Fed Chair Powell suggests rate cuts are coming. What it means for you.

The Sandbox Daily (8.25.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed Chair Powell sends rate cut signal

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.31% | S&P 500 -0.43% | Dow -0.77% | Russell 2000 -0.96%

FIXED INCOME: Barclays Agg Bond -0.15% | High Yield -0.20% | 2yr UST 3.731% | 10yr UST 4.281%

COMMODITIES: Brent Crude +1.57% to $68.79/barrel. Gold -0.23% to $3,410.7/oz.

BITCOIN: -5.57% to $110,261

US DOLLAR INDEX: +0.76% to 98.463

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: +4.01% to 14.79

Quote of the day

“In any creative project, you can’t imagine what the end is going to be, unless it is a very small thing you’re doing.”

- Robert Pirsig

Fed Chair Powell sends rate cut signal

Fed Chair Jerome Powell's speech at the Jackson Hole 2025 Economic Symposium provided the green light that the central bank will resume its interest rate cutting cycle, perhaps as early as the September 17 FOMC meeting. The last reduction in the Fed Funds Rate to ease policy was back in December 2024.

Powell acknowledged that while uncertainty remains around tariffs and inflation, these concerns must be balanced against supporting the job market – a shift in the Fed’s balance of risks that “may warrant adjusting policy stance.”

Markets are hovering around all-time highs, suggesting that investors are aligned with the trajectory of Fed policy and have confidence in this economy.

So, what does a potential rate cut mean for investors?

Why market confidence in the Fed matters

Fed credibility is essential for effective monetary policy. While the Fed sets short-term rates, markets determine longer-term rates – like those for mortgages and corporate borrowing – based on their confidence in the Fed’s ability to achieve its goals through both rate setting and guidance.

Here, history offers a lesson.

In the 1970s, when the Fed lost credibility by allowing prices to surge, bond market investors effectively increased interest rates anyway by demanding higher yields to offset inflation risk.

