Fed easing is around the corner

The Sandbox Daily (7.1.2025)

Welcome, Sandbox friends.

Today is the 1st day of July, the 1st day of the 3rd quarter, and the 1st day of the 2nd half.

It’s also Bobby Bonilla Day! Every July 1st, retired All-Star 3rd baseman Bobby Bonilla receives a $1.19 million check from the New York Mets, despite retiring from Major League Baseball 25 years ago. The Mets owed Bonilla $5.9 million back in the year 2000, but instead of taking that cash up front, Bonilla’s agent worked out a contract that spreads out $30 million in guaranteed payments to him through annual installments from 2011–2035. 10 more to go!

Today’s Daily discusses:

easy monetary policy is coming

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.94% | Dow +0.91% | S&P 500 -0.11% | Nasdaq 100 -0.89%

FIXED INCOME: Barclays Agg Bond -0.09% | High Yield -0.13% | 2yr UST 3.772% | 10yr UST 4.241%

COMMODITIES: Brent Crude +1.02% to $67.42/barrel. Gold +1.26% to $3,349.5/oz.

BITCOIN: +0.72% to $105,694

US DOLLAR INDEX: -0.16% to 96.718

CBOE TOTAL PUT/CALL RATIO: 0.83

VIX: +0.60% to 16.83

Quote of the day

“The last stroke of the hammer breaks a stone. This doesn't mean that the first stroke is useless. Success is the result of continuous effort.”

- Jon Gordon

Easy monetary policy is coming

Judging from my inbox, timeline on Twitter, and the CNBC headlines crossing on my television screen, investors are refocusing on the timing and the likely impact of the potential Fed cuts in 2H.

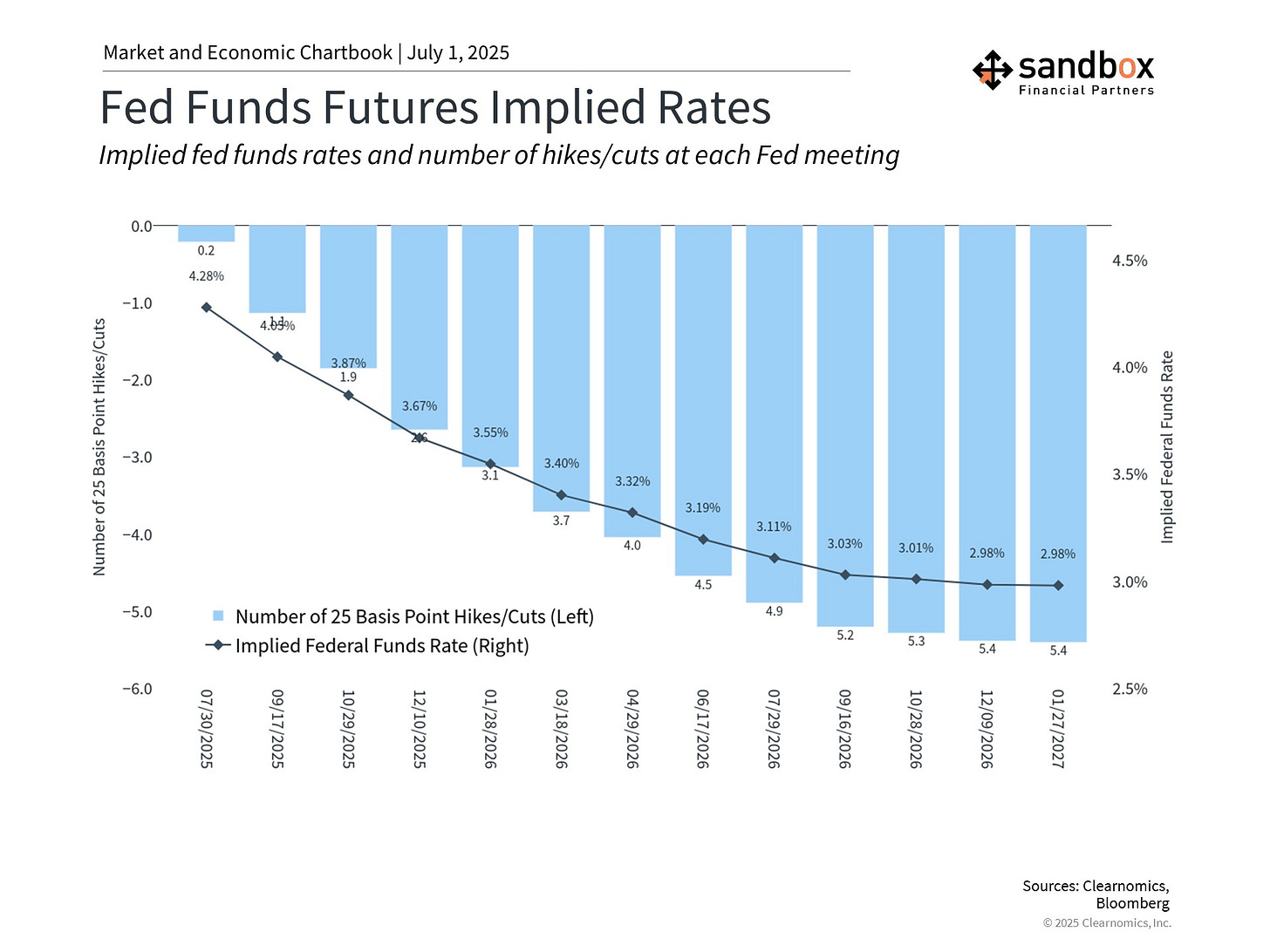

The latest Fed futures are implying nearly three cuts by year-end, at 67bps cumulative, across the September, October, and December Fed meetings.

