Fed's swift pace to raise rates, plus sector relative strength, IPO market, rules-based investing, Caterpillar, and Christmas movies

The Sandbox Daily (12.21.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the Fed’s swift pace of increasing interest rates to stomp out inflation, relative strength of sector groups, primary market issuance grinds to an abrupt halt, dollar-cost averaging as a rules-based investment philosophy, Caterpillar makes new highs, and the most popular Christmas movies.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.65% | Dow +1.60% | S&P 500 +1.49% | Nasdaq 100 +1.48%

FIXED INCOME: Barclays Agg Bond +0.28% | High Yield +0.85% | 2yr UST 4.223% | 10yr UST 3.673%

COMMODITIES: Brent Crude +2.83% to $82.25/barrel. Gold -0.24% to $1,823.8/oz.

BITCOIN: -0.69% to $16,778

US DOLLAR INDEX: +0.27% to 104.249

CBOE EQUITY PUT/CALL RATIO: 0.78

VIX: -6.56% to 20.07

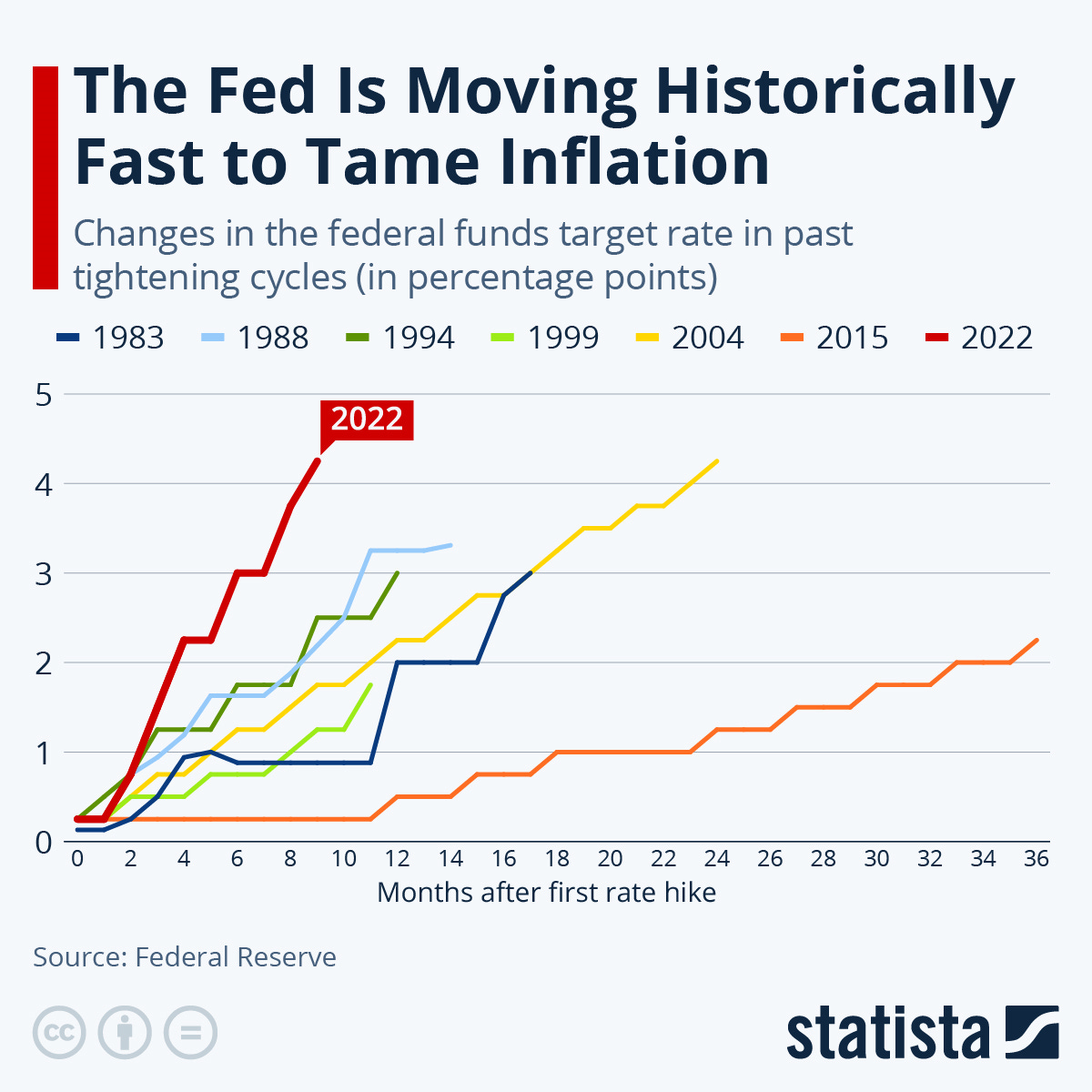

The defining chart of 2022

As the global economy reopened post-pandemic and inflation went from transitory to persistent, central banks around the world began to shift monetary policy from quantitative easing (QE) to quantitative tightening (QT).