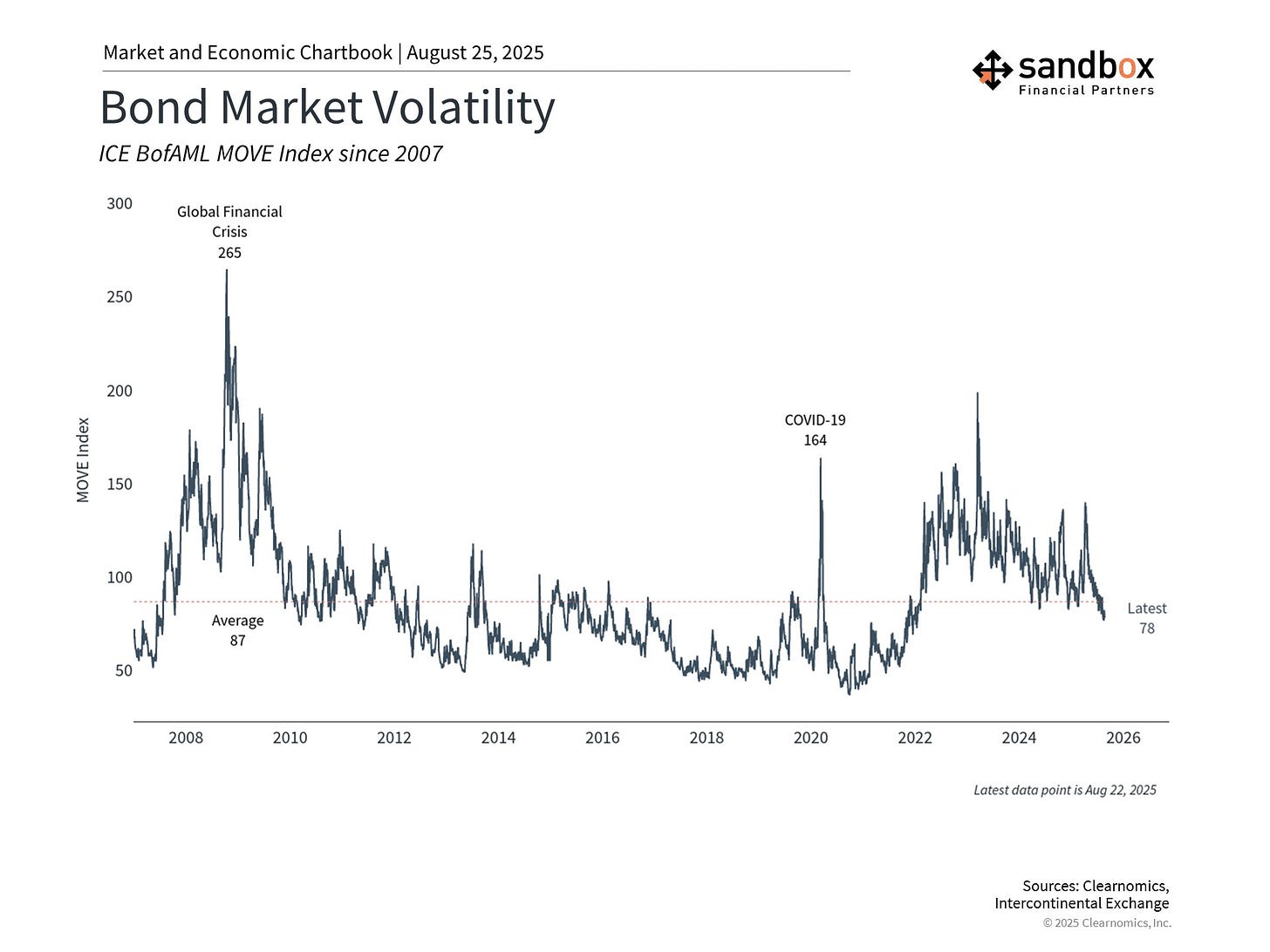

In contrast, strong Fed guidance in the post-2008 period helped anchor inflation expectations – even during pandemic-era volatility.

