Fed hikes target rate, plus manufacturing activity, jobs data, and social media usage

The Sandbox Daily (2.1.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the Fed’s announcement to hike interest rates another 0.25%, the January ISM report that showed manufacturing activity declined for the 5th straight month, the Job Openings and Labor Turnover Survey (JOLTS) report for December, slowing ADP private payrolls growth, and personal consumption across social media.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +2.16% | Russell 2000 +1.49% | S&P 500 +1.05% | Dow +0.02%

FIXED INCOME: Barclays Agg Bond +0.71% | High Yield +1.05% | 2yr UST 4.104% | 10yr UST 3.418%

COMMODITIES: Brent Crude -2.82% to $83.05/barrel. Gold +1.14% to $1,967.5/oz.

BITCOIN: +3.76% to $23,943

US DOLLAR INDEX: -0.92% to 101.153

CBOE EQUITY PUT/CALL RATIO: 0.66

VIX: -7.89% to 17.87

Federal Reserve raises target interest rate by 0.25%

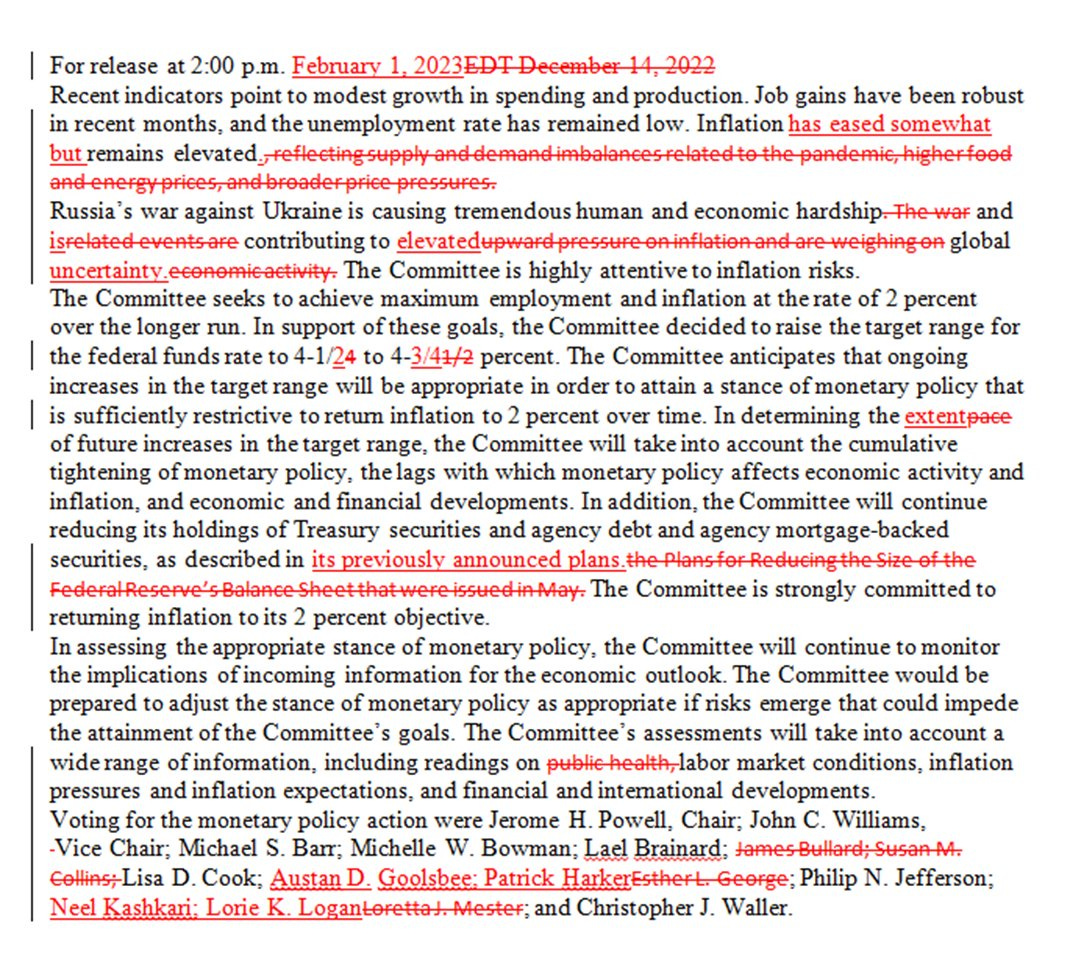

The Federal Reserve voted Wednesday to lift interest rates by another 0.25%, marking the 8th rate increase in the past year and bringing the target for the Federal Funds Rate to a range of 4.50-4.75%. This time last year? The Fed Funds Rate was 0-0.25%!

