Few stocks beating the market, plus household health, holding cash, July seasonality, and Bobby Bonilla

The Sandbox Daily (7.1.2024)

Welcome, Sandbox friends.

Today is the 1st day of July, the 1st day of the 3rd quarter, and the 1st day of the 2nd half.

It is also Bobby Bonilla Day. Every July 1st, retired All-Star 3rd baseman Bobby Bonilla receives a $1.19 million check from the New York Mets, even though he hasn’t played an Major League Baseball game in over 20 years. The reason is that back in 2000, the Mets owed Bonilla $5.9 million, but instead of taking that cash up front, Bonilla’s agent worked out a contract that spreads out $30 million in guaranteed payments to him through annual installments from 2011–2035.

On to the market… Boeing will acquire troubled supplier Spirit AeroSystems for $37.25 per share, meme stock trader “Roaring Kitty” took a 6.6% stake in the pet food e-commerce retailer Chewy, and President Joe Biden meets with family at Camp David amid Democratic supporters' concerns over the president's physical and mental wellbeing to run in the 2024 election.

Today’s Daily discusses:

Q2 top theme: few stocks are beating the market

household health dealing with expenses

many investors remain on the sidelines in cash

July seasonality bodes well for stocks

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.66% | S&P 500 +0.27% | Dow +0.13% | Russell 2000 -0.86%

FIXED INCOME: Barclays Agg Bond -0.54% | High Yield -0.02% | 2yr UST 4.758% | 10yr UST 4.469%

COMMODITIES: Brent Crude +1.93% to $86.64/barrel. Gold +0.11% to $2,342.1/oz.

BITCOIN: +0.26% to $62,790

US DOLLAR INDEX: -0.05% to 105.808

CBOE EQUITY PUT/CALL RATIO: 0.64

VIX: -1.77% to 12.22

Quote of the day

“Carry out a random act of kindness with no expectation of reward, safe in the knowledge that one day someone might do the same for you.”

- Princess Diana

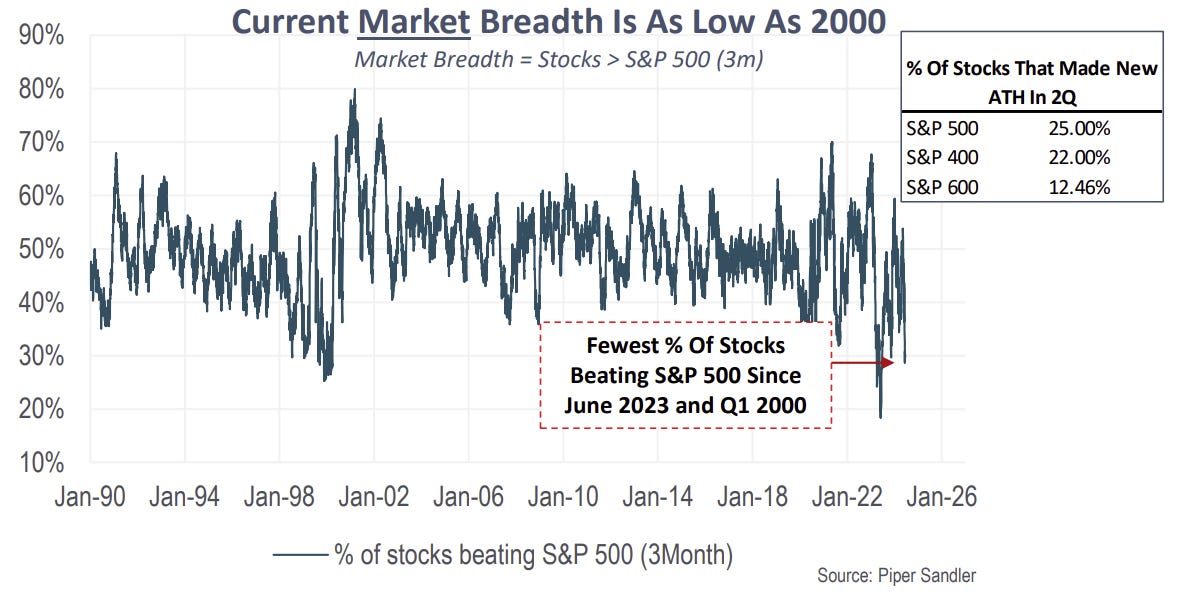

Q2 top theme: few stocks are beating the market

The S&P 500 has returned 14.5% through the 1st half of the year, the 2nd-best start to an election year since 1928. Only 1976 was better.

But, given how concentrated the S&P 500 index has become with the larger stocks continuing to outperform, it has become very difficult for most of the market to keep up with the benchmark itself.

Despite the S&P 500 printing one new high after another this year – 31 new all-time closing highs, to be exact – just 25.2% of constituents within the index made new all-time highs. The same theme from 2023 continues to make for a difficult market environment for stock pickers; only 29.5% outperformed in 2023.

