Fed's inflation measure comes in hot, plus real estate, Russian fossil fuels, worker strikes, and the week in review

The Sandbox Daily (2.24.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the Fed’s preferred inflation measure, the pullback in the U.S. residential real estate market, Russian fossil fuel revenues, worker strikes, and a brief recap to snapshot the week in markets.

Happy Friday.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 -0.92% | Dow -1.02% | S&P 500 -1.05% | Nasdaq 100 -1.73%

FIXED INCOME: Barclays Agg Bond -0.57% | High Yield -0.60% | 2yr UST 4.814% | 10yr UST 3.947%

COMMODITIES: Brent Crude +1.18% to $83.18/barrel. Gold -0.48% to $1,818.0/oz.

BITCOIN: -3.27% to $23,070

US DOLLAR INDEX: +0.63% to 105.260

CBOE EQUITY PUT/CALL RATIO: 0.76

VIX: +2.51% to 21.67

Quote of the day

“Effort and courage are not enough without purpose and direction.”

-John F. Kennedy

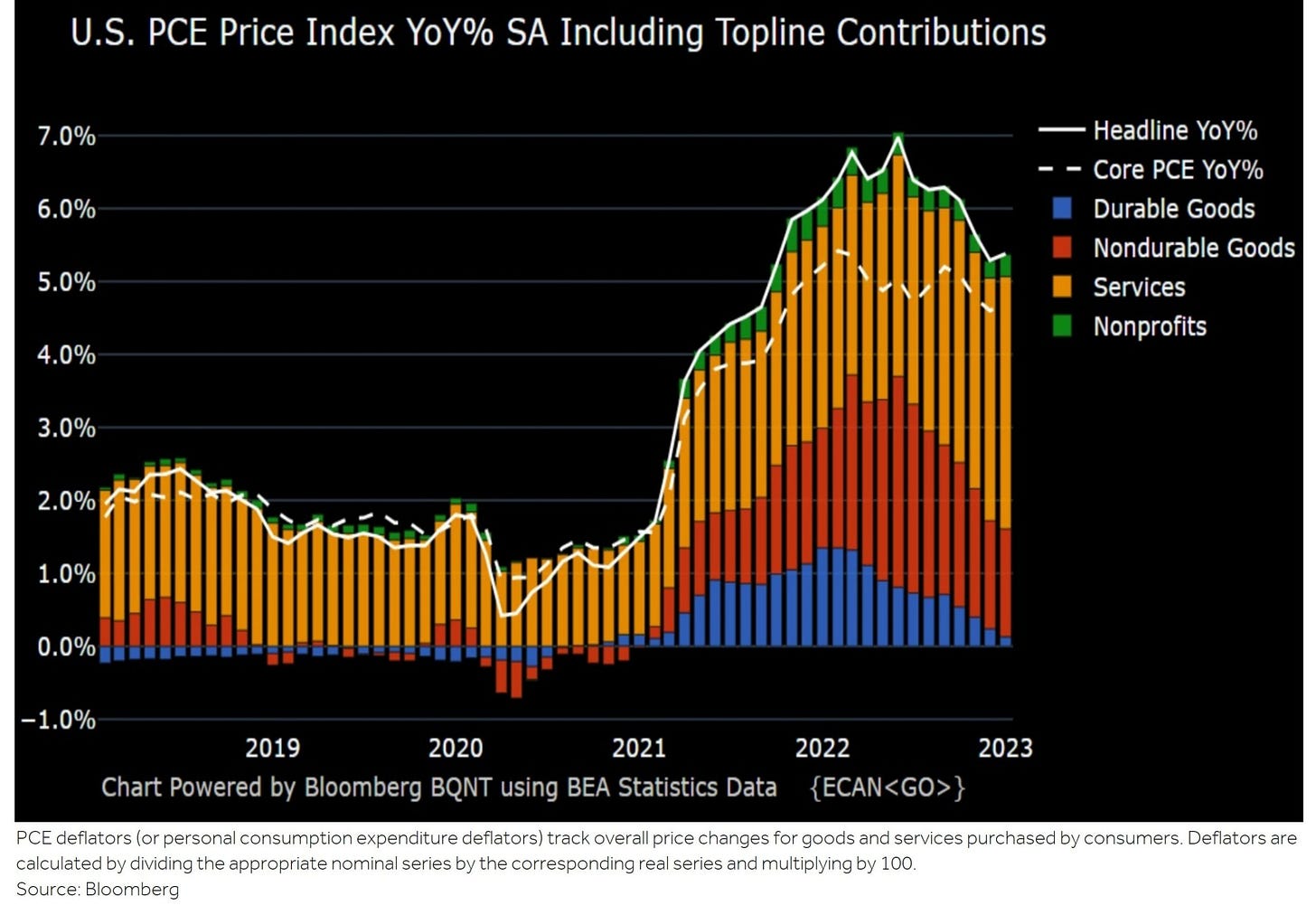

Fed’s preferred inflation measure shows no signs of cooling

This morning’s Department of Commerce report on the Personal Consumption Expenditures (PCE) price index, which the Federal Reserve uses for its inflation projections, was hotter than expected and the data from December was revised higher as well. Resilient spending and stubborn inflation suggest that the Fed’s path to taming prices and demand will be bumpier and longer than late 2022 data had previously indicated.

