Fed hikes another 25 bps, plus "average" returns, IMF forecast, the Dow WOWs agains, and the market multiple

The Sandbox Daily (7.26.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed resumes its rate hikes

an average year isn’t so average

IMF raises growth forecasts as global economy heats up

the Dow continues to WOW

what is the right market multiple?

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.72% | Dow +0.23% | S&P 500 -0.02% | Nasdaq 100 -0.40%

FIXED INCOME: Barclays Agg Bond +0.33% | High Yield +0.40% | 2yr UST 4.851% | 10yr UST 3.873%

COMMODITIES: Brent Crude -0.82 % to $82.95/barrel. Gold +0.84% to $2,102.4/oz.

BITCOIN: +0.90% to $29,493

US DOLLAR INDEX: -0.32% to 101.026

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: -4.83% to 13.19

Quote of the day

“Good advice rarely changes, while markets change constantly. The temptation to pander is almost irresistible. And while people need good advice, what they want is advice that sounds good.”

- Jason Zweig

Fed resumes its rate hikes

The Federal Reserve raised its target interest rate again after taking a brief pause in June which followed 10 straight rate hikes beginning March 16th, 2022.

Today’s policy announcement brings the target range on the Fed Funds Rate to 5.25 – 5.50%. This is the highest target policy rate since March 2001.

The Fed’s decision to hike was unanimous, like the other meetings. This unanimity is mystifying because Fed officials step over one another publicly disagreeing between meetings.

Over the past 16 months, the Fed has raised interest rates by a cumulative 525bps – its fastest tightening cycle in over four decades – in an effort to curb soaring inflation as the economy recovered from the pandemic.

The Fed is saying they no longer forecast a recession, consistent with their recent Summary of Economic Projections document.

Looking out at future policy meetings, the market believes the Fed’s work is done. In fact, we may be looking at cuts.

The majority of the language in the Fed’s statement was unchanged versus June beyond a shifting characterization of economic growth from "modest" to moderate."

The economy remains on healthy footing at the moment but is showing signs of slowing. Now, the central bank faces its toughest test yet. In the coming weeks and months, does the Fed continue talking hawkish and raising the target overnight rate, or does it (permanently) pause and allow the cumulative effects of its tighter monetary policy to run its course through the U.S. economy?

The FOMC meets again in 8 weeks on September 20th. The Fed remains data-dependent, so macro eco data will remain on close watch.

Source: Federal Reserve, FOMC Summary of Economic Projections, Investopedia, Bloomberg, Nick Timiraos, Wall Street Journal, Ned Davis Research, Brown Technical Insights

An average year isn’t so average

This is a great reminder for investors because managing expectations is so important.

Stocks gain ~8-9% per year, on average. Yet, only 4 times since 1950 did they actually gain between 8-10%.

Parsing through the return data also shows that stocks were down in 21 calendar years, yet there were roughly the same amount of time periods – 20 to be exact – that they gained >20%.

So the message is stocks are RARELY average, and the big gains are just as likely as negative returns.

