Fed risks policy error, plus Israel and the A.I. effect

The Sandbox Daily (10.10.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed risks a policy error

tragedy strikes Israel

AI effect – surging stocks, soaring energy demands

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.14% | Nasdaq 100 +0.56% | S&P 500 +0.52% | Dow +0.40%

FIXED INCOME: Barclays Agg Bond -0.10% | High Yield -0.03% | 2yr UST 4.969% | 10yr UST 4.641%

COMMODITIES: Brent Crude -0.42% to $87.95/barrel. Gold +0.64% to $1,874.1/oz.

BITCOIN: -0.63% to $27,446

US DOLLAR INDEX: -0.33% to 105.704

CBOE EQUITY PUT/CALL RATIO: 0.66

VIX: -3.79% to 17.03

Quote of the day

“Headlines are not an investing strategy. This is a crazy thing that investors do where a headline comes out and it’s interesting. It’s, ‘what’s the trade?’ The trade is nothing. The trade is to ignore that and keep doing what you were doing.”

- Steve Strazza, All Star Charts

Fed risks a policy error

Why should the Federal Reserve stop hiking interest rates?

Let’s examine a few key issues at play.

The consensus view for most of 2023 was the lagged effects of the Fed’s monetary tightening measures will exert an increasing drag on growth and push the economy into recession before long. On the surface, this seemed consistent with Milton Friedman’s famous dictum that monetary policy operates with long and variable lags.

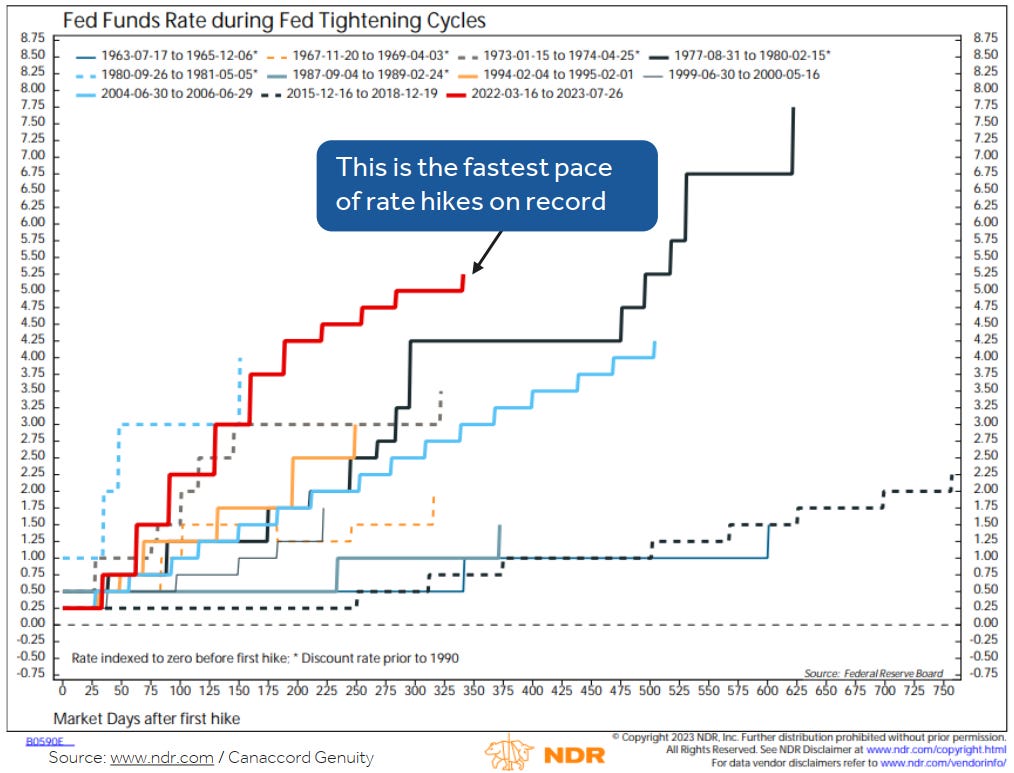

After all, besides the 1977-1980 tightening cycle, the current interest rate hiking cycle is the fastest and highest on record – so we don’t have much history to compare the downstream effects of hiking the Fed Funds Rate by 525 basis points (5.25%) over 17 months (March 2022 – July 2023). Many believe we are entering that time period where those long and variable lags will begin to take hold. If it’s anything like the regional banking crisis back in March and April, then much pain is still to come.

The 2nd major issue is the Fed’s balance sheet. While much of the media attention is focused on interest rates, the other tool at the Fed’s disposal is Quantitative Tightening (QT), also known as balance sheet normalization, whereby the central bank shrinks its balance sheet – effectively removing liquidity (i.e. money) from financial markets.