Both headline and core Personal Consumption Expenditures (PCE) rose by +0.6% in January, up from +0.2% and +0.4% in December (each revised up +0.1%). On a year-over-year basis, the PCE index was up +5.4% and the core PCE increased by +4.7% – much hotter than expectations (+5.0% and +4.3%).

To be clear, a tremendous amount of progress has been made thus far since the cycle peak in June 2022 (headline PCE at 7.0%), despite a resilient consumer and exceptionally strong labor market making the Fed’s job much more difficult to get inflation to its 2% goal. The question becomes are we witnessing a reacceleration in prices, or is the latest report just one data point along a long and bumpy path downward?

Also reported was personal income and spending data, and consumers continued to spend despite lower-than-expected income growth. In January, personal income rose +0.6%, the most in three months. The personal spending component, which makes up roughly two-thirds of GDP, was also higher than expected, rising +1.8% vs. the +1.4% consensus estimate. This was the fastest clip since March 2021.

There is little doubt at this point that the Fed has the resolve to keep raising interest rates if inflation pressures don't dissipate. The problem is the dream scenario for the U.S. economy isn’t playing out quite yet, one in which inflation keeps falling while the job market remains robust and the pain caused by Federal Reserve tightening remains confined to a small segment of the economy.

Source: Bureau of Economic Analysis, Bloomberg

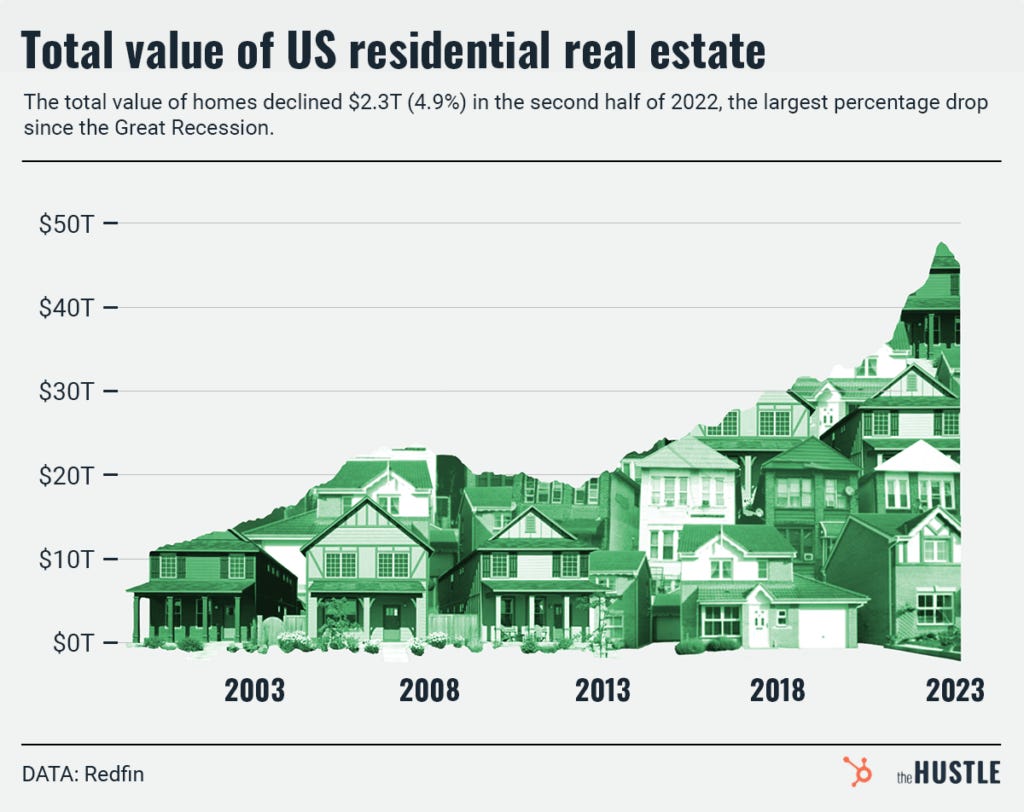

U.S. residential real estate market pulls back

The total value of the U.S. housing market declined by $2.3 trillion dollars in the second half of 2022, the most since 2008.

That -4.9% dip from a record high of $47.7 trillion in June represents the largest percentage drop since the 2008 housing crisis, according to a report from real estate brokerage Redfin which analyzed 99m+ properties.

