Fed hikes target interest rate, plus S&P 500 after a negative year, Tesla's drawdown, dollar strength, and one simple investing principle

The Sandbox Daily (12.14.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the Federal Reserve’s announcement this afternoon to raise interest rates another 0.50% (target 4.25%-4.50%), reviewing S&P 500 performance after a negative calendar year’s return, Tesla’s current drawdown is its worst, 2022 U.S. dollar strength, non-OECD countries’ hyperinflation, and one simple graphic on investing principles.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.42% | S&P 500 -0.61% | Russell 2000 -0.65% | Nasdaq 100 -0.79%

FIXED INCOME: Barclays Agg Bond +0.22% | High Yield -0.56% | 2yr UST 4.214% | 10yr UST 3.476%

COMMODITIES: Brent Crude +2.74% to $82.89/barrel. Gold -0.38% to $1,818.6/oz.

BITCOIN: +0.49% to $17,822

US DOLLAR INDEX: -0.34% to 103.627

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: -6.25% to 21.14

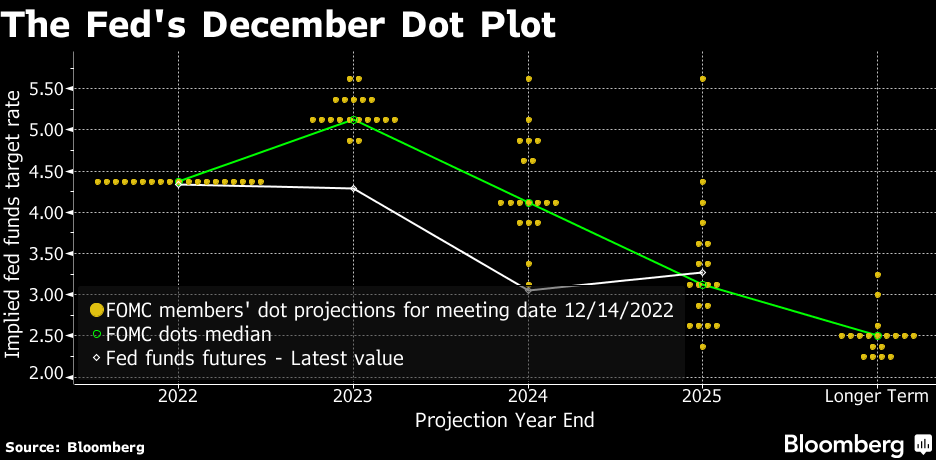

Federal Reserve hikes rates 50 bps to target range 4.25%-4.50%

The Federal Reserve announced today its 7th interest rate increase of 2022, raising the Fed Funds Rate by 0.50% to bring the target range to 4.25%-4.50% – the highest since December 2007. The Fed has raised rates a total of 425 bps since March, making it the fastest hiking cycle since 1980. The unanimous decision delivered by Fed Chair Jerome Powell was widely telegraphed.

The FOMC statement retained language saying “ongoing” hikes will be appropriate to reach “sufficiently restrictive” stance that returns inflation to 2% over time. As such, the dot plot revealed a median terminal rate of 5.1%, up 50 bps from September.

What really matters is when the Fed will be sufficiently restrictive. With core PCE inflation at 5.0% and heading lower and the new target range of 4.25% to 4.50%, the real fed funds rate is not yet in positive territory. But with more hikes early next year, whether that is one 50 and one 25 or three 25s, the funds rate should be in restrictive territory. Once the real fed funds rate is in positive territory and therefore restrictive, the Fed can transition to sustaining that restraint, as it observes the (policy lag) developments in inflation, employment, and the trend of GDP relative to potential.

