Gaming out some potential downside scenarios, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (3.21.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

gaming out potential downside risks

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.39% | Dow +0.08% | S&P 500 +0.08% | Russell 2000 -0.56%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield -0.15% | 2yr UST 3.951% | 10yr UST 4.248%

COMMODITIES: Brent Crude +0.17% to $72.12/barrel. Gold -0.58% to $3,026.2/oz.

BITCOIN: -0.32% to $83,994

US DOLLAR INDEX: +0.28% to 104.138

CBOE TOTAL PUT/CALL RATIO: 0.83

VIX: -2.63% to 19.28

Quote of the day

“If you’re not confused, then you’re not paying attention.”

- Tom Peters

Gaming out potential downside risks

After a 2.5-year rally that proved both economy skeptics and Fed doubters wrong, brought cautious investors off the sidelines, and left stocks expensive across many valuation metrics, it would seem prudent to at least consider the risks of a cyclical top forming in 2025.

I’m not suggesting this is the most likely outcome, but it’s always helpful to game out the downside scenarios and catalysts for risk management purposes.

In fact, I’m not the only one who finds this exercise helpful. Here’s Steve Strazza, CMT discussing the All Star Charts process itself:

My concerns fall into three categories. None of them have been alleviated in recent weeks.

Also, I’m moving past tariffs because at this point 1) it’s a known known, 2) it’s a negotiating tool and not a permanent policy measure, 3) we’ve front loaded the risks (see the VIX curve), and 4) the on-then-off-then-on again frenetic downstream effects are more akin to a one-week detox than a one-year rehab.

Earnings estimates remain elevated and likely must come down to reflect increased uncertainty.

Despite a more-than-respectable 77% beat rate and +18% year-over-year EPS growth rate, S&P 500 companies have used the Q4 earnings season to lower guidance.

Consensus estimates for Q1 operating earnings growth have fallen from 14.0% as of December 31 to 9.17% as of March 18.

By themselves, negative EPS revisions are not a particularly bearish signal because analysts typically revisit estimates lower throughout the course of the year.

But, Q2 through Q4 have declined by much smaller amounts, suggesting plenty of room for further downside revisions later in the year, especially when you consider their sheer magnitude of growth (~18% for Q3 and ~18% for Q4).

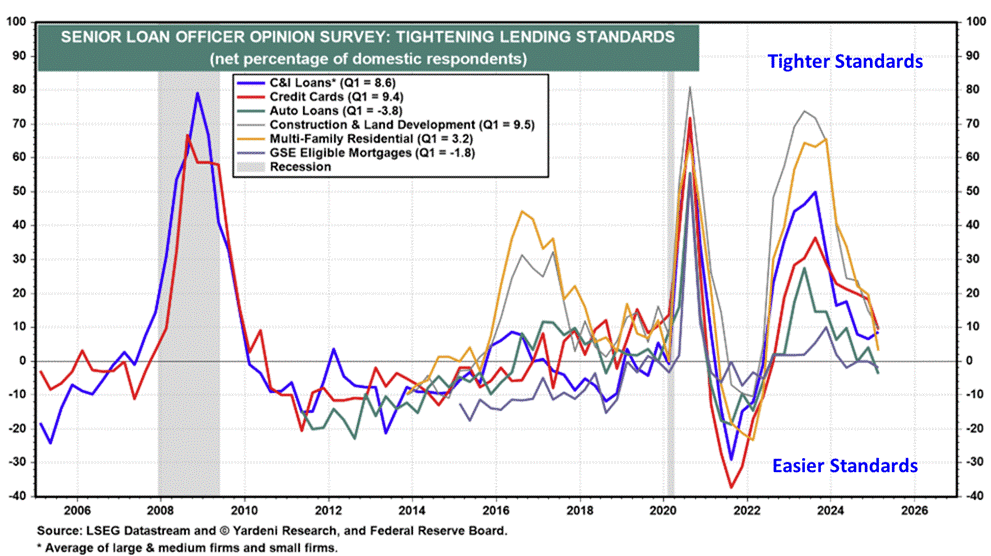

Loan growth remains stagnant.

Of many, one consequence of a softer economic growth outlook, higher uncertainty, and elevated market volatility will likely be continued weakness in loan activity throughout 2025.

As an economy that thrives on credit and the velocity of money, the credit unlock is another potential tailwind that could be shelved in 2025.

For the better part of three years, it’s been the same story: banks reporting tighter lending standards, tougher terms, and weaker demand for business loans for firms of all sizes. While things have shifted positively on the margin, absolute levels of activity remain depressed.

From Treasury issuance to commercial real estate and many verticals in between, higher-for-longer will eventually create downside risks that eventually bubble up to the surface and crash something.

Technical divergences have grown in both number and magnitude.

The percentage of stocks above their individual 200-day moving averages was rangebound over the last year between 60% and 80%.

Recently, that measure has been falling sharply, having retreated to a 1.5-year low. Currently just 39% of stocks are trading above their 200DMA. The divergence from its March 2024 high is getting harder and harder to ignore.

Just like mom saying nothing good happens after midnight, investors know that gains are hard to achieve when the majority of stocks are stuck below their long-term moving average (200DMA).

Sources: Ned Davis Research, Yardeni Research

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Hostile Charts – You Know the Drill (Larry Thompson)

Kyla’s Newsletter – Dollar Devaluation and the Antisystem Youth (Kyla Scanlon)

Humble Dollar – Four Thoughts (Jonathan Clements)

Carson Group – Four Reasons Not to Panic and Sell Right Now (Ryan Detrick)

The Big Picture – 10 Biggest Ideas in “How NOT to Invest” (Barry Ritholtz)

Podcasts

All-in Podcast – In DC with Scott Bessent (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

Bill Burr – Drop Dead Years (IMDB, Hulu, YouTube)

Music

Avi Snow, MVCA, Zeeba - Feel (Spotify, Apple Music, YouTube)

Books

Vishal Khandelwal – Boundless (Safal Niveshak)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: