Fed's balance sheet, plus int'l stocks, job cuts, REITs, and Warren Buffett

The Sandbox Daily (3.30.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fed’s balance sheet declines by $28bn

international stock allocation

from shortages to cuts

REITs, a casualty of the bank crisis

what the world’s greatest investor owns

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.91% | S&P 500 +0.57% | Dow +0.43% | Russell 2000 -0.18%

FIXED INCOME: Barclays Agg Bond +0.11% | High Yield +0.59% | 2yr UST 4.128% | 10yr UST 3.554%

COMMODITIES: Brent Crude +1.26% to $79.27/barrel. Gold +0.70% to $1,998.4/oz.

BITCOIN: -0.78% to $28,157

US DOLLAR INDEX: -0.46% to 102.172

CBOE EQUITY PUT/CALL RATIO: 0.64

VIX: -0.52% to 19.02

Quote of the day

“Transform fear into prudence, pain into transformation, mistakes into initiation, and desire into undertaking.”

-Nassim Taleb

Fed’s balance sheet declines by $28bn

As investors and regulators keep a close eye on the health of the banking system, the weekly post-market release of the Federal Reserve’s H.4.1 Factors Affecting Reserve Balances of Depository Institutions Report on Thursdays has recently adopted a somewhat celebrity status.

The H.4.1 Report captures changes in the Fed’s balance sheet and its various lending facilities – providing us a great deal of information about the size and scope of its operations, and at the moment, telling us how much stress banks are feeling.

Borrowing at the Fed's “Primary Credit” – aka the Discount Window – fell $22.1 billion for the week ending Wednesday, from $110.2 billion to $88.2 billion.

Borrowing at the new Bank Term Funding Program (BTFP) rose $10.7 billion, from $53.7 billion to $64.4 billion.

Borrowing using extensions to FDIC Bridge Banks rose $0.3 billion, from $179.8 billion to $180.1 billion.

Borrowing at the Foreign Repo Facility fell $5 billion, from $60 billion to $55 billion.

That’s a lot of numbers. So what does all this mean?

Banks’ borrowing from the Federal Reserve has declined precipitously from levels seen earlier this month, offering more evidence that pressures banks had faced are receding. The trend lower supports the narrative that bank runs, or fear that they could happen, aren’t forcing lenders to borrow from the Fed. This report is another boost of confidence after historic measures were taken by the Fed and FDIC to shore up the banking system, however we are far from being out of the woods.

Source: Federal Reserve, Reuters, CNBC

International stock allocation

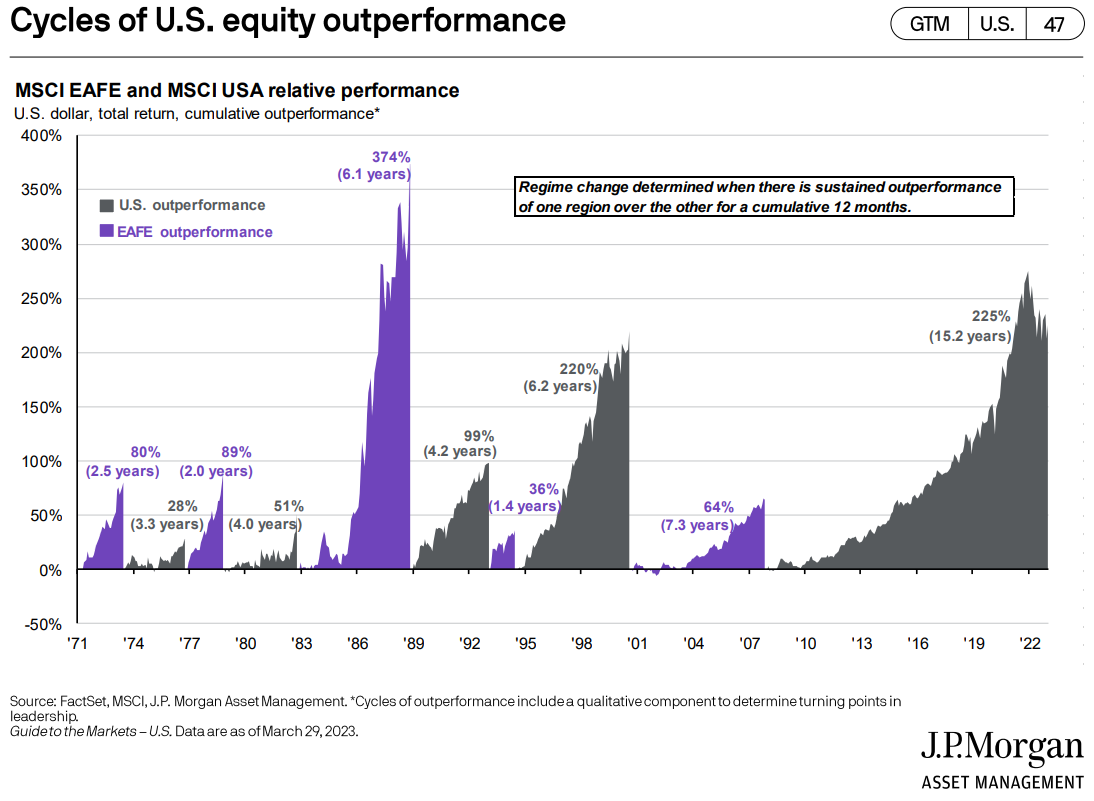

One of the most frequently asked questions in personal finance is: "Should I include international stocks in my portfolio? And if so, what is the ideal percentage?"