Source: Ned Davis Research, Bloomberg

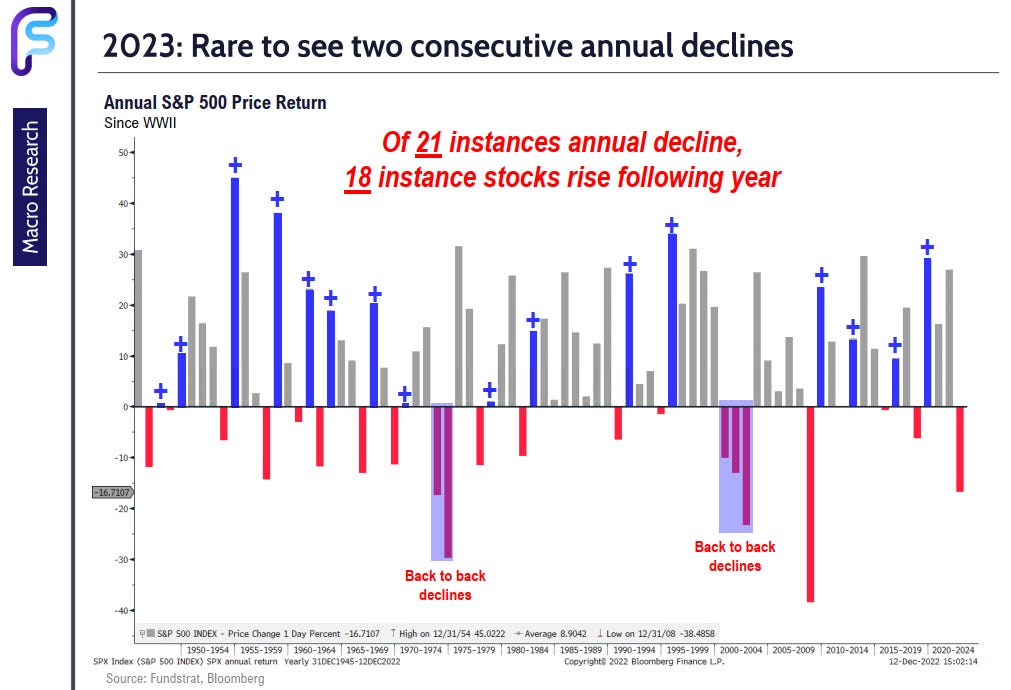

Back to back??

Since World War II, the S&P 500 has returned negative calendar year performance 21 times.

18 of those instances resulted in positive stock performance the following year. In other words, it is quite rare for SPY to post back-to-back negative returns.

1974, 2001, and 2002 are the exceptions.

In fact, the win ratio is 80% after those 21 negative years, with the median return +16.8% one year later.

Source: Fundstrat, Bloomberg

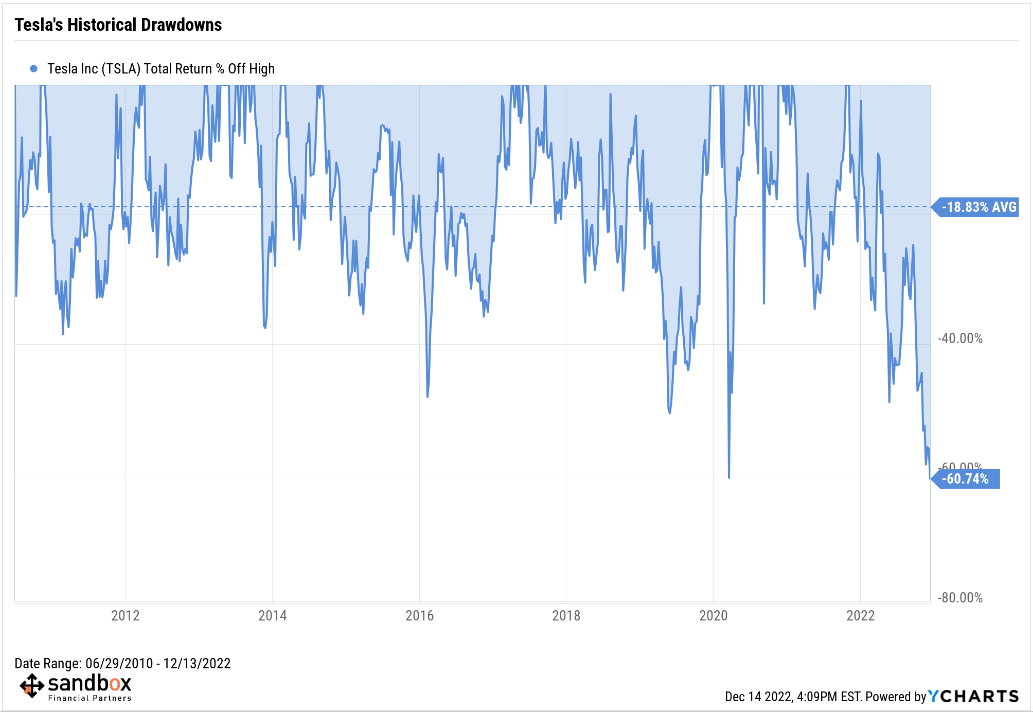

Tesla’s current drawdown is its worst

Tesla Inc. (TSLA) is down -60.74% from its peak in November 2021, now its largest drawdown to date. After topping out at a market capitalization of $1.24 trillion dollars, the company is now worth $495.20 billion dollars, a staggering decline of nearly $740 billion dollars.

This is now the 4th drawdown of ~50% or more in its history.

Perhaps Tesla investors are unhappy that CEO Elon Musk is committing nearly all of his time to Twitter HQ.