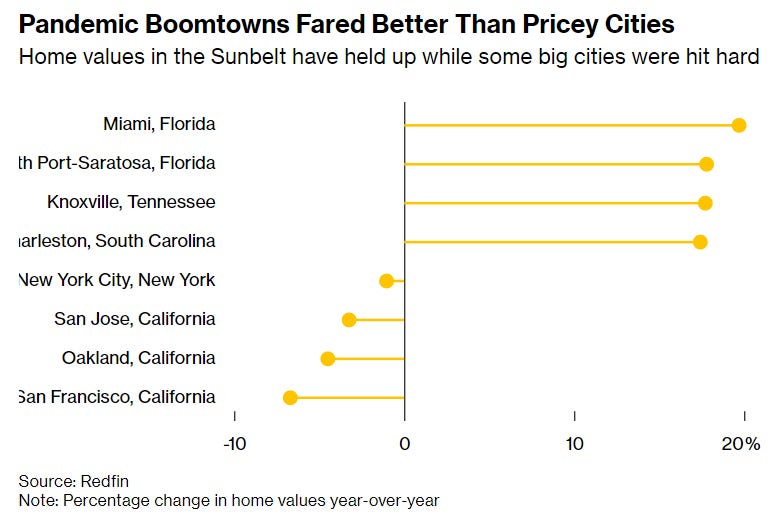

How much homeowners have gained or lost depends on when and where they bought. Some regions are seeing continued strength, while other markets (led by San Francisco) have retreated meaningfully.

“The housing market has shed some of its value, but most homeowners will still reap big rewards from the pandemic housing boom,” said Redfin economics research lead Chen Zhao, adding that the total value of homes remains roughly $13 trillion higher than it was in February 2020.

To be clear, home prices are not collapsing. In December, the total value of U.S. houses was still +6.5% higher than it was a year earlier.

Homebuyer demand has been sluggish as home prices soared and rates lifted from sub-3% in 2021 to 6-7% in 2022 in just one year’s time as the Federal Reserve lifted interest rates to combat multi-decade high inflation.

Source: Redfin, Bloomberg, The Hustle

Russian fossil fuel revenues

Despite major efforts by the United States, European Union, and other countries to restrict Russia's fossil fuel revenues, the country is still earning more than half billion U.S. dollars from oil and gas sales per day, according to think tank Center for Research on Energy and Clean Air.

However, the organization says that by lowering price caps Western nations have been enforcing on Russian crude oil to $30/barrel and by ending all pipeline and LNG exports from Russia to the EU, Russia's daily earnings from fossil fuels could dip as low as $340 million in the future.

Source: Center for Research on Energy and Clean Air, Statista

Worker strikes jumped 50% last year

The number of major worker strikes (those greater than 1,000 workers) in the United States rose to its 2nd highest level in two decades in 2022, per a Bureau of Labor Statistics report released yesterday.

There were 23 major work stoppages last year – involving a total of 120,600 workers – and 98% of the workers were in the service sector, specifically health care and education. The biggest strike of 2022 was the 40-day walkout of 48,000 graduate students at the University of California, followed by 15,000 nurses who walked out in Minnesota. Both ultimately reached contract agreements.

The strength of the labor market and the rise in popularity of unions drove up the numbers. COVID-era issues, like short-staffing, burnout, and pay that didn't keep up with inflation, also pushed workers to the picket lines.

Source: U.S. Bureau of Labor Statistics, Axios

The week in review

Talk of the tape: The path of least resistance has seemed to tilt lower with the meaningful rate repricing seen over the last few weeks. Bears are focused on earnings, valuation, and geopolitical risk, along with dampened disinflation headlines and positioning tailwinds.

Several narratives continue to underpin softer landing scenarios, including the market moving back in line towards the Fed on policy expectations, corporate commentary not signaling a recession, and a tight labor market.

Stocks: The major market averages this week sold off with the majority of sectors ending in the red. Markets have now finished lower for three consecutive weeks.

The S&P 500 is currently trading at a trailing 12-month price-to-earnings (P/E) ratio of 19, which is below the 10-year average of 19.5. This represents a significant reversal down from the 2021 high of 29.9 and shows that equity investor exuberance has waned. A stronger-than-expected labor market, hawkish Federal Reserve (Fed)commentary, and Friday’s hotter-than-expected personal consumption expenditures data has convinced investors the Fed will hold interest rates higher for longer in order to curb pricing pressures.

Bonds: The Bloomberg Aggregate Bond Index finished the week in the red as yields increased for the third straight week. Bonds have been directly influenced by hawkish Fed speak in the wake of higher-than-anticipated inflation data. While yields and stocks remain negatively correlated, the correlation between the S&P 500 and 10-year yields has recently weakened. In general, this suggests stocks are less sensitive to higher rates compared to the past several months.

Commodities: Energy prices finished marginally higher this week even as traders are concerned that the Fed will not pivot on monetary policy given the recent inflation prints. The major precious metals, gold and silver, ended the week lower given future economic growth concerns.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.