Fed hikes target rate 📈, plus cash 💵 💰, prescription drugs, and good habits

The Sandbox Daily (3.22.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed raises target interest rate

Cash – know your environment

Inside America’s prescription drug habits

Build good habits

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -1.37% | Dow -1.63% | S&P 500 -1.65% | Russell 2000 -2.83%

FIXED INCOME: Barclays Agg Bond +0.96% | High Yield +0.09% | 2yr UST 3.974% | 10yr UST 3.449%

COMMODITIES: Brent Crude +0.76% to $75.89/barrel. Gold +1.54% to $1,988.5/oz.

BITCOIN: -3.49% to $27,132

US DOLLAR INDEX: -0.68% to 102.554

CBOE EQUITY PUT/CALL RATIO: 0.62

VIX: +4.12 % to 22.26

Quote of the day

“...the notion of selecting the 'best' securities still deserves a close scrutiny. Those classes of investments considered 'best' change from period to period...what are thought to be the best are in truth only the most popular—the most active, the most talked of, the most boosted, and consequently, the highest in price at that time. It's very much a matter of fashion, like Eugenie hats or waxed moustaches.”

- Fred Schwed, Jr., Where Are the Customers' Yachts?

Fed raises target interest rate

Fed policymakers concluded their two-day policy meeting today, deciding unanimously to hike its benchmark Federal Funds Rate by 25bps (0.25%). This adjustment to monetary policy takes the target range to 4.75 – 5.00%, a significantly different paradigm than early 2022 (0.00 – 0.25%). This is the 9th straight meeting of rate hikes that started March 16th, 2022.

Over the past year, the Fed has raised interest rates by a cumulative 475bps – its fastest tightening cycle in over four decades – in an effort to curb soaring inflation as the economy recovered from the pandemic.

The latest Dot Plot – the future rate projections from each FOMC participant – shows a 5.1% median estimate of the Fed Funds Rate for 2023 year-end, unchanged from the last update in December. However, the 2024 year-end projection rose to 4.3% from 4.1%. Of greater significance perhaps is that no FOMC member projects a rate cut in 2023, which stands in stark contrast to what the market is expecting – multiple rate cuts in the back half of the year.

Earlier this month, some traders were projecting a larger 50bps rate hike, but that all changed once the stability of the banking system forced the Fed to change its reaction function. After all, the collapse of Silvergate, Silicon Valley Bank, Signature Bank, and Credit Suisse sent shockwaves through financial markets, and raised the possibility of the Fed slowing/pausing its rate hikes to ease financial conditions.

One major statement was modified in the FOMC’s forward guidance, a softer and more dovish adjustment to the committee’s tone:

New: “The committee anticipates that some additional policy firming may be appropriate”

Old: “The committee anticipates that ongoing increases in the target range will be appropriate”

Here are some of Federal Reserve Chairman Jerome Powell’s comments that will catch deadlines:

* U.S. banking system is “sound and resilient;” depositors’ savings are safe

* Longer-term inflation expectations appear well anchored

* FOMC considered a pause; a hike was supported by strong consensus

* Too soon to say how rate hiking cycle should respond to bank crisis

* Events in the banking system are likely to result in tighter credit conditions

* Rate hikes well telegraphed, many banks able to handle

* Disinflation is still occurring in the U.S.

* Tighter credit conditions can substitute for rate hikes

* If FOMC needs to raise rates higher than expected, they will

* Balance sheet expansion reflects temporary lending

* Dot Plot of rate forecasts shows 5.1% median estimate for year-end Fed Funds Rate

The U.S. central bank faces a dilemma in the coming months as it attempts to deal simultaneously with the turmoil in the banking sector and persistently high inflation that is running well above its 2% target. Raising interest rates too quickly could further destabilize financial markets and the banking system, while not tightening enough could allow inflation to become more entrenched in the economy.

The FOMC meets again in six weeks on May 3rd.

Source: Federal Reserve, FOMC Summary of Economic Projections, Investopedia, Bloomberg, Nick Timiraos, Wall Street Journal, Ned Davis Research

