Fed day and options flow, the revival in energy markets, crypto liquidations, and KISS

The Sandbox Daily (11.1.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the expectations for tomorrow’s FOMC announcement, the revival in energy markets, last week’s short liquidation event in crypto, and the KISS principle.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.25% | Dow -0.24% | S&P 500 -0.41% | Nasdaq 100 -1.02%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.60% | 2yr UST 4.551% | 10yr UST 4.048%

COMMODITIES: Brent Crude +2.11% to $94.77/barrel. Gold +0.63% to $1,651.0/oz.

BITCOIN: +0.35% to $20,462

US DOLLAR INDEX: -0.01% to 111.516

CBOE EQUITY PUT/CALL RATIO: 0.63

VIX: -0.07% to 25.81

Fed day and options flow

Tomorrow, the Federal Open Market Committee (FOMC) will announce another change to their policy lending rate, the federal funds rate, as well as offer forward guidance on the future of monetary policy and reflect on their assessment of the general health and well-being of the U.S. economy. To date, the Fed has raised interest rates 5 times since March 2022 for a cumulative three percentage points and tomorrow we are expecting another 0.75%. As such, we've seen some of the biggest Fed day market swings of the past two decades this year – second only to 2008. The average move for the S&P 500 on Fed day is ~1.9%.

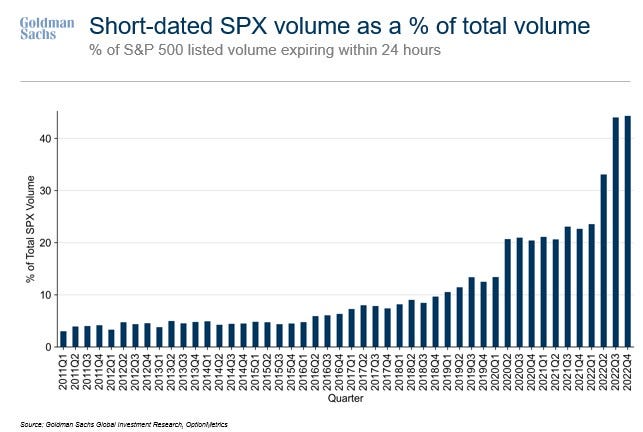

Part of these moves are being amplified by the derivatives market where short-dated options have exploded in popularity – meaning some of these wild days are being driven by hedgers (generally longer-term investors) AND speculators (the opposite) alike. During the 3rd quarter, S&P 500 options expiring within one day accounted for more than 40% of total volume, almost doubling from 6 months ago, according to data compiled by Goldman Sachs Group Inc.

In fact, Tuesday marked the 26th time in 2022 where the S&P 500 erased a gain or loss of at least 1% in a single session. Not since the 2008 financial crisis has the market experienced such frequent swings. And to no surprise – options contracts that expire within the next 24 hours dominated the ranks of the most traded issues today.

The rush reinforces concern that derivatives can amplify moves in underlying assets, potentially creating market dislocations. And when Fed day aligns with a heavy volume day in the options market, well…

Tomorrow, we should get a good read on the future of monetary policy and get another big up/down day.

Source: eToro, Bloomberg, Goldman Sachs

Ex-energy, S&P 500 reporting a decline in earnings for the 2nd straight quarter

The blended earnings growth rate for the S&P 500 for the 3rd quarter is +2.2%. At the sector level, only four sectors are reporting year-over-year (YoY) growth in earnings for the quarter. However, the Energy sector is reporting the highest earnings growth of the four sectors at +134%. In fact, the earnings growth is broad-based and happening across all major sub-groups within the Energy sector: refining, exploration & production, equipment & services, and integrated.

If the Energy sector is excluded, the S&P 500 would be reporting a YoY decline in earnings of -5.1% rather than a YoY increase in earnings of +2.2%. This would mark the second consecutive quarter in which the index would be reporting a year-over-year decline in earnings excluding the Energy sector.

Energy is also expected to be the largest contributor to earnings growth for the S&P 500 for all of calendar year 2022. If the Energy sector is excluded, the index is expected to report a YoY decline in earnings of -0.6% rather than a YoY increase in earnings of +6.1%.

Energy continues to be an area of absolute and relative strength throughout 2022, building on the strong foundation set in 2021. The revival in energy markets continues…

Source: FactSet

Crypto short squeeze

Last week was the largest short liquidation event in history for Bitcoin and Ethereum, with more than $1.6 billion in short positions closing between October 24 to 31, according to data from Cryptoquant. The liquidations came as markets found strength with BTC and ETH, over the same period gaining +8% and +19%, respectively, after a prolonged period of muted volatility.