The mega-cap leaders continue to power the market higher.

In Q2, a meager 25% of large-cap stocks outperformed the S&P 500. Six of the Mag 7 stocks made new all-time highs in the 2nd quarter; only Tesla remains a notable laggard.

Looking down the cap stack, 22% of mid-caps outperformed the S&P 400, while only 12.5% of small-caps outgained the S&P 600.

Narrow breadth has been a function of lingering macro risks (i.e. higher-for-longer rates) and a bifurcated earnings backdrop where predominantly just the mega caps are seeing significant earnings momentum.

Source: Piper Sandler, Ned Davis Research

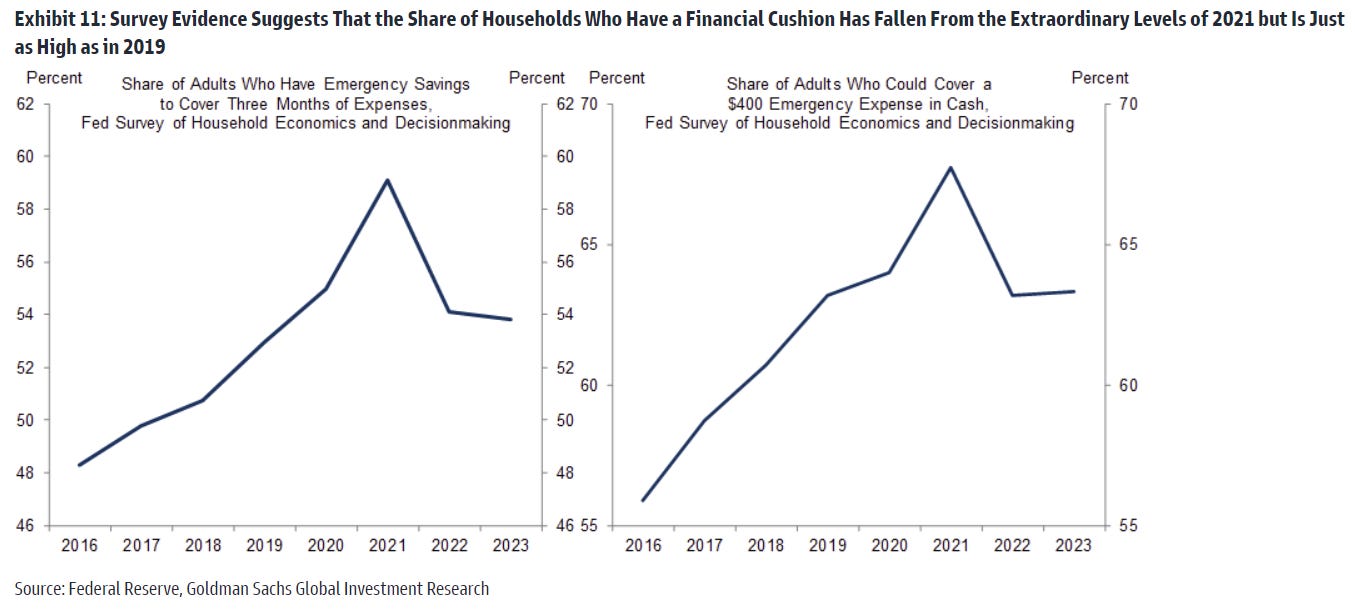

Household health dealing with expenses

Available data, such as reporting from the Federal Reserve’s Survey of Household Economic and Decisionmaking and Goldman Sachs, suggests that the share of households with a financial cushion have declined significantly from their peak during the 1st half of 2021, particularly for lower-income households who likely rely on these savings to weather adverse shocks. That being said, household cushions are still roughly in line with its 2019 level.

Results from the Fed survey also showed just 63% of adults said they would cover a hypothetical $400 emergency expense exclusively using cash or its equivalent, unchanged from 2022 but down from a high of 68% in 2021.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families.

For these households, the most common approach was to use a credit card and then carry a balance, although many indicated they would use multiple approaches.

While total household wealth is close to an all-time high, recent increases in credit card and auto delinquency rates, higher interest rates for borrowers, and softer spending signals in the last few months have raised legitimate concerns about the financial health of the U.S. consumer, especially at the lower-income end.

