Fed's preferred inflation measure, plus insider selling and the 60/40 portfolio

The Sandbox Daily (2.29.2024)

Welcome, Sandbox friends.

Happy Leap Day – a strange phenomena when you think about it.

Today’s Daily discusses:

Fed’s preferred inflation measure continues to moderate

insider selling

perspective on the 60/40 portfolio

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.95% | Russell 2000 +0.71% | S&P 500 +0.52% | Dow +0.12%

FIXED INCOME: Barclays Agg Bond +0.16% | High Yield +0.18% | 2yr UST 4.629% | 10yr UST 4.244%

COMMODITIES: Brent Crude -0.07% to $83.62/barrel. Gold +0.46% to $2,052.1/oz.

BITCOIN: -1.84% to $61,428

US DOLLAR INDEX: +0.14% to 104.125

CBOE EQUITY PUT/CALL RATIO: 0.48

VIX: -3.18% to 13.40

Quote of the day

“Every lie we tell incurs a debt to the truth. Sooner or later, that debt is paid.”

- Valery Legasov, Chernobyl

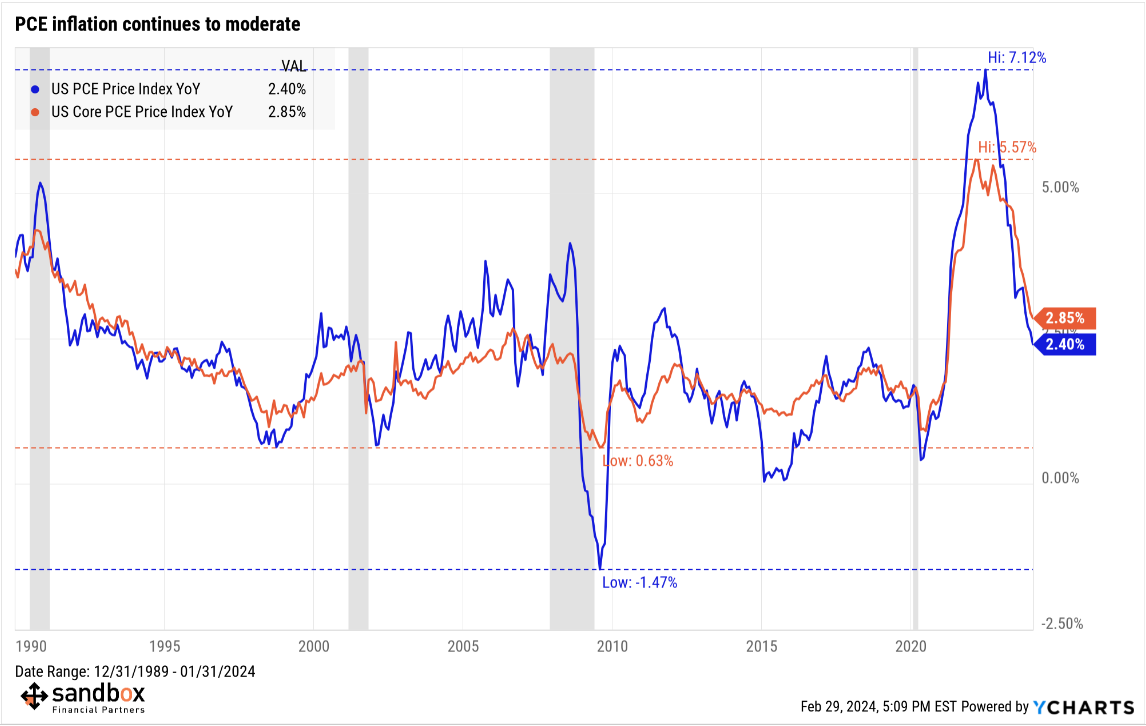

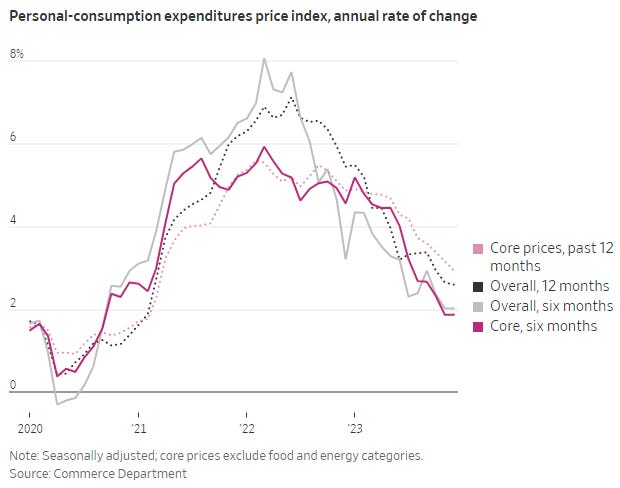

PCE inflation continues to moderate

The Federal Reserve’s preferred gauge of underlying inflation cooled to its lowest level since March 2021, an almost 3-year low.