In the United States, the Federal Reserve acted at an almost unprecedented pace, hiking rates to signal their strong resolve to get double-digit inflation under control. Starting in March, the Federal Reserve took the overnight lending rate (Fed Funds Rate) from 0.00%-0.25% to a target range of 4.25%-4.50% across 7 rate increases over 9 months. This is the highest level since December 2007 and marks the fastest tightening cycle since 1980 when Chairman Paul Volcker was appointed to the Fed to stomp out persistently high inflation.

For borrowers, this is obviously bad news – as borrowing costs on mortgages, credit cards, car loans, and a myriad of other consumer lending products have risen meaningfully. On the flip side, this is great news for savers and retirees who can now earn a decent yield on money markets, CDs, Treasuries, and other short-term debt investments for the first time in many years.

Source: Ned Davis Research, Statista

Relative strength by sector

2022 has seen plenty of sector rotation and leadership changes as market conditions tighten and adapt to a rising rate environment. Keeping tabs on the relative strength of each sector helps us understand momentum and divergences, informing us what sector groups are performing better than the market on a relative basis and what sectors are lagging.

Consumer Discretionary is back to lows for the year relative to the S&P 500, after a strong bounce in the middle of the year.

At the same time, relative strength for Consumer Staples is hitting new highs, as well as notable strength from Industrials and Healthcare.

Meanwhile, Communication Services and Technology remain in firm downtrends versus the market, delivering abysmal returns after years of outperformance.

Source: Bespoke Investment Group

Primary market issuance grinds to a halt

In an environment of higher interest rates, slowing M2 money growth, and lower valuations, primary issuance market has completely collapsed.

The cycle peaked in 2021 with 397 initial public offerings that raising $142.4 billion dollars from the investing public.

In 2022, just 71 companies IPO’d and raised $8 billion, the slowest year of fundraising in over three decades.

"Equity Capital Markets (ECM) activity tends to be higher in periods of distress or where growth is strong, and today we're in no man's land," said Gareth McCartney, who co-leads UBS's global franchise.

Source: Renaissance Capital, Reuters

Rules-based investing

Dollar-cost averaging over long time horizons effectively makes market timing irrelevant.

As they often say, “time in the market” is more important than “timing the market.”

Dollar-cost averaging prevents procrastination, minimizes regret (by using a rules-based investing philosophy), avoids market timing, and removes emotion from your financial plan. While it may be tempting to try waiting for the perfect time to invest – especially in a volatile market – remember the low probability of finding the right entry point and the (high) cost of waiting prevents you from even beginning your financial journey.

As Nick Maggiulli eloquently said, Just Keep Buying.