Source: Ryan Detrick

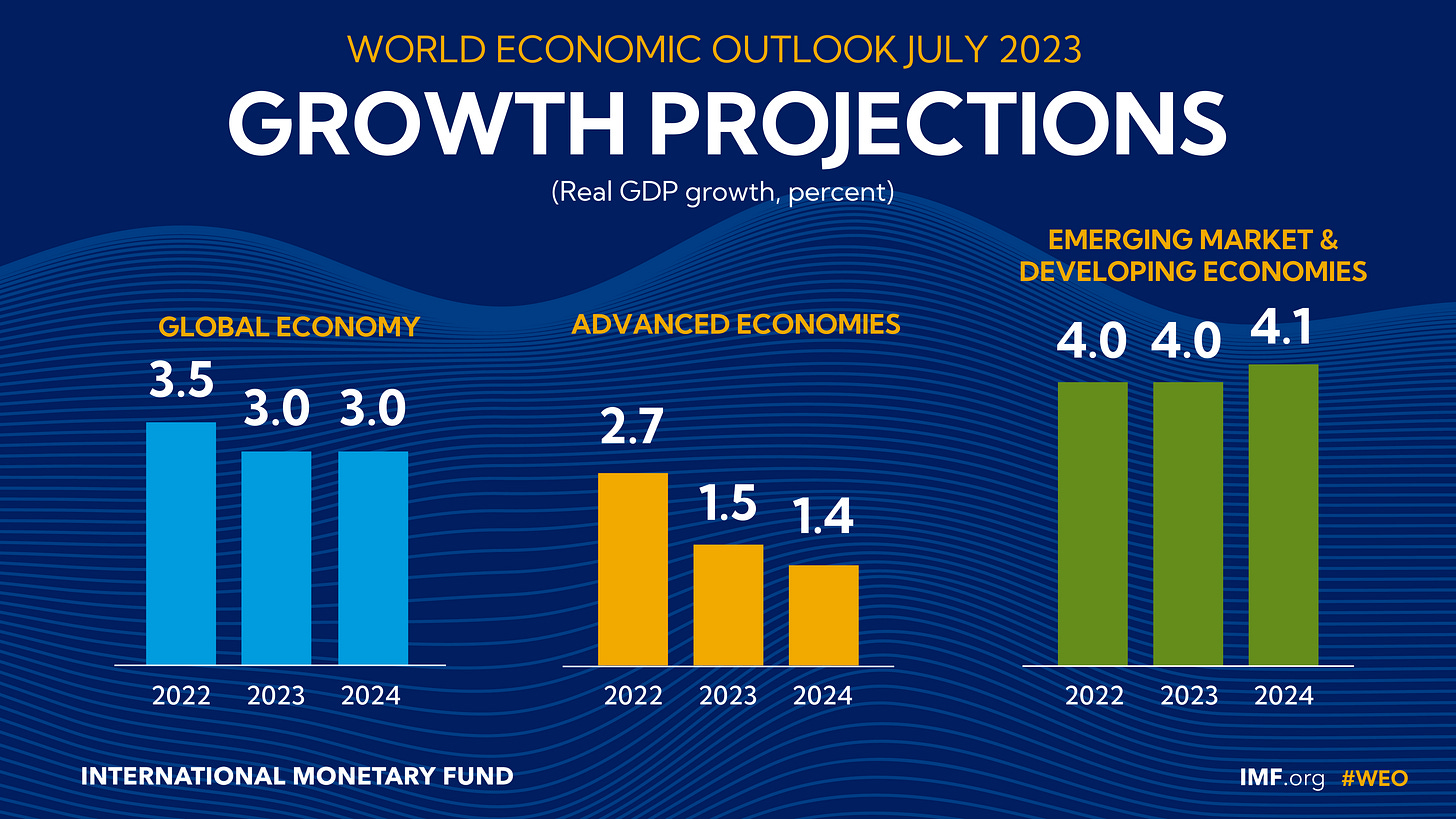

IMF raises growth forecasts as global economy heats up

Yesterday, the International Monetary Fund (IMF) updated their global growth forecast with two positive data points:

1) The global economy is expected to grow 3% in 2023 — down from 3.5% in 2022 but revised higher than their April projection of 2.8%.

2) Global inflation is expected to fall to 6.8% from 8.7% in 2022.

The IMF’s Chief Economist Pierre-Olivier Gourinchas thinks it’s “too early to celebrate” and while the near-term “signs of progress are undeniable, the battle against inflation is not yet won.”

Bottom line, the IMF outlook is not a market-moving announcement. BUT, what it does reflect is a recognition by economists, policy makers, investors and everyone in-between that recession risks are abating and the incoming economic data continues to be better-than-expected, albeit mixed.

Source: International Monetary Fund

The Dow continues to WOW

The Dow Jones Industrial Average (DJIA) is on a 13-day consecutive win streak and has joined the new 52-week high list alongside many other indexes. It was only a matter of time as stocks enjoy its bull fever off the October 2022 lows.

Here is the world’s most followed stock index finally breaking out of a major rounding bottom formation:

Upside follow-through this week after last week’s breakout shows risk remains to the upside.

The path of least resistance is higher for the Dow as long as it holds above the shelf of former highs from 2022 and earlier this year.

A breakout for “Papa Dow” has big implications for the broader market but it mainly confirms the primary uptrend in U.S. equities that’s been in place for roughly a year.

Source: All Star Charts

What is the right multiple

The 7 largest stocks in the S&P 500 – Apple (AAPL), Microsoft (MSFT), Amazon.com (AMZN), Google-parent Alphabet (GOOGL), Nvidia (NVDA), Meta Platforms (META), Tesla (TSLA) – account for 28% of the index’s market cap and have contributed 12% of the index’s 19% year-to-date total return.

In aggregate, these stocks trade at a 32x P/E vs. 20x for the aggregate index. The remaining 493 firms trade at 17x.

Investors seem to be asking: “well… which one is it?”

Source: Goldman Sachs global Investment Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.