The Core Personal Consumption Expenditures Price (PCE) index – which strips out the volatile food and energy components – increased +0.4% MoM, while the price index eased down to 2.4% on a YoY basis (from 2.6% in the prior month).

Although relatively large on the MoM reading, the increase was in line with consensus estimates, providing market relief that inflation is not surprising to the upside.

Most importantly: core PCE saw 12 consecutive months lower than the previous month.

The PCE report today is reassuring because the Consumer Price Index (CPI) and Producer Price Index (PPI) reports for January, which were out earlier this month, were hotter than expected and knocked the stock market around. At the time, we need to see more data because a single month of strength does not make a trend.

While acknowledging some stickiness in certain categories remains, broadly speaking – whichever measure of inflation you track (see below) – prices are moderating back to normal levels.

Consumers have been unfazed by higher interest rates, tighter lending standards, and other headwinds, such as the resumption of student loan payments a few months ago.

Investors expect the Fed will begin cutting rates this summer in part because inflation has moderated much faster than the central bank anticipated over the last 6-12 months.

Nearly all the eco-data released in recent weeks tell the same story: inflation vanishing alongside steady economic activity.

Source: Ned Davis Research, Piper Sandler, Wall Street Journal

Insider selling

For weeks-going-on-months, corporate insiders have been selling shares in what the media has dubbed “The Great Cash Out.”

This insider trading activity has garnered a lot of attention from everyday investors. Here are some examples of the headlines:

JPMorgan Chase (JPM) CEO Jamie Dimon jettisoned $150M worth of shares in his 1st ever sale since becoming CEO nearly 20 years ago (Reuters)

The Walton Family unloading $4.5B worth of Walmart (WMT) ahead of its 3-for-1 stock split (Forbes)

Amazon (AMZN) founder Jeff Bezos has offloaded a staggering $8.5B (Wall Street Journal)

Meta Platforms (META) CEO Mark Zuckerberg sold $428 million in last two months of 2023 (MarketWatch)

Nvidia (NVDA) insiders selling $80M in stock after earnings surge (Bloomberg)

Insiders at Marvell Technology (MRVL) ditched $6.3M in stock (Yahoo Finance)

Advanced Micro Devices (AMD) CEO Lisa Su unloaded $20M (MarketWatch)

Naturally, people are suspicious – the implication is these insiders know something.

But, by and large, most people should just ignore these transactions because we should remember these executives are people, too. Some might be selling for the upcoming tax season, others might need liquidity for spending and hobbies. There are philanthropic goals, charitable contributions, home purchases, moving states for tax purposes, costs of raising cattle in Hawaii, and everything in between.

What’s more, they’re subject to Rule 10b5-1, which was enacted by the Securities and Exchange Commission (SEC) in 1934 to prevent the buying or selling of stock based on insider information. And these trading plans are created way in advance on preset dates, often at preset prices.

While a cluster of sales might look like a signal, these continuous announcements should amount to nothing more than coincidence.