In a paper titled Four Reasons to Embrace Global Investing, researchers at Vanguard provide one perspective to this question: what they found is that historically an allocation to international stocks in the range of 30% to 40% has provided the greatest diversification benefit in terms of volatility reduction.

In other research, Vanguard provides an equally important finding: while international stocks can help dampen a portfolio's volatility, over time there has been no demonstrable performance advantage to either domestic or international stocks. After all, prices tend to trend.

So the reason you would want to own international stocks, according to Vanguard’s research, is really just for the diversification benefit, which provides you the opportunity to participate in whatever region is outperforming at a given time.

Source: Vanguard, J.P. Morgan

From shortages to cuts

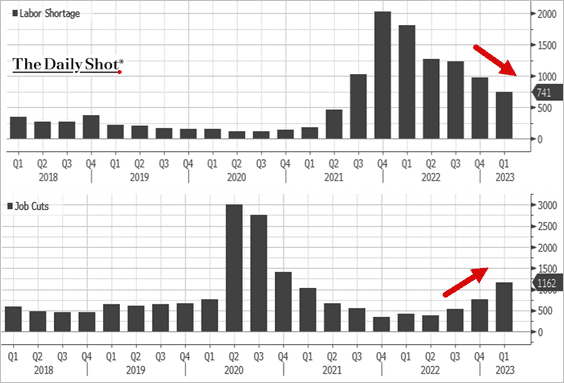

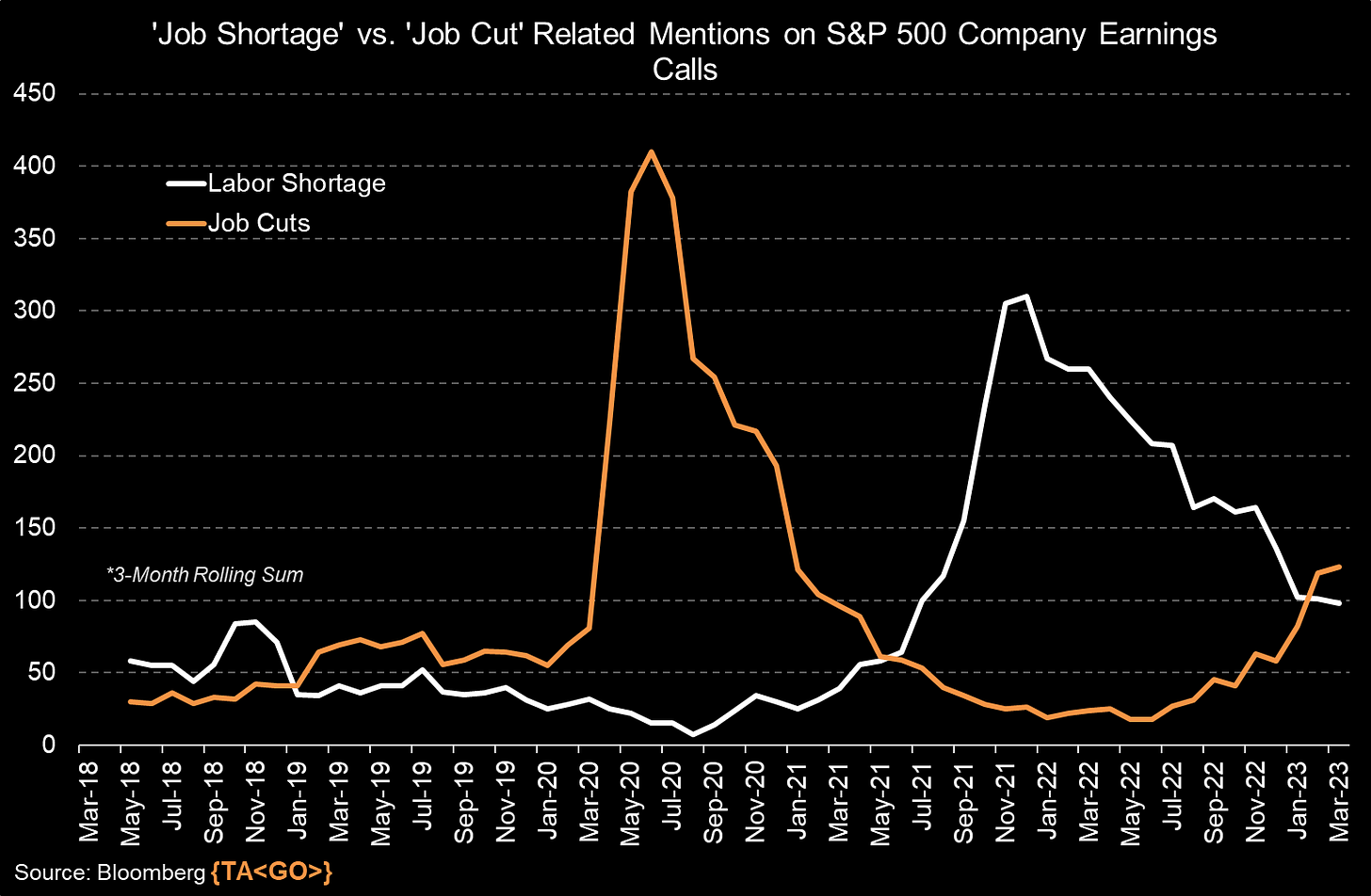

Conversations from the C-Suite have shifted from “Labor Shortages” to “Job Cuts” during S&P 500 company earnings calls.