The Fed has been actively exiting the Treasury and mortgage-backed security (MBS) markets as it unwinds its $8 trillion portfolio, allowing up to $60bn in Treasury bonds & $35bn in MBS to mature each month. Again, the Fed has very little history to look for analogues on downstream market effects; in fact, most would agree the 2017-2018 balance sheet reduction was smaller in scope and largely unsuccessful against the targets that were initially set.

The 3rd issue at stake – surfacing quite publicly over the last month or two – is the amount of leverage in the system due to the excessive borrowing and use of credit to fund government debt. When prior Fed Chairman Paul Volcker inverted the yield curve and hiked rates in the late 70s/early 80s to break the fever of inflation – similar to the playbook of current Fed Chairman Jerome Powell – it was a from a generationally-low unlevered system. Today, we are near generational highs of government debt-to-GDP (blue line below).

When the U.S. government needs to roll debt at 5%+ yields, the interest expense in relation to our nation’s budget becomes a thorny issue that must be dealt with. Remember, $7.6 trillion in U.S. government bonds, or 31% of all outstanding U.S. government debt, will mature over the coming 12 months.

The Fed should acknowledge the current conditions for what they are and stop hiking interest rates. At least for a period of time.

Whether it’s the M2 money supply that remains historically negative, or the Fed’s Senior Loan Officer Survey (SLOOS) data that shows credit conditions and creation slowing mightily, or it’s the pressure on bank balance sheets, or any number of other quantitative metrics, the Fed should appreciate the work that has been done to date and avoid oversteering into another policy error.

Source: Dwyer Strategy

Tragedy strikes Israel

The recent events in Israel are truly horrible. The Palestinian militant group Hamas carried out an unprovoked and devastating surprise attack from the Gaza strip over the weekend, killing hundreds of civilians and taking dozens more hostage. Just awful.

Geopolitical events are tragically unfortunate from many perspectives. But, in respect to the impact on financial markets, the reaction in the form of price action is generally muted and temporary.

Ryan Detrick, CMT put together this excellent catalogue of past geopolitical events dating back to World War II and the impact on S&P 500 forward returns.

Many people often ask the same question as these events unfold: what should I do with my portfolio?

I offer two excellent perspectives.

Steve Strazza, Director of Research for All Star Charts, had this to say:

Headlines are not an investing strategy. This is a crazy thing that investors do where a headline comes out and it’s interesting. It’s, ‘what’s the trade?’ The trade is nothing. The trade is to ignore that and keep doing what you were doing.

Next is Caleb Franzen, who emphasizes sticking to your strategy and thinking about what not to do:

Everyone manages risk in their own way in a manner that suits themselves. That’s fine. Define your risk management parameters ahead of time and stay committed to your plan.

As Ben Carlson once wrote:

A systematic process is how you impose discipline on your lesser self, the one that makes all of the mistakes at the wrong times. Without a set of guidelines or principles to follow you’ll be constantly second-guessing every move you make after the fact.

Source: Ryan Detrick, Caleb Franzen, Ben Carlson

AI effect – surging stocks, soaring energy demands

Artificial intelligence is reshaping industries in a manner reminiscent of the early years of the internet. This shift hasn’t gone unnoticed, especially on Wall Street.

The Nasdaq Composite, the tech-heaviest of the major U.S. stock indexes, has seen a notable upswing this year, predominantly fueled by the enthusiasm surrounding AI-related stocks, rising nearly 30% year-to-date and definitively beating its value counterpart, mid-caps, and small-caps.

However, this groundbreaking technological growth comes at a price: higher energy costs from increased demand.

The root of AI’s energy demands lies in data centers. These warehouses of servers and processing units, operated by the likes of Google (GOOGL), Microsoft (MSFT), and Amazon (AMZN) are massive energy consumers, which is why access to the power grid is a huge factor for data centers.

For reference, data centers use more electricity than entire countries, while recent research from the University of Washington found the energy used by a day’s worth of ChatGPT inquiries is comparable to the daily consumption of 33,000 U.S. households.

Data center energy usage has increased by 25% per year between 2015 and 2021, before the surge in popularity for ChatGPT. In a world where energy is a huge factor in inflation, and companies attempt to go net-zero on emissions, this matters.

Major cloud providers, including Google Cloud, Microsoft Azure, and Amazon Web Services, are countering this by increasing renewable energy investments. Microsoft’s Azure aims to be carbon-negative by 2030, while Amazon and Google target 100% renewable operations by 2025 and 2030, respectively.

The ascent of AI brings both costs and opportunities. As always, success for companies and investors alike lies in finding the right balance between the two.

Source: Bloomberg, Research Gate, Deutsche Welle

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.