Fed needs more clarity from the hard data before cutting rates

The Sandbox Daily (5.7.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed needs clarity from the hard data

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.70% | S&P 500 +0.43% | Nasdaq 100 +0.39% | Russell 2000 +0.33%

FIXED INCOME: Barclays Agg Bond +0.15% | High Yield +0.09% | 2yr UST 3.785% | 10yr UST 4.277%

COMMODITIES: Brent Crude -1.91% to $60.96/barrel. Gold -1.28% to $3,378.9/oz.

BITCOIN: +1.41% to $96,307

US DOLLAR INDEX: +0.70% to 99.931

CBOE TOTAL PUT/CALL RATIO: 0.91

VIX: -4.89% to 23.55

Quote of the day

Rule #1 is don't sweat the small stuff.

Rule #2 is it's all small stuff.

- Robert Eliot

Fed needs clarity from the hard data

Although it wasn’t what the President wanted to hear, the Federal Reserve did what everyone else expected it to do.

Which was… nothing.

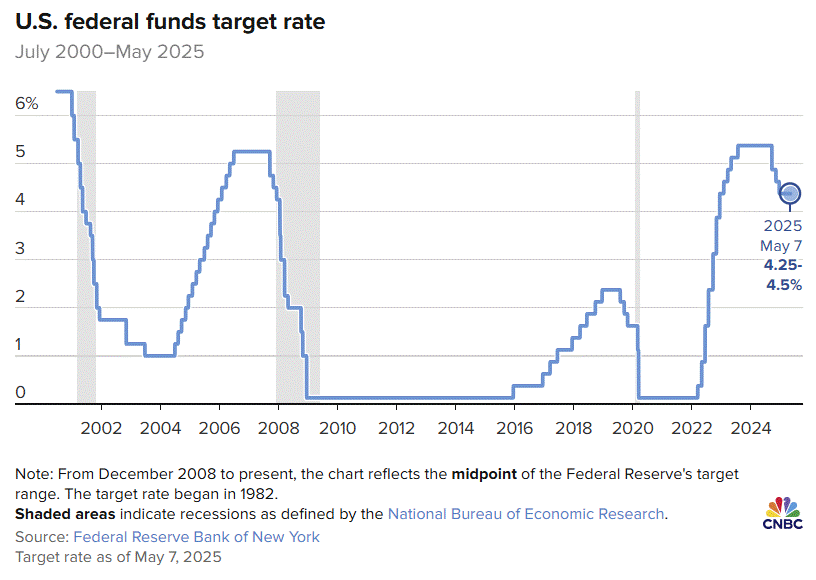

Today, the Fed kept the target range for the Fed Funds Rate unchanged at 4.25%-4.50%. Additionally, there was no change in the pace of Quantitative Tightening (QT).

The Fed is trying to navigate the risks posed by tariffs, immigration and deportations, DOGE cuts, and a multitude of other factors.

At least over the near term, these risks put upward pressure on inflation and downward pressure on growth and employment, resulting in a potential stagflationary-type environment.

That puts the Fed’s statutory goals of maximum employment and stable prices in conflict.

In fact, this was made explicit in their statement, which added that the FOMC “judges that the risks of higher unemployment and higher inflation have risen.”

Future decisions will come down to how far away the Fed is from its goals and how long it expects to return to those goals.

At the March meeting, the dot plot showed a median of 50 bp of rate cuts with a 4.4% unemployment rate this year, indicating a bias to respond to rising unemployment – as long as long-term inflation expectations remain well anchored.

And that’s where it gets tricky. The Fed’s measure of Common Inflation Expectations, which combines 21 market and survey-based measures of expected inflation, crept higher in Q1 to 2.2%.

Although soft data usually leads the hard data, the soft data can be prone to overreactions in the early days of major disruptions to economic activity.

The Fed’s approach is to wait for the hard data before acting, which by definition means it will be late. Powell said umpteen times that they were in a good place, and that they could afford to be patient and wait for greater clarity.

Fed Chair Powell gave no indication that they’re ready to cut at the next meeting in June. It’s possible the Fed could go larger later and still end up with 75 bp of rate cuts for the year.

With no change in Fed policy this month, attention shifts back to the macro data and any marginal changes in the inflation and labor data.

Sources: CNBC, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website:

They aren’t cutting until they see more data related to tariff inflation