One dynamic that contributed to this explosive move: extremely depressed implied volatility. Implied volatility is a forward looking metric that shows investor expectations for price volatility over a period of time. In the crypto space, this measure is typically calculated by looking at the demand for various dated options. Historically, when implied volatility hits a low point, prices tend to move violently in either direction, as evidenced by the following chart from Glassnode:

Could this be a bear market rally, or might we be out of the woods?

Source: Grayscale, Glassnode

The KISS principle

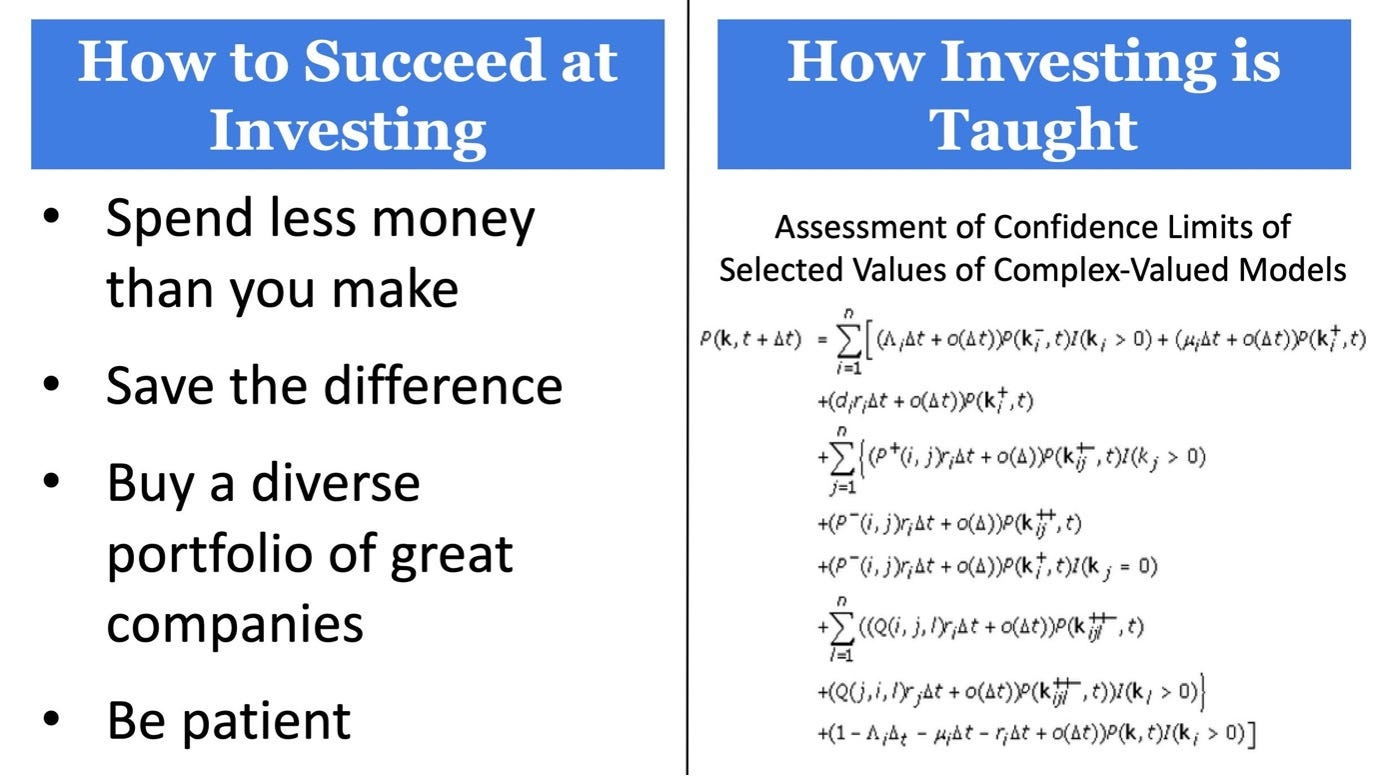

How to succeed at investing and how investing is taught are two completely different things. This overly simplistic checklist may lack depth but possesses the basic tenets for compounding quality over time (left), as opposed to what they’ll teach you from their ivory towers (right):

As many might say, “keep it simple, stupid!”

Source: Morgan Housel

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.