Fed recalibrates its policy measures

The Sandbox Daily (11.4.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed recalibrates its policy measures

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.53% | S&P 500 -1.17% | Russell 2000 -1.78% | Nasdaq 100 -2.07%

FIXED INCOME: Barclays Agg Bond +0.05% | High Yield +0.01% | 2yr UST 3.578% | 10yr UST 4.085%

COMMODITIES: Brent Crude -0.97% to $64.26/barrel. Gold -1.70% to $3,945.9/oz.

BITCOIN: -6.89% to $99,582

US DOLLAR INDEX: +0.34% to 100.212

CBOE TOTAL PUT/CALL RATIO: 0.93

VIX: +10.66% to 19.00

Quote of the day

“Modern luxury is the ability to think clearly, sleep deeply, move slowly, and live quietly in a world that’s designed to prevent all four.”

- Justin Welsh

Fed balance sheet: the great disappearing act

On October 19th, the world was gripped by a good-old-fashioned heist at the Louvre. Despite world-class security, thieves dressed as museum workers made off with eight priceless historical artifacts in under eight minutes.

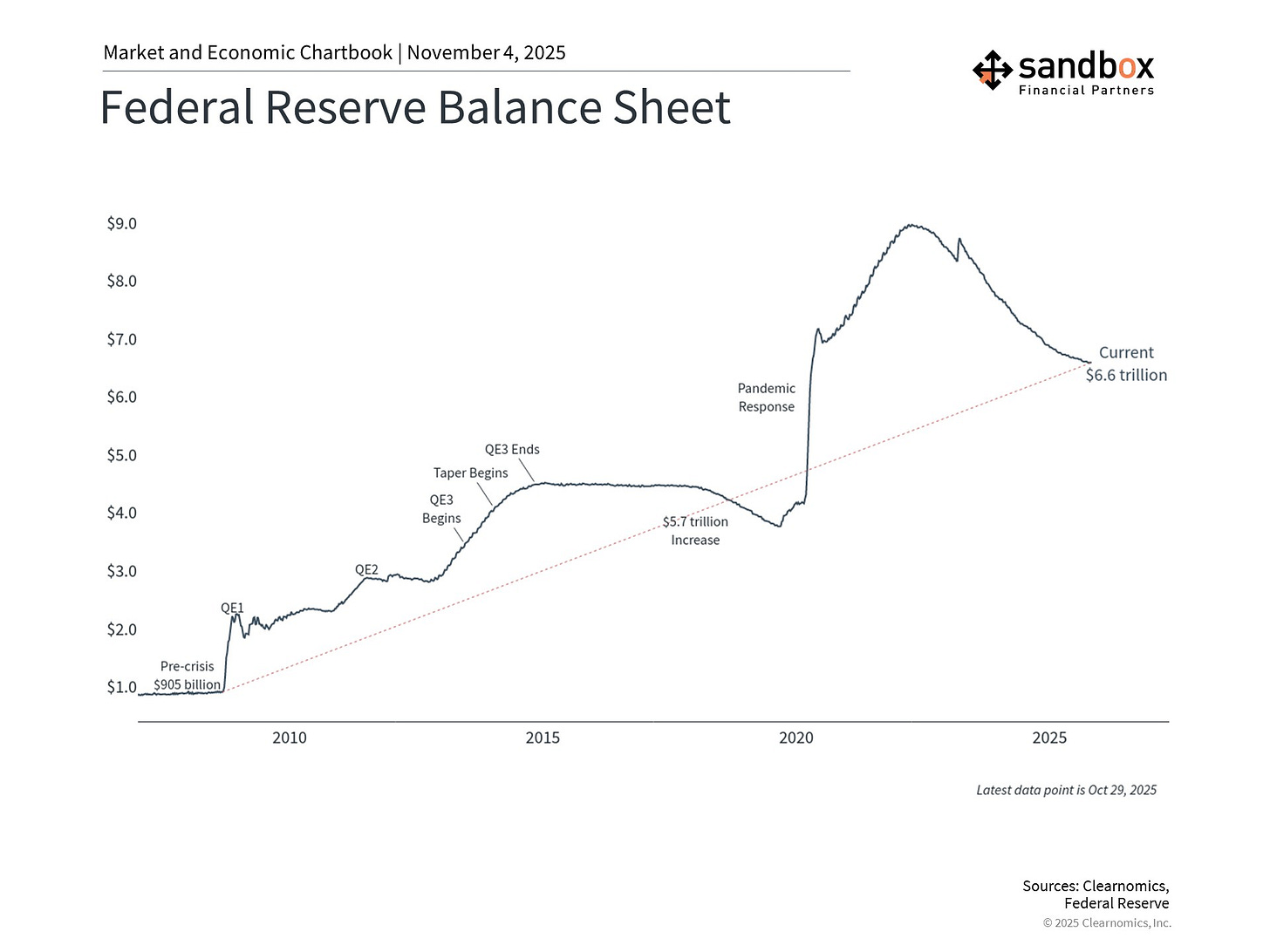

A different sort of disappearing act has played out in plain sight for the past three years. Over $2.2 trillion has quietly vanished from the Federal Reserve’s balance sheet since June 2022. And now, that operation is over.