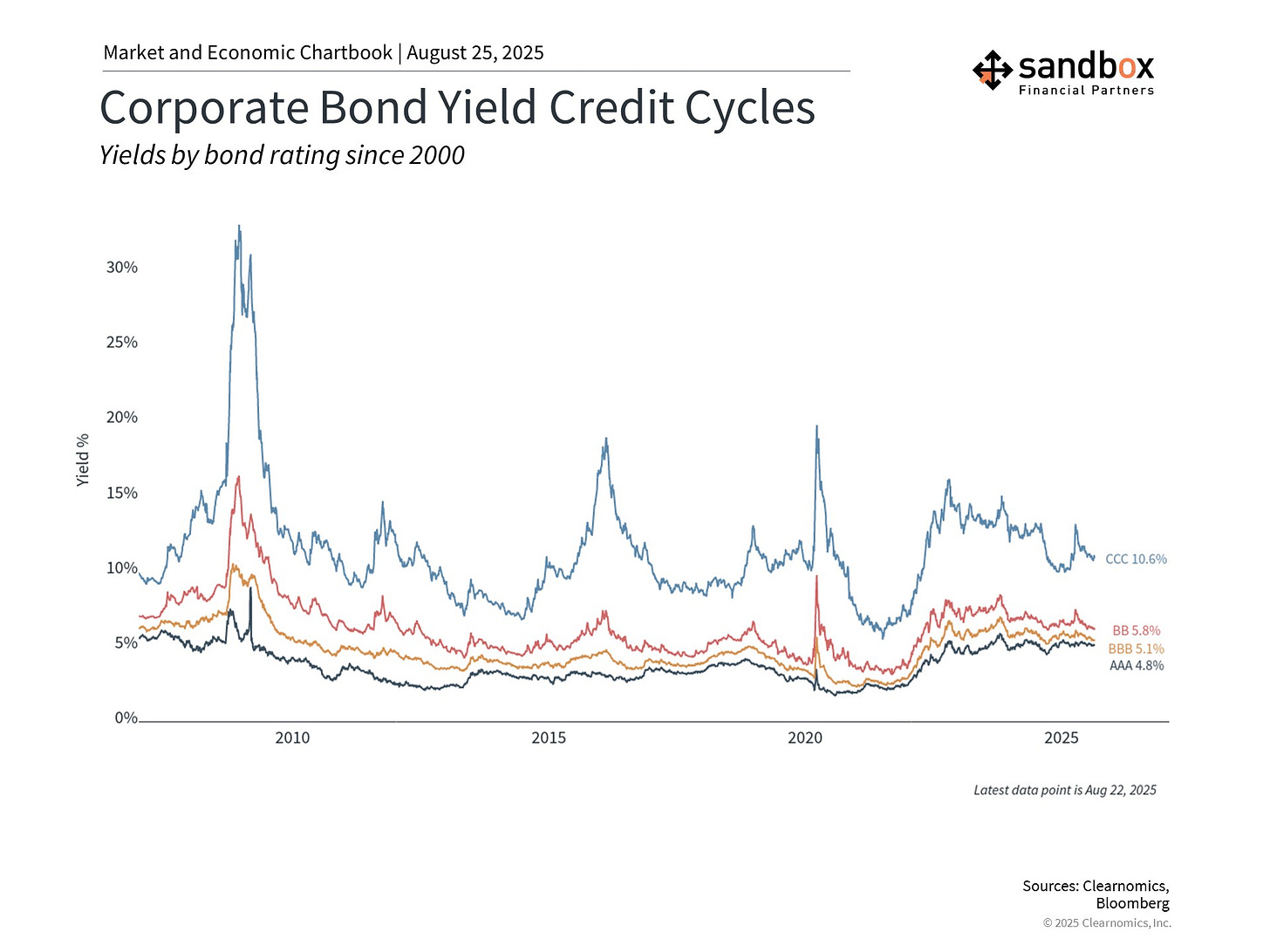

Corporate bond yields and credit spreads are key indicators of this confidence. Today, both are near multi-year lows, signaling investor comfort with credit – see the chart below.

This is consistent with major stock market indices printing all-time highs due to investor confidence.

The Fed is signaling rate cuts

Powell's Jackson Hole speech reflects the delicate balance the Fed must strike between controlling inflation and supporting employment.

While the Fed chair noted that "risks to inflation are tilted to the upside" due to tariff impacts, he also emphasized "significant risks to employment to the downside."

Inflation risks remain elevated – core PCE rose 2.8% over the past year – but employment data is softening.

July's jobs report revealed that only 73,000 new positions were added, well below historic averages. Yet it was the downward revisions to prior months that suggested the job market has been cooling more than initially believed. Unemployment has remained steady between 4.0% and 4.2%, but this stability partly reflects reduced labor force participation and changes in immigration policy affecting labor supply.

The Fed's challenge is to assess whether tariff-driven price increases represent a temporary adjustment or are a sign of worsening inflationary pressures.

For now, the Fed appears to be positioning for cautious and proactive rate cuts, while the bond market appears to dismiss any sign of imminent risk.

