 5.00 – 5.25%.

Over the past 15 months, the Fed had raised interest rates by a cumulative 500bps – its fastest tightening cycle in over four decades – in an effort to curb soaring inflation as the economy recovered from the pandemic.

The most recent Dot Plot, which are the future rate projections from each FOMC member, shows a 5.6% median estimate of the Fed Funds Rate for 2023 year-end – up from the forecast of 5.1% in March, as outlined in the updated Summary of Economic Projections from this meeting.

The increase from 5.1% to 5.6% for the 2023 year-end rate initially shocked the market, sending stocks down albeit briefly, because the Dot Plot implies two more rate hikes to come from the Fed.

Reviewing the Summary of Economic Projections document shows the Fed no longer expects the U.S. to potentially enter recession in 2023 when looking at their GDP forecasts. Also, the Fed now expects a 4.1% unemployment rate at the end of 2023, down from the 4.5% projection back in March.

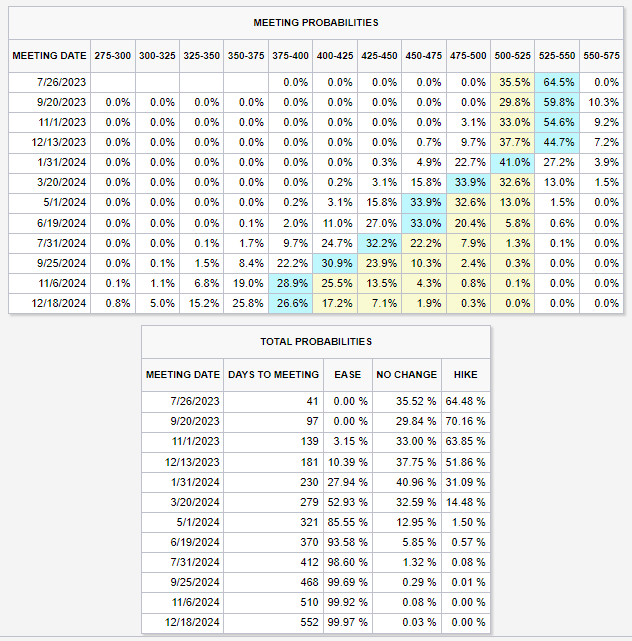

Looking out at future policy meetings, the market is firmly pricing in one more rate hike – as early as the next meeting with an almost 65% chance. One thing is certain: neither the market nor a single FOMC member is projecting a rate cut in 2023, which stands in stark contrast to what the market was expecting just a few weeks ago.

The majority of the language in the Fed’s statement was unchanged:

The economy remains on healthy footing at the moment but is indisputably slowing. Now, the central bank faces its toughest test yet. In the coming months, does the Fed continue talking hawkish and raising the target overnight rate, or does it permanently pause and allow the cumulative effects of its tighter monetary policy to run its course through the U.S. economy?

The FOMC meets again in six weeks on July 26th. The Fed remains data-dependent, so macro eco data will remain on close watch.

Source: Federal Reserve, FOMC Summary of Economic Projections, Investopedia, Bloomberg, Nick Timiraos, Wall Street Journal, Ned Davis Research

Don’t just do something, sit there

I was a double-major at the University of Michigan – philosophy and history – on my way to law school, only to realize I had no interest writing briefs all day long.

But one book that always stuck with me from my Philosophy coursework was Sylvia Boorstein’s Don’t Just Do Something, Sit There.

Call it hyperactivity, call it the temptation to fiddle. We all have a tendency to make trades or changes just to show we are actively managing our positions. Sometimes inaction is the best action.

Source: Brian Feroldi

Wholesale prices (PPI) for May point to further easing of inflation pressures

The Labor Department released its latest Producer Price Index (PPI) for May, tracking inflation from the standpoint of manufacturers and wholesalers.

May's PPI report (producer prices) confirms what the CPI report (consumer prices) showed Tuesday morning – price growth is moderating – with wholesale prices falling -0.3% in May.

Headline PPI rose just +1.1% year-over-year, down from +2.3% in April and the lowest reading since December 2020! The cycle peak was +11.7% back in March 2022, with the index down 13 of the last 14 months. Looking back at a longer time frame of the data series, the current readings are in line with historical measures.

The PPI report differs from the CPI report in that it measures prices that producers pay for the goods and services they need.

"There aren't as many factory price increases in the pipeline waiting in ambush for consumers and that spells relief for the inflation-weary American public," said Christopher Rupkey, chief economist at FWDBONDS in New York.

Source: Bureau of Labor Statistics, Ned Davis Research, Bloomberg

Stock and bond volatility saying different things

Implied volatility in the stock (VIX) and bond (MOVE) markets tell an unusual tale of investor sentiment. Implied volatility uses options contracts to measure the expected price movement of a security or index.

The ratio of the VIX to the MOVE index is at its lowest level in 27 years. Such tells us that bond traders expect significant volatility in the future in bond yields, while stock investors are relatively complacent.

The VIX, currently around 14, is well below its 30+ year average of 20. It is also below levels preceding the pandemic. Unlike the potentially complacent VIX, the MOVE index is at 116, about 15% above the recent average and nearly double its longer-term average.

So why does the MOVE index voice concern that interest rates will be volatile, while the VIX shows investors don't seem to care? Given the economy is powered by debt, the level of interest rates is a crucial factor in determining economic activity. When yields are unpredictable, as the MOVE alludes, the ability to forecast stock earnings, debt costs, and valuations is more complicated.

Source: The Daily Shot

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.