Notably, the pricing in of rate cuts has accelerated in the past couple of weeks, during which an extra 20bps of easing was added.

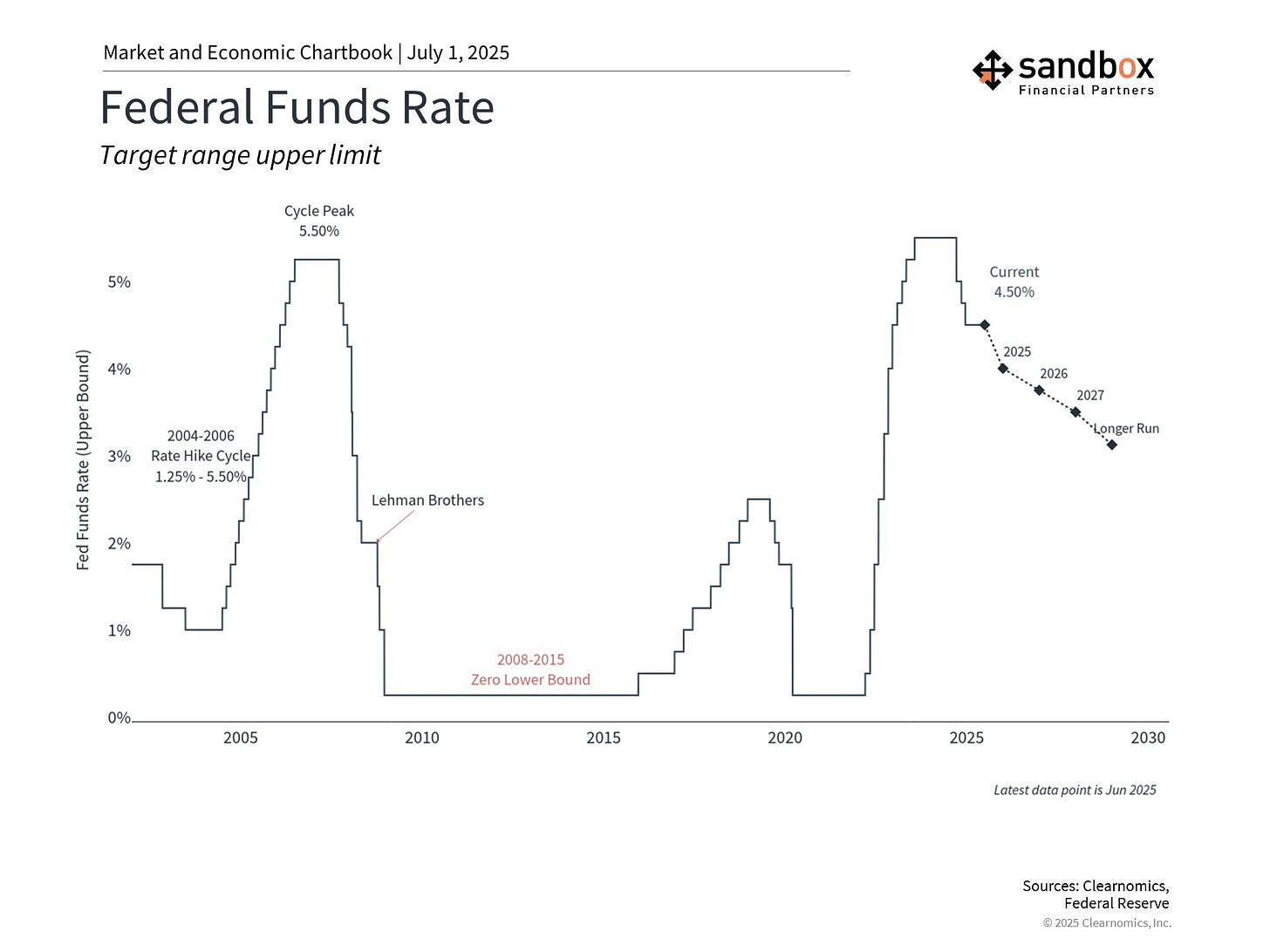

Jerome Powell and the Federal Reserve have been on hold this year after cutting rates by a total of 100bps in Q4 of 2024.

But, the recent shift in investor expectations has coincided with macro datapoints that continue to underwhelm, ongoing uncertainty around trade, and certain labor market indicators showing some softness.

Fedspeak, an unofficial yet critical tool the Federal Reserve uses to communicate its policy goals, is also shaping the change in narrative.

Recent comments from some members of the Fed have suggested that the central bank could be contemplating cutting rates as early as the July meeting.

Fed Governor Waller opined that the next rate cut could come as soon as the July meeting. This wasn’t entirely surprising, as Waller has been positioning himself more dovishly in recent months. Then it was Fed Vice Chair Bowman who also said a July cut could be in play. Bowman’s comments were quite the surprise as she’s been one of the more hawkish members of the committee, and her hawkish dissent last September was the first since 1994.

On the other side is Fed Chair Powell who is inclined to continue a gradual, wait-and-see approach to reading the data and exercising patience over the coming impact from tariffs, thereby pushing back on the notion of a July cut.

This next chart shows the expected path of the Federal Funds Rate. It also shows the number of 25 basis point rate cuts that would be needed to reach the implied rate from today's rate.

It implies the Fed is “behind the curve.” In simple terms, it means the Fed is keeping interest rates too high even though economic conditions – like falling inflation and lower bond yields – suggest it should already be cutting them. In this case, the bond market has priced in rate cuts, signaling that investors believe the Fed is lagging behind where policy should be to support growth.

Bottom line takeaway?

Lower yields are on the horizon and the market reaction will depend on the context of cuts.

Weaker growth expectations are likely not great for stocks, while subdued inflation readings are likely constructive..

Sources: Clearnomics, JP Morgan

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)