Source: Federal Reserve, Goldman Sachs Global Investment Research

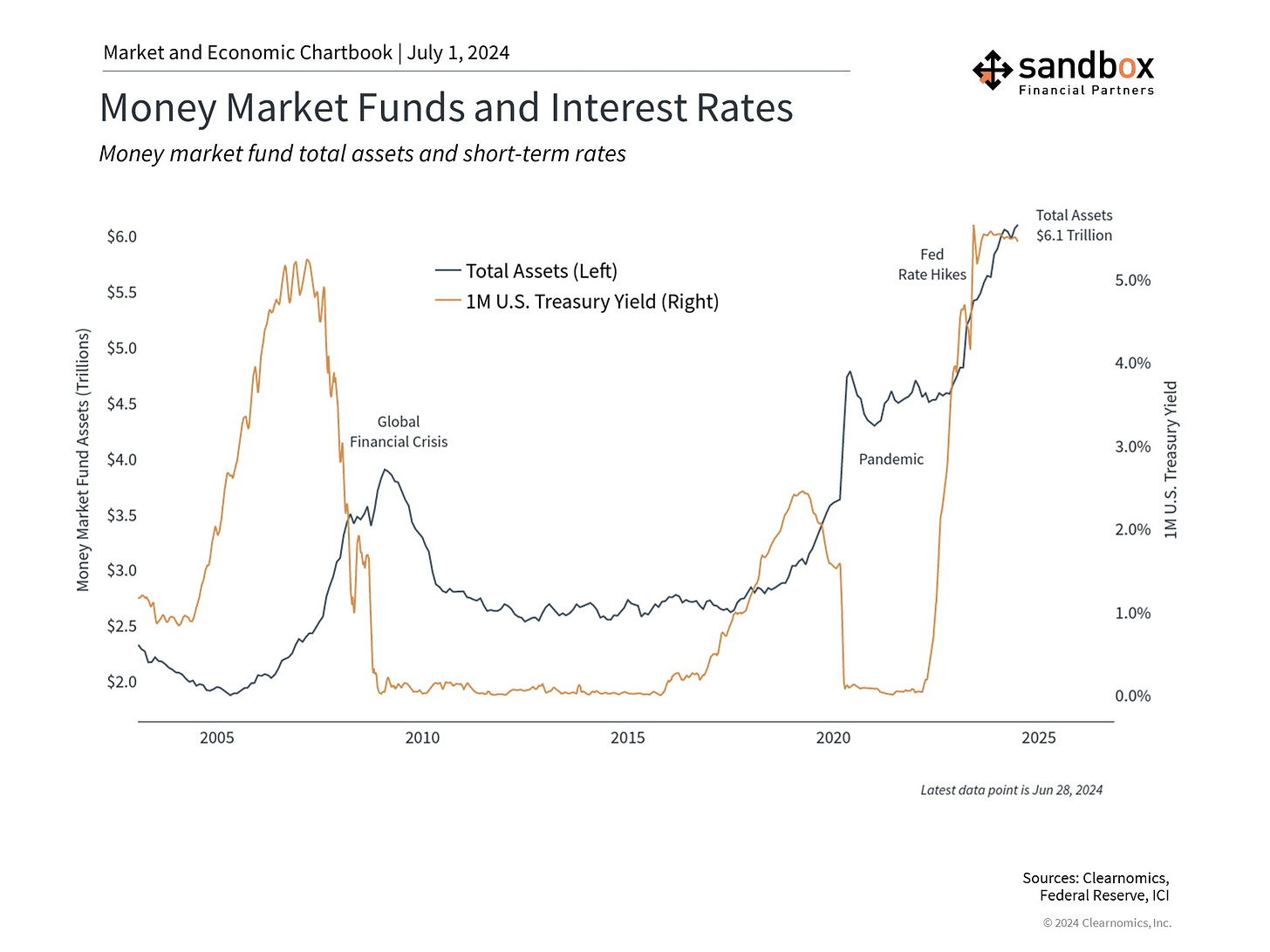

Many investors remain on the sidelines in cash

In times of market uncertainty, investors often seek the safety of cash. This has been true over the past several years as markets have swung due to the pandemic, geopolitical events, Fed rate hikes, inflation, gridlock in Washington, technology trends, and more. Additionally, interest rates on cash are at their highest levels in decades, making it appear that there are attractive “risk-free” returns.

While cash is important, it can become problematic when investors hold too much cash. This is because cash is not truly risk-free for two important reasons.

1st, inflation quietly erodes the purchasing power of cash over time. So even if yields appear to be high, the real value of your money could decline.

2nd, the prospects for cash will only worsen if when the Fed does begin to cut rates. Investors would be forced to reinvest their cash either at lower interest rates or in stocks and bonds whose prices would most likely have already risen.

Source: Clearnomics

July seasonality bodes well for stocks

Since 1928, the 1st half of July has historically been the strongest period for the S&P 500 index, gaining an average +1.5% and positive 69% of the time.

But hold on, July gets even better.

Pulling back the aperture for the full scope of the month, the average monthly return for the S&P 500 is +1.5% since 1990, with each sector positive over that time period.

And, given 2024 is an election year, we know that historically stocks have performed quite well over the summer months during the 4th year of the presidential cycle.

From a historical perspective, the seasonal data shows that we could have more upside in stocks during what is traditionally one of the quieter periods on the calendar.

Source: Mike Zaccardi, Scott Brown, Ryan Detrick

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.