Source: Charlie Bilello

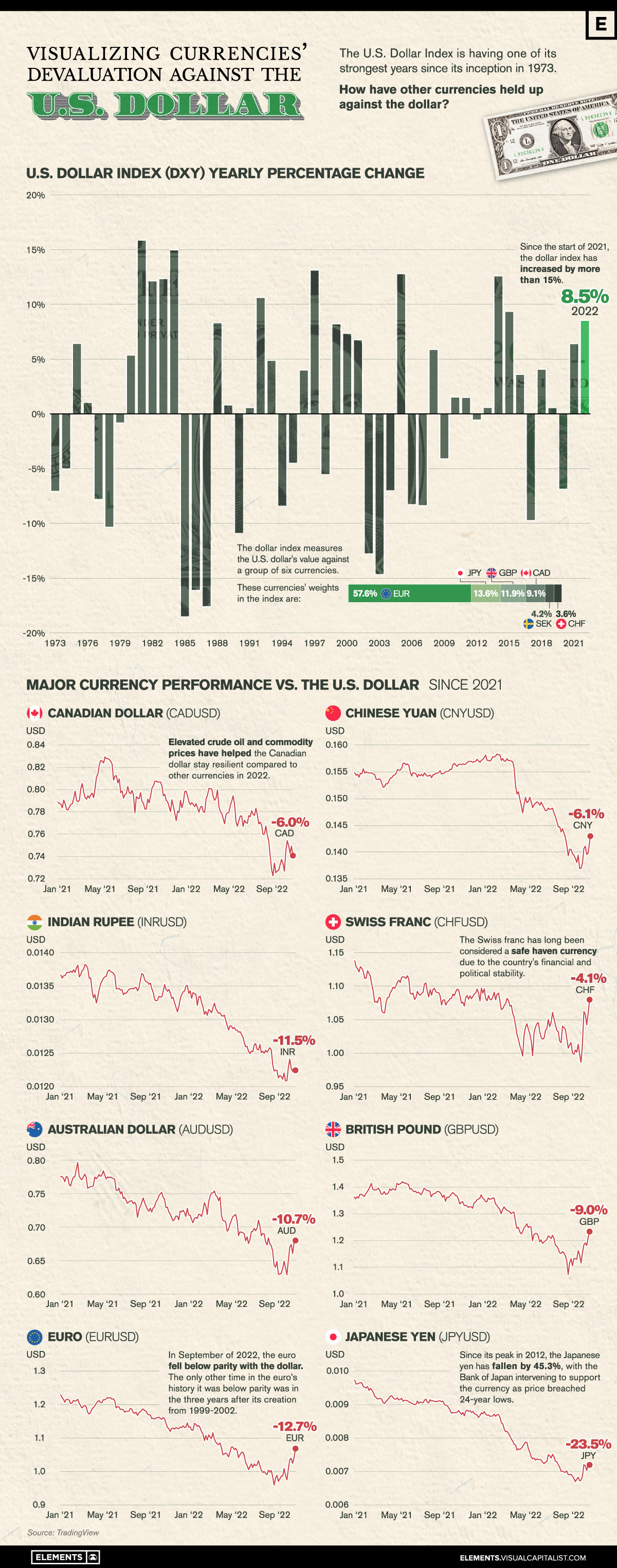

2022 U.S. dollar strength

In a highly volatile and difficult year for many currencies and equities, the U.S. dollar has been a safe haven for investors. The greenback has provided exceptional stability, with almost every currency around the world declining against the U.S. dollar in 2022.

Three reasons for the dollar’s strength in 2022:

the rapid rise in interest rates by the Federal Reserve (monetary policy) allow for higher returns on bonds/cash/savings accounts

a flight to safety as risk assets have been volatile and beaten down

fewer geopolitical and recessionary risks versus other major global players (Eurozone, China)

As shown in the infographic below, the past two years have seen nearly every major currency lose value against the U.S. dollar.

In September of 2022, the U.S. dollar Index was up +20% on the year reaching a high of 114.8, but it has since retreated and given back more than half its gains for this year so far. Investors around the world will be watching closely to see if the U.S. dollar’s rise will continue, or if this end-of-year reversal will carry through and provide major currencies some relief going into 2023.

Source: Visual Capitalist

Non market-based economies struggling with hyperinflation

The global rise in inflation is especially pronounced in non-OECD countries, or countries existing outside of the Organization for Economic Co-operation and Development. A strong U.S. dollar and rising energy prices are exacerbating existing pressures.

Source: Horizon Kinetics

One simple graphic

Investing is hard.

Price is only the tip of the iceberg, which itself cannot be understated. One can learn a lot from just looking at price, including but not limited to understanding a stock’s general trend, its momentum, relative strength, and consumer sentiment around the market/sector/company. These tools are critical for shorter-term time horizons.

However, there are many other important fundamental considerations lying underneath the surface that drive long-term value and stockholder returns. Understanding these quantitative and qualitative metrics are the foundation for building long-term positions with a higher degree of confidence.

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.