Source: Brian Feroldi

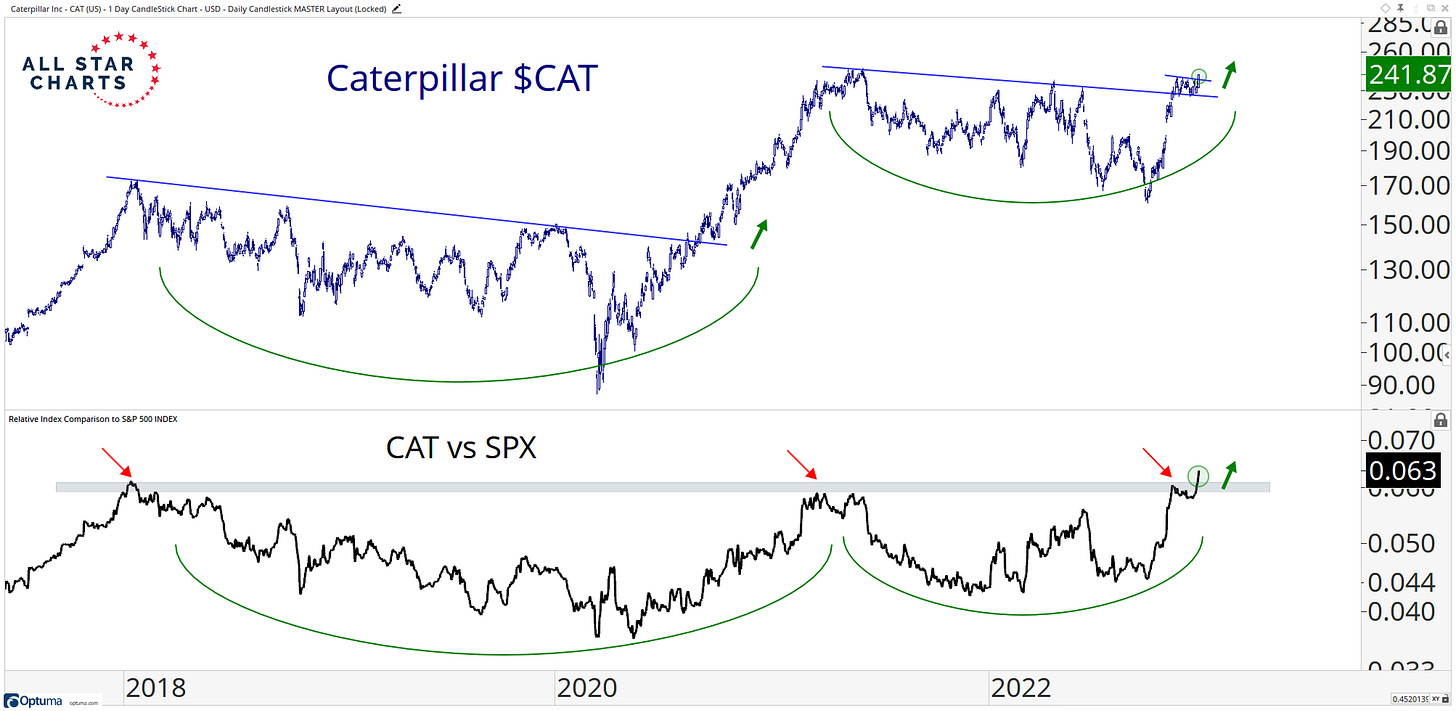

CAT makes new highs

Shares of Caterpillar (CAT) rose +2.8% today as they resolved higher from a flag pattern, reaching fresh 52-week highs.

In the lower pane, you can see the ratio between the industrial conglomerate and the S&P 500 emerging higher from a multi-year base.

These relative trends not only act as an excellent leading indicators but also confirm the price action in absolute terms.

If the breakout in the relative trend holds, we could expect this to be a valid resolution for CAT on absolute terms as well, and price could reach new all-time highs in the near future. If that happens, it will be a major bullish development for the broader market, as CAT is a bellwether stock for the global economy.

Source: All Star Charts

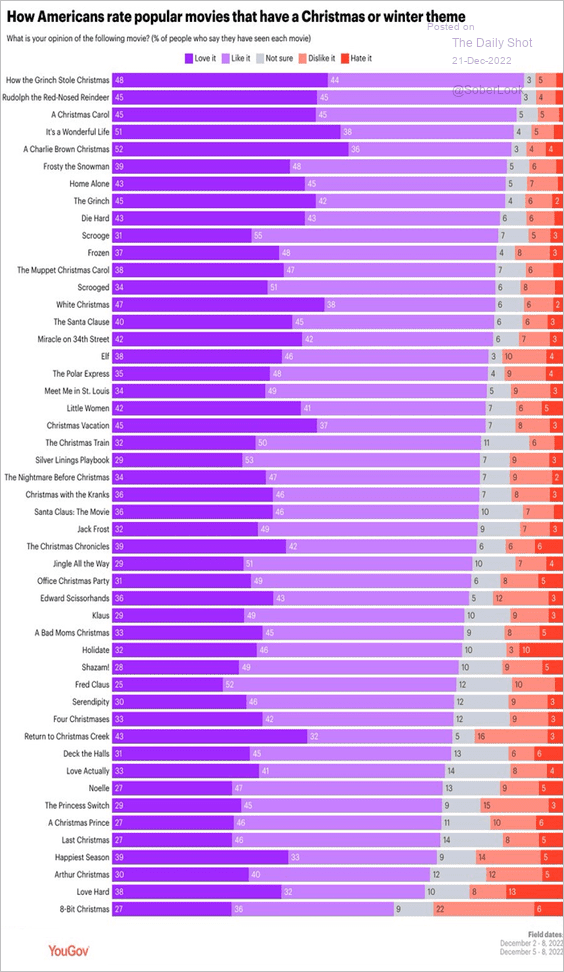

Most popular Christmas movies

The holiday season is upon us, and with it comes the tradition of watching festive movies. Using a survey of 2,000 Americans conducted over two polls in December 2022, here’s a look at American’s favorite Christmas movies – with How the Grinch Stole Christmas capturing 1st place.

Source: YouGovAmerica, The Daily Shot

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.