Source: Forbes

Perspective on the 60/40 portfolio

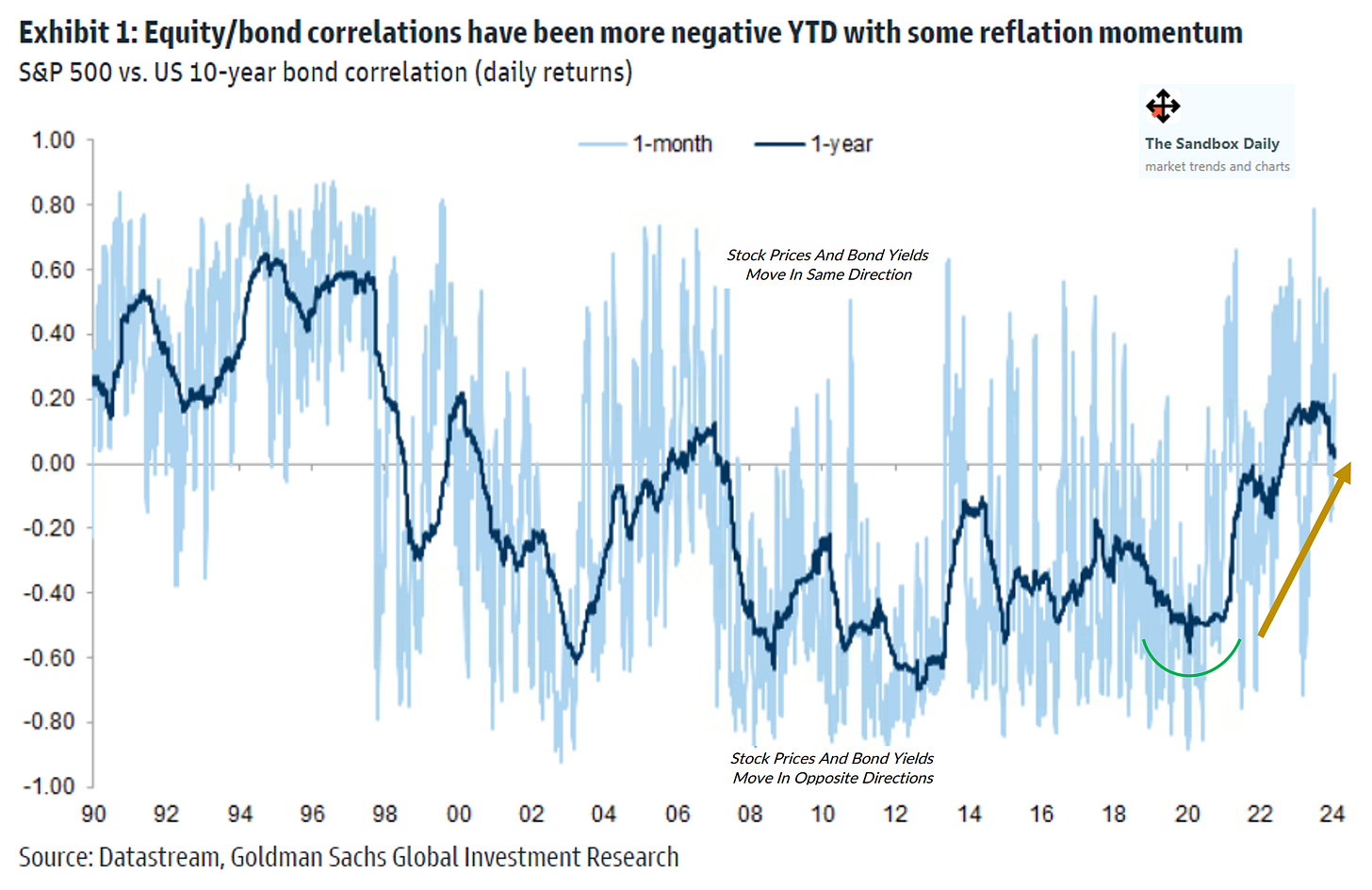

Since the COVID-19 crisis, 60/40 portfolios have been riskier for investors, with equity/bond correlations rising and generally more positive.

In 2022, a U.S. 60/40 portfolio had one the largest drawdowns in the last 100 years, with many quick to proclaim “the death of 60/40.”

Last summer was another major setback when stocks pulled back as bonds crashed when yields pushed above 5%.

Then in the 4th quarter of last year, 60/40 portfolios saw one of the strongest rallies in the last 100 years, when both equities and bonds were boosted by a 'Goldilocks' backdrop amidst growing optimism around synchronous central bank easing.

Equity/bond correlations have been rising and are now positive, although that relationship has only started to reverse/weaken.

What does all this mean?

Poor diversification through rising correlations can have a meaningful negative impact on long-term results. The historical premise of balancing growth (the “60”) and income (the other “40”) was based in the idea that diversification across asset classes would reduce portfolio risk – owning bonds would help cushion the blows from drawdowns and losses in the stock market. One zigs, while the other zags. Something is always working.

Keep in mind, 2022-2023 was an extreme environment for bonds: rising interest rates and a real threat from inflation – bad news bears for both traditional asset classes.

We should remind ourselves, though, that the stock/bond relationship isn’t set in stone. Market interactions are fluid and dynamic.

Higher bond yields, while painful in the moment, significantly improve the effectiveness of the 60/40 portfolio.

And…

Diversification can still work – perhaps not just in every environment, like anything else.

Source: Goldman Sachs Global Investment Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.