FTX's bankruptcy filings, plus the consumer, Twitter 2.0, Goldman's outlook, and housing

The Sandbox Daily (11.17.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the early details emerging from bankruptcy filings on cryptocurrency exchange FTX, mixed signals on the consumer, Twitter 2.0 will be only for hardcore employees, Goldman Sachs 2023 macro outlook, and a bleak housing forecast from the Federal Reserve Bank of Dallas.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.02% | Nasdaq 100 -0.19% | S&P 500 -0.31% | Russell 2000 -0.76%

FIXED INCOME: Barclays Agg Bond -0.42% | High Yield -0.43% | 2yr UST 4.458% | 10yr UST 3.766%

COMMODITIES: Brent Crude -3.14% to $89.94/barrel. Gold -0.70% to $1,763.4/oz.

BITCOIN: +0.85% to $16,684

US DOLLAR INDEX: +0.35% to 106.650

VIX: -0.75% to 23.93

CEO in charge of FTX restructuring calls it an “unprecedented” disaster

John Ray, the newly appointed CEO of cryptocurrency exchange FTX and the same person in charge of the Enron liquidation, had this to say after spending one week overseeing the company!!

I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron). I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding).

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated, and potentially compromised individuals, this situation is unprecedented.

Here is a formal legal filing describing FTX’s (attempt at) human resources:

Before his empire collapsed, Sam Bankman-Fried was actively engaged in lobbying efforts in Washington D.C. to produce a regulatory framework for cryptocurrency – which now appears to be a complete charade.

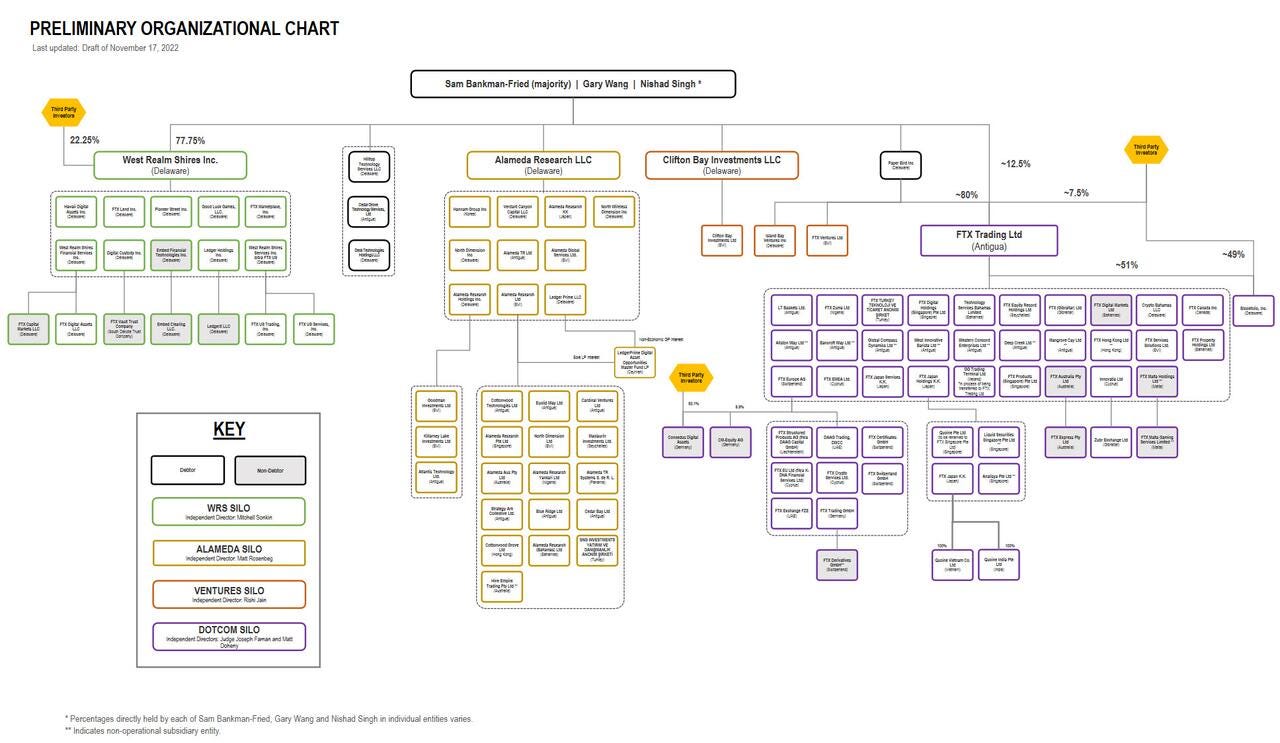

The company’s org chart is a headache, while also lacking proper oversight like a Board of Directors or CFO.