Surprisingly, the vote by the Federal Open Market Committee was unanimous – despite the vast array of conflicting economic data, the uncertain policy outcomes, and the still unknown lagged effects from policy tightening.

In determining the extent of future interest rate increases, the Fed said in its statement it would be considering the lags with which monetary policy operates, as well as the cumulative impact of the steps it has taken so far. The FOMC left unchanged the sentence that says that “ongoing” rate hikes will be appropriate, a modestly hawkish surprise in which the market expected to tone down this language.

Overall, Powell sought on Wednesday to reassert his message that the Fed’s path forward will be dependent on forthcoming economic data, and that the central bank remains committed to keeping policy restrictive until inflation falls back to 2% – while also noting the disinflationary process is underway, yet more must be done.

“We think we’ve covered a lot of ground,” Powell told reporters after the meeting. “Even so, we have more work to do.”

Source: Federal Reserve, Bloomberg

ISM Manufacturing report shows a deepening contraction

The January report on manufacturing from the Institute for Supply Management (ISM) showed manufacturing activity declined for the 5th straight month.

The ISM manufacturing index, also known as the purchasing managers' index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It’s considered to be a key indicator of the state of the U.S. economy; the PMI report indicates the level of demand for products by measuring the amount of ordering activity at the nation's factories. The PMI number, which is announced on the first business day of each month, can greatly influence investor and business confidence.

The headline ISM Manufacturing Index dipped to 47.4 from 48.4 in December, a little worse than the 48.0 consensus estimate; a level below 50 indicates the sector is contracting, or shrinking. December’s report was the lowest reading since May 2020; excluding the pandemic, it was the lowest PMI reading since June 2009. It has been below the break-even level of 50 for 2 consecutive months now, indicating a deepening contraction in manufacturing activity. Just as in the previous month, there were only 2 industries out of 18 that registered growth in January, the smallest share since April 2009, consistent with a decline in manufacturing output.

Source: Dwyer Strategy, Ned Davis Research, Calculated Risk

JOLTS show labor market is still tight

Vacancies at U.S. employers unexpectedly increased at the end of 2022, illustrating a solid appetite for labor that the Federal Reserve sees as one of the last hurdles to bring down inflation.

The number of job openings rose by +5.5% in December to 11.01 million available positions from 10.46 million a month earlier. While the number of open positions has come down from its peak level of 11.86 million in March 2022, it is still much higher than pre-pandemic when it was around 7.0 million. This represents the largest monthly increase since July 2021, led by gains in accommodation and food services, retail trade, and construction.

The job openings-to-unemployed ratio significantly reversed back up to 1.92 from the prior month’s reading of 1.74 – close to the cycle peak of 1.99 last year and signaling that labor market conditions remain tight. It is a clear sign that the labor market is still tight, which may lead to sustained upward wage pressures, hindering the Fed’s efforts to reduce overall inflation.

The quit rate was unchanged at 2.7%, as some 4.1 million American voluntarily left their jobs in December. While off its peak level of 2.9% earlier in this cycle, the quit rate is still higher than the pre-pandemic level of 2.3%, as workers remain optimistic about their job prospects, which is another sign that labor market conditions are still strong.

The layoff rate edged up to 1.0%, but still near its lowest level on record.

Source: Bureau of Labor Statistics, Ned Davis Research, Bloomberg

ADP private payrolls growth slows

Per a jobs report this morning from payroll firm ADP, private employers in the United States slowed their hiring pace dramatically in the latest sign that economic activity is cooling.

ADP private payrolls increased 106,000 in January, the fewest in two years and well below the consensus of 175,000. The report attributed some of the slowdown to weather-related disruptions in activity during the survey week. Annual pay was up +7.3 percent last month, another indication of a tight labor market.

The ADP report offers up a preview of the government’s BLS labor report due this Friday 2/3 which should show slowing non-farm payrolls growth.

Source: ADP Research Institute

Social media usage

Nearly 5 billion people across the world use social media, for better or worse. Internet user aged 16 to 64 are spending an average of 2 hours and 31 minutes per day consuming content across a variety of platforms.

The average user will visit 7.2 social media platforms each month. Women aged 16-24 years old use social media the most, spending 3 hours and 10 minutes per day on social media; on the contrary, men aged 55-64 are the demographic that uses social media the least, averaging 1 hour and 25 minutes per day.

Hootsuite cites the most common reasons people use social media is to 1) stay in touch with friends and family, 2) fill spare time, and 3) read the news (!!).

And with all these eyeballs and time sucked into the social media vortex, it’s no wonder that ad spending is big business – ad spending on social media is projected to reach over $269 billion in 2023 after being just $51 billion dollars in 2017.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.