Rate cuts create opportunities across bond sectors

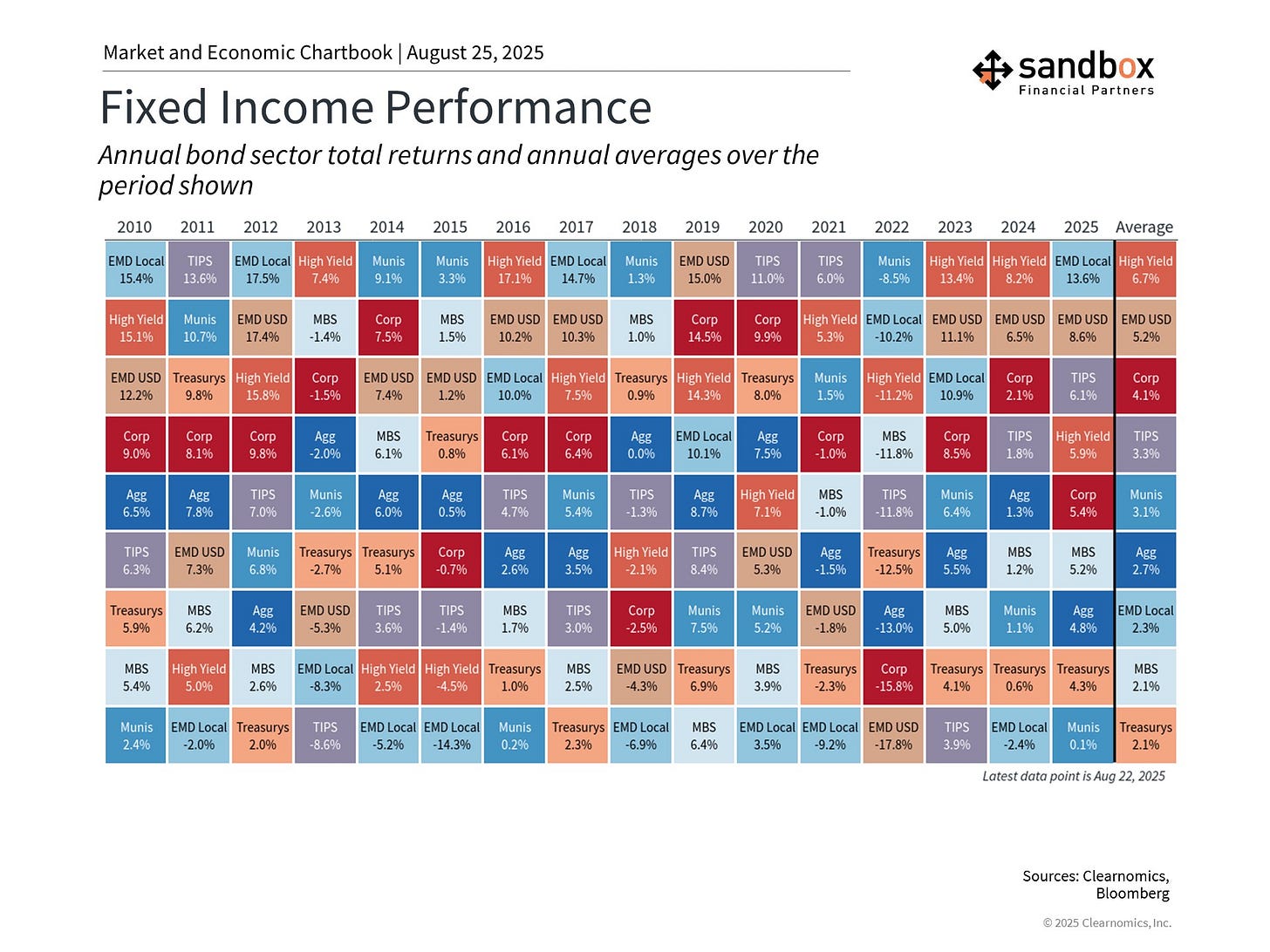

The prospect of Fed rate cuts has important implications for all investors.

In a vacuum, rate cuts typically boost bond prices.

The U.S. Aggregate Bond Index is up 4.8% this year, while yields remain attractive: ~4.0% for Treasuries, ~5% for investment-grade corporates, and ~7% for high-yield credit. For savers and retirees, these yields are far higher than the average levels since 2008.

For stock investors, lower rates reduce corporate borrowing costs, potentially driving growth and supporting higher equity valuations.

Of course, when credit spreads are tight and market valuations are high, it’s important to remain disciplined – future return potential may be limited should conditions deteriorate versus expectations.

This doesn't mean avoiding stocks or bonds with new (or existing) money, or even trying to time the market, but instead highlights the importance of holding a well-constructed and diversified portfolio to balance these risks.

Bottom line?

Strong market confidence in Fed policy and resilient corporate fundamentals create opportunities for long-term investors.

Sources: Federal Reserve, Clearnomics, YCharts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)