Last week, the Fed announced that it will halt balance sheet runoff on December 1, effectively ending its three-year campaign of Quantitative Tightening (QT).

Treasury holdings, previously allowed to shrink by $5 billion per month, will now be rolled over. Proceeds from maturing mortgage-backed securities will be reinvested in Treasury bills as the Fed gradually shifts to a portfolio composed primarily of Treasuries.

The decision came alongside a 25-basis-point rate cut, lowering the Fed Funds target range to 3.75 – 4.00%, and small reductions to interest rates on reserves and reverse repos.

Fed Chair Powell described the move as reaching “the level we judge consistent with ample reserve conditions.”

Translation: the system is running low on excess liquidity, and proximity alarms are flashing in the cockpit.

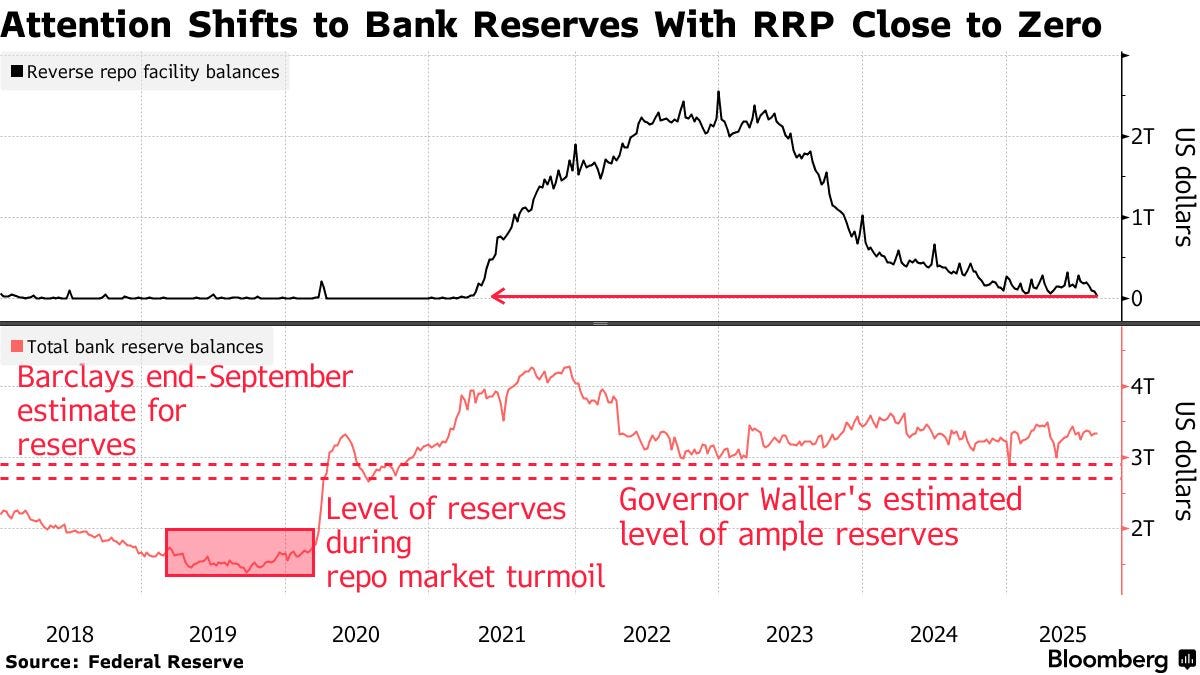

QT was designed to drain the trillions of dollars the Fed created during the pandemic. Early on, most of that runoff came from the reverse repo facility, which fell from $2.6 trillion to nearly zero. Now, each dollar of runoff directly reduces bank reserves, which have slipped below $3 trillion recently. Reference the Bloomberg chart below.

Funding costs have crept higher, and the Standing Repo Facility (SRF) – the Fed’s emergency lending spigot – has surged in use, echoing the tensions that ended QT in 2019.

Powell conceded that “there’s not a lot of benefit to holding on to get the last few dollars.” Market analysts have agreed that the Fed acted preemptively to preserve market function and prevent another repo-market rupture.

Ending QT leaves the Fed’s balance sheet at roughly $6.6 trillion, far larger than pre-pandemic level ($4.1 trillion) but stable enough to maintain control over short-term rates.

Now, many are expecting the Fed will soon resume modest growth in its portfolio – estimated around $20 billion per month – to keep pace with the expanding economy, not as stimulus but as maintenance.

These shifts should not be interpreted as signs of stress; shortfalls have been minor, and relief systems are working as intended. Think of this change in monetary policy as recalibration.

What’s clear is we can be certain the era of excess liquidity has ended. Powell’s cautious flexibility marks the start of a new balancing act: one between liquidity and restraint.

For now, the Fed’s disappearing act is complete. But unlike the Louvre thieves, Powell’s team has left the vault open – ready to refill liquidity as the economy demands.

Sources: Clearnomics, Bloomberg, Wall Street Journal

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)