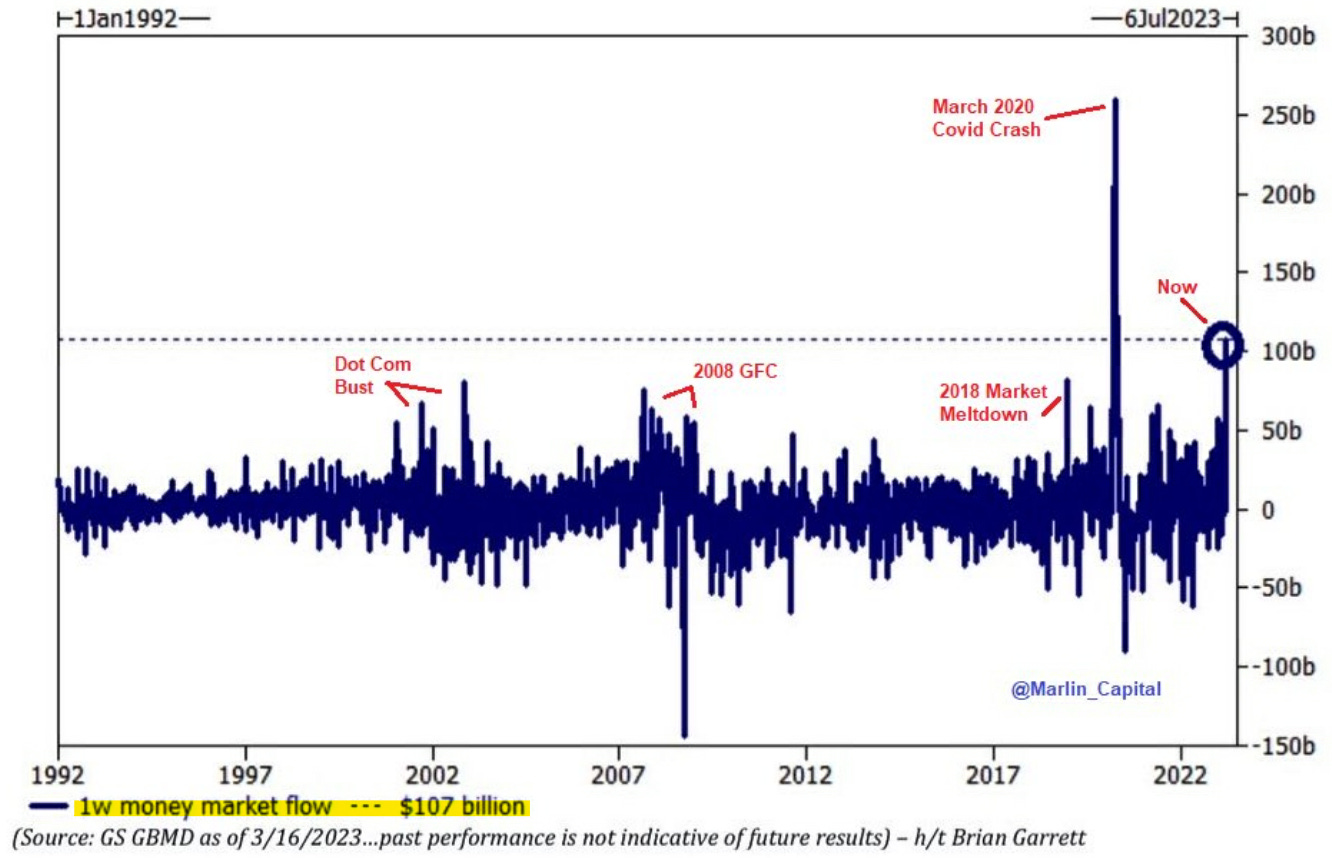

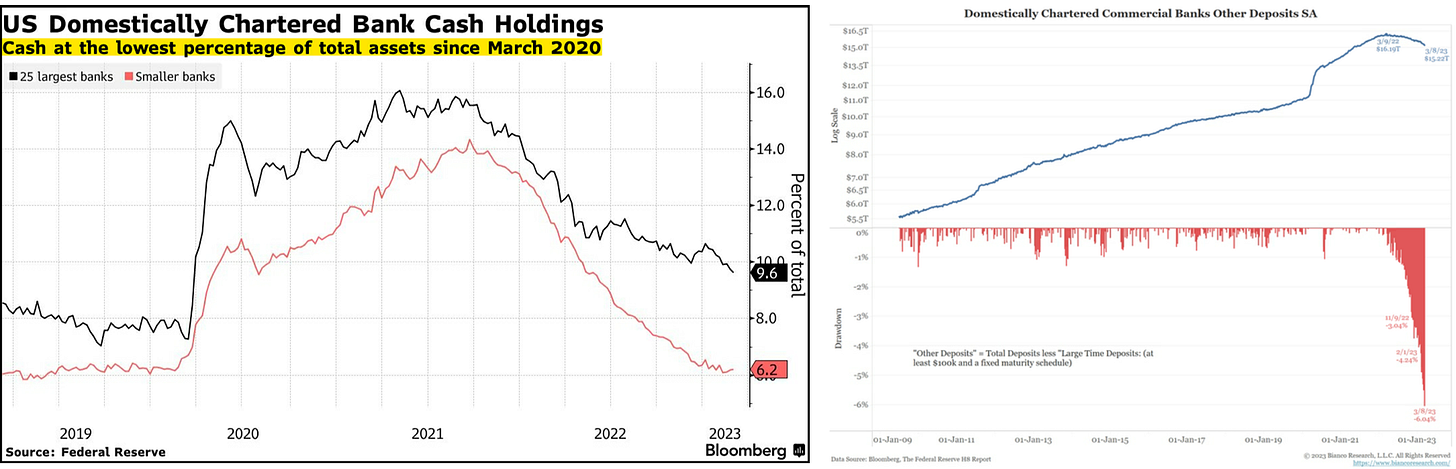

Cash: state of play

No matter

where you look,

investors are seeking compensation (aka higher yields)

on their cash

regardless where they bank

as well as safety of principal

for the first time in years.

After all, 4-5% on cash changes everything.

Know your environment.

Times like this make us crave safety, protection, and certainty.

Oh yeah, and yield.

Source: Financial Times, Bloomberg, Marlin Capital, St. Louis Fed, New York Times, Axios, Bloomberg, Lance Roberts, Bianco Research, JPMorgan Guide to the Markets

Inside America’s prescription drug habits

Americans spend more money on prescription drugs than anywhere in the world, and it’s no secret that Big Pharma is raking in the $$$ from these purchases.

The top prescribed drugs in the United States include Atorvastatin, Levothyroxine, and Metformin, used to treat high cholesterol, underactive thyroid, and type II diabetes, respectively.

Source: Genuine Impact Newsletter

Build good habits

Habits are the compound interest of self-improvement.

They don’t seem like much on any given day, but over the months and years, their effects can accumulate to an incredible degree.

Source: James Clear

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.