Lax controls over billions of dollars in cash and cryptocurrency assets under Sam Bankman-Fried have left current management scrambling to establish just how much money the bankrupt crypto platform has today.

Source: Vox, Wall Street Journal

Is the consumer strong?

Target reported poor earnings and revised its outlook lower. Target claims consumers are pulling back on spending in recent weeks, which hurt sales and profits in the 3rd quarter and will continue to do so going forward.

Adding industry-wide concern for Target's statements are recent actions from economic bellwether’s FedEx and Amazon. FedEx plans to furlough freight workers through the holiday season while warning of a global recession with slowing shipping demand. At the same time, Amazon will lay off 10,000 employees starting this week. Typically both companies are aggressively hiring going into their busiest time of the year.

Another red flag? Perhaps it’s from one of the main U.S. shipping gateways to China. October’s cargo volume through The Port of Los Angeles was at the lowest level for that month since 2009.

While the warnings from Target and other companies keep coming, retail sales are seemingly strong. Retail Sales for November rose +1.3%, above expectations for a +1% increase. The problem, as Charlie Bilello shares below, is that the gains are solely due to inflation. Strip-out inflation and total retail sales are slightly below their March 2021 peak.

Further, as we learned earlier this week from the New York Fed, credit card debt outstanding is surging – household credit card debt grew +15% YoY, the largest annual jump for more than 20 years. It is helping keep many consumers afloat.

Source: Lance Roberts, Charlie Bilello, CNN, Los Angeles Daily News, Federal Reserve Bank of New York

Twitter goes hardcore → A Fork in the Road

Twitter CEO, Elon Musk, says Twitter 2.0 will become “extremely hardcore.”

Elon gave remaining Twitter employees an ultimatum: By 5pm E.T. today, they can choose to keep working at Twitter for “long hours at high intensity,” or give up their job and collect three months’ severance.

Despite the chaotic first few weeks under Elon’s control where half of Twitter’s employee base was fired, the senior brass were terminated or quit, the verified-user Twitter Blue subscription rollout was paused after many impersonation problems, Twitter has reported about 20% growth in its daily users.

Source: CNN

Goldman 2023 outlook

Goldman Sachs release their Macro Outlook 2023, and a few salient takeaways resonate:

* U.S. should narrowly avoid a recession (see chart below) as core PCE inflation slows from 5% now to 3% in late 2023, with a 0.5% rise in the unemployment rate

* The Fed will hike another 125bp to a peak of 5.00% - 5.25%. No rate cuts are expected in 2023.

* 2023 will be a weak year for global growth due to China zero-COVID drag, monetary and fiscal tightness, and geopolitical overhang. U.S. GDP growth will be +1.0%, while global GDP growth projects to be +1.8%.

* Key themes to watch include the drag from tighter financial conditions and the labor market rebalancing

Source: Jan Hatzius, Goldman Sachs Global Investment Research

Bleak housing outlook from the Federal Reserve Bank of Dallas

United States home prices could plunge as much as 20% due to a sharp rise in mortgage rates this year. Higher rates are dramatically increasing home ownership costs and “boost the odds of a severe house price correction,” according to a report from the Dallas Federal Reserve.

Average rates on a 30-year fixed-rate mortgage have jumped from about 3% in January to over 7% as the Federal Reserve aggressively hiked interest rates in an effort to cool inflation. The mortgage share of a household’s income is poised to rise given the rapid increase of the 30-year mortgage rate, which leads to a negative wealth effect on aggregate demand that further retrains housing demand – deepening the home price correction.

Source: Federal Reserve Bank of Dallas

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.