As the business cycle slows from the Fed’s restrictive monetary policies, management is following a common script to maintain profitability and margins – do more with less. After all, labor is often the greatest line item when it comes to corporate expenses.

"The job market is still very tight, but the direction of movement is changing," says Comerica Bank chief economist Bill Adams.

Source: Bloomberg, The Daily Shot

REITs, a casualty of the bank crisis

REITs have been one of the hardest hit areas of the market since the regional bank failures earlier in the month.

Deteriorating financial conditions and tighter lending standards for banks mean that REITs, and their tenants, could find it more difficult to obtain funding, while at the same time, the economy continues to trend towards a likely recession.

For a REIT to qualify for beneficial tax treatment from the IRS, it must comply with several provisions. The requirements include that at least 75% of income is generated from rent, interest, and property sales, and that a minimum of 90% of taxable income is paid out to shareholders.

The provisions limit the amount of cash that REITs can quickly raise from operating activities and can leave companies more reliant on outside sources of financing. The chart below shows that banks had already begun tightening lending standards on commercial real estate loans prior to the failure of Silicon Valley Bank. Banks are likely to turn even more conservative, restricting the availability of credit and raising costs for REITs and their tenants.

Credit concerns, yield competition, rising interest rates, and poor fundamentals all weigh heavily on the short-term outlook for REITs.

Source: Ned Davis Research

What the world’s greatest investor owns

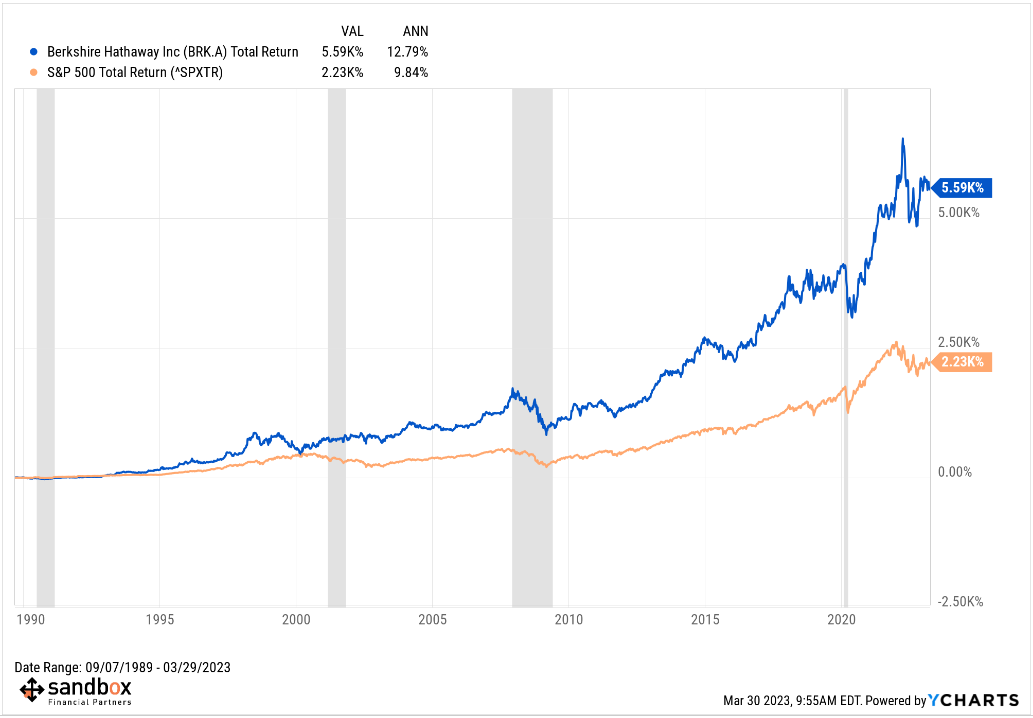

Since Warren Buffett took over Berkshire Hathaway in 1965, Berkshire Hathaway has compounded the company’s book value at an average rate of roughly 20% per year.

Since 1989*, Berkshire has handily outperformed the benchmark S&P 500 index.

The top 5 positions in Warren Buffett’s portfolio (a/o December 31st, 2022):

Apple (38.9%)

Bank of America (11.2%)

Chevron (9.8%)

Coca-Cola (8.5%)

American Express (7.5%)

* 1989 is not a cherry-picked start date; it’s when the data series for BRK A-shares begins in YCharts charting tool

Source: Genuine Impact

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.